James Byrne, marketing manager PML Group, with this week’s view from OOH.

Shining in the June Sun

Momentum is really gathering on OOH and cycle 13, which started this week, has brought a host of new campaigns to our towns and cities. A topic we discussed in our Now Near Next Live webinar series recently was the opportunity for brands to leverage sport and music events this summer and to connect their brands with consumers via OOH event-based advertising. Euro 2020 (don’t worry, it’s not actually still 2020!) is a great current example and campaigns for Pringles, Coca Cola and Paddy Power are manifesting the energy and fun of the event, despite Ireland not participating this time.

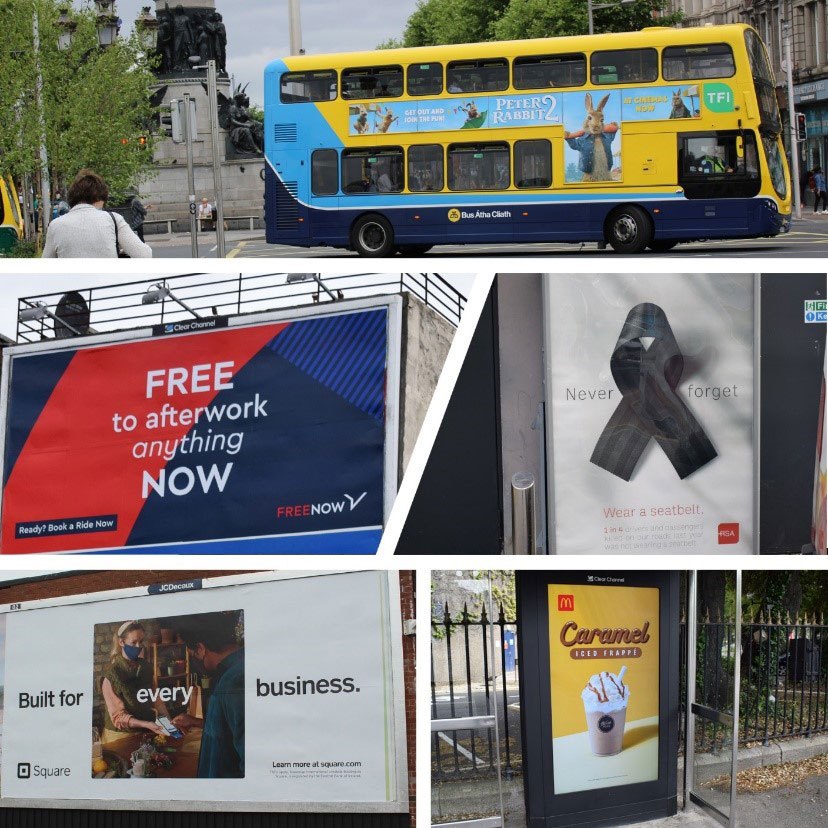

Elsewhere this week, with auto mobility back to pre-pandemic levels, it’s an opportune time for the Road Safety Authority to remind us all about seat belt safety. This of course applies to taxis and as hospitality reopens and taxis become a relevant transport consideration for people again, FREE NOW is using Outdoor to remind consumers of the service and the occasions we can think about using it for. Another example of advertising mirroring society is the return of the film category to OOH, or more specifically, cinema releases. The release of Peter Rabbit 2, carried on T-Sides, is one of many films on Outdoor this week. And as the economy reopens, payments solutions provider Square are using OOH to target the business community.

McDonald’s are using our Liveposter platform to deliver temperature triggered dynamic content to promote some of their summer favourites.

Digital OOH Development

Following on from Exterion Media’s launch of Digital Bridges in Dublin city centre last week, Clear Channel this week switched on the first of more than fifty new Adshel Live Roadside screens in units that also incorporate phone and wayfinding facilities.

McDonald’s, Guinness and Disney+ were among the first set of brands active on the new format, which offers locations in towns and cities across the country including Dublin city centre, Bray, Malahide, Galway, Waterford, Wicklow and Tipperary.

The introduction of these latest screens further enhances the roadside DOOH offering, already serviced by formats such as Digishelters, Digipanels, digital billboards and the new bridges.

Digital OOH accounts for around 30% of total OOH investment in ROI.

Mobility Summary

The Central Statistics Office (CSO) has published its latest Transport Bulletin which captures the impact of the latest COVID-19 restrictions on traffic volumes and the number of journeys taken on public transport.

The volume of cars on Irish roads has been rising slowly since the start of the year following the move to Level 5 restrictions in December and more rapidly since travel restrictions lifted on 10 May. Car-traffic volumes in the week beginning May 24th were nearly twice as high in regional locations than in the corresponding week of 2020. The number of new cars licensed in May 2021 rose by 5,847 vehicles compared with May 2020. The easing of travel restrictions is also reflected in the greater use of public transport.

The TII has reported that, as of Tuesday, traffic volumes are +40% above the level experienced on the same day in 2020. A +4% weekly increase is registered from the sample of ten traffic counters located on the national road network for the morning period from 7am until 10am. Looking at traffic volumes on the radial routes into Dublin, comparisons with Tuesday 8th June are as follows: +4% on the M1 at M50 to Airport , +5% on the N7 at Citywest, +4% on the M11 at Bray and +2% on the M4 at Celbridge-Maynooth.

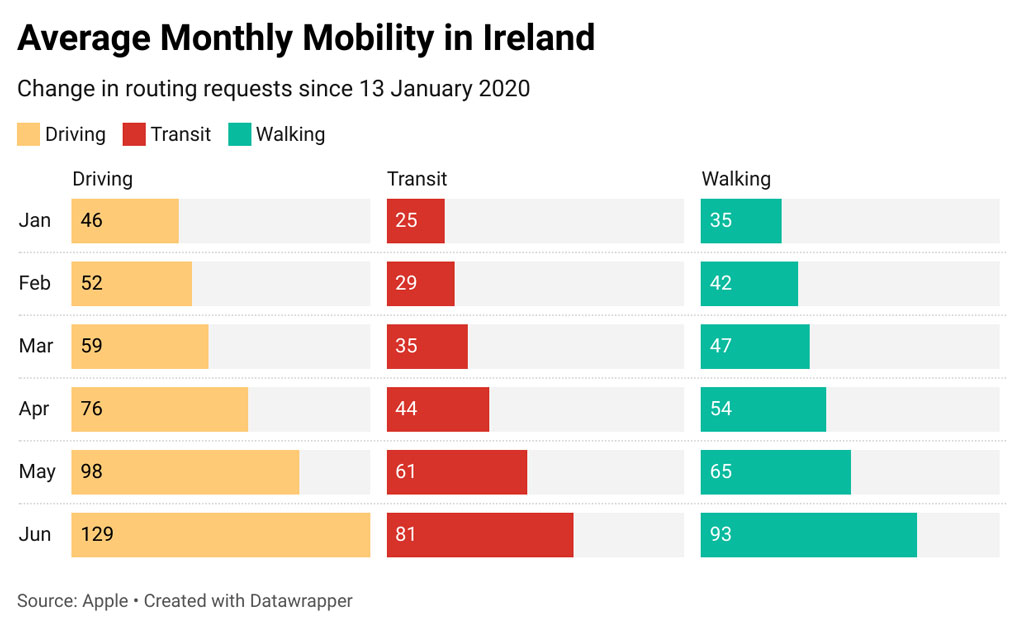

The seven-day average for Apple’s routing requests mobility data to Tuesday 15th June shows traffic in ROI continues to surpass last year’s pre-pandemic baseline consolidating at +30%.

The sustained increase in mobility across all modes, is borne out by the monthly averages, with routing requests for public transport increasing more than threefold since January, while driving and walking have increased by 2.8 and 2.7 times respectively.

Dublin City Council (DCC) footfall counters in the city centre show footfall in the core city area. Footfall has been climbing steadily and by the end of May was 60% higher than it was in early January.

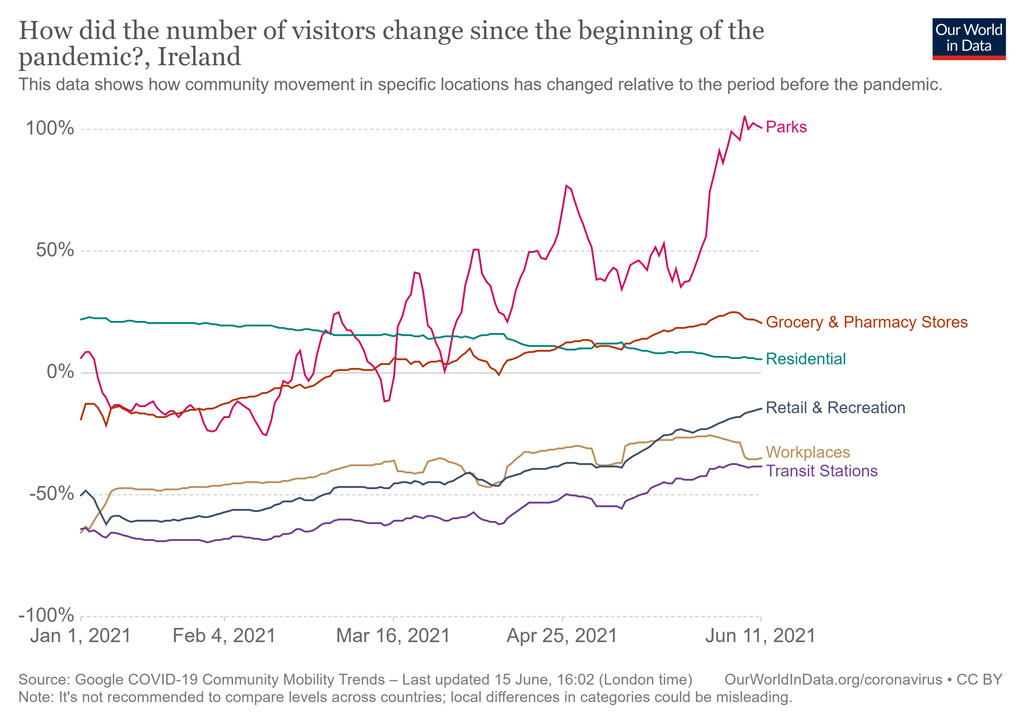

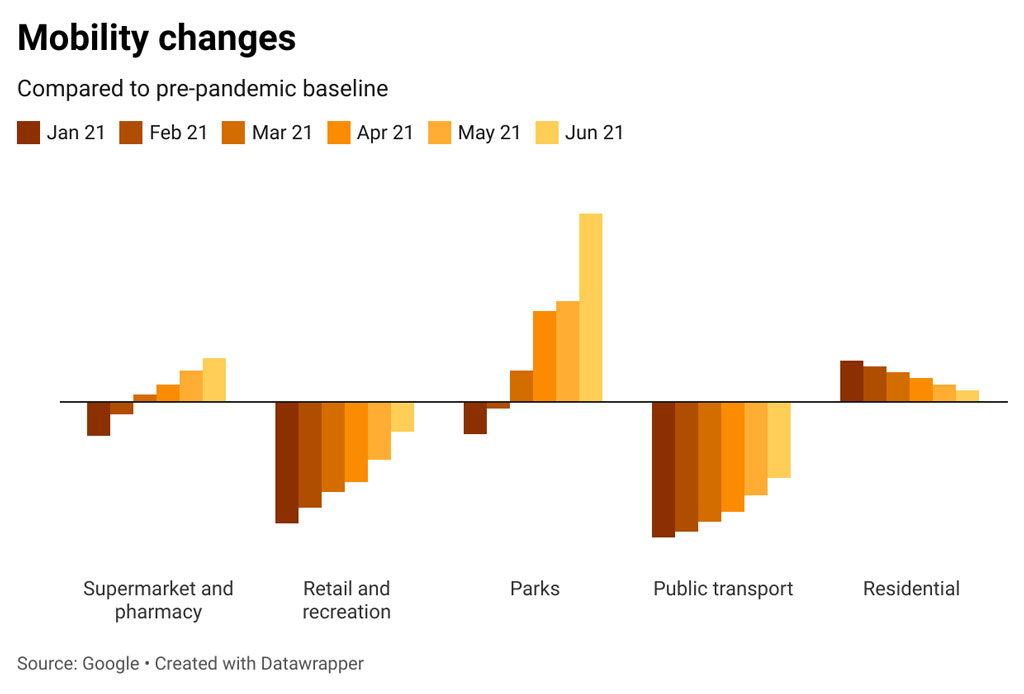

Google’s COVID-19 Community Mobility Report to Friday 11th June reinforces the move to out of home environments from the start of the year.

Time spent in-home has declined from +21% in January to +6% to date this month while visits to supermarkets and pharmacies has increased from -17% to +22%. Visitor numbers to transit stations, workplaces, shopping centres and parks all also show significant recent gains.

Travel

Staycation Nation

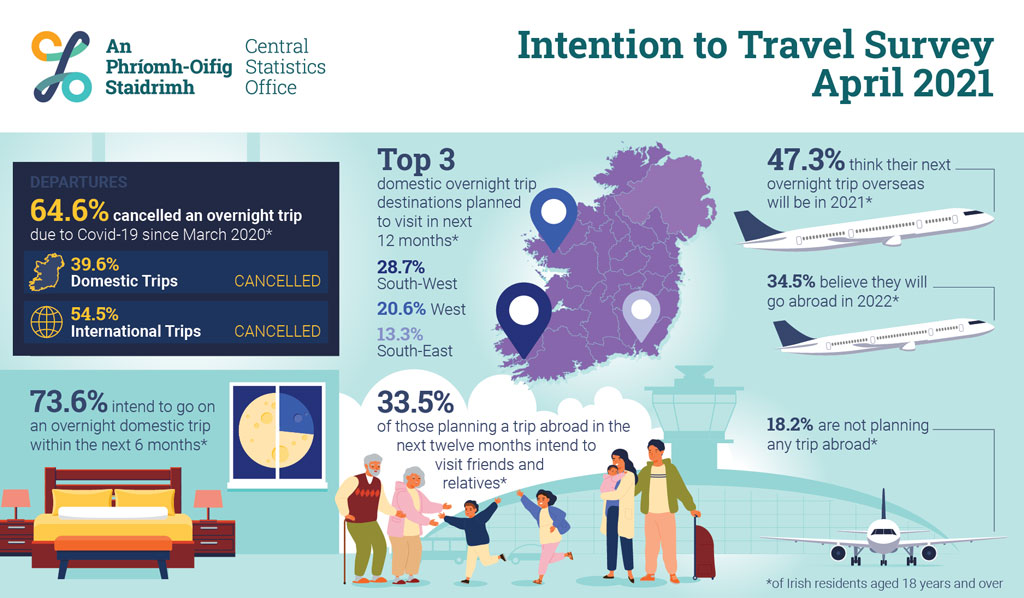

The Central Statistics Office (CSO) published the results of the Intention to Travel Survey April 2021. It’s found that more than seven in ten Irish residents plan to take an overnight domestic trip before November this year.

The South-West region (28.7%) is the most popular destination for Irish residents intending to take an overnight domestic trip in the next twelve months, followed by the West and South-East regions at 20.6% and 13.3% respectively.

Just under three-quarters of Irish residents (74.2%) intending to take an overnight domestic trip in the next twelve months are planning to use it for holidays, leisure and recreation purposes, while 22.4% plan to visit friends and relatives.

One-fifth (20.7%) of those intending to take an overnight domestic trip in the coming year plan to use self-catering accommodation, while 56.7% will use hotel, guesthouse or B&B accommodation

For overseas trips, 47.3% of people intend to travel abroad in 2021 while 34.5% intend to take their next trip outside the island of Ireland in 2022 or later.

Irish staycationers are expected to spend an average of €1,375 per trip this summer, according to a nationwide survey carried out on behalf of leading retail and wholesale group, BWG Foods.

The nationwide survey carried out among a representative sample of 1,000 Irish consumers by Empathy Research, has highlighted the importance of staycations to the local economy, with Kerry (24%), Cork (20%) and Galway (20%) selected as go-to destinations for the majority this summer. Local scenery (51%), proximity to the coast and beaches (48%) and good restaurant/café options (45%) are deemed to be the most influential aspects on the decision of where to choose for a staycation. In terms of choice of accommodation, the majority of respondents preferred hotel accommodation (58%), with 23% planning on staying in Airbnb accommodation when compared to options such as glamping or B&B’s.

After months of isolation and travel restrictions, holidaymakers are planning on embracing what Ireland has to offer with an active, outdoor summer – BBQ’s (40%), hiking (30%), swimming (30%), cycling (22%) and camping (14%) are all high on the travel itinerary.

And, finally…

Our Posterwatch figures reveal the top 5 OOH advertisers in terms of display value for the month of May (cycles 10-11). Detailed analysis of the OOH market by category, brand etc. is available from the team at PML Group.