Despite lower inflation over the past two months, consumers remain cautious about what lies ahead, according to the latest Ipsos B&A Consumer Confidence Barometer.

This wave of the Ipsos B&A Consumer Confidence Barometer was conducted between the 10th and 18th December 2023.

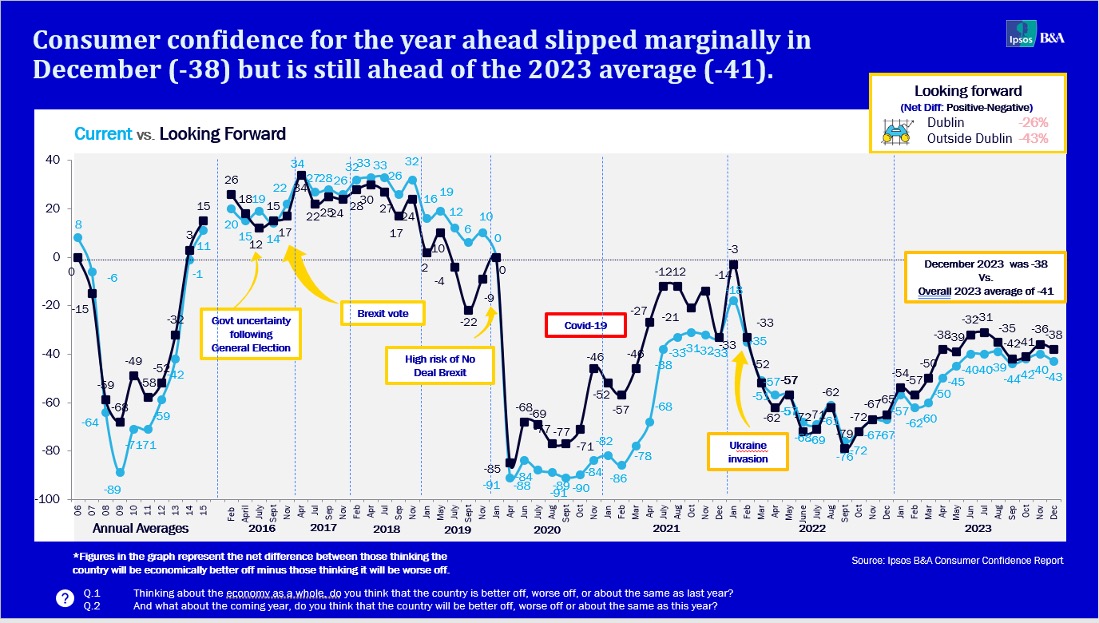

Consumer confidence in the macro economy slipped back slightly in December to -38 vs -36 in November. Yet, we are still in a stronger position compared to the overall yearly average (-41 across 2023).

That said, the proportion of those believing the country will be worse off over the next 12 months remains stubbornly high, with more than half (54%) agreeing. Just 16% believe the country will fare better in the coming 12 months.

Those least upbeat about the year ahead are more likely to be female, aged 35-54, lower down the socio-economic ladder or living outside the capital. Dubliners (-26) and those aged 16-34 (-27) are most optimistic, albeit both cohorts are still in negative territory.

There was a slight uptick in inflation in December 2023, rising from 3.9% in November to 4.6% currently. Although looking at the longer term, this is only the second time that CPI has dipped below five percent since October 2021.

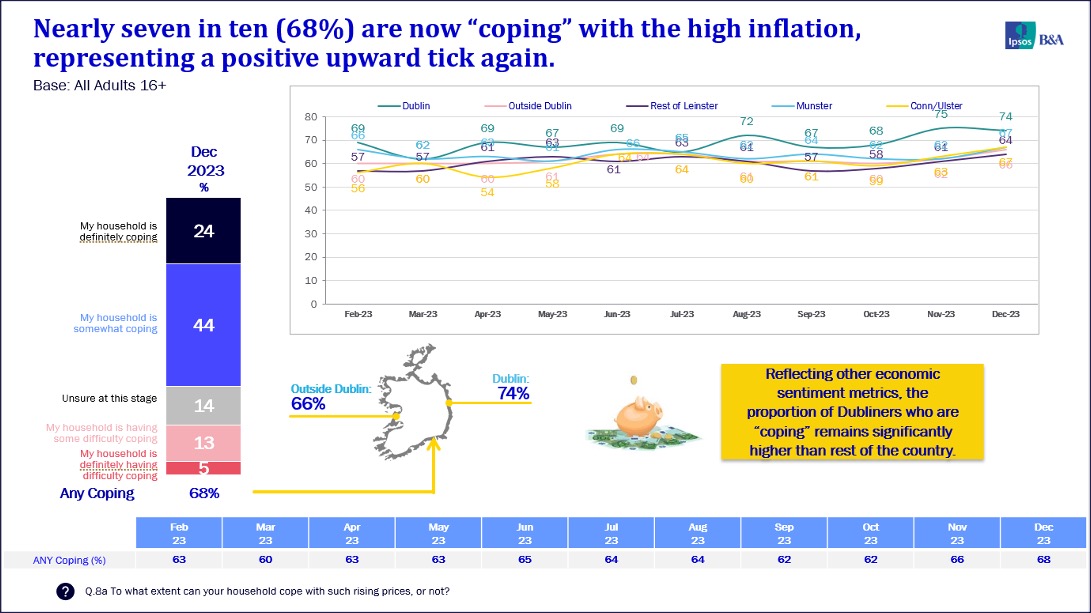

Reflecting a longer term downward trajectory in inflation, nearly seven in ten (68%) say that their household is “coping” with the cost of living; the most positive we have seen all year. Those who are more comfortable in their financial outlook tend to be ABC1s (75% or Dubliners (74%).

However, close on one in five (18%) are struggling. Those who are struggling are statistically more likely to be lower down the socio-economic ladder (C2DEs at 25%) or those aged 35-54 (24%).

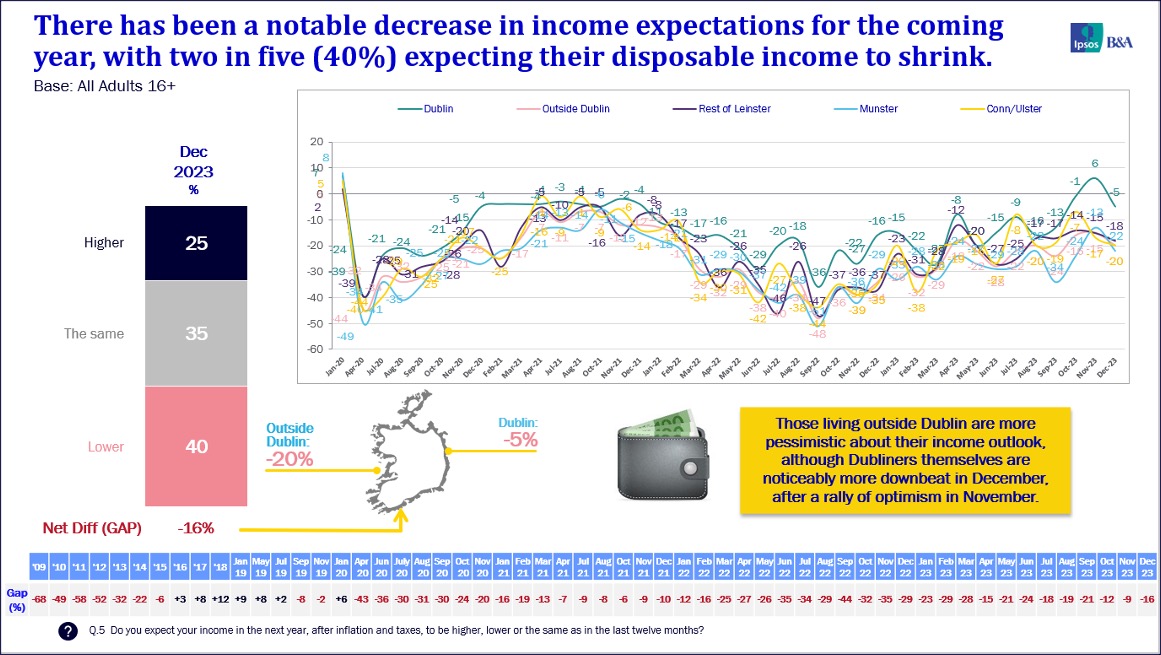

In addition, there is still trepidation about the future – two in five (40%) expect their disposable income to be lower in 2024. As a result, half believe they will purchase less goods and services over the next 12 months, and nearly half (47%) expect to save less.

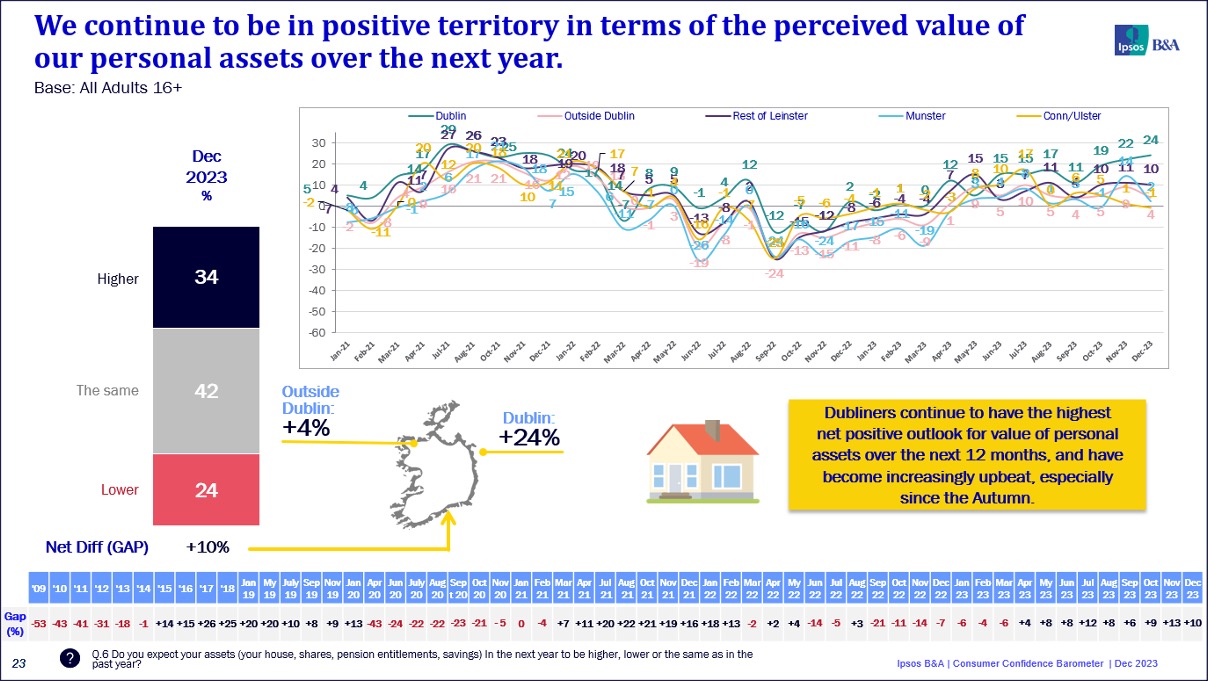

Notwithstanding this, there is a firm belief (34%) that net assets (property, shares, pensions and savings) will increase in value in 2024.

Survey results are based on a sample of 1,025 adults aged 16+, quota controlled in terms of age, gender, socio-economic class, and region to reflect the profile of the adult population of the Republic of Ireland. All interviewing was conducted via Ipsos B&A’s Acumen Online Barometer.

For more details and the full report or more information, please contact Jimmy Larsen and Paul Moran: jimmy@ipsosbanda.ie and paul@ipsosbanda.ie