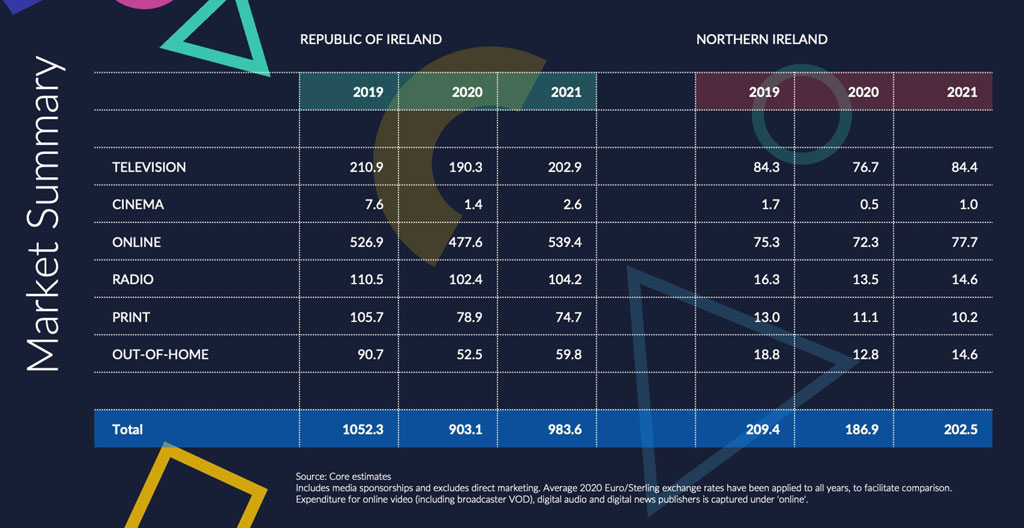

Following a difficult 2020, advertising investment in the Republic of Ireland is forecast to grow by 8.9% to €983.6m in 2021, according to Ireland’s largest marketing communications group Core in its latest annual review of the market.

In 2020, Core estimates that the market contracted by around 14.2% to end the year at around €903.1m. This compares with €1.05bn in 2019.

In Northern Ireland, meanwhile, Core estimates that the market declined by 10.7% in 2020 to £166.3m and this year it expects it to rise by 8.3% to £180.2 (€202.5m)

Once again, the growth in online advertising will drive overall growth in the market with Core forecasting a that online will grow by 12.9% this year to €539.4m. This compares with €477.6m in 2020 but with €526.9m in 2019 which means online is the only media category to return to, and exceed, 2019 investment levels. (A full breakdown of Core’s forecasts for 2021 is below).

According to Stha Banks, head of paid social with Core : “The dominance of the duopoly continues to have a significant impact on the share of the market available to Irish online publishers and broadcasters. We estimate that the slice of the display market (including video on broadcast players) available to Irish media was just €27 million in 2020. This is expected to grow by about 11% in 2021 to €30 million. This level of investment is not congruent with a thriving indigenous media sector.”

Writing in the introduction to Core’s Outlook 2021 report, CEO Alan Cox also highlights the challenges facing the indigenous media sector and the need for a “well-resourced indigenous media that are focussed on servicing the needs of the Irish public.”

Writing in the introduction to Core’s Outlook 2021 report, CEO Alan Cox also highlights the challenges facing the indigenous media sector and the need for a “well-resourced indigenous media that are focussed on servicing the needs of the Irish public.”

“However, the advertising revenue needed to generate high-quality content of relevance to the Irish public, is in major decline,” says Cox.

“To illustrate the extent of the funding issue, it is useful to look at what has happened over the last twenty years. In the year 2000, the total amount of advertising money invested in media in the Republic of Ireland was circa €630 million. Circa 96% of this went to indigenous media. In 2020, the total market spend was circa €903 million, with indigenous media’s share falling to 49%. Therefore, over the last two decades, the level of annual advertising support for the indigenous sector has fallen by €162 million,” he says.

“The prognosis for the future is concerning. Without government intervention, the number of indigenous outlets, and the range of what they cover, will continue to shrink. We should not allow commercial market forces to shape the media landscape in Ireland, because this will eventually lead to market failure, with the breadth and depth of public-interest content being significantly compromised,” Cox adds.

VIDEO (Ellen Kelliher, Head of Video Operations)

2020 was another challenging year for TV. Despite strong viewing levels, we estimate that investment in TV advertising fell by 9.8% last year to €190.3 million, with spends across both ‘spot’ and sponsorship being affected.

We continued to see an increase in the share of advertising budgets moving to online video platforms, which is in keeping with the ongoing growth in web-based viewing. In 2020, there was an annual increase in viewing of 10% for ad-funded video platforms. Separately, according to Core Research, 72% of adults say they access Netflix regularly and 23% say they watch Disney+ regularly.

We believe the TV market will see a recovery in 2021 as brands that were forced to curtail advertising in 2020 return to the medium. We saw this in Q4 last year when spends on TV grew by 20% (versus Q4 2019) leading to record levels of demand. We are forecasting 6.6% growth in TV advertising investment to €202.9 million in 2021.

TV spends in Northern Ireland also fell in 2020, with a decline of 9% to £68.2 million (€76.7m). For 2021, we are forecasting growth in TV revenue, in the North, of 10% to £75.1 million (€84.4m).

ONLINE VIDEO: The online video market continues to perform strongly in the Republic of Ireland, increasing by 6% to €147.8 million last year. Facebook, including Instagram, continues to grow, accounting for 76% of the online video market (for advertising).

The advertising ‘boycott’ of the platform in July last year, initiated by the #StopHateForProfit movement, had minimal impact on Facebook’s bottom line. Circa 1,000 advertisers from around the world paused their advertising in protest at the platform’s handling of hate speech and misinformation. However, once the campaign lost momentum, after July, advertising demand returned to normal. We expect to see continued growth in online video investment in 2021, and we are forecasting an increase of 13.1% to €167.2 million.

We have revised the online video spends for Northern Ireland as they were overstated in previous reports. We estimate that the market in NI last year was £15.7 million (€17.7m), an increase of 4.1% on the previous year. Like the Republic, we are forecasting strong growth in 2021, with advertising investment levels likely to increase by 11.9% to £17.6 million (€19.8m).

CINEMA: 2020 was a tough year for the cinema industry. As a result of lockdowns and restrictions, cinemas were either closed or under strict admission controls for most of the year. We estimate that spend fell by more than 80% to €1.4 million in the Republic of Ireland. For the first half of 2021, we expect to see little improvement; however, as we exit lockdown and cinemas reopen, brands and audiences will return. The film studios will be anxious to release their backlog of movies, and we expect spend will almost double to €2.6 million, but it is worth bearing in mind that this will only represent one third of the level of spend in 2019.

In Northern Ireland, advertising investment fell by circa 70% to £0.45 million (€0.51m) in 2020. Like the South, we are expecting cinema spends to double this year to £0.91 million (€1.02m).

ONLINE (Stha Banks, Head of Paid Social)

In 2020, online media spend experienced its first year-on-year decline. We estimate that advertising investment fell by 9.4% to €477.6 million in the Republic of Ireland. This figure includes search, social, classified and display spends. Display is a catch-all description for online video (including broadcast players), digital audio, email, text and native formats.

Despite a slower H1, due to the pandemic, both Google and Facebook experienced growth in their global advertising revenues of 13% and 18% respectively. Google’s growth was driven by a strong Q4 for its search business and a 46% increase in YouTube spends. In the case of Facebook, a 12% increase in daily active users, coupled with an increase in demand for ecommerce advertising formats were key to its increase in revenues last year.

Despite their global growth, we believe that Google and Facebook’s combined advertising revenue in the Republic of Ireland contracted by 5.5% to €403.1 million. This was driven by sharp declines in spends from SME advertisers, a collapse in key categories like travel and entertainment and an ecommerce sector that still lags behind bigger international markets. Despite this, Google and Facebook still accounted for 84.4% of all online advertising investment and 44.6% of the total media market in the Republic of Ireland last year.

For 2021, we expect the online market will increase by 12.9% to €539.4 million, with Google and Facebook growing by 14% and 12% respectively. A continued surge in video investment will benefit both businesses, even though competition from TikTok will increase substantially this year.

The dominance of the duopoly continues to have a significant impact on the share of the market available to Irish online publishers and broadcasters. We estimate that the slice of the display market (including video on broadcast players) available to Irish media was just €27 million in 2020. This is expected to grow by about 11% in 2021 to €30 million. This level of investment is not congruent with a thriving indigenous media sector.

The online share of the advertising market in Northern Ireland at 38.3% is lower than the UK and Republic of Ireland with 71.3% and 54.8% respectively. In Northern Ireland, the level of online advertising was worth £64.3 million (€72.3m) in 2020 which represented a decline of 4% on 2019. We expect growth of 7.5% in 2021 to £69.1 million (€77.7m).

AUDIO (Christina Duff, Investment Director)

We estimate that radio advertising revenues fell by 7.3% to €102.4 million in 2020. This was driven by an estimated 28% decline in the local and direct markets. The demand for spot advertising at a national level was strong, due to a significant increase in government spend, which accounted for approximately one third of all advertising activity on radio last year.

In 2021, we anticipate that advertising investment in the Republic of Ireland will grow slightly to €104.2 million, an increase of 1.8%. Digital audio (podcasts and online streaming) investment has seen a surge since March last year as consumption increased, and this will continue to grow, reaching approximately €7.3 million in 2021.

After several consecutive years of growth, the Northern Ireland radio market recorded a decline of 17.2% in 2020 with estimated revenue of £12.0 million (€13.5m). We expect this to grow by 8.1% to £13.0 million (€14.6m) in 2021.

Bauer Media Group’s recent acquisition of Communicorp, for circa €100 million, is likely to be the standout event in the industry this year. The Communicorp stable is an impressive collection of premium audio brands – Today FM, Newstalk, 98FM, Spin 1038, Spin South West, OTB Sports and AudioXi – which accounts for circa 38.5% of all advertising investment in audio channels in the Republic of Ireland.

Bauer is a long-established privately owned media business, headquartered in Hamburg, with radio interests in seven countries (now eight), including Northern Ireland, where it owns Downtown and Cool FM. It is also Europe’s largest magazine publisher.

Developments in Australia surrounding the introduction of its News Media and Digital Platforms Mandatory Bargaining Code have been watched carefully by governments across the globe.

The purpose of the Australian code is to force technology platforms to pay publishers for news content made available or linked on their platforms. The code’s main provision is that platforms should negotiate with publishers in good faith, and where parties cannot come to an agreement, an arbitration panel will intervene.

The introduction of the code created a lot of noise and posturing on all sides, including Facebook temporarily blocking news content on its platforms in Australia. This action damaged Facebook’s reputation but did enable it to secure some ‘last minute’ concessions such as the inclusion of a two-month mediation period.

Critics of the Australian solution say that it favours big publishers and that local media will lose out. The Future of Media Commission needs to address this issue in its recommendations here. Ireland’s local publishers are an important part of the media landscape, but they are struggling to stay afloat.

The EU has various pieces of related legislation in the works (such as the Copyright Directive, Digital Services Act and the Digital Markets Act) which could be amended to include aspects of the Australian reforms if members wish. The publication of the Commission’s report this summer could be useful stimulus in this regard.

NEWS MEDIA (Niall Murphy, Trading Operations Director)

The print industry was significantly impacted by Covid-19 in 2020. As restrictions were implemented, advertising revenue declined across numerous revenue sources including classified advertising, SMEs and local advertisers. This impacted both national and local print titles.

In the Republic of Ireland, total investment in print advertising fell by 25.3% to €78.9 million. We estimate that ad revenue across the national titles fell by 23.5% to €65.7 million. There was also a contraction in digital revenue, which we estimate was in the region of €21.1 million, a decline of 13.9%. Overall regional press spends fell by approximately 22%, last year.

We are forecasting a further decline in revenues in 2021, albeit at a much slower rate. The overall print market is expected to decline by 5.3% to €74.7 million, but digital revenue for national titles is expected to increase by 8% this year to €22.8m.

Print advertising revenue fell by 14.6% to £9.9 million (€11.1m) in Northern Ireland last year. Revenue would have been more severely impacted were it not for significant advertising activity from the UK government. We are predicting further declines in 2021, with advertising investment in print expected to fall by 8.1% to £9.1 million (€10.2m).

As mentioned earlier in this report, the most important industry development this year is the work being carried out by the Future of Media Commission. The timing of the Commission’s work coincides with developments around the world regarding how news should be paid for by online platforms – Google and Facebook in particular.

Developments in Australia surrounding the introduction of its News Media and Digital Platforms Mandatory Bargaining Code have been watched carefully by governments across the globe.

The purpose of the Australian code is to force technology platforms to pay publishers for news content made available or linked on their platforms. The code’s main provision is that platforms should negotiate with publishers in good faith, and where parties cannot come to an agreement, an arbitration panel will intervene.

The introduction of the code created a lot of noise and posturing on all sides, including Facebook temporarily blocking news content on its platforms in Australia. This action damaged Facebook’s reputation but did enable it to secure some ‘last minute’ concessions such as the inclusion of a two-month mediation period.

Critics of the Australian solution say that it favours big publishers and that local media will lose out. The Future of Media Commission needs to address this issue in its recommendations here. Ireland’s local publishers are an important part of the media landscape, but they are struggling to stay afloat.

The EU has various pieces of related legislation in the works (such as the Copyright Directive, Digital Services Act and the Digital Markets Act) which could be amended to include aspects of the Australian reforms if members wish. The publication of the Commission’s report this summer could be useful stimulus in this regard.

OOH (Emmet O’Fearghail, Trading Director)

In the Republic of Ireland, the out-of-home advertising market declined by approximately 42.1% to €52.5 million in 2020. OOH was significantly impacted by the Covid-19 pandemic, with up to 80% of investment either cancelled or deferred in Q2 alone.

The areas of the OOH market most impacted where city centre locations and the transport network, as people stayed at home.

OOH did see a partial reprieve later in the year as restrictions were lifted with advertisers focusing on suburban locations including retail areas.

Like last year, the start of 2021 has been difficult for the out-of-home industry as restrictions limit the number of brands using the medium. As the year progresses, we expect to see spends return. We are forecasting that advertising investment will increase in the Republic of Ireland by 13.9% to €59.8 million in 2021. However, this will still be one third less than the investment in the medium in 2019.

The OOH market in Northern Ireland recorded revenue of £11.4 million (€12.8m) in 2020. This was a decline of 31.9% on 2019; however, it was a better performance that the UK, which fell by 44%. Like the Republic of Ireland, the start to 2021 has been difficult for OOH in the North, but we are still expecting growth this year. We forecast that advertising activity will increase by 14.1% to €13.0 million (€14.6m).

When the country reopens later in the year, advertisers should consider the opportunity that out-of-home formats provide in creating a canvas to project a positive brand communication that connects with people who will be happy to be moving around freely once again.

The Coca-Cola 96-sheet poster (above) from a few years ago is outdoor advertising at its best, and is a good example of the kind of creative approach that would go down very well with consumers this year – weather permitting.

SPONSORSHIP (Jill Downey, MD, Core Sponsorship)

Investment in the sponsorship market, in the Republic of Ireland, specifically fees paid, decreased by an estimated 14.8% to €160.6m in 2020, bucking the trend of sustained growth over recent years. This was the lowest spend level since 2016.

The decrease in fees was not as great as anticipated with many sponsors supporting rights holders and showing solidarity by continuing to pay agreed fees. However, most rights holders were pressed to offer contract extensions, additional assets or added value to compensate for curtailed competition schedules, less TV coverage and fewer activation opportunities. Music and event fee levels were among those impacted most with all concerts and festivals postponed or cancelled.

If everything goes as planned, we have a feast of sport to look forward to in 2021 including a rescheduled Olympic Games, the UEFA European Football Championships and a Lions Tour.

However, despite this, we estimate that investment will decrease by a further 5% to €152.5m in 2021. Short-term brand decision making is prevalent. Also, uncertainty over sports scheduling and a continued pause on music events are contributory factors. Major new deals are likely to be scarce, and the FAI is still seeking to replace Three as its main sponsor as we enter a new World Cup qualifying cycle. Retaining existing sponsors while protecting revenue levels may be the priority for many rights holders – especially those smaller to mid-sized

The Northern Ireland market decreased by circa 18.8% in 2020. We estimate the value of the market was £10 million (€11.2 m). An added factor here was some knock-on impact from UK sponsorship activity – Covid-19 and Brexit related. We forecast that the NI market may recover a little faster than the Republic in 2021 but remain static overall at £10 million (€11.2 m).

Sponsors and rights holders have continually proven to be particularly resilient and creative over the past 12 months. While many relationships have improved due to stronger communications, and extensive scenario planning, it is likely that this will be tested again. A successful vaccination rollout will help accelerate a return of fans to sporting, music and cultural events. However, we are not likely to see the full benefit of this, or a return to increased investment, in either market, until 2022.

There are green shoots emerging though; as we look beyond Covid-19, we predict sustainability will become increasingly influential in sponsorship investment decisions and activation.

A recent example here is SSE Airtricity’s announcement of an energy partner programme for clubs as part of its new title sponsorship of the Women’s National League and its renewal of the SSE Airtricity League. This is an excellent opportunity for rights holders to attract additional sponsorship revenue, as it recovers from this uniquely challenging time.

To subscribe to Core’s Outlook and updates click HERE