With digital audio continuing to gain considerable traction in the Irish media market, the latest TGI Irish survey from Kantar shows that of the 47% of Irish people who visited the website of a radio station, within the last 12 months, 31% did so to listen to live radio followed by 12% who wanted to listen to pre-recorded programmes.

With digital audio continuing to gain considerable traction in the Irish media market, the latest TGI Irish survey from Kantar shows that of the 47% of Irish people who visited the website of a radio station, within the last 12 months, 31% did so to listen to live radio followed by 12% who wanted to listen to pre-recorded programmes.

The TGI figures also show that of these, 42% visited RTE.ie in the past week, followed by 28% who went to Newstalk.ie while 23% headed to TodayFM.com.

The figures also show that podcasting continues to be a key attraction for listeners with the penetration rate of podcast among older adults increasing from 45% in 2023 to 48%.

Not surprisingly, Spotify and YouTube remain the most popular services for listening to podcasts at 58% and 40% respectively, according to TGI.

Some 42% of the podcast listeners agree that podcasts offer an “authentic, trusted voice” and 20% said they would be willing to pay for exclusive podcast content.

When it came to advertising within podcasts, 19% say that ads in podcasts improve their perception of the brand.

With smart speakers becoming an integral part of the digital audio ecosystem, the TGI figures show that 19% of adults in the Republic of Ireland (783,000 people) claim to have a smart speaker at home – up slightly on last year’s figure of 18%.

In addition, 3% of adults claim they intend to purchase a smart speaker in the next 12 months.

Those with young children are particularly likely to have a smart speaker, according to TGI which shows that ‘Primary School Parents’ (live with son/daughter and youngest child aged 5-9) are 40% more likely than the average adult to say they have a smart speaker at home, whilst ‘Playschool Parents’ (live with son/daughter and youngest child aged 0-4) are 21% more likely than the average adult to say they have one.

The TGI report also notes that those with a smart speaker can be particularly valuable targets for brands, for a number of reasons. TGI shows that they are 31% more likely than the average adult to say that if they trust a brand they buy it without looking at the price. They are also 26% more likely than the average adult to say that advertising helps them choose what to buy.

When it came to TV and streaming, the TGI survey shows that Irish adults spend 24.2 hours a week watching TV. RTE One remains the most popular channel and increased viewers from 55% in 2023 to 57% in 2024.

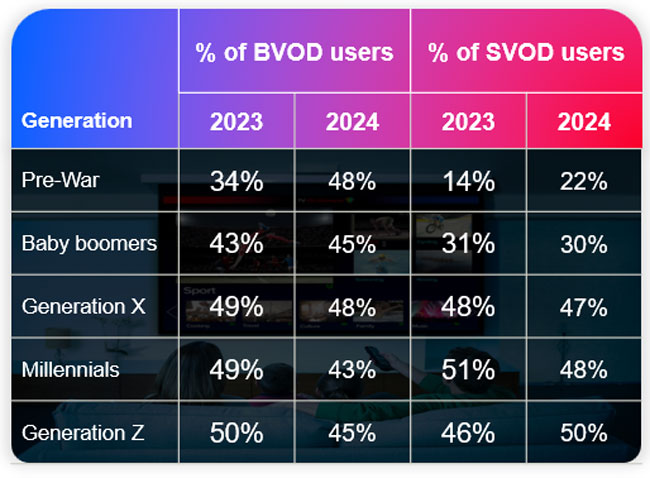

The TGI figures also show that there has been a large increase in the number of BVOD and SVOD users among the pre-war adults (see table)

When it comes to streaming, Netflix remains top of the ladder although it didn’t increase viewership over the last year. The RTE Player and Amazon Prime, on the other hand, have increased their viewership from 36% and 35% in 2023 to 40% and 39% respectively.

For consumers, the cost of subscriptions remains the most important factor when choosing a subscription at 71% followed by amount of content available at 43% and quality of video and audio at 33%.

When it comes to radio listenership, the TGI survey diverges with the JNLR which was published this week. According to TGI, radio listenership is down from 75% in 2023 to 73% in 2024. According to the JNLR, 91% of adults listen to radio. TGI notes that the number of 45-54 year olds who listen to radio increased from 75% in 2023 to 80% in 2024.