James Byrne, marketing manager, PML Group with this week’s Out \ Look on Out of Home

New Toyota C-HR is Impossible to Ignore on OOH

The bold just got bolder. The new Toyota C-HR breaks all the rules. Impossible to ignore, it combines the style of a coupe with a powerful stance.

The ‘Stand Out – Be Bold’ OOH campaign, planned by Javelin with Source out of home showcasing the new model is live across Dublin with a strong roadside presence on Digital Bridges, D48s and Bus T-Sides together with a synced full motion display across ten screens on the Digital Gallery in Connolly Station.

The CHR’s mould-breaking exterior design delivers a style that defies convention along with an engaging drive and classleading efficiency with a focus on European customer expectations of premium quality and sustainability. Inspired by a vision of a ‘concept car for the road’, it stays true to its heritage by taking another bold step forward.

Róisín Shaw, Account Director at Javelin comments ‘The striking new Toyota C-HR Hybrid Electric is an exciting arrival to the 2024 car market. With 5th Generation innovative Hybrid Electric technology and sleek, eye-catching design, we wanted to showcase its very bold new style credentials. Outdoor is the ideal medium to deliver and we wanted to ensure we celebrated the launch on premium, impactful sites. The Connolly Gallery is an ideal format to stand out in a high footfall environment, supported with high impact Digital Bridges and Digital 48 Sheets and driving frequency & coverage with T-Sides. This campaign is a superb start to an ambitious year for Toyota who have closed out 2021, 2022 and now 2023 as Ireland’s #1 best-selling car brand.’

Zoë Bradley, Head of Marketing Communications and Corporate Affairs at Toyota Ireland remarks ‘Our new Toyota C-HR Hybrid Electric not only reduces harmful emissions as we make the move from diesel but also is a knockout and visually stunning addition to our Hybrid Electric range – Toyota has Ireland’s widest range for the third year in a row is Ireland’s favourite car brand.’

Out of Home is the most natural environment to gain the attention of car drivers. The latest TGI survey finds that a third of Dubliners who intend to change their car in the next two years are heavily exposed to OOH (travel 9+ hours per week) leading to 78% of them having seen some form of OOH advertising in the past week.

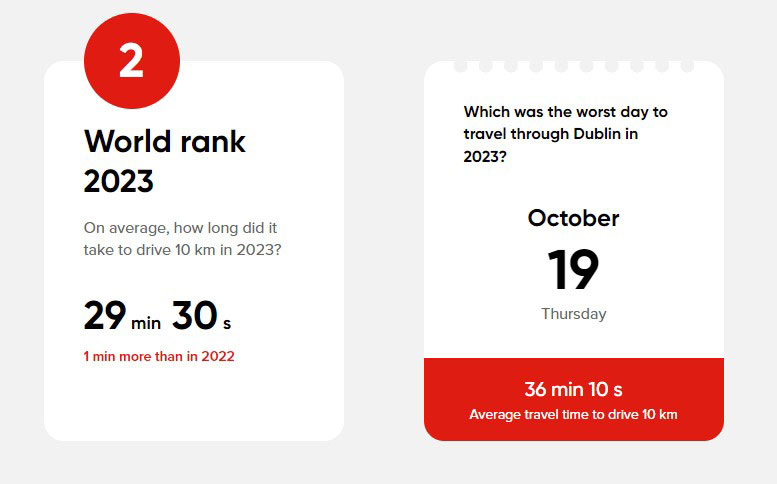

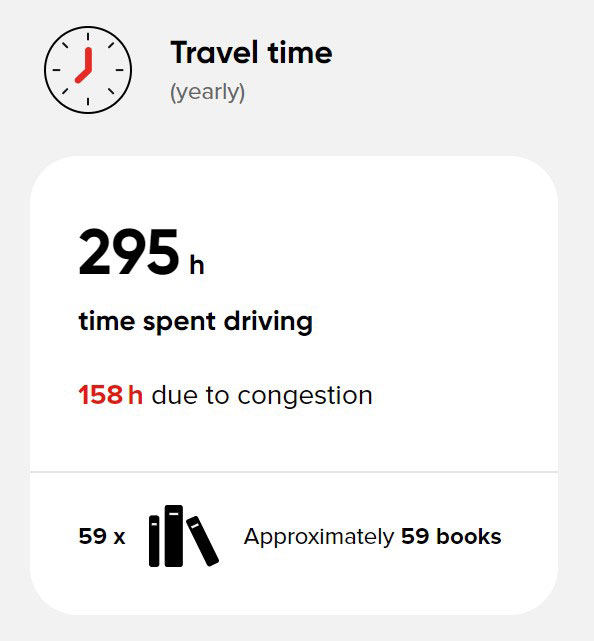

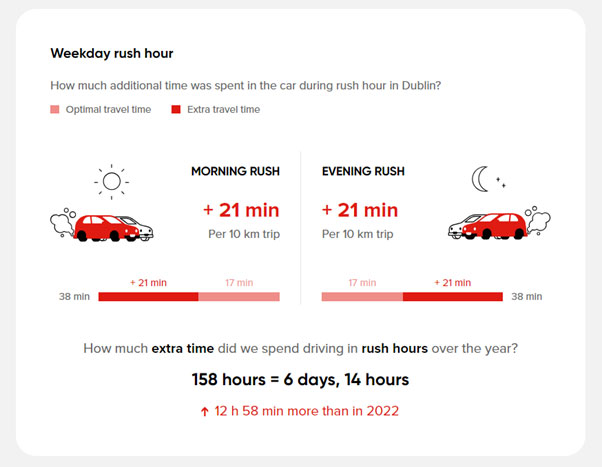

Dubliners Continue to lose the Most Time to Rush Hour Traffic of any City

In 2023, Dublin drivers experienced some of the worst levels of congestion in the world. We lost the most time to traffic at peak hours of any city in the index: 158 hours over the course of the year, to be exact. At 66% our congestion level is also the highest. This is the average additional time (in percent) lost to traffic, compared to driving in free-flow conditions. Dublin is also the world’s 2nd slowest city to drive in, behind only London, with an average speed in morning and evening rush hours of just 16 km/h. Dublin’s ranking was worse than large cities such as Toronto (Canada), Milan (Italy), Bengaluru (India) and Brussels (Belgium).

Covering 387 cities across 55 countries on 6 continents, the TomTom Traffic Index measures cities around the world by their average travel time.

The average driver in the city spent over 295 hours commuting last year. That’s more than an hour per working day traveling, with about half of that time being the result of suboptimal traffic flow. The time drivers spent in congestion would have been enough to read 59 books. Let’s hope they had audiobooks.

The overall average 10 km trip in Dublin’s city centre took 29 minutes 30 seconds, one minute longer than in 2022 and nearly three minutes more than in 2021. The worst rush hour was on Wednesdays 8 AM – 9 AM when driving 10 km took on average: 41 min 30 s at 14 km/h which is 123% above the optimal travel time.

Consumers 50% more likely to change job in 2024

Our latest iQ study, conducted with Ipsos B&A, sets out to identify consumer sentiment for the year ahead. In this second instalment, we look at their likelihood to make big moves, where they want to holiday, and how they intend to approach changes to service and utility providers in 2024.

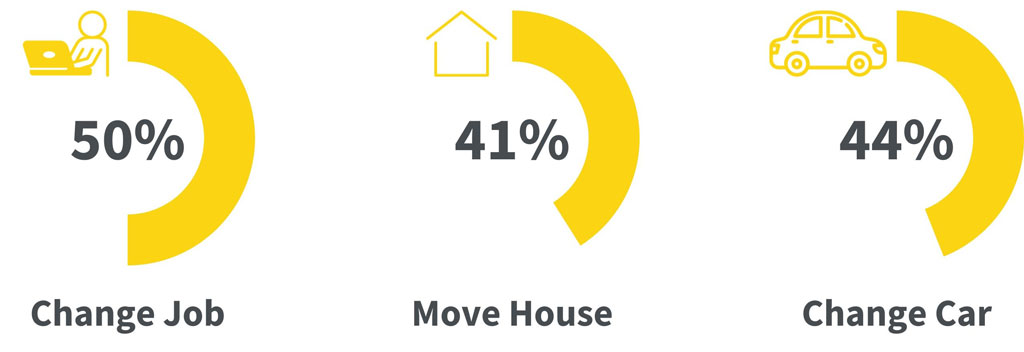

Personal Circumstances

The survey highlighted that a big personal change is on the cards for at least 41% of respondents: when it comes to those indicating a likeliness to move home more than 2 in 5 agreed that 2024 is the year, peaking at 50% of those aged 25-34.

Half of the survey respondents indicated their intention to change job or career in the coming year. A higher likelihood was seen amongst younger workers, with 58% of 25–34-year-olds indicating a likeliness to change job at some point throughout the year.

44% noted their intention to purchase a new car, rising to 56% of 35-44 year olds. The latest SIMI report for 2023 noted over 120,000 new car registrations were made in 2023, up 16% YoY. Based on our most recent Motor Mindset results, half of those intending to buy a new car this year are likely to consider purchasing a hybrid or electric variety.

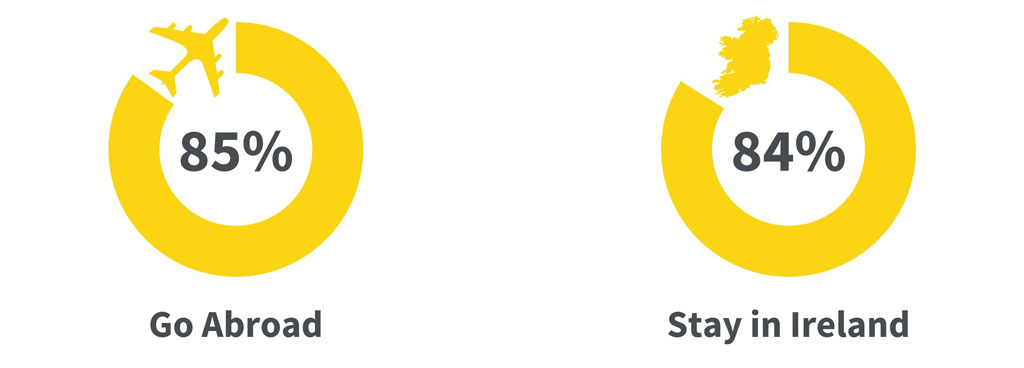

Holidaying

The vast majority of consumers are likely to take some form of holiday in 2024. Looking to escape the Irish weather, 85% noted they are eager to take a vacation beyond our shores. A stronger inclination is seen amongst young-mid level professionals with 90% of 25–44-year-olds agreeing. Meanwhile a similar number (84%) are just as keen to discover the beauty of Ireland on holiday, resonating more with the older audiences at 86% of those aged 45-54.

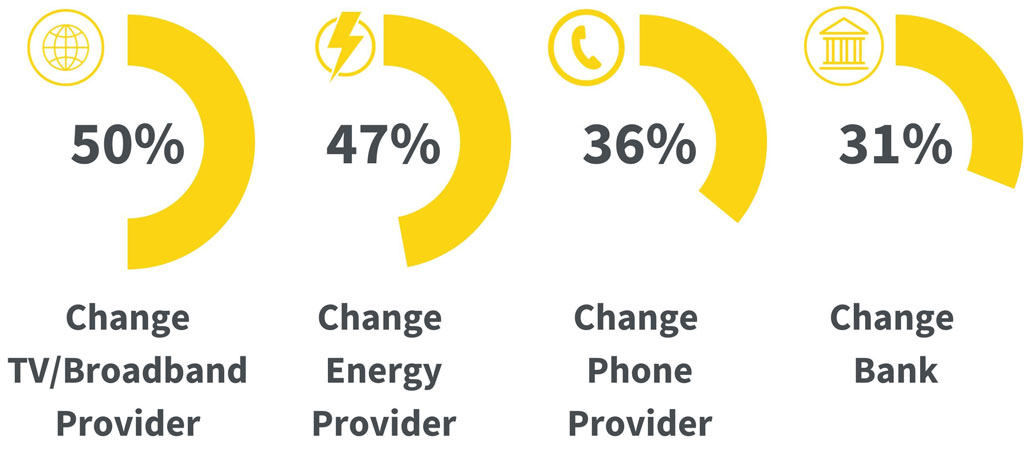

Service & Utility Providers

When it comes to networks and utilities, it’s unsurprising that consumers are factoring cost of living into their 2024 plans. 47%, 36% and 31% noted their intention to change their Energy provider, bank and phone provider respectively.

The biggest overall inclination came in TV/Broadband services at 50% noting their intention to switch, with highs at 41% of 25-34 and 40% 45-54s.

Highs of 63% were seen in energy providers amongst 35-44s and 61% of ABs, while over 40% of 25-34s and 45-54s noted their likelihood to switch phone provider. 42% of 16-24s noted a likelihood to switch bank as their financial independence begins to grow in importance.

For brands looking to tap into consumer sentiment in 2024, OOH is the attention medium. For more information on how to get your brand noticed and avail of the attention opportunities offered by Outdoor, contact info@pmlgroup.ie