James Byrne, marketing manager, PML Group with this week’s view from OOH.

James Byrne, marketing manager, PML Group with this week’s view from OOH.

Connecting offline and online

Out of Home media drives consumer activity in the real world and online. In part two of the latest release of React research we explore further the responses via smartphones by consumers to OOH ads they’ve seen.

Nearly six in ten of us have visited a website after exposure to an OOH ad. For the 16-24 year old cohort who spend much of their time out of home, this figure risers to 82% (index 139). They also index positively for app activation (58%, index 145) and availing of promotional offers (69%, index 141). Switching the focus to socioeconomic groups ABs are most likely to visit social media as the result of seeing OOH, with 47% of them doing so. The research was conducted in partnership with Ipsos MRBI.

![]()

In relation to how OOH compliments online Scott Green, strategy director at Posterscope comments; “In today’s smartphone infiltrated world, the way people consume media is constantly changing, and as mobile and digital media become more saturated, OOH can intercept consumers. Using smart data-led planning and buying, OOH can cut-through the noise, earning consumers attention to seek out relevant brands through mobile.

OOH is at the heart of mobility. There’s a natural synergy between the OOH and mobile experience, with both steeped in location. Unlike other media it can’t be skipped, scrolled past, or blocked. It’s hard to ignore. Which is why OOH can affect real behavioural change in ways that other, more passive media cannot.”

Mobility

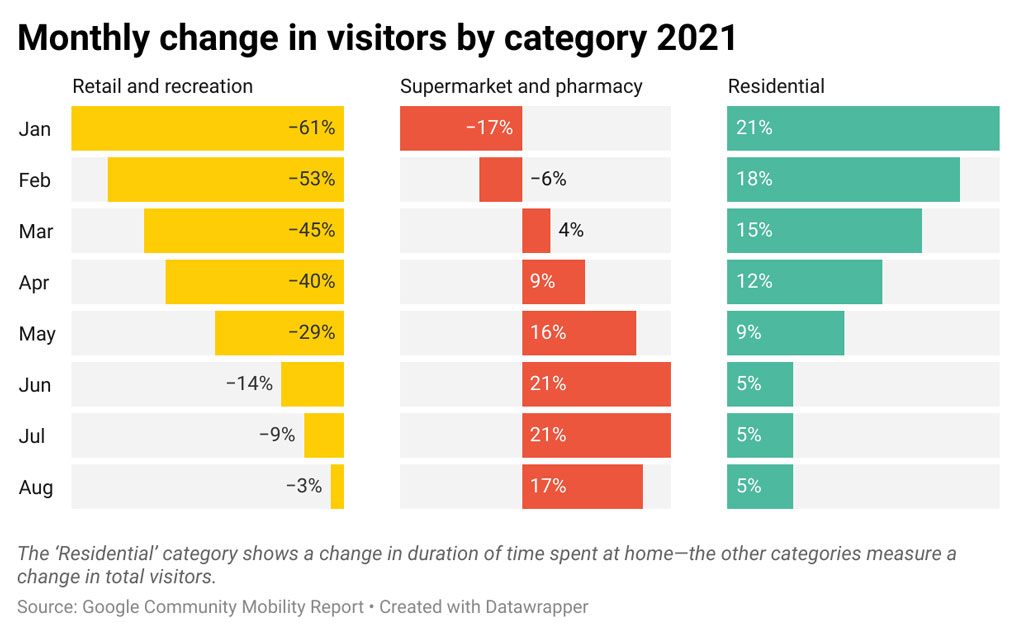

This week we look at Google’s ongoing Community Mobility Report to see how three key location types have fared this so far year in terms of average monthly visitor numbers and duration (residential). The data shows how visitors to (or time spent in) categorised places change compared to baseline days. The baseline day is the median value from the 5‑week period Jan 3 – Feb 6, 2020.

Retail and recreation covers mobility trends for places such as restaurants, cafés, shopping centres, museums, libraries and cinemas. From a low of -61% at the start of the year it is now close to baseline at -3%, following the lifting or relaxation of many of the restrictions relating to hospitality and entertainment.

Visits to supermarkets and pharmacies has flipped from -17% to +17% while conversely time spent in places of residence has declined from +21% in January to just +5% to date this month, indicating that Irish people are increasingly spending more time out of home.

In its latest transport bulletin the CSO has reported that car traffic volumes are now at 87% of July 2019 levels in the Dublin area and 90% of July 2019 levels in regional locations. Latest available data for the week beginning 26 July show that car traffic volumes were 119% higher in selected regional sites compared with week 1 of this year.

Hospitality spending rose again in July

Spending in the hospitality sector rose again in July as it continued to reopen to include indoor dining for those who are fully vaccinated.

According to the AIB Spend Trend, spending was up 30% in hotels, 28% in pubs and 10% in restaurants. Meanwhile, spending on airline tickets was up 19% as people started to travel internationally again. All this points to a pent up demand for experiences being realised as restrictions relax and vaccination uptake progresses, especially among younger age groupings, who traditionally tend to be more socially active.