TGI: An OOH Analysis

TGI data is a leading source of consumer insights for the Irish media and marketing community. At PML Group, it is an important element of the suite of tools we employ to optimise campaign planning through relevant audience information. It offers understanding of who consumers are, what makes them tick and the media and lifestyle choices they make. The TGI sample is a robust 4,000 respondents, aged 16+ in ROI, with findings released twice yearly, in May and October. This week, we take a closer look at some of the latest findings from the ongoing study and explore some key attributes of the typical OOH consumer.

At a topline level, the study shows that 61% of all adults have seen OOH advertising in the past week (65% among Dublin residents). Of those, 30% are earning more than €50,000 a year, 52% are male, 48% female, with 43% considered ABC1. Just under 10% are educated to PHD/Doctorate level. When we delve bit further and look at media quintile 1 for OOH (i.e. the top 20% of consumers of the medium), we find the average age is 40 years and the average family income is €43,000. This represents a younger average age and higher average income than the top quintiles of most other media.

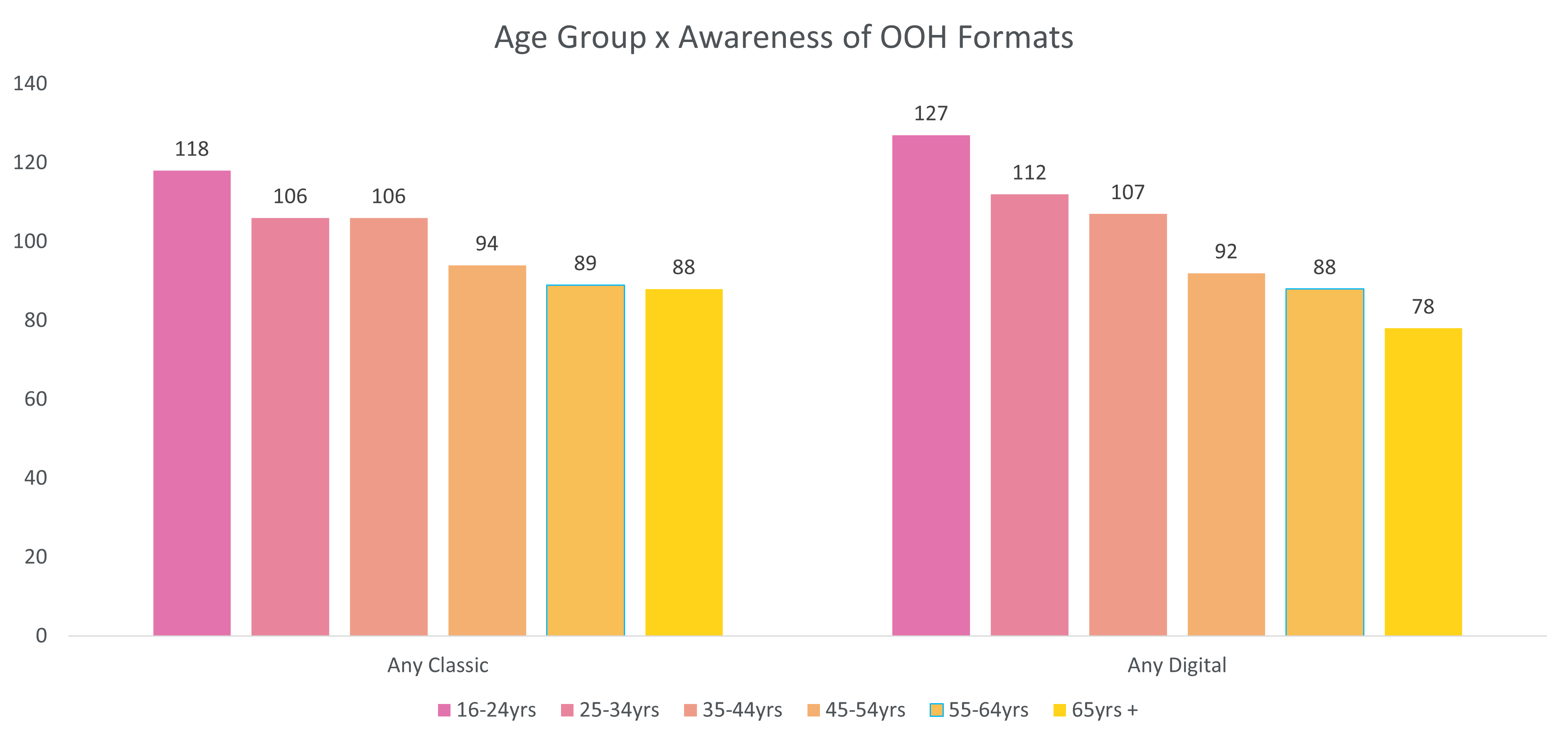

Awareness levels for both Classic and Digital OOH (DOOH) peak among 16-24 year olds. Classic OOH indexes at 118 for this youngest age cohort, compared to 88 for the 65+ group. A similar, but more pronounced, pattern applies to DOOH.

(Republic of Ireland TGI-2022r1-© Kantar)

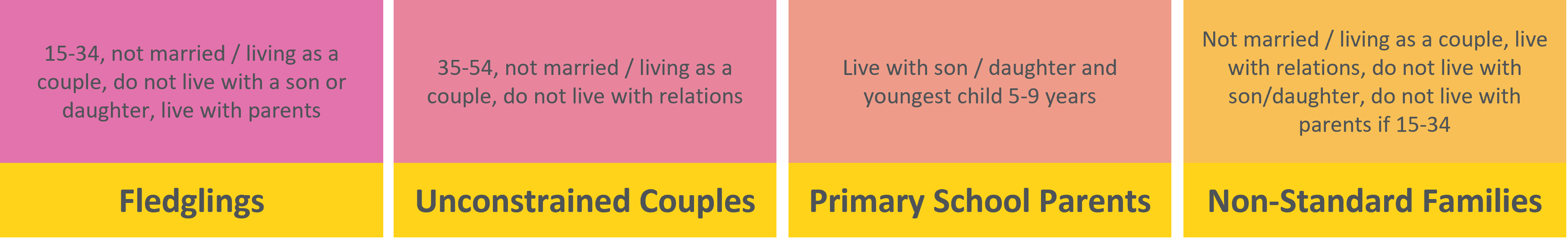

When it comes to ‘Life Stages’ as apposed to age breakdowns, some of the highest indexing for OOH are Unconstrained Couples, Playschool Parents, Fledglings and Non-Standard Families.

Driving Response

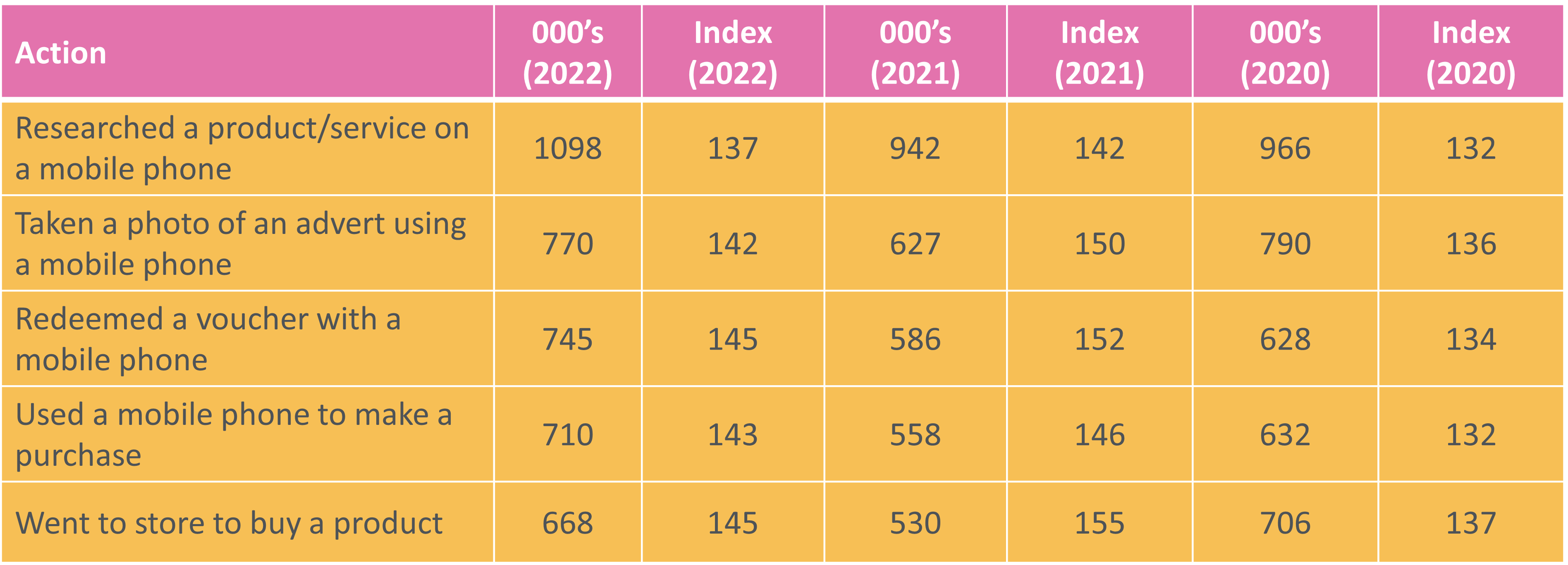

Actions taken as a result of seeing ads are an important effectiveness indicator and through our React study in partnership with Ipsos, we have seen clear evidence of OOH driving response among consumers. In its latest survey, TGI reinforces these findings. It indicates that more than ONE MILLION consumers have researched a product or service on a mobile as a result of seeing an OOH ad, up from 942,000 in 2021. More than 700,000 people have used their mobile to make an actual purchase in response to an OOH ad. The research also shows that OOH not only prompts online action, it also drives footfall into physical outlets, with almost 670,000 claiming to have gone to a shop to buy a product in response to an OOH ad.

(Republic of Ireland TGI-2022r1-© Kantar)

This Out \ Look series has frequently highlighted the opportunity for contextually relevant, event-based content on OOH and the added effectiveness such an approach produces. TGI shows that OOH consumers spend more than average on key retail dates such as Black Friday, Cyber Monday, and Amazon Prime Day. For example, on average, all consumers spend €155 on Cyber Monday, with OOH consumers spending €160. They would also be very much in line with the wider population when it comes to key consumer periods such as Halloween, Easter, back to School and Christmas.

Eco-Leaders

According to TGI, one in five OOH consumers are eco-leaders, defined in the research as ‘the most environmentally and ethically focused group. Particularly likely to buy green, be intellectually engaged with environmental issues, recycle, and avoid waste. 56% say they know a fair amount or a lot about climate change and 46% say the same about sustainability. More than half (and indexed at 109 vs all adults) believe that ‘buying sustainable products or choosing environmentally and socially conscious services shows others who I am and what I believe’. 82% say they take positive steps to reduce the energy they use.

Diversity and Inclusion

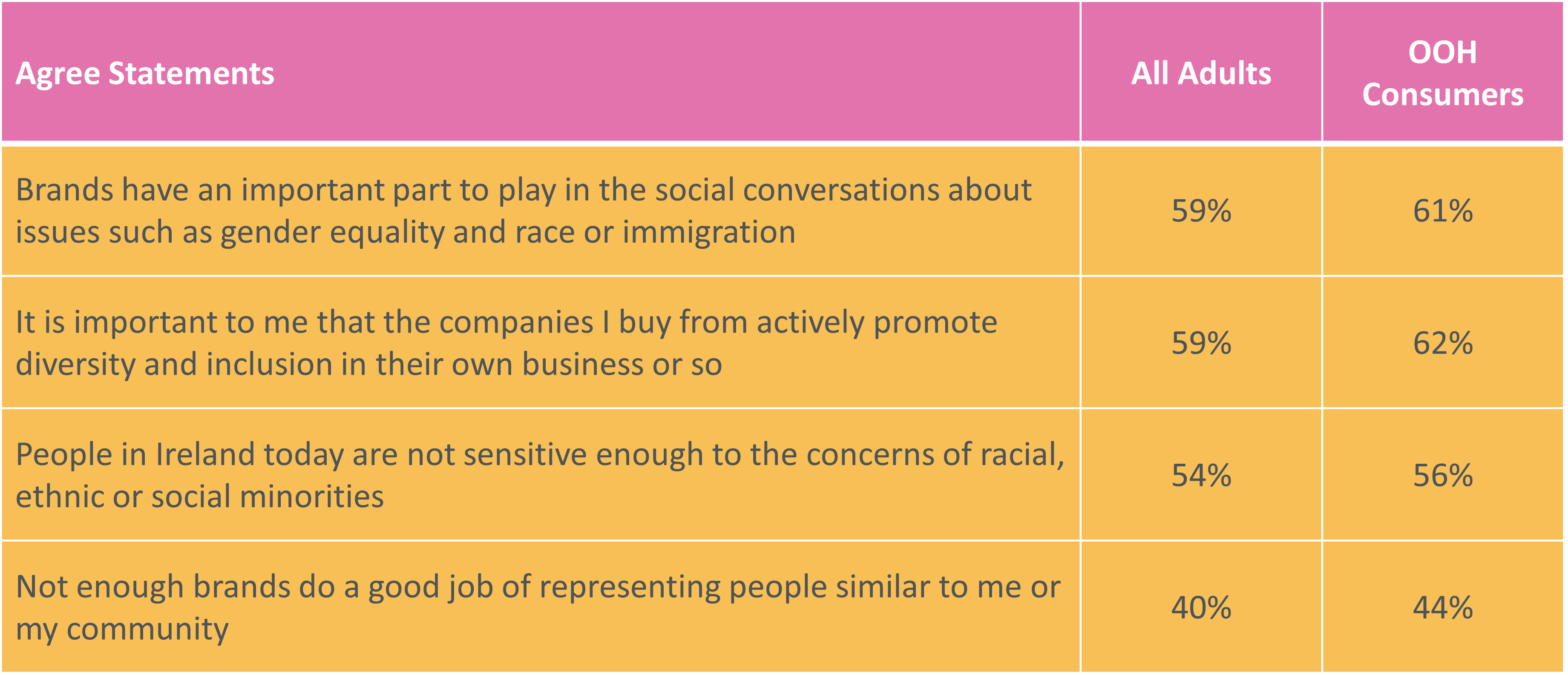

OOH consumers are engaged and concerned about diversity and inclusion in society and in the marketing communications aimed at them. The table below highlights this and points to some food for thought about the content and context that brands should consider in their OOH comms.

(Republic of Ireland TGI-2022r1-© Kantar)

For further details on any of PML Group’s suite of research and insight tools, feel free to contact your PML Group contact or drop us a note to info@pmlgroup.ie.