As economic uncertainty continues to cast a shadow over the global marketplace, consumer confidence remains rooted in negative territory, according to the latest Ipsos B&A Consumer Confidence Barometer.

As economic uncertainty continues to cast a shadow over the global marketplace, consumer confidence remains rooted in negative territory, according to the latest Ipsos B&A Consumer Confidence Barometer.

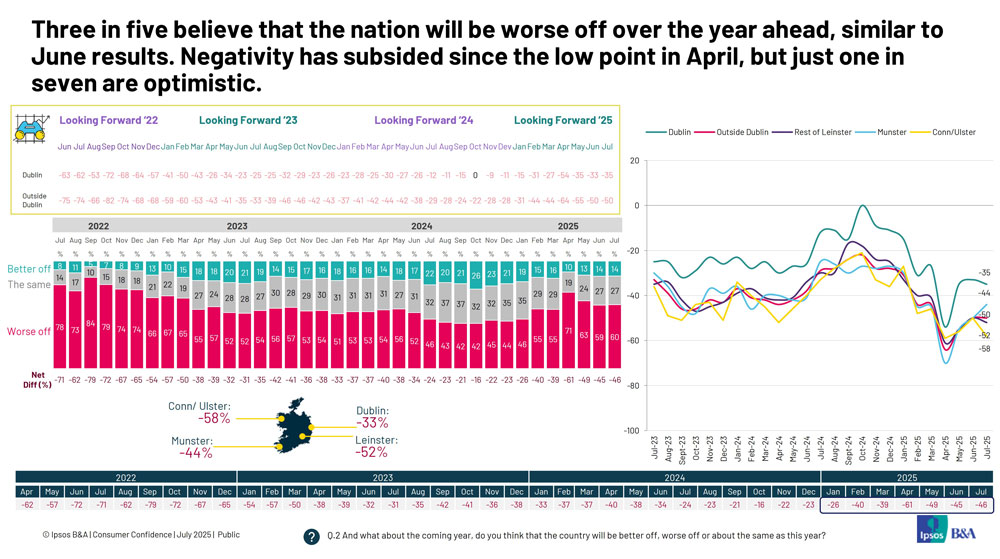

This wave of the Ipsos B&A Consumer Confidence Barometer was conducted from the 3rd – 10th July 2025 and it shows that consumer confidence has stagnated in July, with a net rating of -46 (those feeling downbeat versus those feeling more upbeat). This compares with -45 last month.

60% believe that the country will be worse off in the year ahead, with a mere 14% expecting the country’s economy to improve. Relatively speaking, Dubliners continue to be most upbeat. As seen previously, confidence is lowest among females, those aged 35-54, and C2DEs.

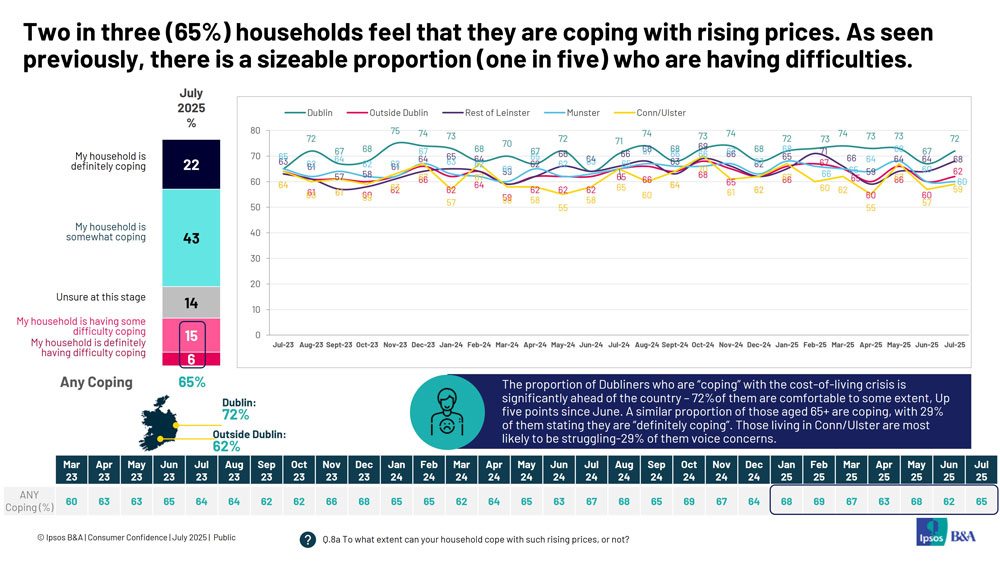

Official warnings of a jobs slowdown as a result of tariffs are becoming more strident. In addition, unemployment is creeping upwards. Those households who claim to be “coping” with the cost-of-living now stands at 65% vs. 62% in June. However, one in five households (21%) claim to be struggling. Inflation has declined from the high watermark of 2022, but there are still key pinch points.

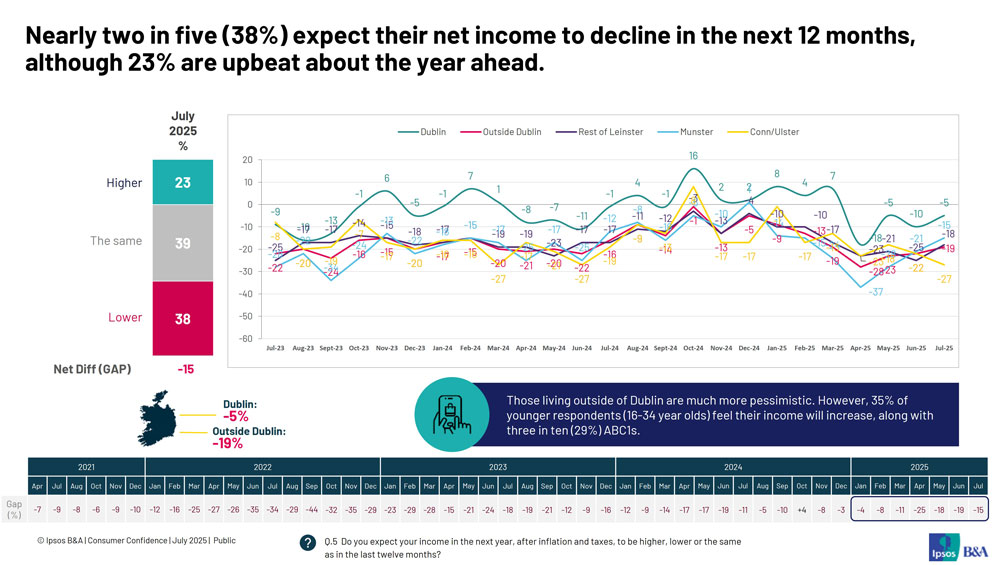

Nearly two in five (38%) expect their net income to decline in the next 12 months, although 23% are upbeat about the year ahead. Throughout the results, Dubliners are most positive in their appraisals.

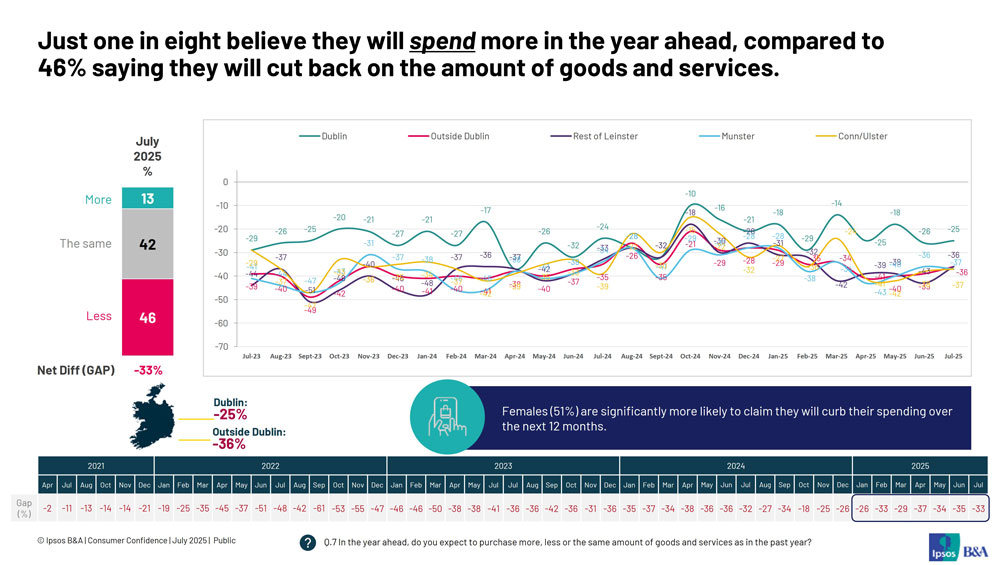

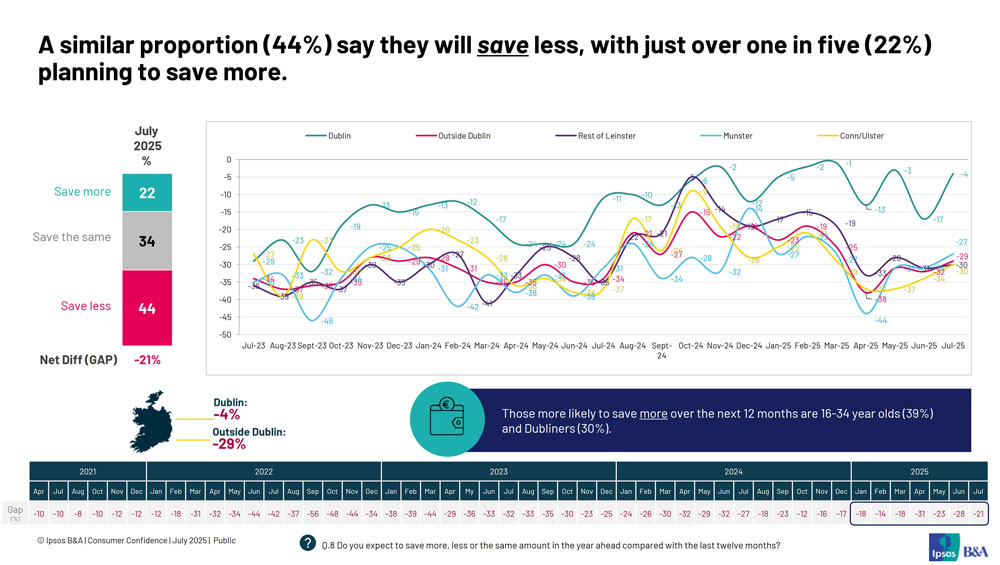

In total, over two in five (42%) think they will spend less over the year ahead, with just one in eight (13%) planning to spend more. This mirrors saving intentions – 44% plan to save less, compared to just over one in five planning to boost their savings over the next 12 months.

Householders in general do believe that their net asset wealth will increase over the next year. Projected asset growth over the next 12 months has increased notably since June. The net gap (those who think their asset value will increase minus those anticipating a decrease) stands at +21; up from +9 in June.

Again, this is largely driven by Dubliners – 45% of them forecast an increase in asset value, compared to 36% outside of the capital.

For more details and the full report, please contact Paul Moran and Pooja Sankhe: paul.moran@ipsos.com and pooja.sankhe@ipsos.com