Aaron Poole, marketing executive, PML Group with this week’s Out \ Look on Out of Home

Aaron Poole, marketing executive, PML Group with this week’s Out \ Look on Out of Home

Black Friday is at the forefront of the Christmas shopper’s minds today as deals and discounts are availed of en masse. In the midst of it all, Curry’s Black Tag Event is present across a range of OOH formats as the retailer continues to build a strong presence in terms of mental availability.

Key commuter and retail routes see the brand meet shoppers at a moment when value is front of mind and decisions are being made in real time. The campaign runs across roadside large format, national digital, transport and mall environments with a focus on core tech offers.

At Ushers Quay the activity takes an innovative twist. The well-known Golden Square site carries a raised Black Tag detail with perimeter lighting. The panel faces traffic leaving the city and holds a clean read across the junction, giving Curry’s a distinct moment to help align with a day when many shoppers are acting on planned purchases and comparing bigger ticket items before the weekend.

“Our Black Tag event is always an exciting moment in the year for Currys,” says Keith Daly, country manager for Currys Ireland. “It is a time when our customers are actively seeking great value whether they are treating themselves or choosing gifts for others ahead of the festive season. It is also a great time to be out and about ourselves, whether that is meeting customers in our stores and delivery network or seeing how our work with PML Group comes to life across OOH.”

Our iQ insights show that Black Friday shoppers look to advertising for reminders and signposting, with OOH formats such as high streets, shopping centres and supermarkets considered the most useful for keeping offers top of mind. PwC’s latest outlook also points to selective spending this year, with many planning to manage budgets carefully but still prioritising electronics, which strengthens the relevance of Curry’s product mix on Outdoor today.

“Working with PML on this year’s campaign has been a real highlight,” continues Daly. “We brought together trusted formats with new special builds that amplify our presence in busy city environments. This mix helps ensure Currys stays top of mind at a moment when people are comparing key tech products and making decisions in real time. We are delighted with how the campaign brings the energy of Black Tag to life for people on the move and shows the power of OOH to meet customers where they are.”

Innovation continues to help brands stand out at busy trading moments. Our research into enhanced formats shows that special builds are more noticeable and more likely to signal an innovative brand, without needing large structural changes to deliver impact.

With 59% intending to shop in-store across Black Friday and Cyber Monday, OOH remains a central part of the journey from street to store, giving brands like Currys a visible signal at a key location as shoppers move through the day.

Disney brings Zootropolis 2 life

Outdoor consumers are finding themselves in the middle of Zootropolis this week as Judy Hopps, Nick Wilde and friends have begun to appear across OOH networks in support of the release of Zootropolis 2 in cinemas today.

Planned by Zenith and Source out of home for Walt Disney Studios Ireland, the campaign spans large format roadside digital bridges, The Green Screen, Orbscreens, mall digital and Dublin Bus T-Sides, ensuring the new adventure is visible on key commuter and family routes. Consistent creative carries the release date and lead characters, building familiarity from street level to retail and leisure environments as anticipation for the film grew.

Dundrum Town Centre has become a hub of activity for the campaign, where Disney has invested in bespoke installations turning high dwell areas into full Zootropolis scenes. In addition to the atrium’s DXScreen, a series of vinyl wrapped lift doors brings the cast right into the mall with character pairings greeting shoppers as they move between levels. Inside the lifts, full interior wraps and character standees create a playful reveal when the doors close, making every journey feel like a trip through the city.

Along the centre’s main travelators, extended runs of branded glass panels follow visitors up and down the mall. The creative uses the winding form of new reptilian character Gary De’Snake to guide the eye along the length of the travelators, integrating the artwork with the architecture and reinforcing the film’s release date at multiple points on the journey. From the upper levels, the effect is a continuous band of Zootropolis branding tying together different parts of the centre.

Smaller touches complete the world building. Floor level decals styled as miniature doors and viewpoints reference some of the film’s supporting characters and reward closer inspection, particularly for younger visitors. These elements are positioned at natural pause points, encouraging families to stop, notice and share photos of the activity.

Dundrum is a key family and entertainment destination, with Movies@Dundrum sitting at the heart of the complex, so the special build naturally aligns Outdoor with the point of purchase. Families heading to or from the cinema encounter the creative multiple times, with the mall activity reinforcing the film choice right when tickets are being considered or collected.

As Judy and Nick take on a new case in the mammal metropolis, Disney’s latest OOH outing ensures the world of Zootropolis is already familiar on the streets, roads and shopping centres where Irish audiences are planning their next big screen visit.

January Choices: Health, Habit and OOH

January is often treated as a clean slate. Resolutions are made, routines are reset and shelves fill up with products promising a healthier year ahead. To benchmark this, earlier this year our iQ research set out to understand where people place themselves on that health spectrum and how that sits alongside the food and drink advertising they say they are noticing in the real world, including on OOH. Fieldwork took place at a time when high-protein foods, better breakfast choices and no or low alcohol options were already prominent on OOH as part of the usual January reset activity.

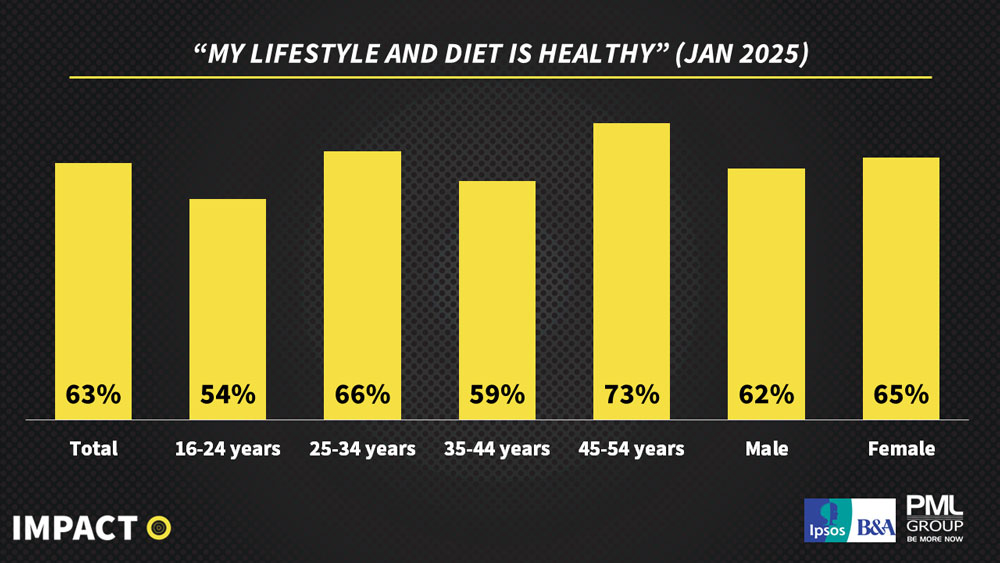

Among Dublin adults, 63% say they would describe their lifestyle and diet as healthy. At the same time 26% say they would not and 11% are not sure. That does not suggest people are struggling, but it is not a picture of complete confidence either. It sits somewhere in the middle, with a clear gap between the ideal and the reality of everyday life. That is useful context when so much new year messaging might approach audiences as if they are either fully “on the wagon” or completely off it.

Younger adults are the most likely to feel that gap. Among 16-24s, 54% consider their lifestyle and diet healthy, while 35% say it is not. By contrast, 73% of 45-54s say they are living healthily, with only 13% in that group disagreeing. On paper, older adults sound more content with where they are, while younger audiences are more likely to say they are not where they want to be with their health, even as they are exposed to more content, more products and more expectations around wellness than any previous generation. For OOH, which is embedded in the same everyday journeys as those behaviours, that mix of aspiration and unease is part of the backdrop rather than a simple targeting line.

Recent Kantar Worldpanel work around Veganuary points in the same direction, with three out of four Gen Z now spending less than 20 minutes cooking lunch and dinner and a quarter following high-protein or vegan diets, more than twice the average. Convenience, speed and healthier choices are all in play at once, which helps explain why younger adults both question their own health and say they are noticing a lot of food and drink advertising around them.

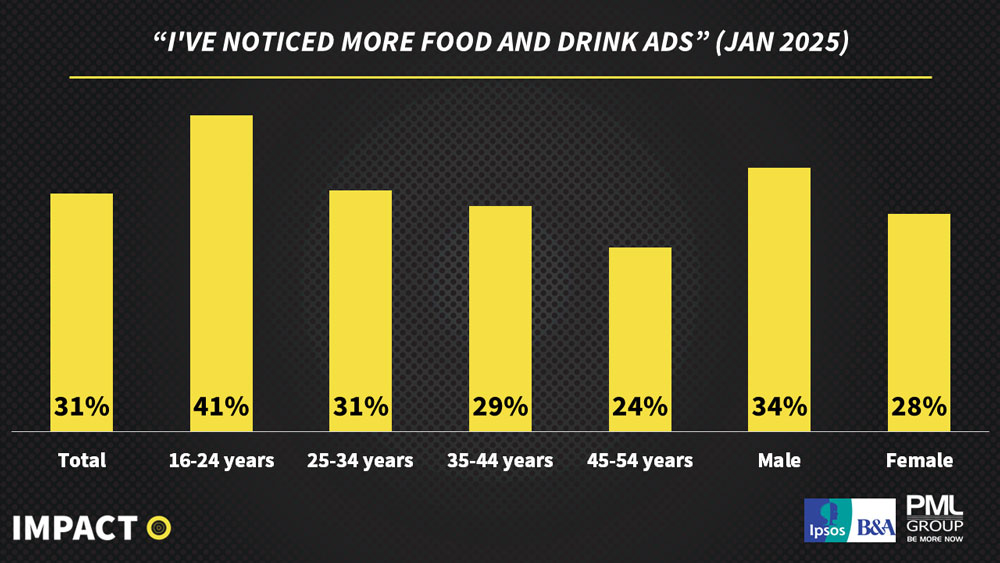

We also asked whether people had noticed more food and drink advertising across those early weeks. Food and drink is a consistently active category on Outdoor and the results reaffirm that visibility in those early cycles. Overall, 31% say they have noticed more food and drink ads, 54% feel it is about the same as usual and 15% are not sure. Younger adults are again more attuned. Among 16-24s, 41% report noticing more food and drink advertising, compared with 31% of 25-34s, 29% of 35-44s and 24% of 45-54s. The group least likely to describe themselves as fully healthy is also the group most likely to say they are seeing a lot of food and drink messaging around them.

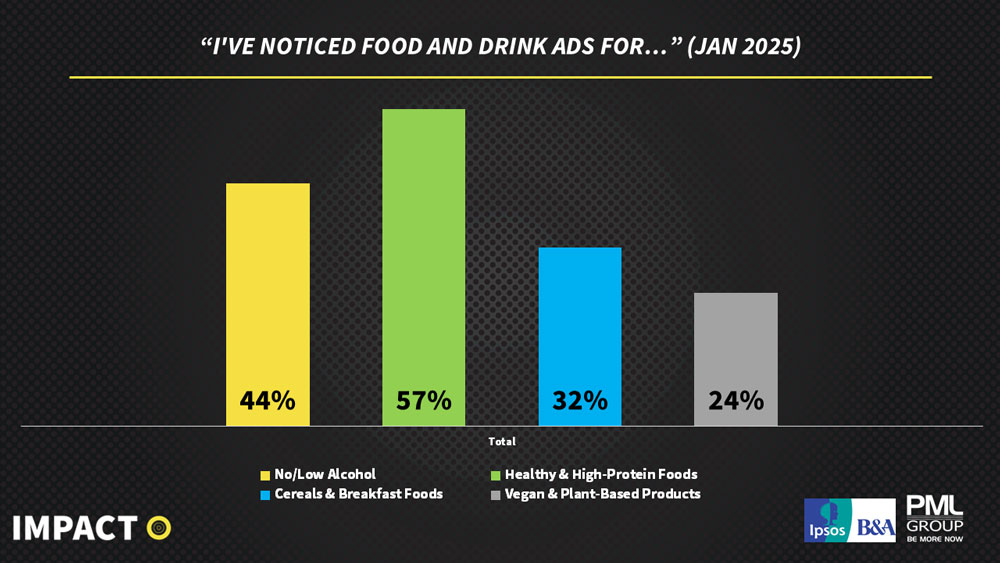

To understand what that looks like in practice, we showed respondents a list of health-related food and drink categories and asked which they had seen advertising for recently. The focus here is on category presence rather than individual campaign performance, but the pattern is instructive. Healthy and high-protein foods sit clearly at the top, with 57% saying they have seen advertising for products such as protein bars, yoghurts and supplements. These products have moved from niche to everyday, appearing in lunch breaks, gym visits and convenience missions, and OOH often meets audiences at those moments.

No and low alcohol follows closely, with 44% saying they have seen advertising in this space. Claims are strongest among 25-44s, which aligns with a wider moderation narrative that focuses on balance and substitution rather than all-or-nothing change. In an OOH context that often means normalising alcohol-free options in familiar social and retail environments during periods such as Dry January.

Cereals and breakfast foods are mentioned by 32% overall as something they have seen advertised recently, peaking at 49% among 45-54s. Breakfast remains one of the most habitual parts of the day. Outdoor formats that connect residential areas, workplaces and retail locations sit naturally alongside those routines, which may help explain why this category features strongly in people’s mental picture of recent food and drink advertising.

Vegan and plant-based products are named by 24% overall as something they have seen advertised, rising to 29% among 16-24s and 25% among 25-34s. That puts plant-based behind protein and no or low alcohol in absolute terms, but the age profile is consistent with how many of these brands position themselves and where they tend to appear in the OOH landscape.

Taken together, the findings suggest that January on OOH is less a story of dramatic reinvention and more about small adjustments. Most people feel broadly healthy, yet a substantial minority do not, and younger adults in particular are more likely to sit on that uncertain middle ground while also saying they notice a lot of food and drink advertising around them.

For Gen Z in particular, OOH also sits close to the moment of decision. Our own Media Impact research on media touchpoints shows bus stops, billboards, bus sides and retail OOH among the strongest prompts for Gen Z spending, ahead of many other channels. When high-protein, vegan and no or low alcohol brands appear in those environments, they are meeting an audience that is already primed to act on the choices they have been considering. For OOH planners, the question is less about tapping into a once-a-year reset and more about using Outdoor to support realistic, everyday shifts that are already under consideration.