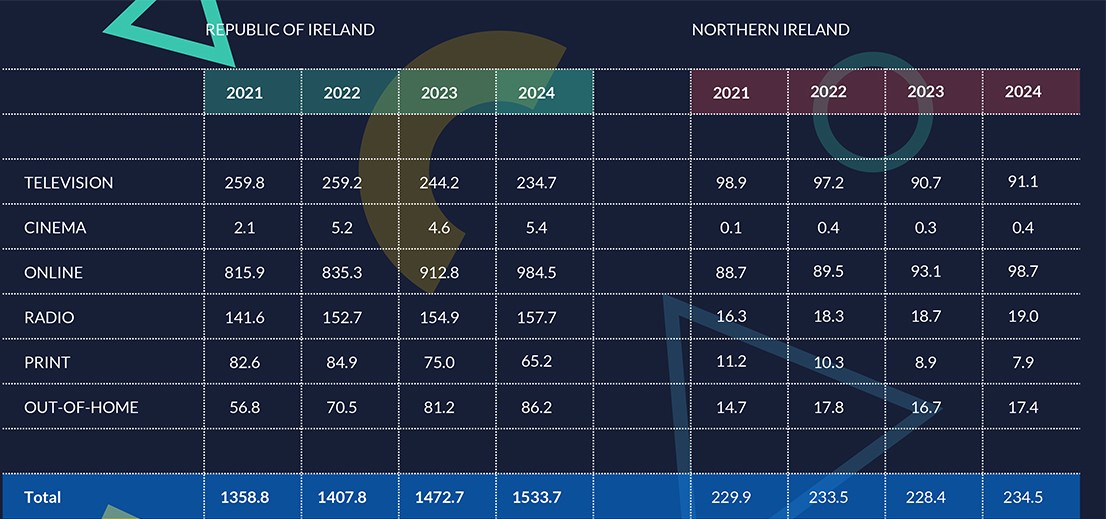

The Irish advertising market is forecast to grow by 4.1% this year to €1.53bn, according to Core. This follows a 4.6% growth in the overall market in 2023 to €1.47bn, according to the marketing services group which includes media agency brands like Starcom, Zenith, Spark Foundry, Core Creative and Core Research.

In its annual Outlook report, Core notes that “trends are very similar to what we witnessed in 2023 with Out-Of-Home and digital expected to be the key drivers of growth.”

According to Core, “the key watch-outs will be the impact of major sporting events on consumption habits in the year ahead. Euro 2024, without the Irish team, will take place in June from Germany, followed by the Olympic Games which will be held in Paris across July and August. As ever, advertising revenues are expected to increase during these periods.”

Digital

This year Core is forecasting that digital advertising revenues will grow by around 7.8% to €984.5m, accounting for a 64% of the total market. Of this, social will account for around 47.8% of the total spend while search advertising is likely to account for around 34.2%. Classified (4.9%) and display (13.1%) make up the balance.

“Social Media and Video investment will once again be the largest categories for growth, increasing by 13.5% and 10.4% respectively,” the Core Outlook report notes.

“Vertical video’s rise is expected to continue with TikTok being the key driver of the growth in Social. We forecast that media spend with TikTok will increase by 42% in 2024. We estimate it will account for circa 13% of social media spend. This compares to a global share estimate of 20% in 2024,” it says.

Within the digital space, Core estimates that advertising on Meta and Google platforms, will accounted for around 79% of the total digital spend in 2023 and this is likely to be a similar figure in 2024. “TikTok’s increasing importance to brands will ensure that the share of digital spends going to the global players will increase in 2024,” it says.

Core’s Outlook report also notes the growth in Broadcaster Video-on-Demand (BVOD) which is expected to grow by 15% this year to €37.4m “alongside the growth in connected TV inventory.”

Video

According to the Outlook report, the TV advertising market declined by 5.8% in 2023 to €244.2m which it notes, is “in line with declining consumption.” For 2024, Core is also forecasting a further decline of 3.9% to €234.7m although it adds that “increased investment from certain categories including motor, utilities and banking will help slow down the revenue decline.”

“2023 could go down as one of the most significant years in recent times for the TV industry with RTÉ’s controversy making waves. The result is budgets cuts of €10m across the organisation. These cuts have meant reducing Fair City from four to three episodes per week. Continued cuts to content budgets seem inevitable. This will be a concern for the industry which has already experienced significant impact from the increasing fragmentation across the video landscape.”

Singling out the importance of live sport to TV schedules, the report notes that “it will be increasingly important for advertisers to access live sport and appointment to view programming to reach the large-scale audiences that TV can still deliver.”

“Broadcasters clearly see sport as a crucial part of their strategy going forward with all increasing their investment in this area. Joint ventures with competitors for sporting rights may become more prevalent as the competition and pricing for the rights increase and budgets come under pressure,” it adds.

With online video continuing to surge to a forecast €450.1m this year, Core says that “the rise in consumption through Connected TV now means that 50% of online video consumption will be delivered through this technology. This growing trend allows advertisers to ensure that there are no ‘gaps’ in their broadcast advertising. CTV, gives us more opportunities to now target more granularly across online video, therefore improving the effectiveness of marketing budgets.”

Elsewhere, Core estimates that cinema advertising will return to growth this year. Despite the success of Barbie and Oppenheimer, cinema advertising fell by an estimated 11.8% last year to €4.8m but this is expected to bounce back by around 17.7% to hit €5.39m on the back on new releases like Dune: Part 2, Deadpool 2 and Despicable Me 4.

Audio

Following a period of modest growth during 2023, the Irish audio advertising market is forecast to grow to by 1.8% this year to €157.7m

“Whilst live listening has remained consistent, significant growth has been seen in digital formats. Music streaming now reaches 40% of adults weekly, up 54% since 2019, and podcasts have doubled to 22% reach. Investment follows audiences and digital audio is expected to command 10.6% of overall audio spend to reach €18.6m in 2024, growth of 18.5% year on year,” Core notes.

News Media

With cutbacks and declines in print readership a key feature of the news media industry in recent years, Core’s assessment of the sector is bearish with a forecast decline in advertising spend of 13.1% to €65.2m this year. On the upside, however, it also notes that “digital spends with publishers are expected to rise by 7.1% to €31.5m this year.”

According to Core, “the impact of artificial intelligence on the news sector will become clearer in 2024, a year with more than half the world’s population eligible to vote in elections. The US Presidential election is the highest profile of these, but closer to home a general election is expected in the UK this year and in Ireland before March 2025. What’s clear from the recent Dublin riots is that the tech companies are losing the battle when it comes to both misinformation and disinformation. AI algorithms prioritising views over verified content, could be the straw the breaks the camel’s back for the Irish consumer and, as was seen during the Covid period, push people towards more trusted content, i.e. the news industry.”

However, it also notes that “the most recent Reuters Report (Reuters Digital News Report) Ireland, 2023) shows, unsurprisingly, that fewer people are reading printed newspapers, which has once again sparked discussions about the future of newspapers in this country.”

Out-of-Home

Following a period of strong growth for the OOH industry since the pandemic – advertising investment in grew by an estimated 15% last year- Core is forecasting that it will grow by around 6% this year to a forecast €86.2m, although this is still marginally down on the estimated €90m in pre-pandemic 2019.

“OOH’s position at the end of 2023 confirms its continued upward trajectory,” notes the report. “The heightened commitment from advertisers, the expansion of new advertisers, and the introduction of compelling digital formats collectively underscore the growing positivity surrounding this medium,” it adds.

“While Republic of Ireland digital share of expenditure still falls behind the UK where the share is close to 60%, it will be a key driver of future growth. The digital share in 2023 was 40% and this is expected to rise to 45% in 2024. The flexibility which digital OOH offers, in relation to production and creative executions, continues to drive Digital OOH growth,” it says.

“OOH audiences are bigger than ever, with traffic, public transport and retail footfall now meeting 2019 levels. 2023 saw traffic levels in Dublin increase by 3% year-on-year, while regional traffic levels increased by 7%.”

Northern Ireland

According to Core’s Outlook report, total advertising investment in Northern Ireland will grow by around 2.7% this year to £204.3m (€234m) following a decline of around 2.2% in 2023.

With the Northen Ireland Assembly back in situ, Government spending- a key component in the advertising mix- is expected to pick up this year.

According to Core, the biggest chunk of advertising expenditure goes to digital channel. This rose by around 4% to £81.1m (€93.1m), it says. “For 2024, we expect to see continued growth, with spends increasing by 6% to £86.0m (€98.7m).”

Last year, advertisers spent an estimated £79.0m (€90.7m) on linear TV, according to Core. This was down by around 6.7% on 2022 it says. “This performance is some way behind the UK where spends are expected to be down by just 2% in 2023. A weak local retail category coupled with lower-than-expected spends by government departments were significant contributors to this performance. We are forecasting that the linear TV spends in 2024 will see a small 0.4% increase on 2023 spends, to £79.3 million (€91.1m).”

Meanwhile, Core says radio expenditure rose by 2.3% to £16.3m (€18.7m) last year and this is forecast to grow by 1.9% to £16.6m (€19m). However, it also notes that the digital audio market is not as developed in Northern Ireland as it is in the Republic.

“A lack of local inventory is a factor in the low spends currently being allocated to this medium. Despite this, we have seen growth of 14% in 2023 to £0.548 million (€0.630m). We forecast further growth in 2024 of 12% to £0.614 million (€0.705m),” it adds.

Mirroring trends across the border, news media organisations in Northern Ireland face many of the same issues and Core expects print advertising revenues to fall “by up to 11.2% £6.9m (€7.9m). Digital revenue with the news media is expected to increase by 4.9% to £1.88 million (€2.16m).”

Elsewhere, the OOH market in Northern Ireland did not encounter the growth achieved in the Republic of Ireland during 2023, according to Core with the overall market contracting by around 6% to £14.5m (€16.7m) although digital OOH (DOOH) spend increased slightly to £5.37 million (€6.17m).

“In 2024 we are forecasting small growth in NI. We believe that expenditure will increase by circa 4% in 2024 to £15.1m (€17.4m). Similar to the ROI market, increased digital spends in NI will be a key driver for the category. We are forecasting digital will account for 40% of the OOH spend at £6.04 million (€6.94m).”

A full copy of Core’s annual Outlook report can be downloaded HERE