Mall Scene: James Byrne, marketing manager PML Group with this week’s Out \ Look on Out of Home.

Mall Scene – More than Shopping Centres

In this week’s Out \ Look, we publish new research from our iQ programme ‘Mall Scene’ investigating retail trends amongst 300 Dubliners, aged 16-54. The findings suggest consumers look to shopping centres for far more than just shopping. Consumers are taking full advantage of both retail and leisure amenities that shopping centres have to offer.

The traditional shopping centre has long been characterized by its large department stores and surrounding clusters of retail apparel chains. But now, shopping centres combine retail with other non-retail attractions such as entertainment venues, expanded dining options, fitness centres and beauty services. These non-retail amenities help drive footfall and provide advertisers with great opportunities to reach their target audience near points of purchase.

With consumers spending more time outside of the home, we asked respondents how often they would visit a shopping centre. 65% of all respondents visit a shopping centre once a week or more. This peaked amongst 35-44s with 83% of females and 69% of males visiting at least once a week or more. Another strong age category is 16-24s with 68% of females and 60% of males. The findings suggest shopping centres are attracting more than just your average shopper as attendance is strong across all categories.

In terms of time spent, 45% of respondents spend about two hours in a shopping centre during a typical visit. 65% of females and 46% of males spend up to 3 hours during a typical visit. DOOH formats such as dPods, iVisions and DX Screens in retail environments help brands extend their messaging along the entire path to purchase. This is a necessary move as consumers are spending more time in retail settings and more time interacting with brands throughout their buying journey.

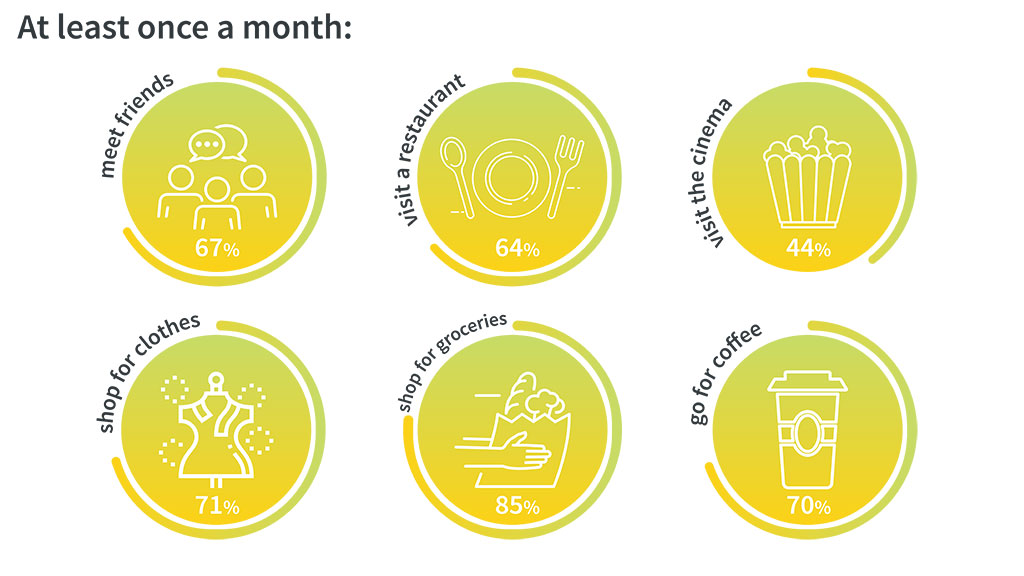

Following this, we asked respondents about types of activities they take part in during their visit. The chart above demonstrates how there is an appetite amongst consumers to get out and socialise through a range of leisure activities such as visiting a restaurant, the cinema or simply going for a coffee. Shopping centres are truly evolving into ‘leisure centres’ to drive footfall and encourage greater social interactions between visitors.

Leisure activities such as visiting the cinema or a restaurant were the most popular during the weekend. Interestingly, only 26% of respondents shop for groceries during the weekend. When comparing grocery shopping to weekdays, this figure increased by 11% amongst all respondents. This peaked for main shoppers at 43% who said they take part in grocery shopping during weekdays. In terms of age categories, 35-44s shop for groceries during weekdays (51% of females and 40% of males). With this insight in mind, brands can tailor their messaging and contextually target consumers using DOOH. The landmark three-stage research ‘Moments of Truth’ study highlighted the effectiveness of relevance in Digital OOH advertising from the point of view of brain response, ad recall and sales. Key findings from this pioneering study reveal that consumer brain response is 18% higher when viewing relevant content in digital Out of Home campaigns, which in turn leads to a 17% increase in consumers’ spontaneous advertising recall, and ultimately proving that dynamic digital Out of Home campaigns can deliver a 16% sales uplift.

Our ‘Mall Scene’ research highlights how brands can create more interesting advertising and better experiences for consumers via retail environments. The networks now exist in Ireland to make that impact scalable and truly powerful. As we move beyond the third-party cookie, unblockable channels like Dynamic OOH will be more prominent and a bright opportunity lies in contextual targeting.

For more details on the study contact info@pmlgroup.ie

Growth in Retail Footfall across Environments

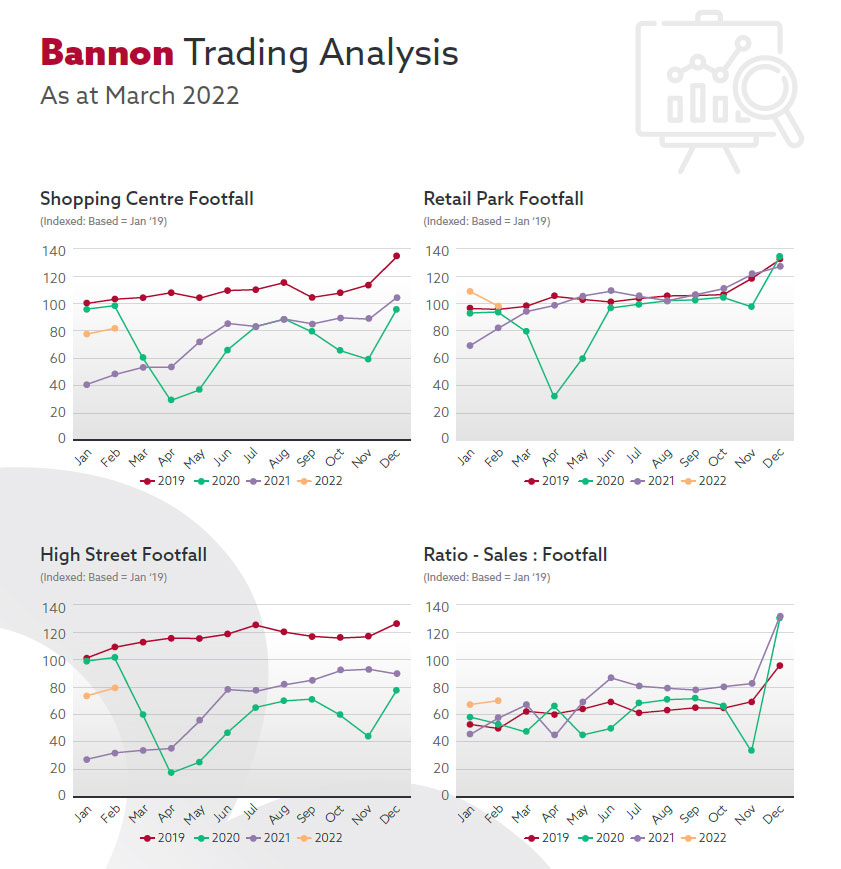

Bannon’s latest Retail Pulse reports positive trends from retail footfall and spend data.

- Similar to January, shopping centre footfall for February 2022 was almost double that of February 2021 and just 16% behind pre-pandemic levels (February 2020).

- The continued improvement in the footfall to sales conversion ratio (125% – February 2021) is very positive.

- Footfall in retail park remained strong in February. As is evident from the chart above, retail parks remain the consistent performer with footfall growth of 6% versus pre-pandemic levels (February 2020).

- The improvement in footfall on the high street is positive to see and we expect this will continue as tourists, office workers and students return to the city centre over the coming months.

OOH plays key role in Brand Discovery

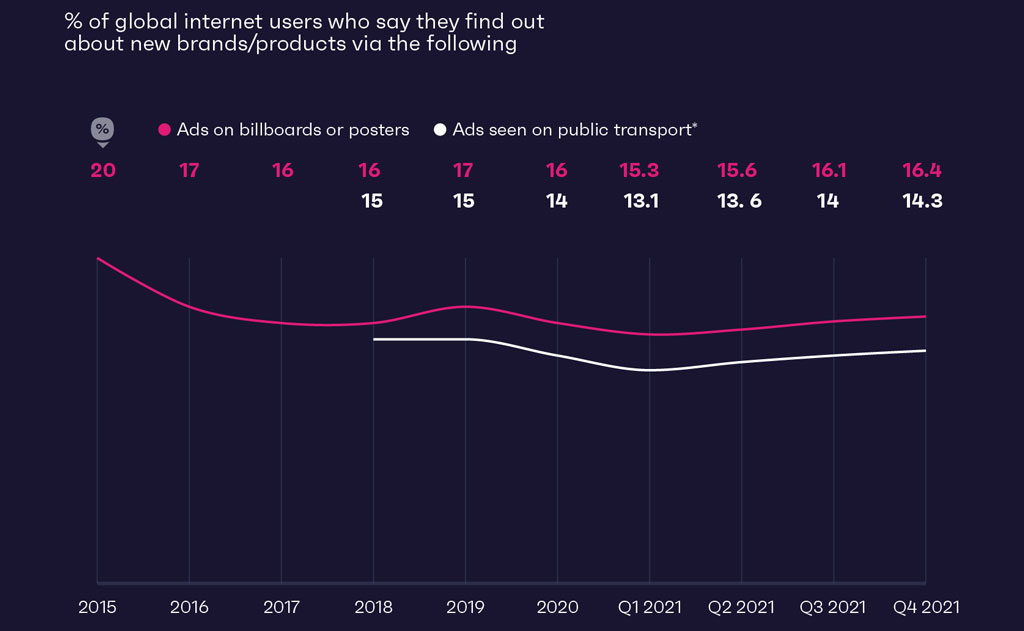

Out of Home brand discovery has recovered from its pandemic downturn, with roadside billboards being the most memorable format, according to data from target audience GWI.

In Q4 2021, 16.4% of internet users said they discover new brands or products via ads on billboards or posters. This is above the level reported throughout 2020 and in line with pre-pandemic levels.

Ads seen on public transport show a similar recovery, with 14.3% saying they use this format to find out about new brands or products.

The data shows that roadside ads are the most memorable OOH format with 46% of commuters saying they recalled seeing these ads during their last work commute, followed by ads on a bus, bus station, or a bus stop (38%). This is followed closely by those at street level (e.g. a poster) and at specific locations like a shopping mall or airport.

Bus commuters are the most likely to recall ads specific to their main form of transport (61%), beating rail commuters recalling ads in stations (58%) and pedestrians recalling ads at street level (44%).

Bus ads are effective across different transport types as well. For example, cyclists are almost as likely to remember roadside ads (52%) as they are bus ads (50%).