As the country continues to emerge from lockdown and the vaccination roll-out continues, Colm Finlay, senior research executive with RED C looks at the key findings of the latest RED C Mood Monitor which paints a picture of overwhelming optimism, tinged with a modicum of caution.

As the country continues to emerge from lockdown and the vaccination roll-out continues, Colm Finlay, senior research executive with RED C looks at the key findings of the latest RED C Mood Monitor which paints a picture of overwhelming optimism, tinged with a modicum of caution.

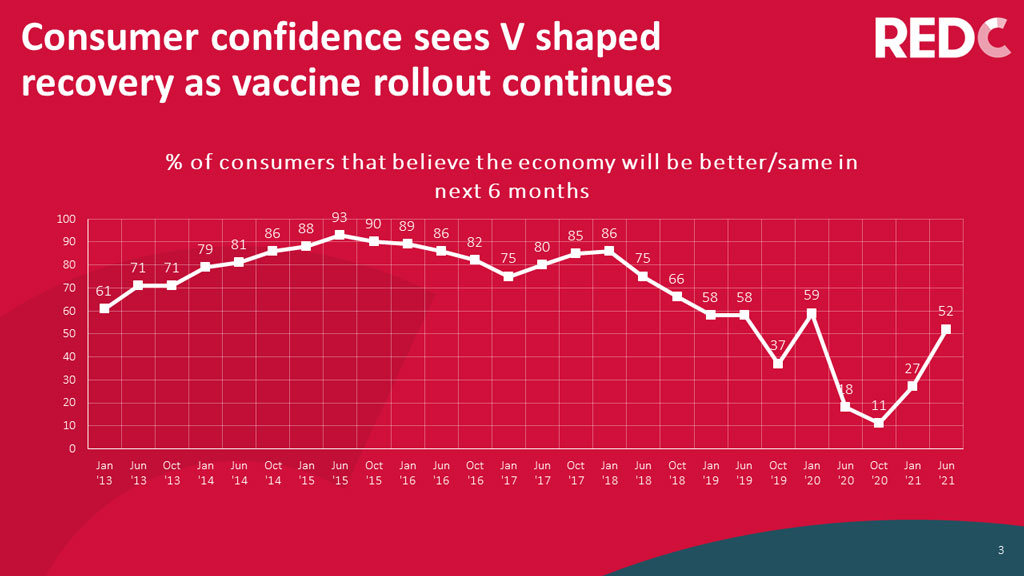

Consumer confidence has continued to rebound with the ongoing rollout of the Covid-19 vaccination programme, and the gradual easing of restrictions. The June edition of RED C’s regular Consumer Mood Monitor records a significant upsurge in consumer confidence in the Irish economy, rebounding from a low point in late 2020, the lowest level recorded since the global financial crash.

There is a growing mood of optimism with consumer confidence back to roughly pre-Covid levels. The rebound began in January following the announcement of several effective vaccines, and of a Brexit trade deal, and confidence has continued to rally since. However, it is clear some concerns remain with outlook on the economy still well below levels seen from 2015 to early 2018, before a hard Brexit increasingly came into view.

Now some 37% of Irish adults expect the Irish economy to improve in the next six months, while 52% overall believe that it will improve or at least stay the same. Over half (52%) also believe that the world economy will improve or stay the same in the coming six months. Nonetheless, 48% expect the Irish economy to fare worse in the next six months.

Confidence has rebounded across all ages, genders, regions and social classes as well as among those with children and those without. There is some difference in outlook on the economy between demographics, with women being somewhat less likely to believe the economy will improve compared to men, as are those aged 25-34, those with children, and those in lower social grades, perhaps the groups most likely to work in retail and hospitality, among the hardest hit industries. There is little difference in confidence between the provincial regions, however we do see lower confidence in border counties, perhaps explained by their proximity to Northern Ireland and fears around the long-term effects of Brexit, and around the Northern Ireland protocol.

The research also signals that the majority (59%) believe that the Covid-19 situation will improve in the next six months, a significant increase from 18% in October 2020 and 47% in January 2021, while only 17% believe the situation will deteriorate. Again, outlook has improved among all demographics, but with lower confidence among women, 25-44 year olds and lower social grades.

Moreover, 64% believe that the employment market will improve or stay the same in the next six months, almost double the figure from January, and five times the level seen in October 2020. There is some stabilisation in regard to views on disposable income with a majority of 53% expecting their income to stay the same and a further 16% expecting it to increase. Less encouragingly, 31% currently expect their income to decrease in the next six months, perhaps some of whom are on the PUP which is due to be phased out. As with outlook on the economy and the pandemic, women, 25-34 year olds and lower social grades are less likely to be optimistic about the employment market and about their disposable income.

Spending is predicted to increase dramatically as restrictions are lifted, with household savings at an all-time high, and our research showing a significant surge in the number of people expecting to increase their discretionary spending across holidays, entertainment and consumer goods.

The only area of spending where there is no change is expected spend on groceries, an area most have spent more in during lockdown anyway, and which can also be interpreted as a positive stabilisation with fewer expecting Brexit to further drive up prices.

There is also growing readiness to partake in different activities, as confidence in the pandemic situation and vaccine rollout increases, with more than a half of adults already doing or being prepared to do activities such as taking public transport, holidaying in Ireland, returning to work, visiting health professionals and visiting shops other than supermarkets. In particular people appear to show a real value in worthwhile “experiences” that were denied during us the crisis. The desire to party, socialise, and meet friends and family are very high. However, there are still some levels of concern around attending a large sporting or music event, or taking a holiday abroad, meaning increased holiday spend is likely to occur mostly within Ireland for the rest of 2021.

Overall, optimism is clearly rebounding in the Irish and world economies as well as in the employment market. There is an increasing willingness to take part in different activities, and an expected increase in household spend. However, Covid-19 is not yet behind us and there is still a palpable sense of caution around the pandemic as well as lingering concerns around the impact of Brexit. Greater levels of socialising and spending can be looked forward to in the next six months, however holidays abroad and large concerts are unlikely to take place to a significant extent until 2022, while income and the employment market could take some time to fully rebound.