James Byrne, Marketing Manager PML Group, with this week’s view from Out of Home.

With the first week of phase 3 complete, there was a buoyant start to the single biggest reopening of society and the economy.

Retail, mobility, and sentiment figures points to a strong rebound in recovery with uplifts in spending and confidence. Analysis below shows how people are embracing the great outdoors and opting to socialise and meet friends and families in public spaces.

This behavioural trend opens up a wide range of OOH solutions for brands to connect and engage with audiences in these public spaces. Meeting people outside the confines of a home will be a prevalent pattern in the coming months and OOH is perfectly placed to communicate with audiences in these spaces.

Mobility

Ireland is now in Phase 3 of the Roadmap for reopening society and business. ‘Staying local’ is no longer a necessity and means you can now travel anywhere in Ireland. Businesses that could reopen from 29th June included cafés and restaurants, pubs and hotel bars operating as restaurants, hotels, hostels, caravan parks and holiday parks. Hairdressers and all remaining retail (for example, bookmakers) along with gyms can also reopen. Cultural and religious destinations such as museums, galleries, theatres, cinemas and religious places of worship are also free to open.

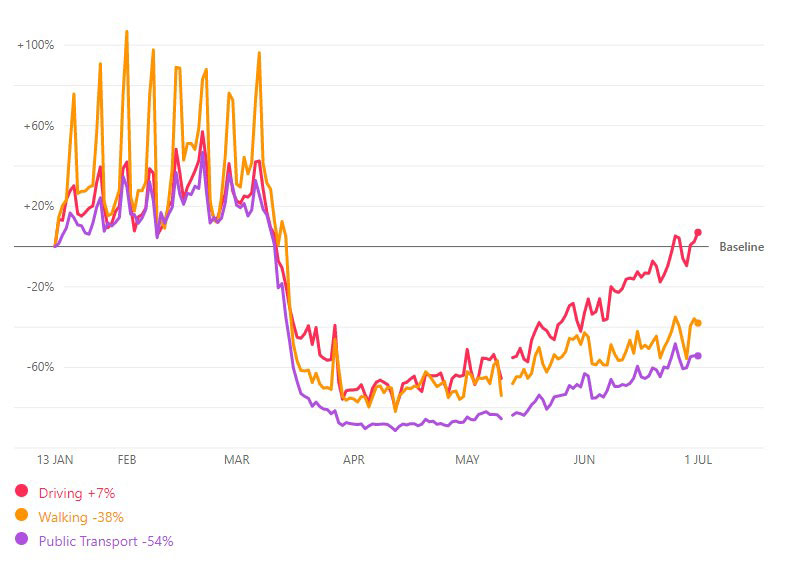

Apple’s routing requests mobility data to Wednesday 1st July shows driving in Ireland is now +7% above January’s baseline and +23% in the past fortnight. It has fully recovered in 95% of counties. Munster has seen the strongest bounce back with driving levels up an average of +50% across the six counties on pre-Covid level taken January 13th. From a low point during lockdown in early April public transport numbers have increased more than four-fold. Driving in Northern Ireland is now 16% above baseline, ahead of the UK which stands at -7%.

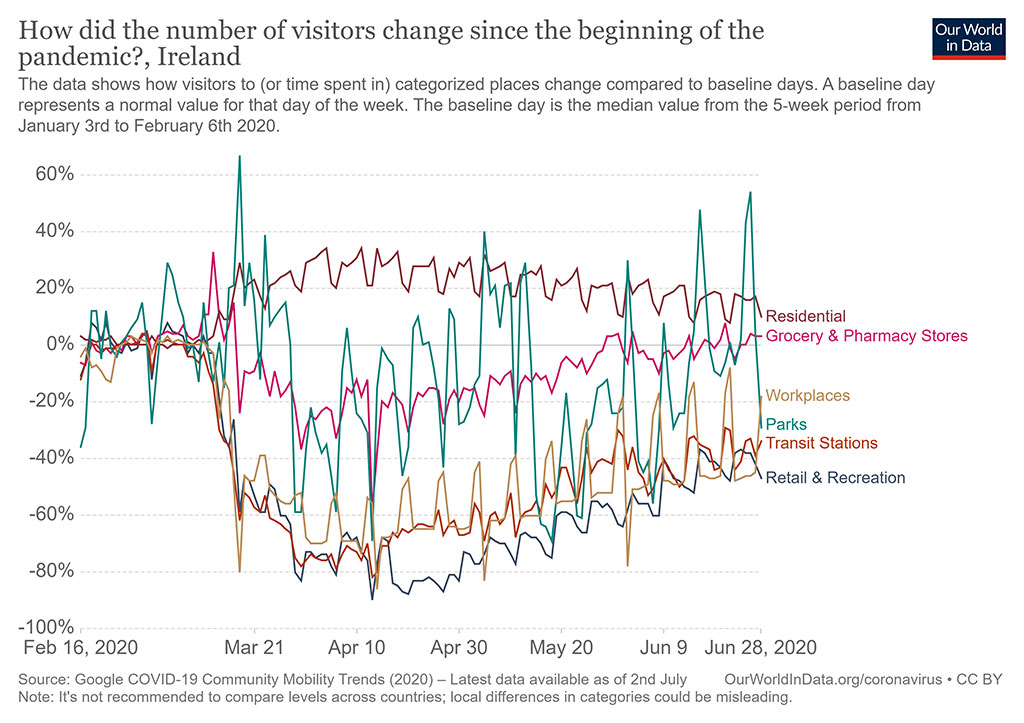

What impact has the pandemic had on how people across the world work; live; and where they visit? We can get some insights on this from the data that Google presents in its COVID-19 Community Mobility Reports. Using anonymized data provided by apps such as Google Maps, the company has produced a regularly updated dataset that shows how peoples’ movements have changed throughout the period. The dataset measures visitor numbers to specific categories of location (e.g. grocery stores; parks; train stations) every day and compares this change relative to baseline day before the pandemic outbreak. Baseline days represent a normal value for that day of the week, given as median value over the five‑week period from January 3rd to February 6th 2020. Measuring it relative to a normal value for that day of the week is helpful because people obviously often have different routines on weekends versus weekdays.

With the reopening of businesses as part of phase 3 we expect mobility within retail and recreation (places such as restaurants, cafés, shopping centres, theme parks, museums, libraries and cinemas) to substantially recover as initial pedestrian and auto metrics from Locomizer, based on analysis of mobile phone location data via anonymised app reporting, has indicated.

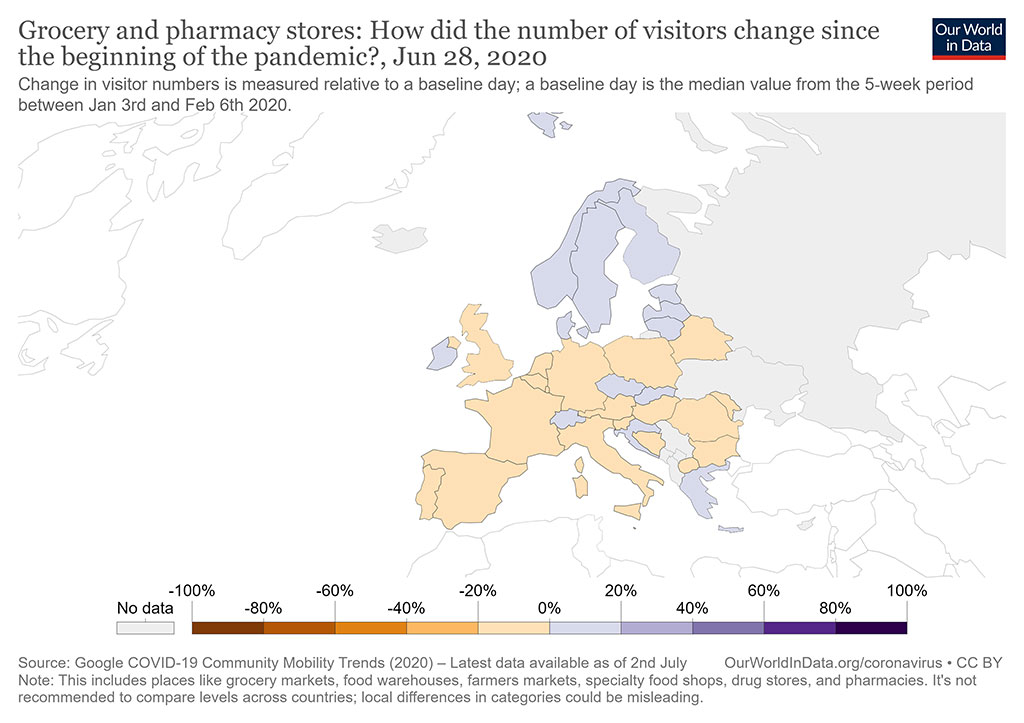

Latest figures for Ireland show that visits to supermarkets and pharmacies have risen above baseline in the past month. While international comparisons aren’t recommended the recovery is this sector here appears to be stronger than much of Europe.

The National Road Car Traffic Report released by the TII on Wednesday 1st July shows that, overall car traffic was typically down by between 24% and 37% of the volumes of one year ago, across the sampled traffic counters. Car traffic just south of the Northern Ireland Border on the N1 at Jonesboro is up 14% as compared with Wednesday 24th June, continuing the strong growth in car traffic recorded at this site. Car traffic volumes on the radial routes into Dublin showed an increase as compared with Wednesday of last week of between 5% and 9%. Car traffic was up 9% on the M4 at Celbridge-Maynooth, 8% on the M11 at Bray, 8% on the N7 at Citywest, and 5% on the M1 at Swords to Airport.

Retail

Shopping Patterns Begin to Return to Normal

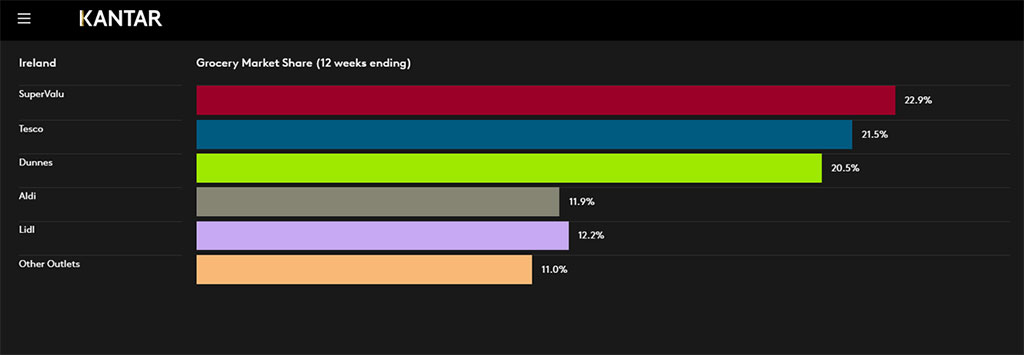

The latest figures from Kantar showed that take-home grocery sales in the Republic of Ireland increased by 24.7% in the 12 weeks to 14th June.

In the supermarket stakes, SuperValu was crowned top retailer for the 3rd consecutive month with 22% market share, in the 12 weeks. The retailer welcomed an additional 53,000 shoppers into its stores.

Tesco sales grew by 22% to gain 21% of the grocery market share. Kantar attributes this growth to consumers increase in spending with an additional 5 items purchased each trip.

A similar picture is witnessed at Dunnes, with customers adding an additional 5 items and spending an extra €14 per trip. Generating strong growth of 15%, Dunnes Stores market share now stands at 20%. Lidl boosted its sales by 29% with the strongest growth experienced in Dublin.

Witnessed during the lockdown, shoppers adjusted their shopping behaviour and were making fewer, larger trips to the supermarket. However, now that restrictions have begun to ease the number of shopping trips has increased slightly in the past four weeks, suggesting a small return to more normal shopping habits.

However, shoppers are still buying more than normal. The average person spent an extra €204 in June, averaging €30 each trip. In terms of clicks vs bricks, the physical shopping experience is still the most prevalent with 63% of people stating they have not shopped online and don’t intend on doing so in the future.

Shaping Ireland’s Retail Future

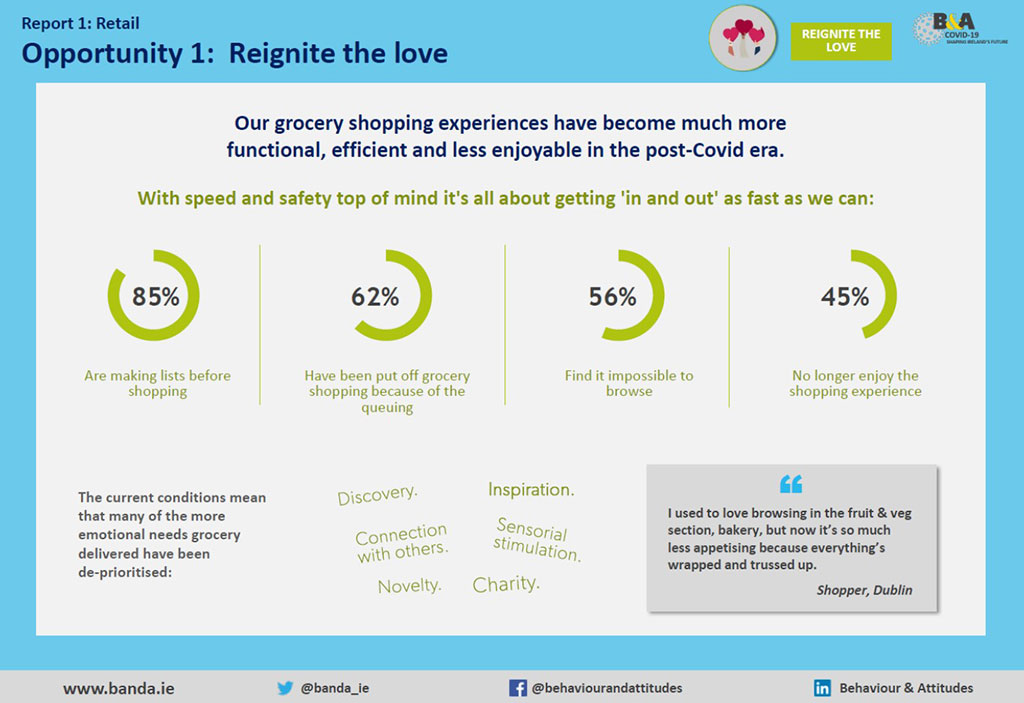

This week, B&A launched a new phase of its Covid-19 reporting. The first report examines challenges and opportunities for the Irish retail sector.

According to the ‘Shaping Ireland’s Future’ report, our shopping experience has become much more functional and efficient. 85% are making shopping lists beforehand and 56% reported they find it difficult to browse in store.

Shoppers continue to shop locally even after restrictions have lifted with supporting the local area, working from home and a more personalised service being credited to this continuation.

We are still in a state of influx and the how, when, where, why we shop has changed. Consumers have changed their shopping times and are more narrow focused when they are shopping.

The report recommends retailers utilise other channels beyond in-store to inspire and engage emotionally with customers. This present an opportunity for brands and advertisers to influence the shopping list on the journey to stores. The importance of influencing the shopping list prior to entering the supermarket is more important than ever for FMCG brands and this will remain the case in the ‘Next’. Out of Home has long been recognised as the ‘Last Window of Influence’ as it is the channel most consumers will encounter last before entering a store – both en-route, in car parks and at entrances to stores. OOH can influence the shopping list by driving mental availability and awareness of products. If brands can make the final connection with shoppers with relevant and flexible messaging it will bear fruit a few minutes later in store. Shopping local and with purpose plays to some of OOH’s key strengths – location and context.

Another strategic assessment from the report is for brands to understand and focus on the specific needs of local communities as a strategy.

Average Spend in Clothing Stores Jumps

AIB debit and credit card transactions data published this week shows the Friday before the June Bank Holiday weekend was the busiest shopping day since lockdown restrictions began to lift.

Over one million AIB transactions between May 18 and June 14 were compiled to measure spend in the first two phases of the governments reopening.

Friday, May 29 was the busiest day for shopping and the busiest day for in-store spending so far since the restrictions started to lift.

As Penney’s opened on the June 12 along with other major retailers’ days before, the data reveals this was the busiest day for clothes shopping and the second busiest day overall in relation to in-store transactions.

The average amount spent on clothes increased compared to a normal shopping period pre-covid. Consumers spent an average of €75 per transaction in clothing stores, up €15 from an average of €60 before stores closed.

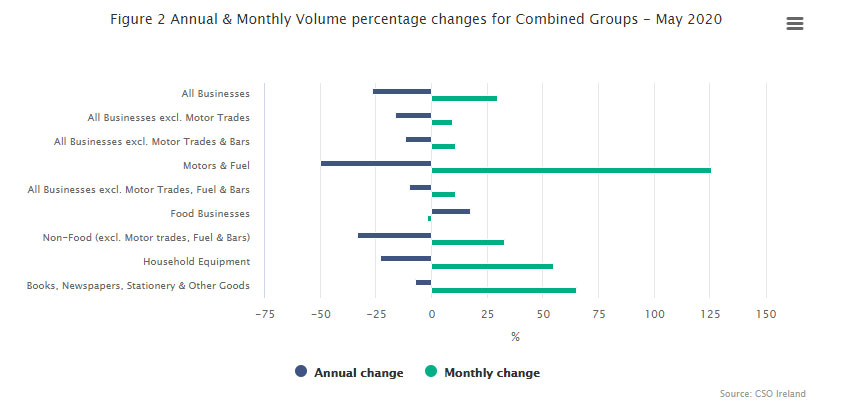

Retail Sales Jump By 29.5% in May

The volume of retail sales increased by 29.5% in May 2020 when compared to April 2020, the latest figures from the CSO reveals.

Among the sectors showing a large volume increase between April and May 2020 were Motor Trades (+153.9%), Hardware, Paints & Glass (+92.5%), Furniture & Lighting (+85.9%) and Other Retail Sales (+69.3%). The research shows that there was an increase of 28.4% in the value of retail sales in May 2020 when compared with April 2020, suggesting signs of recovery.

It is important to note that most retail outlets were still closed in May with the exception of essential retail sectors. Compared to last year, sales were only 26% lower.

Leisure

Consumer Spending Spike as Lockdown Eased

It has been an optimistic start to this week’s phased reopening of Ireland according to revolut spending figures.

Spending rose by 53% on Monday compared to the average day in lockdown. The pent-up demand of consumers was evident as the data showed the average spend was almost one-quarter higher than a normal pre-Covid Monday.

The spend in hairdressers and barbers was triple of a normal Monday as consumers flocked for a post lockdown trim. Stories emerged of hairdressers and barbers opening at midnight on Monday to cater to the demand with large queues forming outside some premises.

Health and wellbeing services were other high spend sectors. Spending on spa services was 50% higher than that of an average day. While customers also spent heavily on services such as dentists.

As pubs open, spending was ahead of a normal pre-Covid Monday. The €9 meal requirement helped propel spending, with the average customer handing over €27 compared to €13 on an average night out before Covid-19.

Dublin Pubs ‘Booked Out’ for Early Days of Reopening

Another milestone of the recovery was the reopening of pubs and restaurants on Monday. Healthy demand was witnessed this week with businesses being inundated with bookings.

Its reported that over 450 pubs reopened this week in Dublin, roughly 60 per cent of the total. With many pubs taking pre-booking, demand was strong with reports that a majority of pubs are fully booked for the whole week.

The next big day out for punters and publicans is July 20th when pubs and bars that do not serve food can reopen.

Meanwhile, the Restaurants Association of Ireland have also confirmed strong demand for bookings.

Outdoor dining and seat areas was evident in Cork this week, with Cork City Council temporarily giving up pedestrianised streets to help business and members of the public adhere to social distancing guidelines.

Cork City Council is creating up to 12 ‘people friendly’ pedestrianised city centre streets, offering scores of free street furniture licenses and will also install 43 new bicycle racks across the city. With this new continental style of dining emerging in Ireland, audiences venturing into city locations may be met with more al fresco dining options.

As the weeks go on, we can expect to see a continuation of this pent-up demand with an uplift in audiences visiting leisure locations as people look to venture to their favourite watering hole and step away from the kitchen.

Sentiment/Insights

Confidence Prevails in Latest Wave of Covid Research

The Irish public has become much more confident with managing life with Covid-19, the latest findings from Core Research public confidence research shows. For the first time, there are now more people only a little concerned about Covid-19 than those who are concerned.

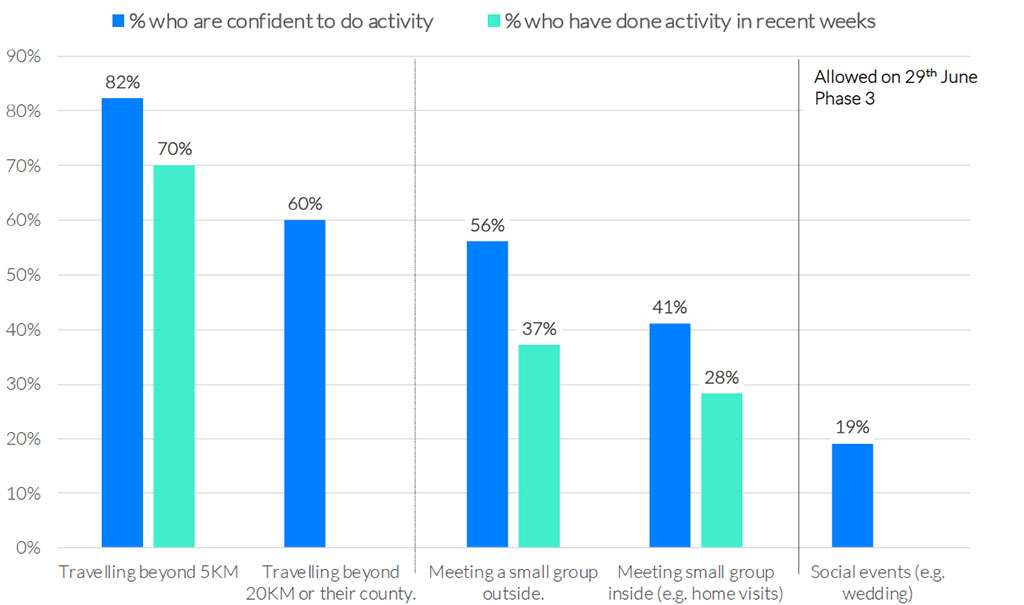

The research also shows how people are prioritising and engaging with experiences they missed the most with socialising with friends and family seen as a top priority as confidence increases.

We are embracing the great outdoors in our stride with meeting people outdoors becoming very familiar and the most comfortable way for people to re-connect. As usual, the fine weather contributes to significant peaks in the use of public spaces and outdoor socialising.

As people begin to travel further afield, the research found the key reason for travel is to meet other people, with 37% saying they have done so in recent weeks.

With the majority of cultural, recreational, sports and hospitality reopen, one in three people said they will return immediately, this will increase across the summer to two in three by September.

As the research suggest the summer will be a key period to instil and improve public confidence in engaging in certain activities.

As we begin to grasp the monumental phases 3 of the roadmap, people will begin to navigate the new lifting in restrictions and begin to feel more comfortable in various spaces and settings. The research found those who engaged in activities permitted in phase 1 and phase 2+ are more confident in engaging with other activities.

Core Research suggests three key themes for planning based on the research findings to instil confidence in the public;

- Embracing the outdoors – the summer season will be a benefit in improving public confidence as peoples’ desire to spend more time outdoors intensifies.

- Reassuring on safety– a focus on safety communications will be integral to instilling confidence

- Re- positioning the enjoyment – reassure and remind people of the enjoyment and fun of recreation and retail areas

Gen Z Eager for Events Return

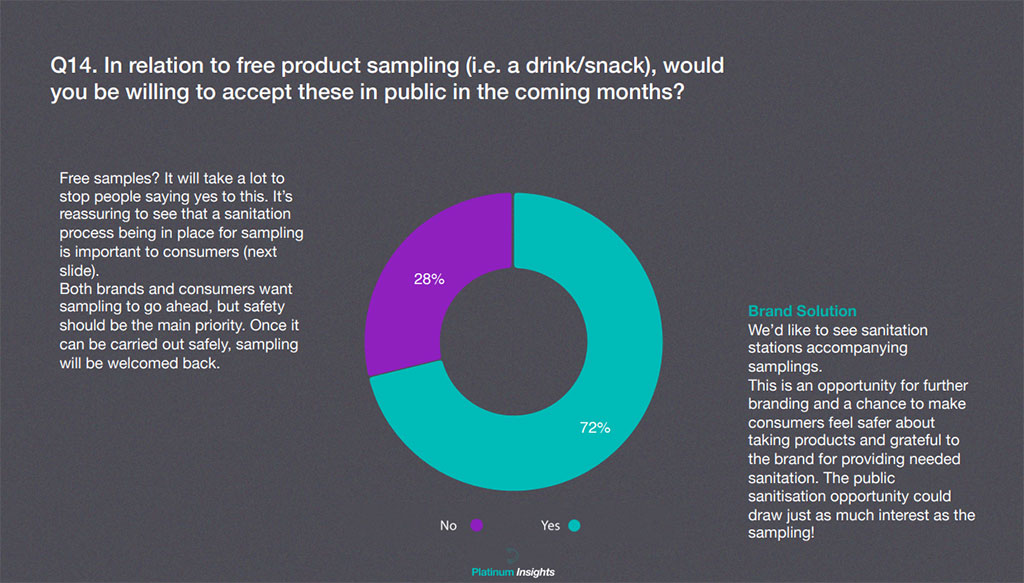

Creative experiential marketing agency, We Are Platinum, recently conducted a survey of 18-24 year olds in Dublin to assess what young consumers are thinking when it comes to events this summer.

The research found that 48% of people surveyed would attend an event with over 1,000 people this summer, indicating there is a desire for large scaled events when allowed to do so.

And they are willing to spend more with 43% of 18-24 year olds stating the would spend more to attend events.

More intimate events will see a rise in popularity and demand for smaller events is evident with 42% stating they would attend an event this summer with an attendance of only 100 people. 85% of 18-24 year olds would like to see smaller, lower capacity events taking place this summer.

Looking at free product sampling activities at events, a whopping 72% agree they would be willing to accept sampling products in the coming months. However, sanitation process will be important to this age group in relation to sampling.

Looking to the reopening of pubs, the age group shows its eagerness to return to the pub. 58% of 18-24 year olds would still attend a pub that was not enforcing social distancing. However, despite their willingness to attend a pub with no social distancing implementations, 72% of 18-24 are interested in having private sections in pubs.

Consumer Confidence Rebounding

Shoppers’ caution about spending eased this month, according to Bank of Ireland’s Economic pulse findings.

Money and job security fears eased in June as more people returned to work boosting buying sentiment slightly. Around one in five people surveyed considered this a good time to make major purchases.

The Business Pulse rose for a second month running in June, 47% of Irish firms now believe activity will increase in the next 3 months.

The Bank of Ireland Economic Pulse showed a reading of 56.3 for June, up 12.4 on last month.

The findings show a rebound in sentiment is under way with business and consumer confidence rising. As more stores and sectors reopen and more people returning to work, we can expect consumer sentiment to continue to strengthen.