Ireland’s audio landscape remains one of the most robust in Europe, with 96% of adults listening to some form of audio each week, according to the Irish Audio Report 2025, published as part of the latest JNLR survey. The findings highlight a market where traditional radio continues to command mass daily reach, even as streaming and podcasts cement their position in younger audiences.

Radio is King

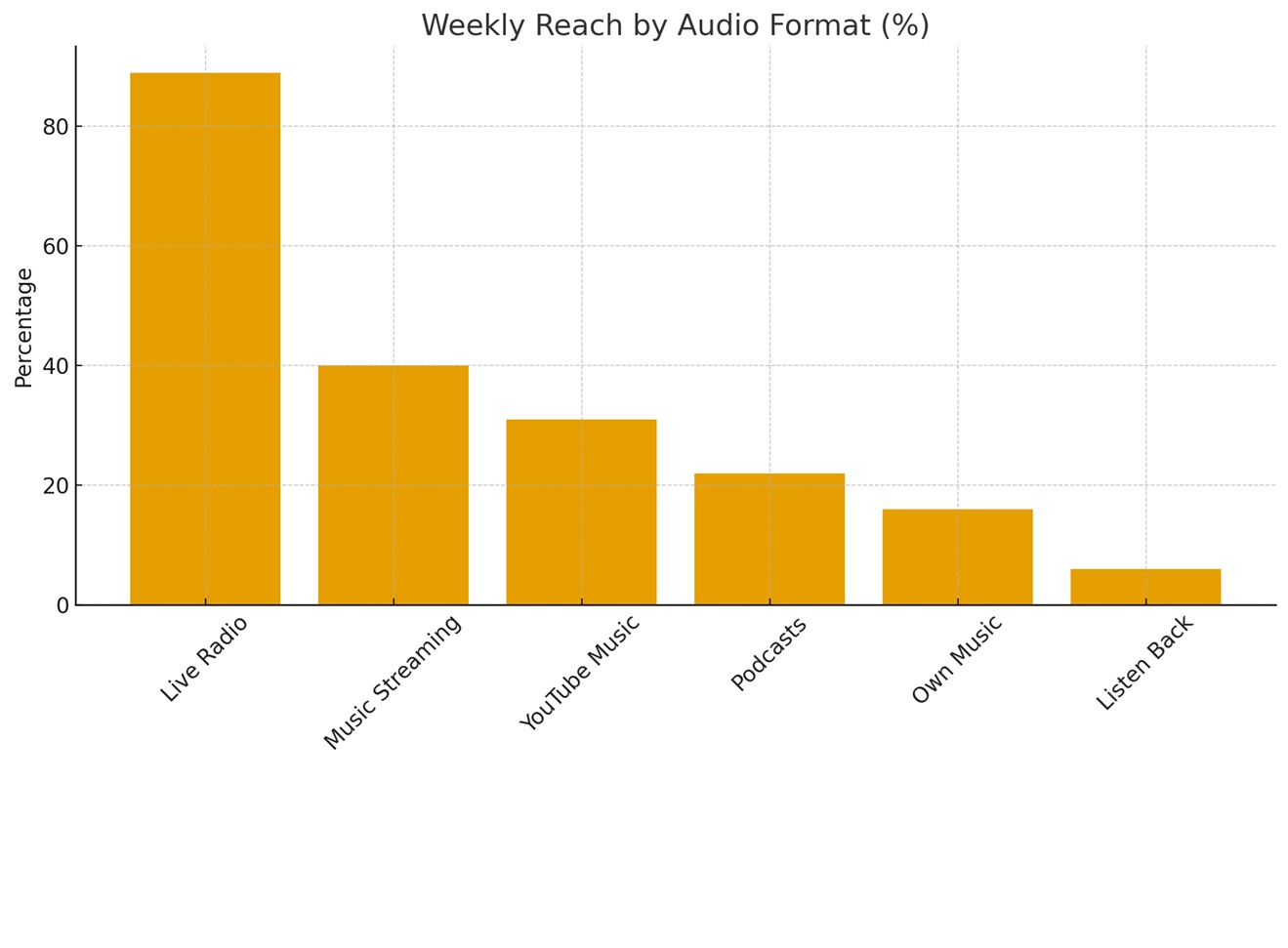

The Irish Audio Report 2025 shows that radio remains the dominant audio format, reaching 89% of adults weekly, compared with 56% who listen to online on-demand audio. Music streaming, YouTube Music and podcasts continue to grow in usage but still trail live radio considerably in terms of time spent listening.

Technology Ownership and Access

The continued strength of the audio market is supported by near-universal device penetration. Smartphone ownership now sits at 91%, with almost complete uptake among 15–24-year-olds (98%). Smart speakers have seen slower but steady growth, reaching 44% household penetration, a dramatic climb from the pre-covid days of 10% in 2018, though adoption has levelled off in recent years. Younger listeners are more likely to own Bluetooth headphones and smart speakers, but ownership is rising among older adults too.

Subscriptions Improve

According to the report, subscriptions to premium services have rebounded following a dip in 2024. Around 38% of adults now pay for at least one audio subscription, returning to 2023 levels.

Paid music streaming leads the category, with 34% subscribing to platforms like Spotify. Younger audiences remain the heaviest subscribers: nearly half of 15–24s (49%) and 46% of 25–44s pay for an audio service. Podcast subscriptions still remain a niche segment, according to the report, with around 10% of adults paying for premium content.

Weekly and Daily Listening Patterns

The report confirms that audio listening remains almost universal, with 4.24 million people engaging weekly across any format. Live radio continues to lead, followed by music streaming (40%), YouTube Music (31%), and podcasts (22%). “Own music”—personal archives or CDs—continues its long-term decline as streaming becomes the default music access point.

Among young adults, however, trends shift somewhat. The report notes a downward movement in overall listening among 15–24-year-olds, with weekly engagement falling from 99% in 2022 to 94% today.

Online audio also dropped more sharply among this cohort—particularly YouTube Music, which fell six percentage points year-on-year. Radio reach among young people remains strong at 81%, though lower than the population average.

Daily listening data shows the same pattern of dominance for radio. Around 77% of adults listen to live radio daily, compared with 36% who engage with on-demand audio. Music streaming accounts for 26% of daily listening, while podcasts reach 8% on an average day. Among 15–24s, streaming nearly matches radio, with 52% streaming daily compared with 59% tuning in to live radio.

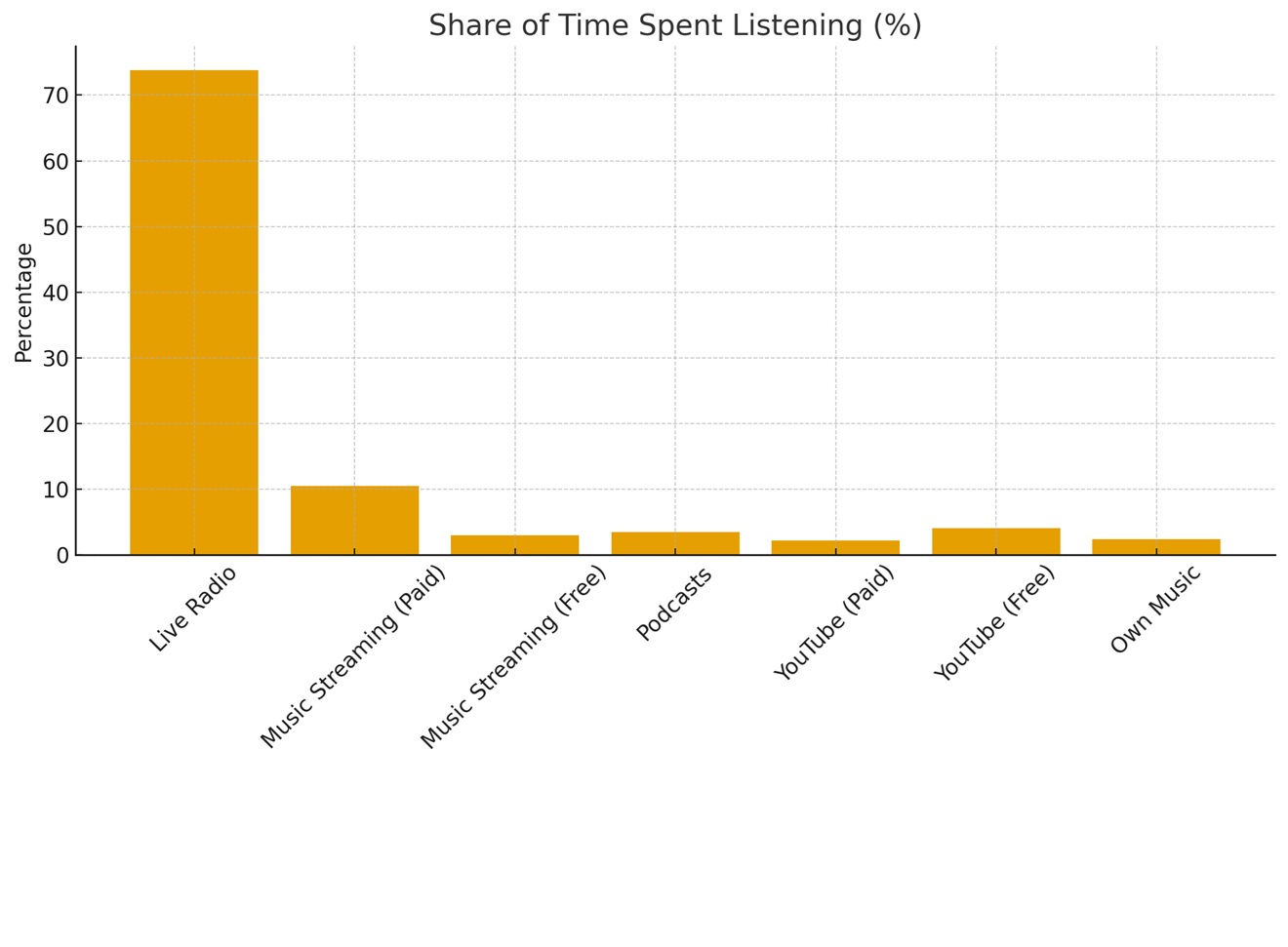

Time Spent Listening

Time spent remains the clearest indicator of radio’s enduring strength. Live radio accounts for 73.8% of all audio minutes consumed in Ireland, a slight decline from last year but broadly consistent with the long-term trend. The report also shows that paid music streaming accounts for 10.5% of time spent, while free streaming represents 3%. Podcasts remain stable at 3.5% of total listening time.

Younger listeners show a very different profile: among 15–24s, radio accounts for 46.4% of listening time, with streaming close behind at 32.6%. YouTube Music continues to play a proportionally larger role among younger audiences, though its share remains smaller than music streaming services.

When examining commercial listening—excluding audiences on ad-free services—radio’s dominance becomes even more pronounced. Live radio accounts for 87% of all commercial audio listening time, a figure largely unchanged from 2024. Among 15–24s, commercial radio’s share is lower but still significant at 67.3%.

Where and How People Listen

The home continues to be the primary listening location, with 67% of people consuming audio at home daily, led by older audiences. For its part the car has grown into a major listening environment, now reaching 49% daily-a 15-point rise since 2021. Live radio dominates in these settings, especially in the car, where 44% listen daily.

Listening at work, school or college accounts for 12% of daily behaviour, peaking among 25–44-year-olds. Meanwhile, 10% listen while walking or running, with younger audiences most likely to consume audio “on the move,” driven largely by streaming apps.

Traditional devices still anchor listening habits: 67% of adults use a dedicated radio or music system daily. However, smartphone listening continues to rise, now at 32% daily, driven primarily by music streaming. Younger listeners show the strongest use of mobile, with 43% of 15–24s using their smartphone to stream audio each day. Smart speaker listening also shows steady growth, used daily by 11% of the population.

A Market in Transition

Overall, the 2025 Irish Audio Report depicts a maturing digital audio market where streaming, smartphones and on-demand content are deeply embedded in daily life-especially among younger age groups. But the findings also underline the enduring centrality of radio as Ireland’s primary audio medium.

Despite ongoing shifts in consumption, the report notes that radio continues to deliver unrivalled mass reach, habitual daily usage and the overwhelming share of commercial listening time, reinforcing its continued strength for both audiences and advertisers.

“The 2025 Irish Audio Report shows a dynamic audio ecosystem, but it also underlines the central role radio continues to play in people’s everyday lives. Radio’s combination of scale, trust, and consistently high time spent listening sets it apart, even as audiences embrace a wider mix of digital formats. For advertisers and content creators alike, radio remains a powerful and deeply valued part of Ireland’s audio landscape,” said Ciaran Cunningham, CEO, Radiocentre Ireland.