James Byrne, marketing manager, PML Group with this week’s Out \ Look on Out of Home.

New OCS survey finds 86% of people visited a supermarket in the past month

Place-based media seen in places such as supermarkets, shopping malls and transport hubs are seeing increasing audiences a new survey shows. 86% of people have visited a supermarket in the past month reports our latest OCS survey of more than three thousand Irish adults. Other notable destinations are shopping centres / high street at 61%, pharmacies (53%). A quarter of adults have visited a gym or health club in the past month.

Comparing with 2021 figures shows most destinations have seen increases in visitor numbers. Those visiting shopping malls or the high street at least once in the past month has increased by 4% to 61%. Regular visitors to restaurants and bars have increased by 11% and 10% respectively while more those going to airports or concerts has more than doubled in the past twelve months.

As regards generational cohorts, Gen Z (less than 25 years) index highly for entertainment and leisure activities with 43% visiting a bar (index 118) and 11% going to a music concert (index 138). Every brand needs a stage and 16% of 16-24s report attending an arts or cultural event (including theatres) in the past month. Millennials (25-38) also index over par for socialising locations as Dubliners.

Turning our attention to older audiences both Gen Xers (39-56) and Baby Boomers (57+) index well for retail destinations with over nine in ten visiting a supermarket in the past thirty days while over two thirds of baby boomers report visiting a pharmacy.

The survey also finds that over a fifth of males of males have visited a sports stadium in the past month.

Location-based marketing connects brands with consumers in the real world. Through investment in research, technology and a focus on data led planning, we understand even more about how people live, work and play. The Locomizer platform for example, adds to our ability to provide clients with new levels of targeting matching audiences and locations via mobile data.

Brands Build on Anticipation for Six Nations

Following a successful autumn series and with the World Cup taking place later this year in France, there’s no doubt as to the added significance of the 2023 men’s rugby Six Nations Championship. Ireland gets the competition underway in Wales this Saturday. The world’s top ranked team has two massive home fixtures in this year’s series, against France on February 11th and, in the final round of games, against England on March 18th.

Big brands are running on OOH in the build up to the opening weekend. Building on one of the most successful sports sponsorships, team sponsor Vodafone its utilising OOH in rallying the country and getting widespread talkability around The Team of Us. Guinness is marking the championship with its ‘Hope Rises’ campaign that celebrates the brand’s status as title partner and official beer of the tournament. The Irish and Sunday Independent are promoting their expert team of writers who bring the action to readers across screens in shopping centres and malls.

Both home fixtures will be fantastic opportunities to engage the match going crowds, but the entire series offers brands the chance to leverage the uniquely positive relationship the Irish public have with the rugby team and the Six Nations competition. Research PML Group commissioned, and carried out by Ipsos, reveals that a whopping 72% of Dubliners intend on watching the Six Nations. This figure is relatively consistent among age groups, peaking at 76% for 16-24s and 45-54s. 85% of the AB social group will be tuning in. 75% of men intend to watch, compared to 70% of females.

More than 40% will be watching matches either at a friend’s house or in a pub/bar. More than one in ten respondents are hopeful of being able to attend a game in person. Those aged 16-34 are most likely to be watching the matches outside of the home.

Sports events offer brands the opportunity to use OOH in a contextually relevant way, employing dynamic content to optimise messaging in the run up to the match, during the game, and post-final whistle. According to our OCS study 35% of those passionate about rugby union are VERY interested in Digital Screen messaging relevant to a live sporting event (Index: 172) while a further 40% are quite interested.

January WATCH: Retail leads OOH

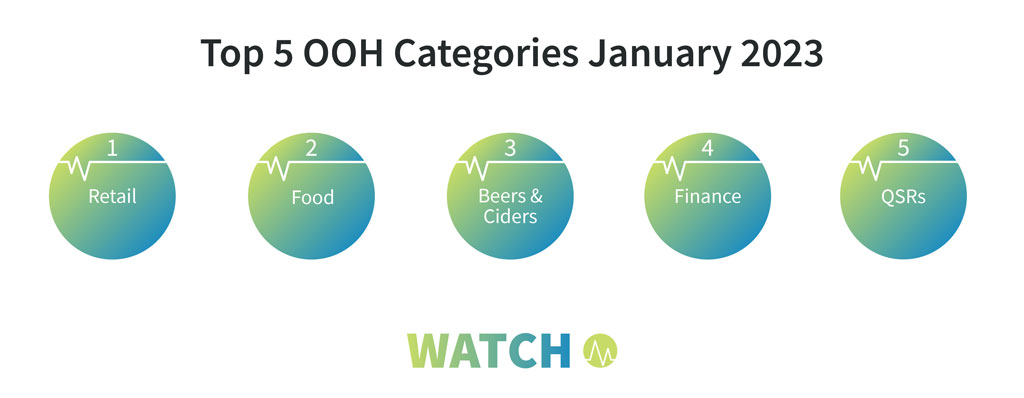

As the new year settled in the retail category showed no sign of slowing down after a busy close to 2022, with a 26% increase in spend compared to December and SOV coming in at more than 40% higher than the second highest category, Food.

This comes as the supermarket sector was in full awareness of inflation being a top-of-mind concern. As a sub-category of retail Supermarkets accounted for over 10% SOV, with almost all major supermarket chains launching campaigns showcasing saving schemes and discounts coming out of a busy Christmas period.

This comes as the supermarket sector was in full awareness of inflation being a top-of-mind concern. As a sub-category of retail Supermarkets accounted for over 10% SOV, with almost all major supermarket chains launching campaigns showcasing saving schemes and discounts coming out of a busy Christmas period.

Meanwhile as Veganuary and the January fitness kick began, the Dairy/Plant Based category accounted for over 6% SOV as food brands reinforced their commitment to consumers by showcasing alternative options available to them.

Beer & Ciders were the third most active category as light and no/low brands took advantage of ‘Dry January’. Diageo accounted for most activity with 0.0 campaigns on display from Gordon’s and Guinness – the latter taking the top 4 spot overall for January OOH campaigns.

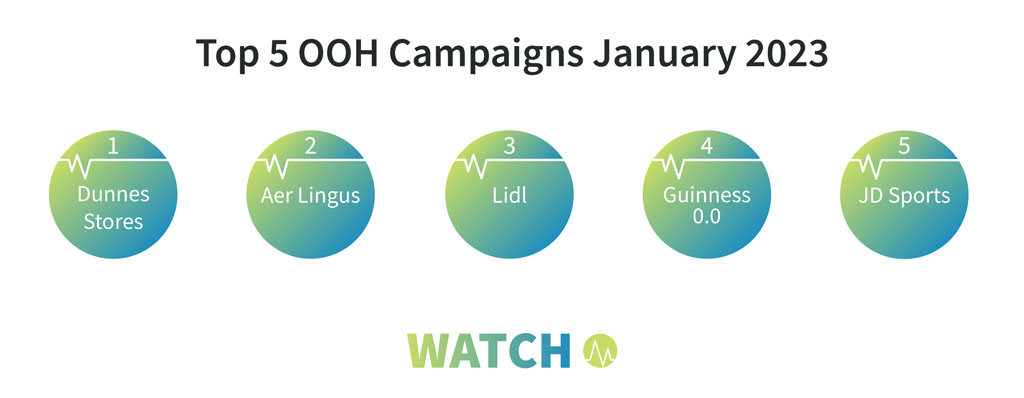

Dunnes Stores was top campaign for the month, reflecting Retail as top category in addition to Lidl and JD Sports at 3rd and 5th respectively. Aer Lingus came in at second highest, reflecting a 90% increase in OOH spend for the Tourism and Travel category compared to December.

Customer confidence hits 7 month high

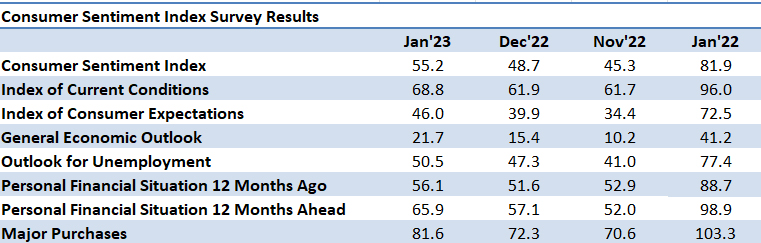

The latest Credit Union Consumer Sentiment index for January has revealed Irish consumer confidence hit its highest point since June 2022.

The new report notes a confidence index uptick to 55.2 – a 13% increase from December – suggesting consumers had a less negative view of household economic and financial burdens as 2023 began.

Report author Austin Hughes noted “this was likely driven by the very positive news on the 2022 outturn for the public finances, as well as continued low unemployment data during the survey period.”

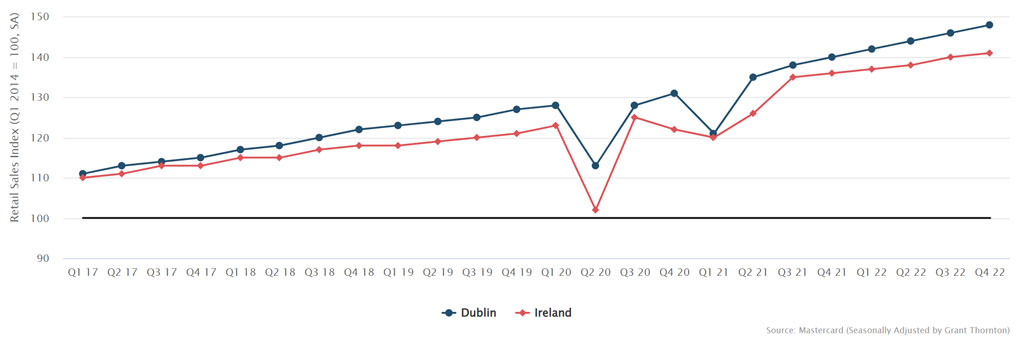

This reflects figures released this week by MasterCard SpendingPulse which noted the value of retail spending by consumers in Dublin remained broadly stable in Q4 2022, despite concerns surrounding inflation.

The report, published by the Dublin Economic Monitor, showed an increase of growth rates in Dublin retail spending by 1.2% vs Q3 2022, and a 6% increase compared with Q4 2021 driven by an expenditure increase of over 38% in hospitality.

At the national level, spending grew by 4% YoY. This was mainly driven by entertainment and discretionary spending which increased by 41.2% and 7% respectively