Aaron Poole, marketing executive, PML Group with this week’s Out \ Look on Out of Home.

As 2022 ended and ‘Dry January’ began, there was a significant increase in positive attitudes towards no and low beers and spirits compared with the same period last year. Having previously examined consumer opinions and perceptions associated with the market as part of our Zero In Focus research, we are now revisiting these customer sentiments with up-to-date research to gain fresh perspectives on how no and low beers and spirits are perceived by Irish adults.

The findings are part of our ongoing iQ insight programme, which was conducted on our behalf by Ipsos MRBI among 300 residents of the capital, aged 18-54.

The past few years have seen the no and low alcohol market grow at a consistent level, and 2023 looks to continue that trend. Drinks Ireland noted that category market share grew by 275% in the period 2017-2021, with Irish sales tripling from 1.79 million to 5.55 million litres. It is expected that Irish consumption of no and low alcohol will mirror global predicted growth of the category at 8.7% annually between 2021 and 2025.

Recent figures released by the CGA have shown that upwards of a third of Irish consumers buy low/low alcohol drinks more consistently than they did a year ago, while Musgrave MarketPlace research on the area has shown younger adults (18+) are actively reaching for no/low options more than ever before.

This comes as health and well-being continue to be at the forefront of lifestyle choices with four in five Irish adults now proactively trying to lead a healthy lifestyle, leading to consumers curtailing their alcohol consumption.

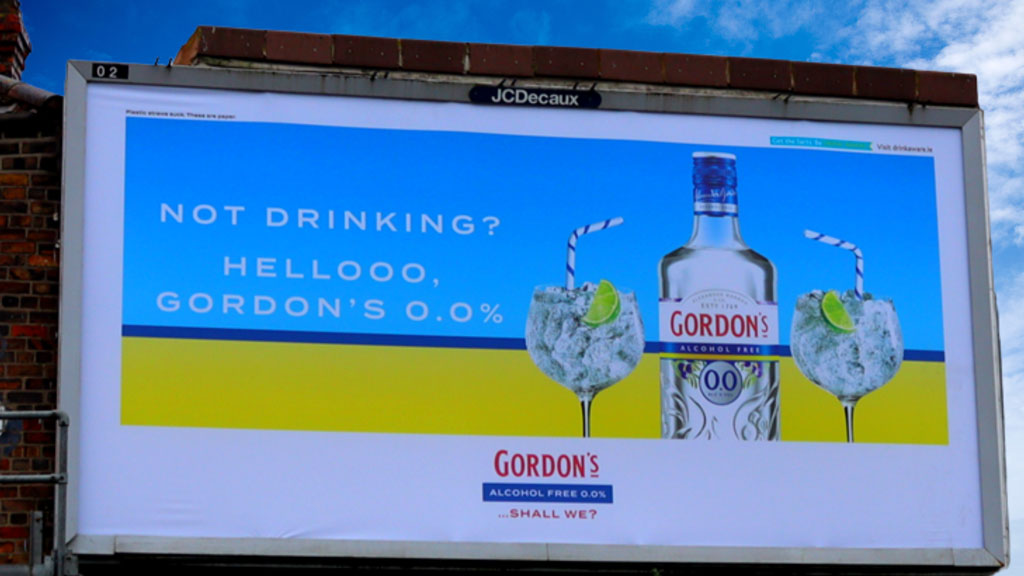

This has been anticipated by the market, with brands such as Guinness, Carlsberg, and Gordon’s offering zero alcohol alternatives that have become a mainstay in the on and off trade alongside their core products.

Results from the study found that 35% of all Dublin alcohol drinkers were partaking in ‘Dry January’. When it came to participation rates, the highest were found amongst males and females aged 18-24 at 51% and 41% respectively. This reflects recent research by Musgrave MarketPlace which showed that Irish Gen Zs were the most likely to take part in an alcohol-free drink.

Regarding consumption levels, 36% of all adult drinkers responded as having , closely aligning with CGA figures relating to consistent consumption of no/low alcohol products at 37% of all Irish adults. Looking at specific age groups, 39% of adults aged 25-34 responded as having consumed more zero alcohol beers and spirits when compared with the previous year.

Reflecting the increasing number of options available, seven in ten respondents are of the mindset that the quality of zero alcohol options has improved greatly in the recent years. This apparent positive attitude towards the category is also reflected in the intent to consume more zero alcohol products in 2023, with 43% of adults noting their intent to do so as a replacement for drinks with alcohol content.

This aligns with research by Musgrave MarketPlace which noted one in three adults see no/low alcohol options as a good way of feeling involved on a night out when driving. The highest category was seen in adults 35-44, peaking at 52% and 55% for males and females respectively.

Regarding demographics and motivations of no and low consumers in Ireland, CGA research showed over-indexing among younger consumers based in cities or towns which emphasises the importance of good branding.

This aligns with our research suggests purchasing influence is largely related to how no/low beers and spirits are marketed. 4 in 5 adults responded as having noticed advertising for zero-alcohol beers and spirits more than they had previously, while 43% of adults noted advertising plays a role in influencing their decision on whether to purchase no/low alcohol beers and spirits.

Much of this may be attributed to supermarket off-trade advertising, with 52% of SuperValu and 47% of Tesco, and 43% of Dunnes Stores shoppers noting they are influenced by advertising for this category.

When it comes to the range of zero-alcohol beers on offer, a greater variety has led to better perception of taste and quality. 1 in 2 adults agree that the taste of zero-alcohol options is on par with those containing alcohol. A higher percentage of females at 60% favoured the taste of zero-alcohol drinks, while 38% of males noted the same.

In terms of choosing what zero-alcohol beers and spirits to drink, 59% of all 35-44s responded as being more likely to choose the zero-alcohol version of brands they already consume (72% of Females vs 46% of Males). This finding is at its lowest amongst consumers aged 18-24 years at 47%.

For more details on the study contact info@pmlgroup.ie

Brands channel Valentine’s Day messaging through OOH

PML Group recently published our latest Media Impact Study results which showed that key occasions can be crucial opportunities for brands to influence the buying decisions of consumers.

The results showed that Outdoor advertising has the propensity to generate both physical and mental availability for audiences in a more effective manner than other media, and brands are seizing that opportunity this Valentine’s Day.

Running on Commuter dPods, An Post’s Love stamp campaign offers the long-distance lovers among us an opportunity to attach special good wishes to their letters or cards. Planned by Source out of home and Starcom, the heart-shaped adhesions promise to be a great way to embellish Valentine’s messages opened on February 14th.

Planned by PML and Spark Foundry, Cadbury Milk Tray creative plays on the ‘no fuss’ mentality. Running on screens in retail locations across the country, the brand is offering itself up as the perfect buy-and-be-done gift to satisfy the annual Valentine’s annual obligation.

Meanwhile, running on Digital Kiosks, Apache Pizza are taking a more tongue-in-cheek approach running a Valentine’s themed promo for their mobile app. Labelling it as ‘the only app to give you unconditional love’, the campaign planned by PML and Carat is certainly of the cheesy variety.

The messaging here may also be reflective of how inflation is impacting consumers this Valentine’s Day. Recent figures released by HelloFresh revealed that 83% of respondents see dining out on the occasion as too expensive, while 2022 figures from Bank of Ireland and US-based Sugarbreak showed as many as 67% gift chocolate on Valentine’s Day given its accessibility compared with other high-ticket items.

For more information on how to use OOH to engage consumers and play a role in leveraging communal experiences on key occasions, contact the PML Group team.