Aaron Poole, marketing executive, PML Group with this week’s Out \ Look on Out of Home.

National Lottery Goes Dynamic

As we move further in 2023, the benefits of integrating dynamic triggers to produce more disruptive campaigns for audiences in the Outdoor environment are more obvious than ever before. The most recent advertiser to employ the use of DOOH to effectively target consumers is National Lottery, whose most recent campaign kicked off this cycle.

Running across Digitowers, Applegreen screens, and mall digital formats including dPods, Adshel Live Retail, and iVisions, the creative has been specifically designed to trigger in proximity to National Lottery retailers throughout the country via Liveposter.

Running on days and times specific to National Lottery draws, including Lotto Jackpot and Euromillions, the creative is set to only display on formats that are within a 50-metre radius of locations selling National Lottery tickets. This enables hypertargeting beyond the traditional Outdoor touchpoint, reaching relevant consumers in a point-of-purchase environment where it matters the most.

National Lottery’s campaign follows in Guinness’s footsteps in terms of seizing opportunities to innovate using DOOH. Planned by PHD and Source out of home, the stout brand’s most recent Six Nations Rugby and Nitrosurge dynamic campaigns have been displaying match fixtures and scores throughout the tournament season, attracting attention by virtue of displaying contextual information in alignment with the Moments of Truth research.

For more information on how your brand can innovate on Outdoor through the use of dynamic-enabled campaigns, contact the PML Group team.

WATCH Review – February 2023

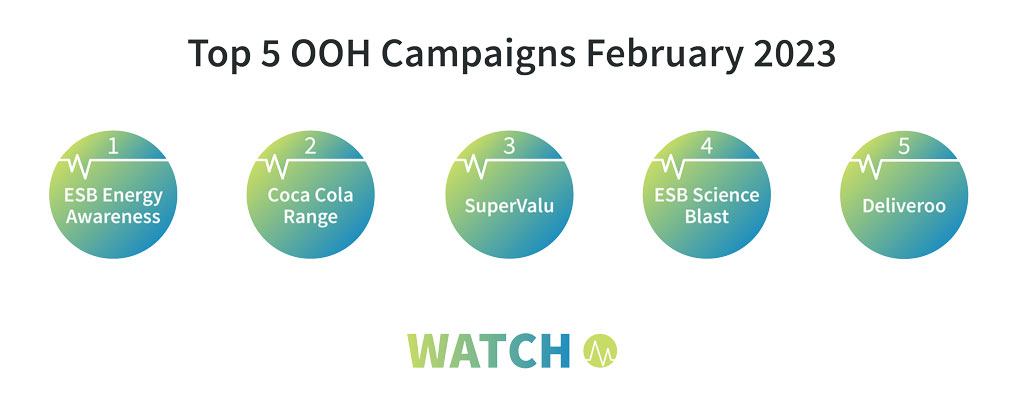

As February came to a close, PML Group’s WATCH market intelligence data showed ESB’s Networks and Science Blast campaigns were amongst the biggest on Outdoor in February at #1 and #4 respectively, helping make Electric Ireland the top advertiser for the month.

Planned by Carat and PML, ESB Network’s Energy Awareness campaign looked to engage the cost-conscious consumer via creative that encouraged onlookers to ‘Take more control of your home’s electricity’. Running across a mix of classic and digital roadside, 6 sheets, and T-Sides, consumers were directed via QR code and URL to sign up for the provider’s ‘Is This a Good Time?’ pilot scheme that helps to optimise electricity usage outside of peak hours to lower overall costs.

Meanwhile ESB Science Blast was live in the run up to the titular event which had its Dublin leg kick off at the RDS this week. Also planned by Carat and PML and running across a combination of classic/digital 6’s, roadside, T-Sides, and digital bridges, the event-centric campaign featured curious and colourful creative that brandished scientific questions posed by primary school children throughout the country. A great example of event-based marketing, the campaign gave consumers a taste of what was on the agenda in anticipation of this past Monday.

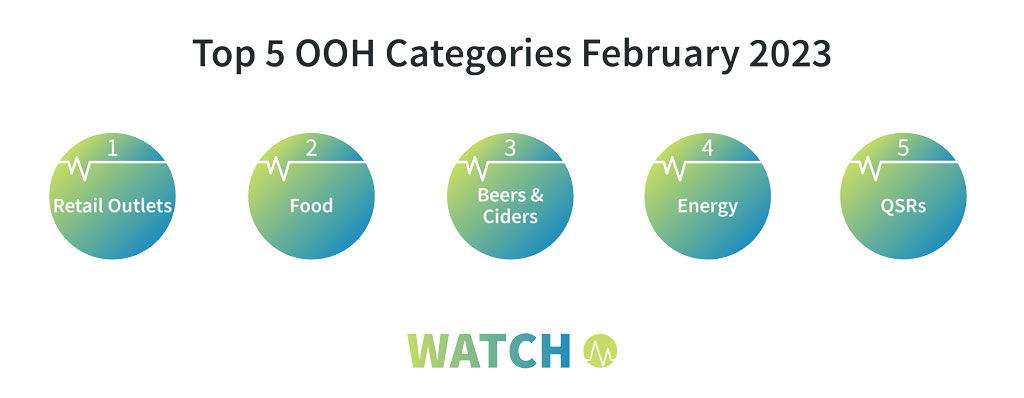

Also reflecting the top categories were SuperValu and Deliveroo representing Retail Outlets and QSRs.

Planned by Starcom and Source out of home, SuperValu’s ‘Value for Money’ campaign ran across 48 Sheets, 6 Sheets, Digipanels, Digishelters, and Adshel Live Roadside. Bearing the store brand’s signature yellow and red colour scheme, the campaign continued January’s trend of the supermarket sector being in full awareness of inflation being a top-of-mind concern, targeting the cost conscious consumer by showcasing their commitment to price matching everyday products that might be found in competitor stores.

Meanwhile, Deliveroo’s first OOH activity for 2023 was live across a combination of retail and roadside classic and digital 6’s. Planned by Initiative and PML the pizza-clad, hunger pang-inducing campaign cleverly targeted prospective app users just as the Six Nations season kicked off, enticing new game-watching users to the delivery service by offering a substantial discount for first time orders with the code ‘10IRELAND’. QSRs saw an overall increase of 38% YoY, landing it the #5 spot in February’s top categories.

The biggest increases YoY were seen in the Political & Advisory and Energy categories with SOV increases of 115% and 191% respectively, the latter coming in as the #4 top category for the month alongside regulars Retail Outlets, Food, and Beers & Ciders.

Top advertisers and categories are based on WATCH marketing intelligence from PML Group. Based on campaign monitoring display at rate card. For full information on categories or brands, please contact the PML Group team.

On-trade Consumers Reclaim Social Occasions

The latest data release from CGA by NielsenIQ has shown that total drink sales for 2022 increased across ROI and NI by 83% and 41% respectively when compared with the previous year.

This comes as city centre and urban on-trade locations returned to normal trading for a first full year without restrictions, with Dublin seeing an increase in share of ROI compared to 2021 and cosmopolitan consumer confidence in visiting on-trade locations increasing by 18% YoY. An increase in visits and monthly out of home spend was also noted in the segment, with an uptick of 11% in on-trade weekly visits noted compared to the average consumer.

Consumers in general made up for missed opportunities in previous years, with a return to casual social occasions such as post-work drinks seeing an increase of 11% as workers continued to return to offices. This was particularly evident over the Christmas period which saw 88% of on-trade consumers going out for seasonal food and drinks, with 30% of consumers noting their motivations to go out as making up for missed occasions over the course of the COVID-19 pandemic.