Retail Tops OOH Spend for 2021: James Byrne, marketing manager PML Group, with this week’s Out \ Look on Out of Home.

Watch Review of 2021

2021 was a year when advertisers re-engaged the core strengths of the Outdoor channel to build their brands through the medium’s potent combination of high impact classic panels, digital innovation at scale and attention-grabbing special builds. OOH got its swagger back, and below we look at the brands and categories that had the biggest presence on OOH in the year gone by. Figures are drawn from our Watch market intelligence service, based on our monitoring of OOH panels all over the country, and are based on display value at rate card.

Four supermarkets feature among the top twenty advertisers for the year, driving Retail to top spot among categories of advertisers. Display value in the Retail sector grew by 46% compared to 2020 and by 10% compared to 2019, the last full year unaffected by the pandemic. Share of voice on the medium for Retail in 2021 was almost 17%, nearly double that of the second most active category – Beers & Ciders. Although the Beers sector was up 27% versus 2020, it was down by 15% when set against 2019 figures. The vast majority of categories showed large increases year on year (Media +21%, Soft Drinks +15%) with a few notable exceptions – Finance down 31% and Tourism & Travel down 17%.

Turning to advertisers now, and drinks giant Diageo maintained their position as the country’s largest OOH advertiser in 2021, with brands including Guinness, Rockshore and Smirnoff giving the group an 8.5% share of voice and a display value increase of 37% v 2020. Sky finished slightly ahead of Mondeléz in second spot with Musgrave Group jumping into the top five, thanks to an increase in their display value for SuperValu and Centra of more than 200%. Out of Home perennial Coca Cola rounded out the top five, followed by McDonald’s and Disney.

Digital accounted for more than 30% of display value on OOH for the first time as expanded networks and new launches such as Digital Bridges and Digital Kiosks made their presence known on the streets.

PML Group published its full Watch Report for 2021 earlier this week and it can be accessed HERE.

Zero In Focus

Over the last few years, producers have begun to release zero alcoholic or low alcohol (NoLo) brands such as Guinness 0.0 and Gordons 0.0 to meet the growing trends of health and well-being as we see many consumers cutting back on alcohol consumption. 76% of all consumers are proactively trying to lead healthy lifestyles and 31% say they’re drinking ‘NoLo’ alternatives more regularly than a year ago, per CGA’s Opus research. Dry January is another initiative to spark further interest in this category and in this week’s Out\Look, we publish the first of our two-part research called ‘Zero in Focus’.

The study investigated opinions and perceptions associated with zero-alcohol beers including taste, consumption, relationship to alcohol brands and the role of advertising in consumers’ decision making in the sector. The findings are part of our ongoing iQ insight programme, which was conducted on our behalf by Ipsos MRBI among 300 residents of the capital, aged 18-54.

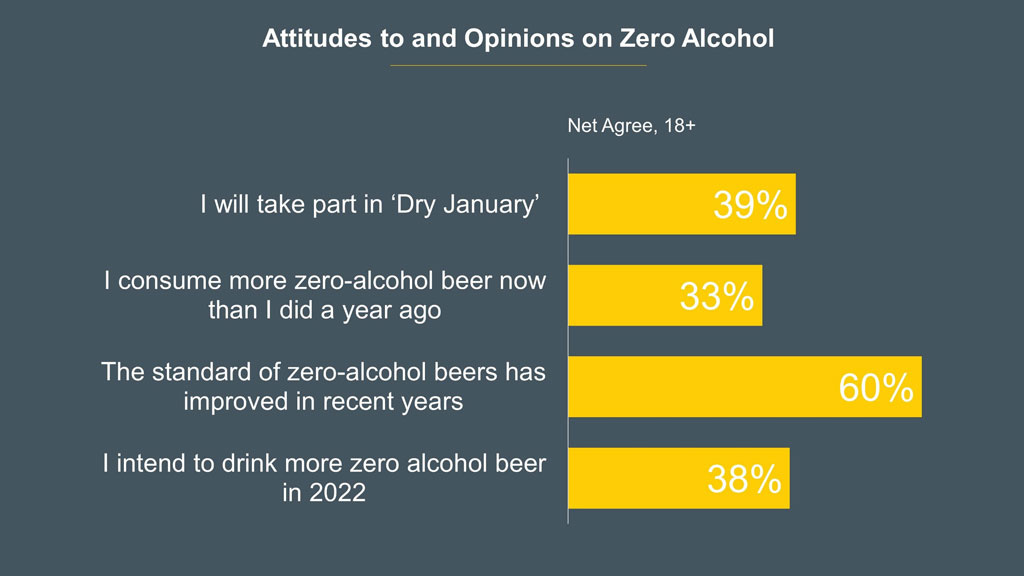

The study found that 39% of all Dublin alcohol drinkers are currently partaking in ‘Dry January’. The highest participation rate was amongst females aged 18-24, at 60% which is an increase of almost 20% within this category compared to last year’s findings. Males aged 18-24 also had a high participation rate at 50%. However, males aged 45-54 had the lowest participation rate out of all Dublin alcohol drinkers at 30% in the well-established month of abstinence.

When querying participants on consumption levels, one third of all adult drinkers said they consume more zero alcohol beers than they did a year ago. A further breakdown found that 46% of adults aged 25-34 said they consume more zero alcohol beer than they did a year ago. This is an increase of 15% amongst this age category when asked about their zero-alcohol consumption last year.

The research indicates consumers have a positive attitude towards this product category with three in five respondents believing the quality of zero-alcohol beers have improved greatly in recent year. Looking ahead, 50% of adults aged 25-34 intend to drink more zero alcohol beer in 2022, as a replacement for beers with alcohol content. There’s no major gender or age differences regarding this intention.

Next week, we will focus on advertising of zero alcohol and the importance of brands when it comes to making zero-alcohol choices, among other relevant findings. For more details on the ‘Focus in Zero’ study, contact info@pmlgroup.ie