James Byrne, marketing manager, PML Group with this week’s Out \ Look on Out of Home

James Byrne, marketing manager, PML Group with this week’s Out \ Look on Out of Home

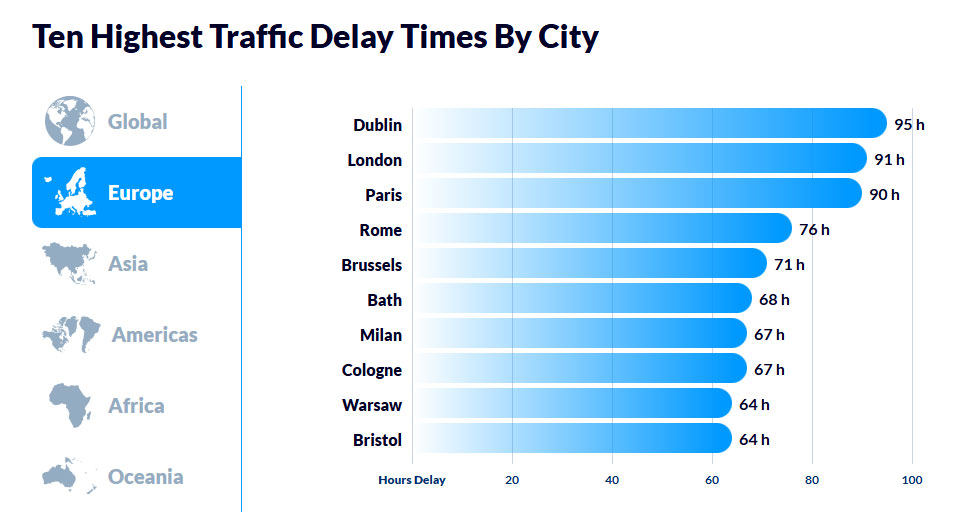

Dublin is #1 City in Europe for Time Lost in Traffic Delays.

Although not necessarily good news for everyone, traffic congestion is favourable for Ireland’s OOH advertisers. Longer and slower commutes increase dwell time exposure to, and impact of, OOH formats from billboards to buses, to bus shelters.

Dubliners lose the most time in traffic congestion of any European City. The Global Traffic Scorecard report from Inrix, analysed 942 urban areas across 36 countries, and ranked those cities using actual, observed trips.

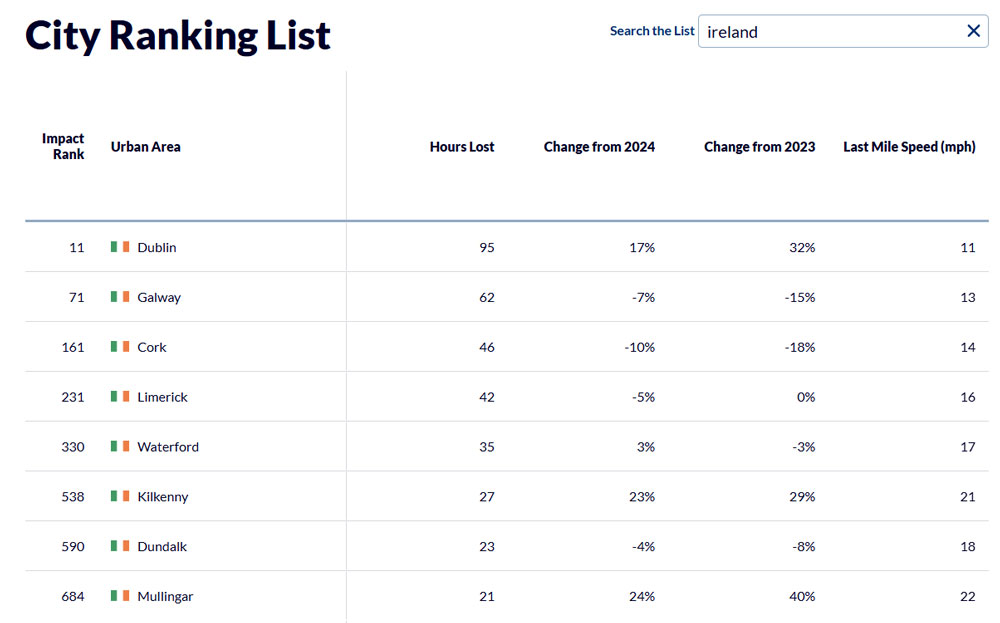

Drivers in the capital were delayed by an average of 95 hours last year, an increase of 17 per cent when compared with the 81 hours lost to congestion in 2024, and a 32 per cent rise from 2023.

Hours lost is defined as the total number of hours lost in congestion during peak commute periods compared to off-peak conditions.

The last mile speed, the speed at which a driver can expect to travel one mile into the central business district during AM peak hours, averaged at just 11 mph or 17.7 kmph.

In urban areas, OOH becomes an ever-present part of the environment, leveraging high foot traffic and daily commutes to deliver messages. In essence, OOH in urban settings turns the city itself into a marketing channel, leveraging physical space and consumer behaviour for impactful brand communication.

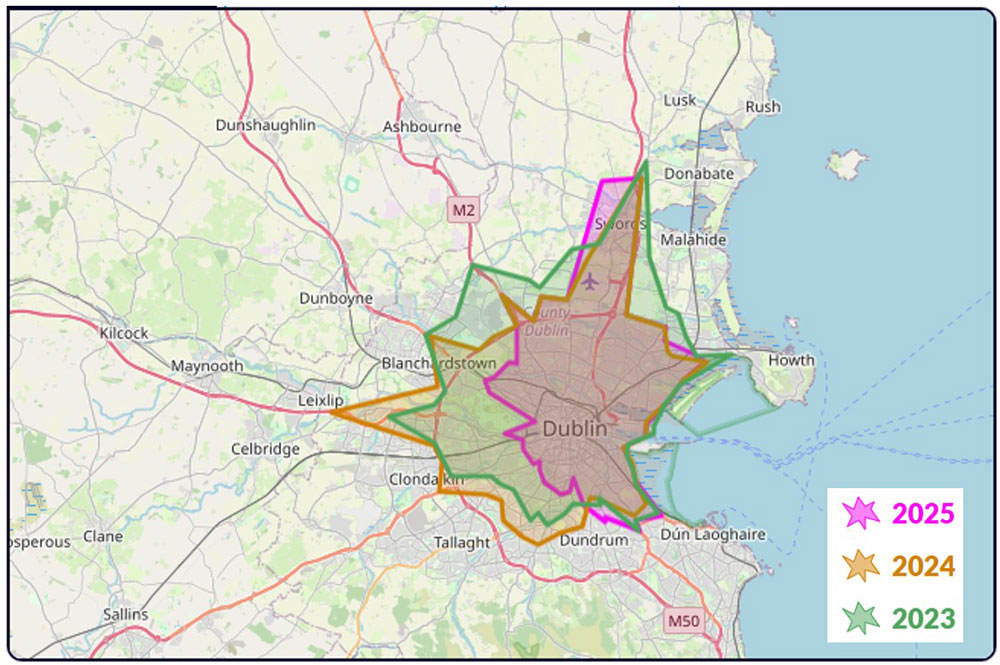

INRIX Drive Time visualizes commuting patterns by time of day. The animation indicates the distance a driver can travel from the city centre outwards in 30 minutes in 2023, 2024 and 2025. INRIX uses anonymous trip data to identify the most frequented routes and destinations throughout a region, not just to and from a downtown core.

Elsewhere, Galway was the 71st-most congested city in the world, with motorists losing an average of 62 hours last year, followed by Cork and Limerick.

This report follow’s last year’s TomTom Traffic Index which found that Ireland’s capital was found to be the 2nd slowest-moving city centre in Europe after London, based on actual average travel times. Dublin drivers lost an average 42 minutes per day due to congested rush hour traffic. This is the second highest figure globally behind Lima in Peru.

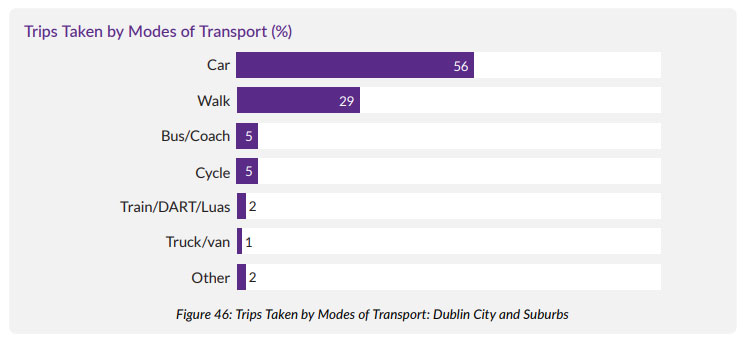

The 2024 National Household Travel Survey revealed that car usage is the dominant mode of transport nationally (71%), but there are significant variations across regions. Car usage is less prevalent in Dublin City and Suburbs (56%) than in Rural Areas (81%). This is further supported by the higher incidence of walking as a mode of transport in Dublin City and Suburbs (29%) and the Greater Dublin Area (25%) compared to Rural Areas (8%).

Across the country, the most frequent reasons for travel are work/business (21%), education (19%), and social engagements (18%), with shopping trips accounting for 15% of all journeys.

Almost six in ten trips (56%) taken by those living in Dublin City and Suburbs were made by car while 29% of trips were made by walking. Trips taken by bus registered at 5% followed by train/DART/Luas at 2%. Those living in Dublin City and Suburbs were more likely to take a trip by cycling (5%) than those living in any other region.

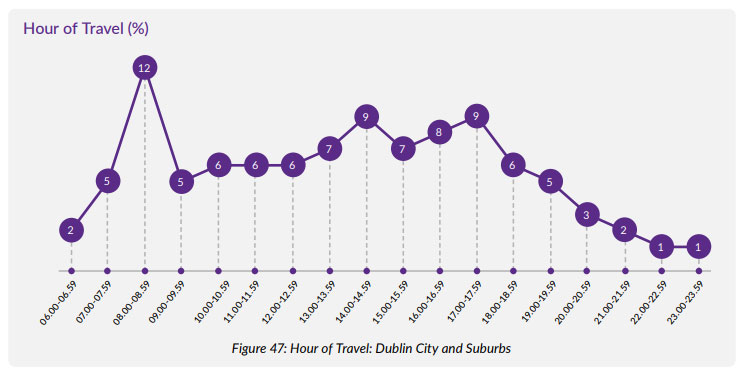

In line with the national picture, travel in Dublin City and Suburbs peaks at 12% between 08.00 and 08.59. The periods between 14.00 and 14.59 and 17.00 to 17.59 are the second busiest, each accounting for 9% of trips.

The majority of car trips taken by residents of Dublin City and Suburbs (almost 60%) last 15 minutes or longer, with the largest proportion (33%) lasting between 15-29 minutes.

Almost one third (32%) of walking trips take 15-29 minutes. Bus/coach trips tend to be longer, with 24% lasting 60 minutes or more.

A significant proportion of cycling trips also fall within the 15-29 minute range (36%). Train/DART/Luas trips are mostly longer, with almost eight in ten lasting 30 minutes or more.

In our increasingly mobile society, consumers spend a significant portion of their time outside the home. OOH advertising effectively reaches them during these moments, whether they’re commuting, shopping, or socialising. This research underscores the opportunity for brands to connect meaningfully with audiences on the move. Furthermore, as consumers grow increasingly weary of intrusive digital ads, OOH stands out as a non-disruptive medium that complements the real-world environment.

By meeting audiences where they are, standing out in a crowded media landscape, utilising iconic locations and dynamic opportunities for storytelling, and driving measurable engagement, OOH provides a go to platform to amplify your brand’s presence and impact.

What January Looks Like on the Street

January gets treated like a clean slate, but it rarely plays out as a dramatic reinvention. What actually happens is re-entry. Commutes restart, routines return, and small adjustments feel achievable again. That is exactly where Out of Home earns its role in 2026, built for impact because it meets people in motion, shows up beside real decision moments, and can be measured back against what audiences actually do.

You can see that reality in what is live right now across Cycle 1. Breakfast cues are back on the street, with belVita bringing a simple morning habit message to life in a campaign planned by Spark Foundry with PML. At the same time, Rice Krispies Bars lean into the humour of daring to ‘give into the gooey’ and be brave in with new year resolutions, planned by dentsu with PML. These are not big, dramatic transformations. They are prompts that sit alongside everyday routines, where location and audience context do the heavy lifting before the copy even lands.

Recent iQ research with Ipsos B&A suggests the public mindset is already primed for that kind of messaging. Among Dublin adults, 63% describe their lifestyle and diet as healthy. That rises to 73% among 45 to 54s and lands at 54% among 16 to 24s. This is not a city starting from zero. It is a city already thinking about habits, with January acting more like a volume knob than a reset button.

That same pattern shows up when we look at perceived advertising visibility. Overall, 31% say they have noticed more food and drink advertising at this time of year, while 54% feel it is about the same as usual. Younger adults are most alert to the shift, with 41% of 16 to 24s saying they have noticed more, versus 31% of 25 to 34s, 29% of 35 to 44s, and 24% of 45 to 54s. It is a useful reminder that Out of Home often picks up attention at the edges of routine, not in grand “new year, new me” moments.

When we dig into what people feel they are actually seeing, the story is consistent with the Cycle 1 landscape. Healthy and high protein cues lead, with 57% saying they have noticed advertising for products like protein bars, yoghurts and supplements. No or low alcohol options follow at 44%, an opportunity being taken advantage of by Rockshore 0.0 planned by PHD with Source out of home. Cereals and breakfast foods come in at 32% overall, peaking at 49% among 45 to 54s, which sits neatly alongside the breakfast presence we are seeing from belVita and broader grocery messaging in market.

Retail brands are also treating January as a credibility moment rather than a trend chase. Holland & Barrett is leaning into trust and expert advice with a campaign planned by dentsu with PML, while Dunnes Stores continues to own value-led seasonal utility in work also planned by the same. In a different register, Heinz Beanz is doing what it does best, anchoring a simple product truth. Even where the category is not traditionally framed as “January health”, the common thread is usefulness, clarity, and repeatable behaviour.

That is why the January moment is better understood as a swap, not a switch. It is not about abandoning the basics. It is about small adjustments that stick, and messaging that meets people where those choices happen by making an impact.