The number of brands advertising on TV now has now surpassed the figures for 2019, despite the ongoing restrictions and the current lockdown, according to Core Research in its latest Covid-10: Media Consumption report.

While the number of brands advertising in Q2 at the height of the pandemic in Ireland declined dramatically, in recent months activity has picked up considerably says Core with the brand count now above the 2019 weekly average of 308. “Level 5 restrictions have had minimal impact on the number of brands advertising year on year,” notes the report.

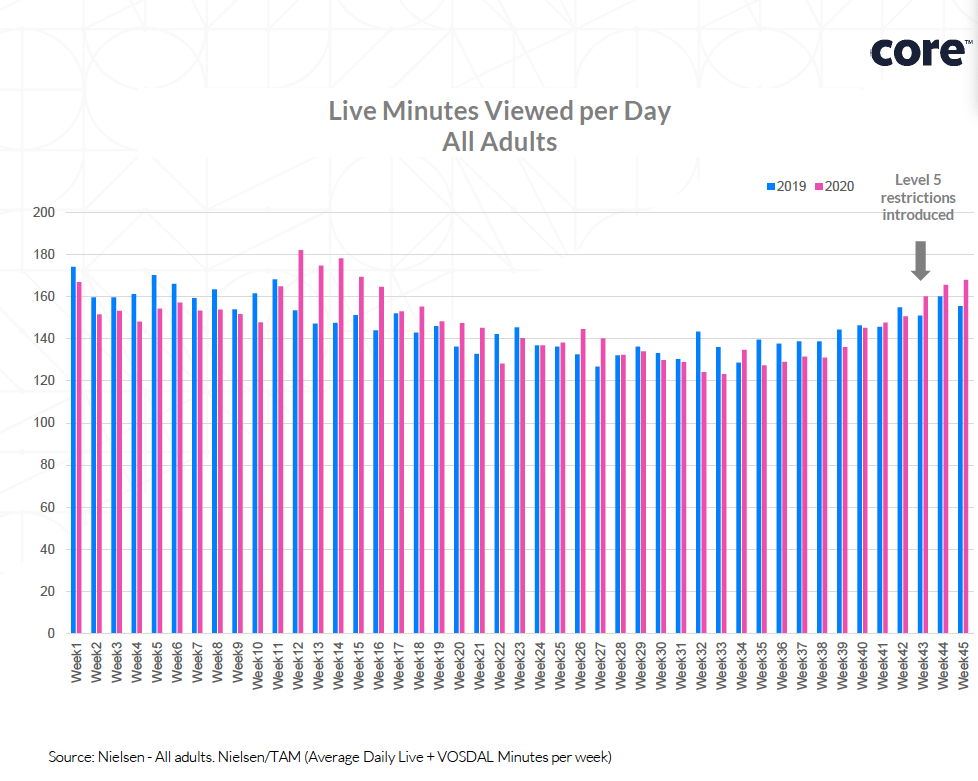

With two more weeks to go until Ireland re-emerges from its latest lockdown due to Covid-19, the research also notes a surge in screen time during lockdown with people now spending 2hrs and 44 minutes per day watching live TV.

The report looks at the impact Level 5 restrictions have had on media consumption, revealing live tv viewership has increased by 6% year-on-year since the highest level of restrictions were introduced, reversing a previous trend of declining viewership year-on-year. The report also reveals that habits differed from generation to generation with those aged between 15-34, increasing by 9% year-on-year. This is mainly driven from news and current affairs plus new schedules across all broadcasters. Sport was also top of list of programmes from 22 October – 3rdNovember with both of Ireland’s Six Nations games appearing on the charts, reinforcing the importance of sport for broadcasters.

When it came to television streaming, RTE’s share remained the highest while Virgin Media and All 4 saw a steady increase. Despite falling short of market estimates, demand for Netflix continued in Q3 as the streaming giant added a further 2.2m to its global subscriber.

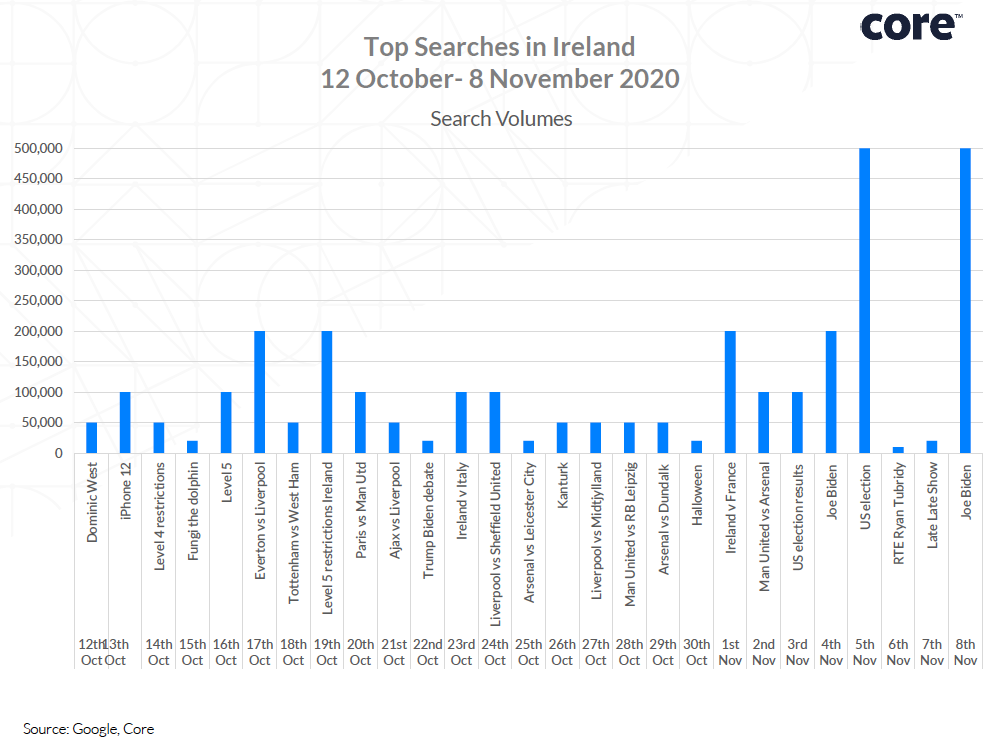

Meanwhile, Google searches and daily social mentions witnessed a spike throughout lockdown with the 5th October seeing the highest, reaching 15k total mentions within 24 hours. Daily social mentions of Covid-19 has shown a recent lift in activity in tandem with Level 5 measures across the country. Searches for sporting fixtures dominated in October while November was all about the US elections with a huge spike in searches for “Joe Biden” and “US Election” before the results were announced. In more recent days, supporting local Irish businesses and shopping locally is a trend seen in search traffic and on social media.

The report also looks at social advertising performance which saw continued growth in investment throughout October which resulted in a rise in inflation over the past three months compared with Q1 of 2020. For Facebook, Google, and Amazon, ad revenue growth beat all expectations for Q3 2020. The growth is attributed to heavy direct response e-commerce activity as the pandemic continues to push more business online.

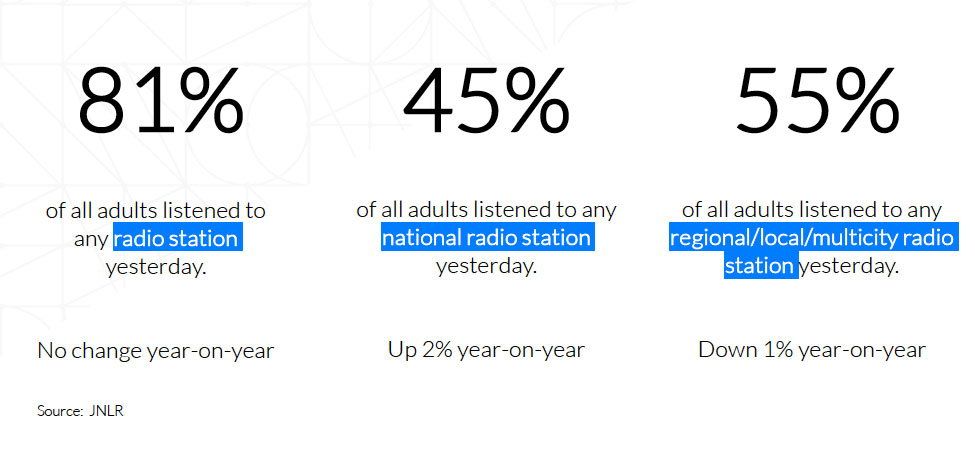

Elsewhere, Core notes that radio listenership remains high with 81% of all adults listening each day, while overall, there has been a migration of audience from local to national, news-based stations, which saw listenership grow by 2% year-on-year. According to the latest JNLR results, Morning Ireland remains Ireland’s most popular radio show with significant growth year-on-year reflecting a general migration toward news content during Covid lockdown. The popularity of podcasts continues with the report revealing the most popular to be a mix of different content genres from international and local podcasters, with The Tommy and Hector Podcast with Laurita Blewit remaining no.1 in the chart.

According to Colm Sherwin, managing director of Core Investment: “A media evolution has taken place in a few short months. During this period of pandemic-induced social isolation, it’s no surprise that people are consuming vast amounts of media. Regardless of what type of content we are consuming, every generation is relying on their devices to inform and distract more than ever before, creating a huge opportunity for media companies to engage and captivate audiences.”

To download a copy of the report CLICK HERE