Luke Reaper and Niall Brennan examine some of the key findings from the latest B&A Sign of the Times 2023 research and how marketers can use some of these themes to inform strategy.

For over a decade, B&A have conducted its annual Sign of the Times research which delves into the consumer mindset, consumers decision making and the cultural and societal context in Ireland.

This year, B&A conducted five qualitative focus groups with consumers across Ireland and a robust nationally representative quantitative survey (n=1000) through their Acumen online panel that uncovered 5 key themes for brands in 2023.

Briefly, they are summarized as follows and, following on from this, some of the key trends and how they can inform strategy are assessed.

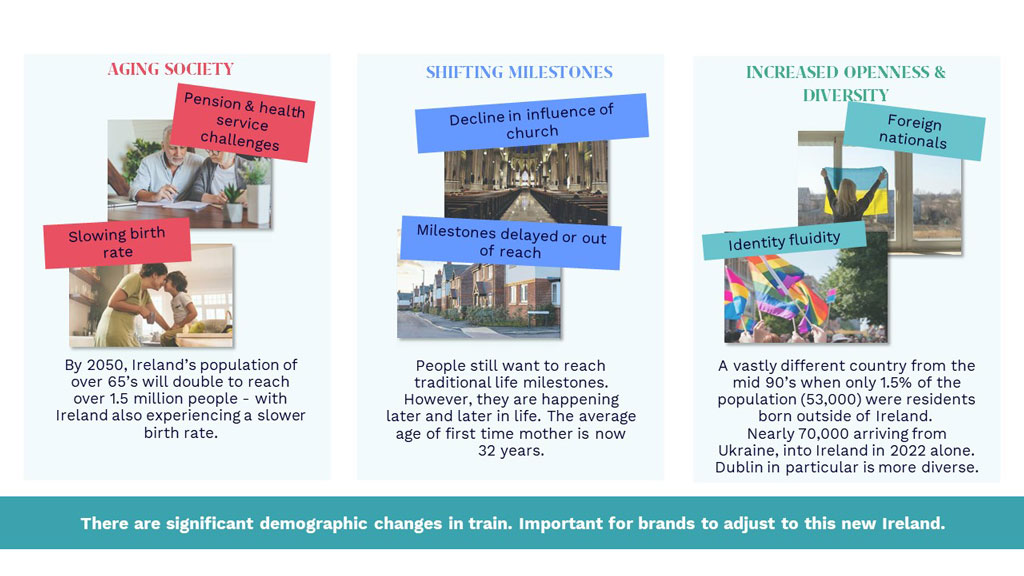

The cultural backdrop: Ireland is currently going through a process of significant societal change. We are becoming older and more diverse. The country is also in the process of redefining its values and identity – there is a growing realisation that we need to shape our own future as we can’t rely on others.

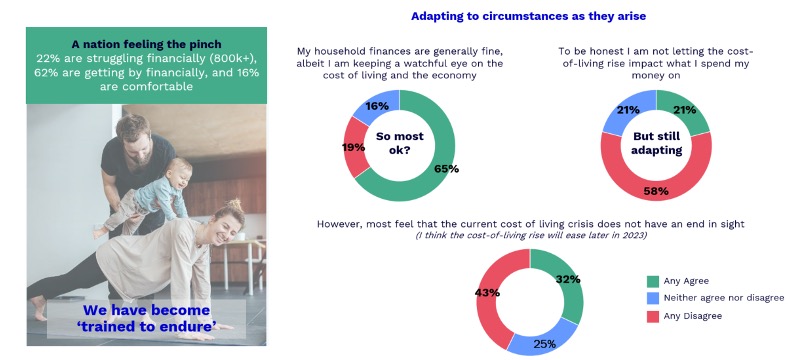

Trained to endure: Consumers have become a battle-hardened bunch. The challenges of the last few years has trained consumers to endure economic and social uncertainty – with consumers more able to adapt to circumstances as they arise.

The rise of self-care: Despite having the desire to maintain a slower pace of life post pandemic, consumers have fallen headfirst into a productivity trap as they try to catch up on what they and their families missed out on. However, not all lessons have been lost – with people now more determined than ever to put strategies in place to achieve balance within the chaos of life.

The battleground of human & technology: There is a feeling that we are on the cusp of a giant leap forward with the emergence of new technologies such as the metaverse and ChatGPT. However, as we reach ‘peak tech’ consumers are starting to question who is actually controlling who.

A new frontier for sustainability: As we get closer to 2030, the gap between where we are and the governments targets feels wider and wider apart. However, early adopters are beginning to find ways to engage with the circular economy.

The cultural backdrop

A New Ireland

Ireland has come a long way and is in a vastly different place compared to 20 years ago, and will indeed continue to evolve. We are an aging population with a slowing birth rate, which bring pensions and health challenges. Traditional influences have waned and milestones have shifted. However, we have become a more open and diverse nation. It’s a balancing act for brands, in which they need to be responsive to the new Ireland that is emerging, whilst ensuring that brand differentiation remains front and centre.

North Stars are Fading

There has also been a seismic mindset shift in Ireland over the past decade, From the times of austerity post the financial crisis – an Ireland that was kept tightly under control and given a blueprint out of a crisis, to an Ireland that got through a pandemic in one piece. There is a growing realisation that we need to shape our own future, a feeling that we can’t truly rely on others, and a renewed sense of confidence that we have the ability to forge our own path. As a country we are finding it harder to find inspiration from any other countries. Brand voices need to carry a new confidence in ourselves and lean into being of, or from here. We aspire less and less to anything from anywhere else.

The Productivity Trap

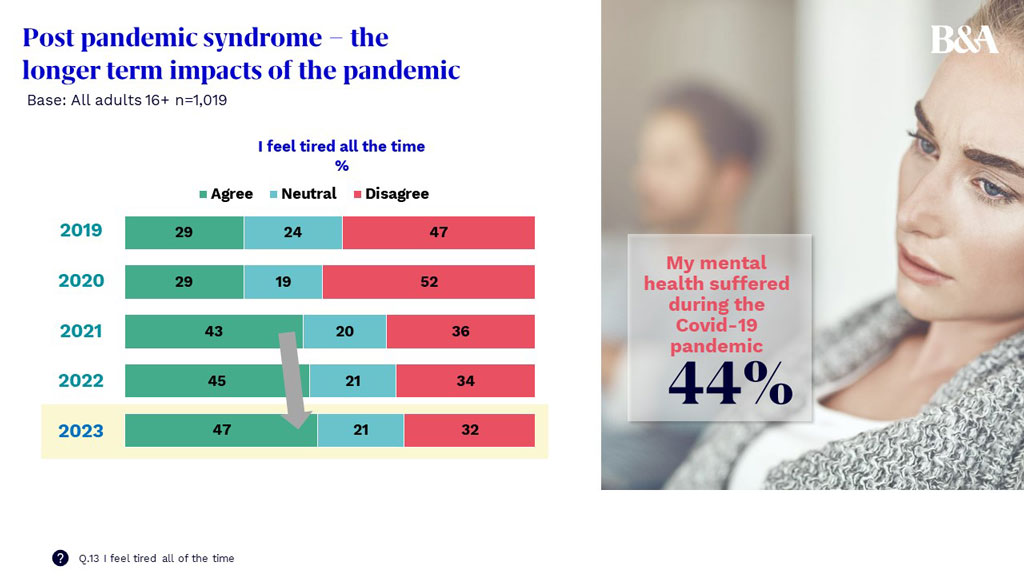

The level of change and uncertainty in life has contributed towards us feeling increasingly tired as a nation over the past few years. And as life picks up pace, many are finding it challenging to come to terms with the return to the hustle and bustle of everyday life.

As we try to catch up on lost time, productivity has been a key focus (consciously or not) – with many filling schedules to the max. Despite wanting to hold onto some of the benefits of a slower life experienced during the pandemic, many have fallen head first into a productivity trap on their return to day to day life.

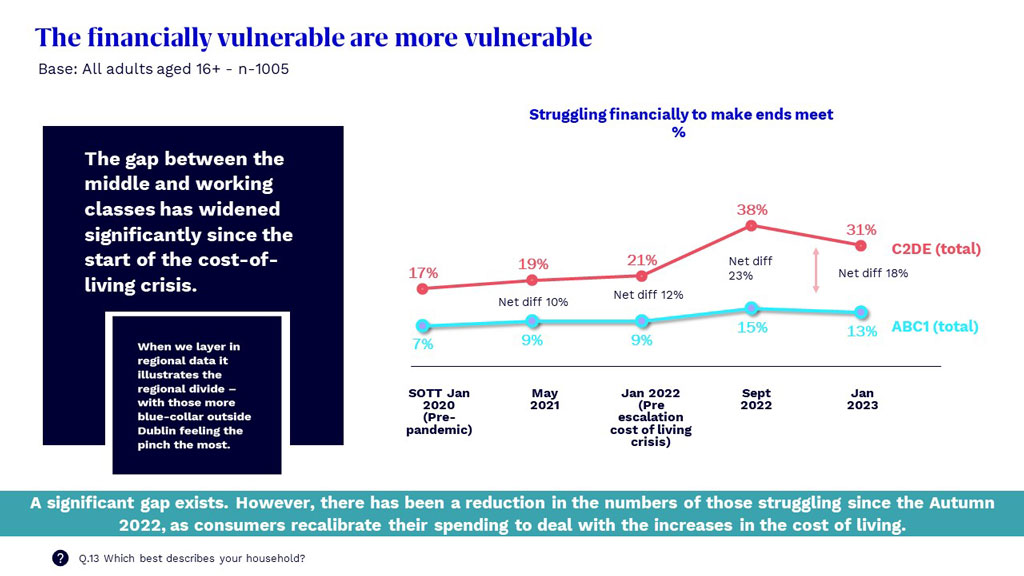

A Financially Divided Nation

Understanding the divides in society is important and one of the clear issues currently is that not all people are being impacted equally. In reality, the financially vulnerable are becoming more vulnerable.

Trained to Endure

A Battle-Hardened Bunch

Consumers have become a battle-hardened bunch: Most feel equipped to navigate the cost-of-living crisis, having built resilience from the last few years. The challenges of the last few years has trained consumers to endure economic and social uncertainty – with consumers more able to adapt to circumstances as they arise.

Hence, most are making at least some changes to their buying behaviour.

Today’s consumer is savvy – making sacrifices and looking for ways to make their money go further while ensuring they still have enough to enjoy the day-to-day. Most consumers’ horizons have shortened, with many unwilling to commit to financial decisions too far in the future. In fact, versatility and flexibility are increasingly important. Consumers are trimming back, hence the brands and products that can offer the most versatility will have an advantage in certain categories. Demonstrating relevance to a variety of needs/occasions has never been as powerful.

The cost-of-living crisis has been a reality check for many. Most are having to compromise on at least some areas of their consumption behaviour (private label, less on non-essentials, etc). With consumers looking where they can compromise, it is important for brands to drive home the added value delivered over private label.

That being said, in harder times, consumers may actually become more loyal to brands they trust, as they look for ways to reduce risk and uncertainty (we saw this in the Pandemic). This means that brands may need to focus on building brand loyalty or reinforcing their equity to retain customers.

‘Eagle eyed’ Consumers

Consumers are increasingly sensitive to price increases but also to any shortcuts brands, restaurants, etc. are making to their product quality or experience. Shortcuts brands make are spotted – a handle with care point for brands.

However, some brands can raise their prices and charge more based on their brand equity. They can override predictable price strategy by using their brand power, but they must have a deep understanding of their brand strength, otherwise it can go horribly wrong. Companies need to think about research, such as some proper qualitative work or conjoint analysis on brand, pack and pricing.

There are Still Moments of Carpe Diem

The struggle between carpe diem and prudence is real: leading to inconsistent financial philosophies. Deviations from ‘good behaviour’ are defended as important for wellbeing – keeping us human. Brands need to work hard to align with moments of release.

How these themes can inform strategy?

- Each choice, each price point and each cost-of-living trade-off is increasingly a more considered act. How can your brand best articulate its value in an increasingly System 2 thought space?

Invoking emotionally led brand love will be ever more critical as a differentiator.

- As consumers reassess value and ‘ladder down/up’ by category –do you understand the category dynamics?

It’s important to understand where your brand fits within consumers’ wider decision making.

- As a nation we are shining more and more light on historically taboo spaces – resulting in huge opportunities as Irish society becomes more diverse and inclusive.

As brands have ‘permission-to-play’ in new spaces that are opening, are you ready to play?

- Consumers are human beings – never lose sight of human psychology. Remember self-control only goes so far; we need release; Experiences are in vogue.

Can your brand Seize the Day?

Be courageous and brave and assert your added value. If in ‘convenience’ watch value, …. Mind the Gap! (in pricing vs value terms).

Some brands can override predictable pricing strategy by using their brand power. But you must have a deep understanding of brand strength to consider this.

For more information on this research contact Luke Reaper luke@banda.ie or Niall Brennan niall.brennan@banda.ie