Aaron Poole, Marketing Insights Manager, PML Group with this week’s Out \ Look on Out of Home – February 6th 2026

Aaron Poole, Marketing Insights Manager, PML Group with this week’s Out \ Look on Out of Home – February 6th 2026

Giving a city a shared deadline is one of the cleanest ways to make Out of Home feel live. When creative is built to move in real time, repeat exposures stop feeling like repetition and start feeling like progress.

McDonald’s has launched “The One with Friends”, a limited-time meal that gives its golden-arches favourites the Happy Meal treatment, only this one is very much “the one for the grown-ups”.

Planned by Zenith and Source out of home, the supporting tease-and-reveal activity has been running across the cycle. It is a useful example of what OOH can look like when you give the street a role in the storyline, not just a poster to carry.

Over the past week, a familiar purple door has been quietly appearing on digital street-level screens, half-open and glowing from within. No product close-up, no big reveal, just the promise that something Friends was coming, plus a countdown clock doing the talking. It works precisely because it happens in public. You do not “skip” a countdown on your walk to lunch. You clock the number, and the date starts following you around for the rest of the day. The discipline here matters too. Countdowns only work when the message stays minimal, and the reveal earns the wait.

That countdown mechanic was delivered through PML Group’s LIVEPOSTER platform, using dynamic copy to make the build-up feel live in the days leading into 3 February 2026. Time-based creative is simple, but it carries a clear advantage. Every repeat exposure brings genuinely new information, which means the campaign refreshes itself without needing to shout for attention.

Then, on launch, the door “opened” and the menu reveal landed: a choice of Big Mac, 9 McNuggets or McPlant, upgraded with one of six character collectibles. Monica’s Marinara Sauce joins the mix for a limited time, with Friends cues running across packaging and McCafé.

The poignant alignment here is how cleanly the media behaviour matches the brand behaviour. A collectibles mechanic is built on repetition, and the countdown makes that repetition feel rewarding rather than redundant. That matters, because our effectiveness work consistently shows that DOOH does not just get noticed, it gets acted on. Our IMPACT Attention research found that 76% of DOOH viewers take action post-exposure, while our iQ research shows 69% feel ads that feature information local to their surroundings help brands form a tangible connection. Dynamic creative, at its best, is simply that principle applied to time, place, and moment.

Consumer intentions 2026: big moves, holidays and switching behaviour

Last week we looked at the lifestyle side of 2026, the routines, the nights out, and the clear intent to do more in the real world. The other half of the story is less visible day to day, but commercially it is often more valuable. Switching, upgrading, and making the kinds of decisions that reshape spend across the year.

Our latest iQ study with Ipsos B&A asked consumers how likely they are to make changes across personal circumstances and service providers in 2026. What comes through is a market that still feels open for persuasion, with several categories sitting in active decision territory.

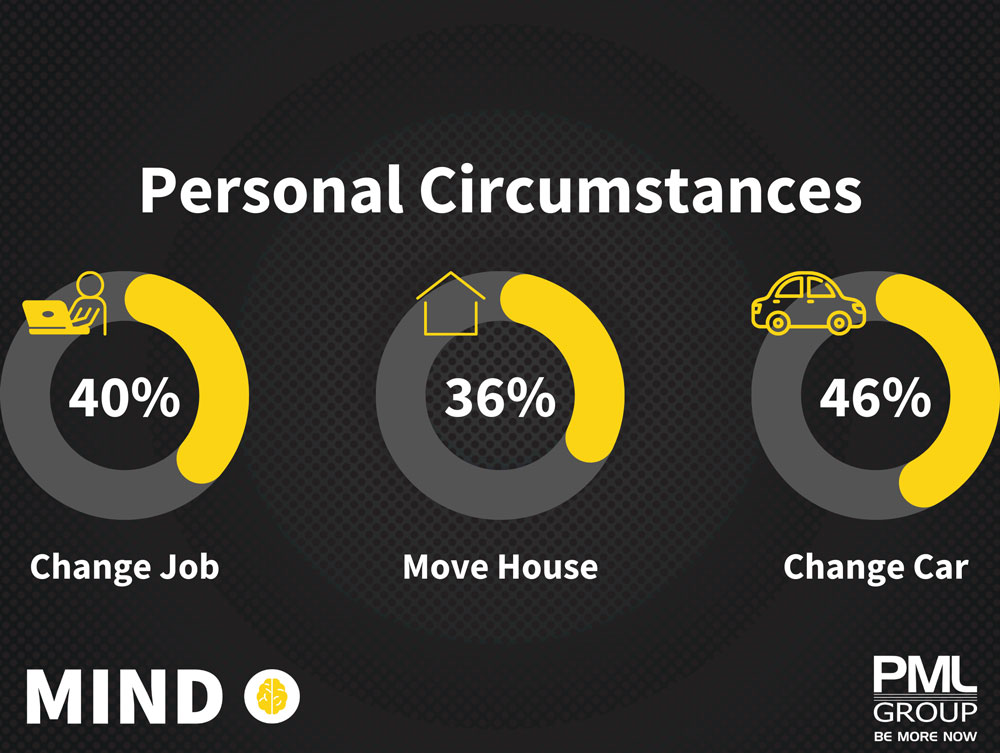

Four in ten Irish consumers say they are likely to change job in 2026, while 36% say they are likely to move home. Those are not niche numbers. They indicate a meaningful portion of the population entering periods where budgets are reviewed, brands are reconsidered, and new habits form quickly.

Four in ten Irish consumers say they are likely to change job in 2026, while 36% say they are likely to move home. Those are not niche numbers. They indicate a meaningful portion of the population entering periods where budgets are reviewed, brands are reconsidered, and new habits form quickly.

The strongest concentration sits with 35-44 year olds. 50% in that group are likely to change job, and 45% are likely to move home. That is a high value life stage for categories like financial services, telecoms, utilities, furniture, home improvement, and mobility, where choice is both competitive and consequential. Intent also skews commuter-led: among those who most often travel by bus, 65% say they are likely to change job in 2026, and 52% are likely to move home.

We also see momentum in mobility itself. 46% say they are likely to change car in 2026. For automotive, finance and insurance brands, it is an early indicator of an in-market audience building across the year, not just around plate-change moments. It is particularly pronounced among households with kids under 15, where 59% are likely to change car, and among men, where the figure is 55%.

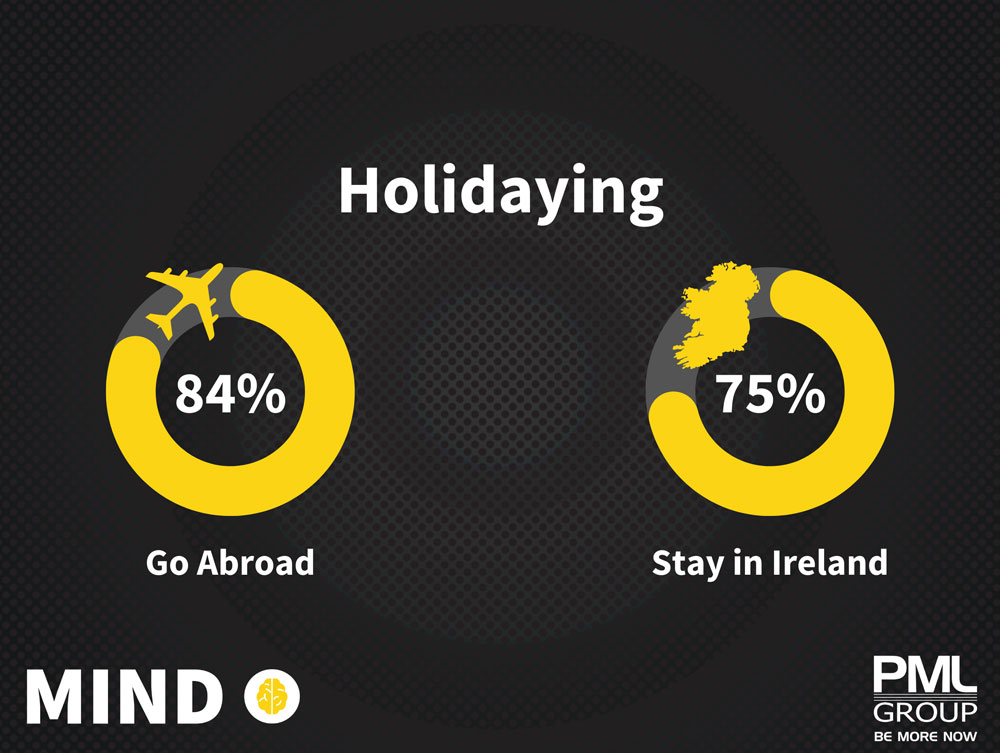

Holiday intent remains one of the most consistent signals in the dataset, and it stays high. 84% say they are likely to go on a holiday abroad in 2026, with 51% very likely. Travel abroad is broad-based, but the peaks tell you where demand is hottest: 25-34s lead on likelihood (85%), while 45-54s are the most committed with 62% very likely. Parents are especially live here too, with 88% of households with kids under 15 likely to travel abroad. Domestic travel holds strong too, with 75% likely to holiday in Ireland and 34% very likely.

The “very likely” result is a particularly useful planning clue. Half the market is not just open to the idea of travel, they are closer to committing to it. That translates into opportunity for airlines, ferries, tourism bodies, attractions, hospitality, and the brands that travel alongside the journey, from luggage and insurance through to food and drink.

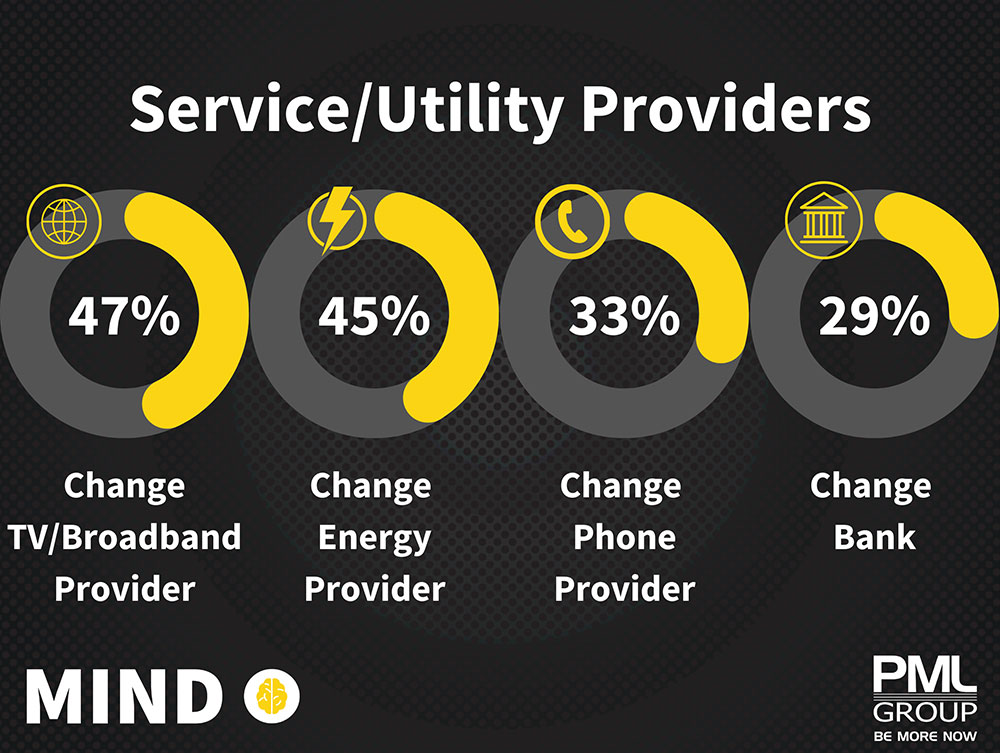

Switching behaviour is where the competitive pressure is most obvious. 47% of consumers say they are likely to change their TV or broadband provider in 2026, with 45% likely to switch energy provider. Phone switching sits at 33%, while 29% are likely to change bank. Broadband switching is led by 35-44s (53% likely) and households with kids under 15 (55%), while energy switching peaks among 45-54s at 58% likely. Even banking moves when life is busy: 32% of 25-34s are likely to switch bank, rising to 35% among households with kids under 15.

Two points stand out. First, these categories are sitting at levels that signal an active consideration market. Second, they are categories where attention quality matters as much as reach. People do not switch provider every week. When they are open to it, brands have a narrow window to earn consideration, simplify the decision, and land the proof points.

This is where Out of Home consistently plays a practical role. The switching moment is a real-world moment. It happens while commuting, shopping, and going about life admin, not in a single linear journey online. Outdoor gives brands the ability to stay present through those weeks of consideration, with the added advantage of being seen in trusted public spaces, at scale, with high frequency.

OOH with IMPACT is about planning into those moments with accountability built in. Reach and presence still matter, but so does proof. When the market is switching, the brands that win will be the ones that show up consistently in the right places, and can evidence that their Outdoor investment delivered attention and action, not just impressions.

To explore how OOH can support your brand in reaching an in-market audience, contact info@pmlgroup.ie