Niamh Manning, Marketing Executive, PML Group with this week’s take from the world of Out of Home.

Retail Tops OOH Investors in 2020

Next week we will publish our third quarterly Posterwatch OOH market review. Q3 has improved cycle by cycle and the sector is gaining momentum as we enter the final stretch of a tumultuous 2020. With news dominated this week by speculation around further restrictions on movements, the current standing is that the rest of the country has joined Dublin and Donegal at level 3 of the government plan for living with COVID. As the data over recent weeks has shown, mobility has held up at approx. 80% of 2019 levels in Dublin and we would expect this to be the case in the rest of the country also as we navigate the next three weeks.

Diageo, Mondeléz and Sky are the three top OOH advertisers for the year so far, closely followed by banking giants AIB and Bank of Ireland. A wide variety of categories are represented among a top ten advertiser list that also includes Vodafone, Lidl, Coca Cola, the National Lottery and McDonald’s.

Unsurprisingly, Retail retains top category on the medium in 2020, with Tesco and Musgrave Group joining Lidl among the top twenty advertisers. Finance and Beers & Ciders make up the top three.

More to follow on that next week but for this week in Now Near Next we look at how cycling as a mode of transport continues to thrive, new developments in Ireland’s DOOH portfolio and how consumers are gearing up for Christmas.

Mobility

Apple Mobility Trends

Apple’s routing requests mobility data on Tuesday 6th October shows driving in Ireland at 83% of January’s pre COVID-19 baseline and more than 2 ½ times higher than that recorded in mid-April (32.6).

Transport Infrastructure Ireland – National Road Car Traffic Report

TII provides traffic trend information derived from a sample of ten traffic counters located on the national road network during the peak morning travel hours from 7:00AM to 10:00AM. As of Friday 2nd October, car traffic volumes are down by a combined 18% on the equivalent day one year ago. They are 2.66 times higher than those recorded on Friday 24th April.

TomTom Traffic Index

The TomTom Traffic Index provides detailed insights on live and historic road congestion levels in cities around the world. Congestion level in Dublin for the first four days of this week (Mon-Thur) averaged 40%, 21% less than the standard daily congestion in 2019. It is 2.8 times higher than that recorded in mid-April (14.5%).

Locomizer Auto Mobility

Latest data from Locomizer, based on analysis of mobile phone location data via anonymised app reporting, shows that auto mobility levels in ROI, which are calculated though a combination of mobile users, time, and signals, are at 85% of where they were pre-COVID-19.

CSO Transport Bulletin

Traffic counter data shows that traffic volumes for the week commencing 27 September were 19.2% lower in regional locations and 26.4% lower in Dublin than the same week in 2019. Dublin volumes are 3.2 times higher than that recorded in mid-April. There has been an increase of 6.9% in the volume of cyclists in Dublin city during off-peak hours in September 2020 compared to September 2019.

Retail

August Boosts Retail Sales Even Further

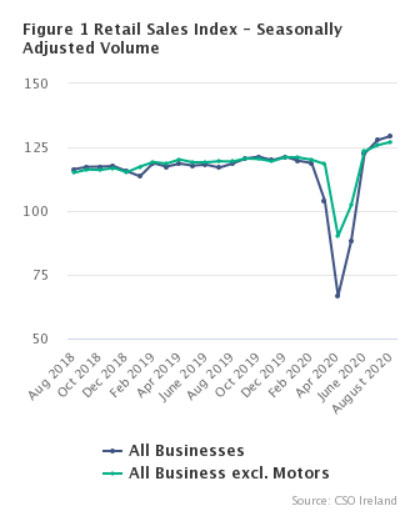

Figures recently released by the CSO show retail sales in August surpassed last year’s figures and were higher than sales in February, before the pandemic dramatically reduced consumer activity.

The volume of retail sales increased by 9% compared to August last year and were 8.9% higher than in February. Excluding the motor trade, readjusted figures reveal a 6.5% increase on last year’s sales and there was a modest 1.1% increase on July 2020 figures.

Leading the rebound, big ticket electrical goods, hardware and furniture showed increased demand. Other categories with large monthly increases were Books, Newspapers and Stationery (+22.5%), Bars (+18.1%) and Department Stores (+12.9%).

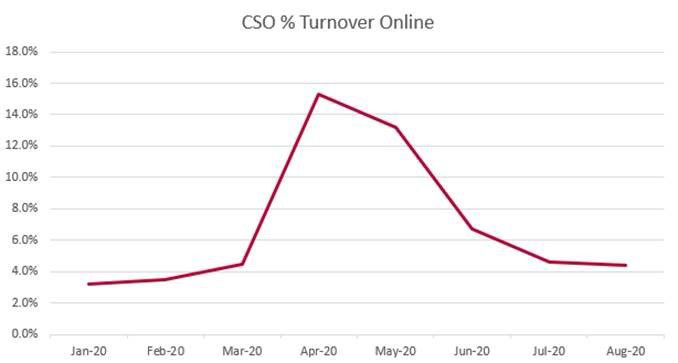

As the volume of people returning to in-store shopping increased, the proportion of total online retail sales fell from a high of 15.3% reported in April to just 4.4% in August. This shift back to the physical shopping experience is positive from an OOH standpoint as it has a unique role to play in influencing shoppers in the retail environment.

Further emphasising this return to in-person shopping, Neil Bannon, Director of commercial property consultants Bannon stated; “The latest CSO retail sales data show an interesting trend in respect of online sales. The chart below shows the % of sales taking place in Irish Retailers that are online. After peaking in April the level of online penetration has fallen dramatically. This will fall further when the pubs eventually fully open as despite some publican’s best efforts it’s hard to buy a pint online. The narrative continues to be that online is taking over but the data does not reflect this.”

Wide Eye Outdoor and Edge Media Expand ‘Shelfie’ Network into Circle K

Another fantastic DOOH development has been announced as Wide Eye Outdoor and Edge Media expands the Shelfie network into the top 100 Circle K forecourt locations nationwide.

Shelfies are a network of digital point of sale advertising units, strategically placed on the retail shelf, at eye level and located in over 100 convenience stores. Shelfies, developed by Edge Media and now operated by Wide Eye Outdoor allow brands to influence consumers at the exact moment of choice.

This expansion of the Shelfies network to over 300 Digital Screens, offers an added dimension to the Wide Eye Outdoor Digital Out of Home network, presenting advertisers and brands with a fantastic opportunity to boost sales across impulse / convenience stores, communicating with an impressive audience of 4.7 million consumers. Convenience and forecourt stores have been the second fastest growing channel in grocery over the past five years and are projected to grow even further.

According to Sarah Taylor, DOOH director with Wide Eye Outdoor: “We know, the final purchase decisions are made in the last 3 seconds, with 83% of purchase decisions made in-store. No other format can get brands closer to the shopping decision than Shelfies. Wide Eye Outdoor believe Shelfies are the leading advertising solution for brands looking to target convenience store sales.”

Units are positioned in three key sales areas in store; across convenience, at the minerals fridge and at the alcohol fridge. The shelf is the last space left where consumer attention cannot be diluted by external factors or competing formats. Shelfies deliver a clean, 1 to 1 interaction, influencing right at the moment of choice. Previous successful brands that have advertised on the network have seen up to 30% growth in sales with shoppers engaging with, and reacting to, content on the screen.

Sentiment/Insights

The ‘Now’ Intentions of the Dublin Population

As part of our Now Near Next thought leadership series, we have continually carried out bespoke research to investigate the views and opinions of the Dublin population to help our clients gain insight into consumers, at a time when consumer behaviour and habits have shifted dramatically and beyond anything we’ve seen before.

Looking at what Dubliners intend to do in the coming weeks, outdoor activities and retail visits are still high on the agenda. Fieldwork was carried out by Ipsos MRBI in the latter half of September.

60% of all adults surveyed plan on visiting a public park in the coming weeks, with three quarters of 45-54-year olds planning to visit green spaces. A third of Dubliners are planning to visit the city centre for purposes other than work and over half plan to visit a shopping centre.

As some of our daily movements and activities have been restricted, it is interesting to see how the outdoors and retail are helpful in grounding ourselves to normal life. As we travel to these outdoor spaces and retail environments, audiences can and will encounter many OOH touchpoints – whether that’s in the form of roadside and commuter formats we pass by or in retail environments as we shop. The possibilities to engage with audiences in these environments are endless.

World Federation of Advertisers – Global Response Tracker

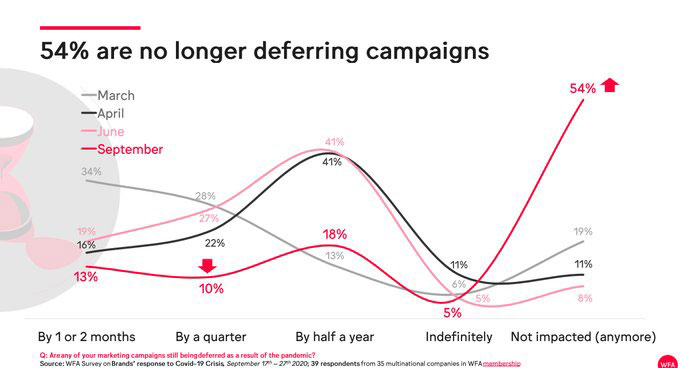

The fourth wave of research again gathered input from senior multinational marketers on how they are reacting to the ongoing global crisis.

Less than half (46%) of respondents are now deferring campaigns as a result of the pandemic – compared to 92% in June. Optimism about the current business environment has started to improve. Among those asked, 21% say they now feel positive, while 36% feel neutral about business conditions. That compares with only 8% feeling positive and 41% neutral in June this year, when the WFA last posed the same question.

Shaping Ireland’s Future: Insights from B&A

In B&A’s latest wave of research for its series ‘Shaping Ireland’s Future’, the research body looks at consumer spending, saving and budgeting coming out of lockdown and looking ahead to the next year.

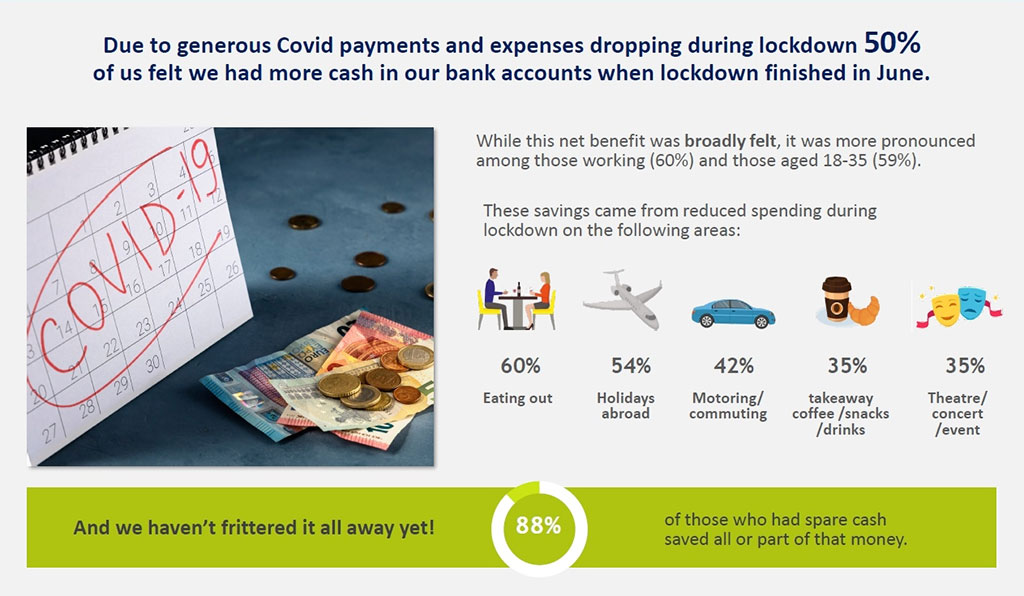

According to B&A, half of those surveyed felt they had more cash in their bank accounts when lockdown finished in June due to generous COVID payments and expenses dropping. 88% of those who had spare cash saved all or part of that money.

The home became a focal point for our spending during and after lockdown and that looks set to continue. The research found 25% spent discretionary spare cash on homewares and home improvements while 17% spent it on DIY equipment.

The report also outlines how discretionary spending will be focused around things to brighten the dark days such as treats, projects/ hobbies, things to look forward to such as short breaks and restaurant nights out, although there is concern around planning in advance, and entertainment.

Looking to Christmas, the research points to how spending will be different in many ways this year but presents for the kids will be prioritised. 58% of parents intend to do most of their shopping a good deal in advance this year. Almost 30% stated they will prioritise Christmas gifts/toys above other discretionary spending in the next few months.

67% will be streamlining the stores they visit as they prep for the festive season, presenting retailers with an opportunity to advertise their range of products and offerings.

In the final section of the report, B&A looks at ways for brands to capitalise on the research they carried out;

- There will be significant opportunities in the DIY/homewares sector. Marketing strategies have a wide range of consumer needs to play to, but as ever, engaging on an emotional level will be more effective than targeting the purely functional.

- Small, inexpensive treats look set to help lift the mood in a cost-effective way. If you play in the FMCG space, look for opportunities to upgrade the experience for your customers, creating more excitement and rituals around the consumption of your product.

- Toys and gifts look set to have a good year. With Christmas ‘experiences’ set to take a back seat, Christmas shopping trips may become even more important as a way of getting people into the Christmas spirit.

- When it comes to Christmas shopping, it will pay to get on consumers’ radars early this year, as they start shopping earlier themselves. It will also be important to carve out a place on their (limited) list of ‘go to’ stores (whether that’s online or on the ground).

View the full report HERE

And Finally…

Stay Safe and Protect Each Other

The HSE and Department of Health has launched the latest wave of its OOH campaign to promote its public health advice on COVID-19 safety. The campaign reiterates and reminds people to continue following the safety guidelines.

Planned by teams in Spark Foundry and PML, the ads are primarily aimed at people who are out commuting, socialising and shopping and highlights the need for us all to double down on our efforts to control the spread of the virus.

The campaign is running on a number of formats in a large range of environments and locations where the safety measures and prompts are needed the most.