Physical Shopping at Pre-Pandemic Levels: Colum Harmon, marketing director PML Group, with this week’s Out \ Look on Out of Home.

Shopping Centre sales approaching Pre-Pandemic Levels

Bannon’s latest Retail Pulse reports positive trends from retail footfall and spend data. Their latest report gives footfall analysis for January – we should see further improvement in the coming months.

- Shopping centre footfall for January 2022 was almost double that of January 2021.

- What is much more significant is that shopping centre sales for January 2022 were just over 1% down on pre-pandemic levels (Jan 2019). This is despite footfall being down by over 22% for the same period. This demonstrates the continued improvement in conversion.

- Retail park portfolio continued its march in January 2022 with footfall growth of 56% versus January 2021. Furthermore, and more notably, retail park footfall in January 2022 was over 12% above January 2019 (pre-pandemic).

On the Move

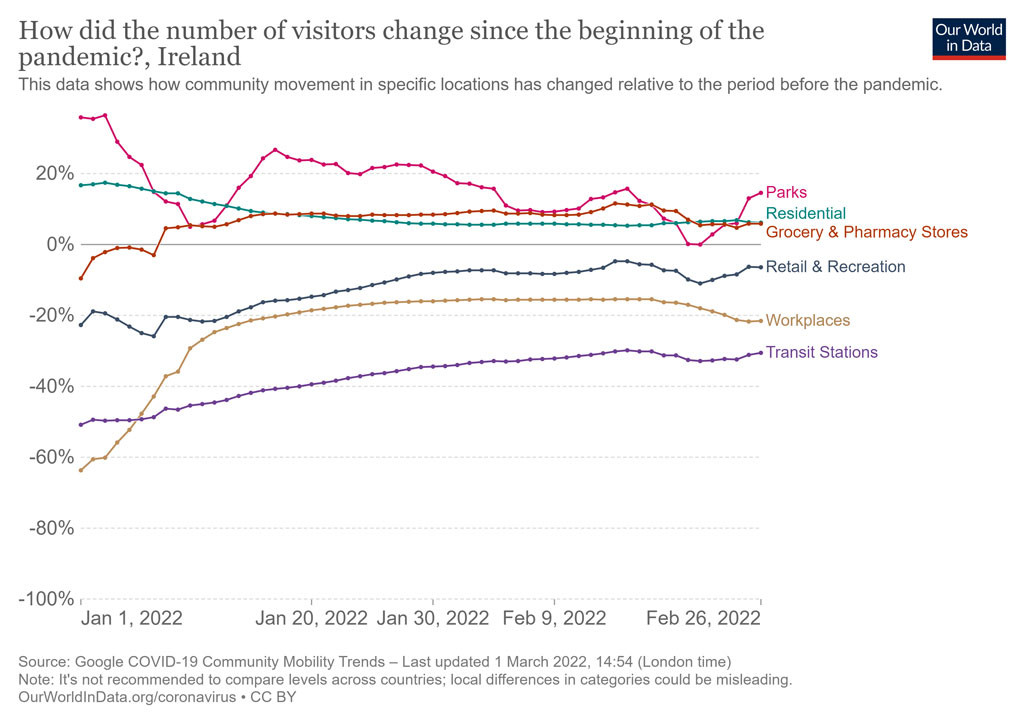

Google’s Community Mobility Report shows there has been a sustained increase in visitor numbers to transport hubs, workplaces, and retail locations in Ireland since the start of the year. all well up since the start of the year. Conversely time spent at home has decreased.

Google Mobility data shows how visitors to (or time spent in) categorised places change compared to baseline days from the start of 2020.

Return to the Workplace

Research PML Group conducted with Ipsos MRBI in recent weeks has shown the shift in where some Dubliners will be working from in the coming months.

Since the start of the pandemic 72% of workers have been either going into their workplace everyday or working a mix at home and workplace. Just 17% intend to continue to work exclusively from home in the coming months dropping to 8% of 25–34-year-olds.

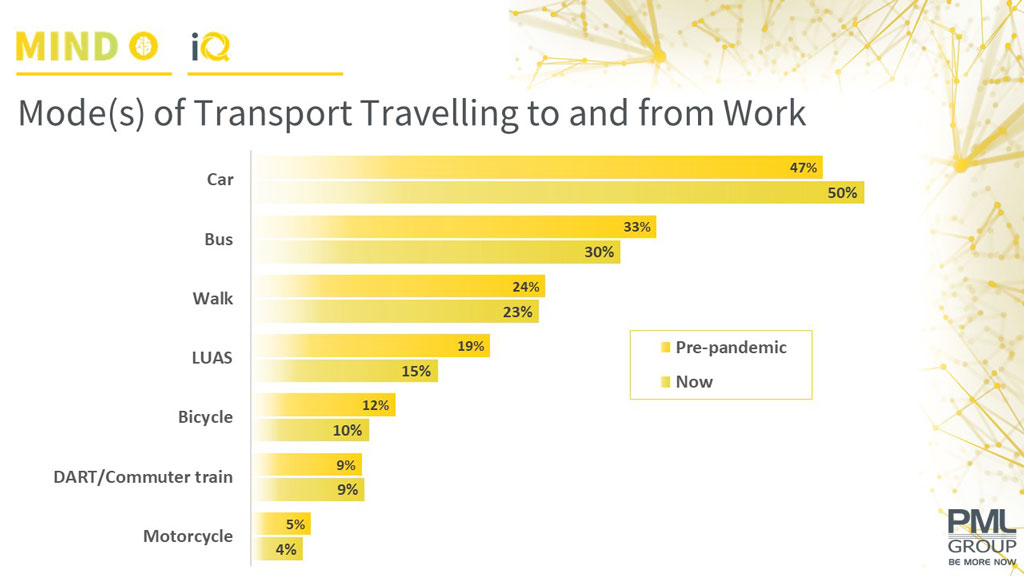

Transport usage for the commute has remained very consistent. In terms of modes being used to travel to work the survey shows a small shift to cars from bus and LUAS.

Recent research by broadband and telecoms provider Pure Telecom has found that 97% of office workers aged between 18-23 will be working from the office on a full or part-time basis. The research found that the vast majority of Gen Z office workers plan to work from the office – that includes the 4% who never worked remotely during the pandemic and 93% who did work remotely, but who plan to return in some capacity. Overall, 86% of office workers plan to spend at least some time in the office following the easing of restrictions. That figure is the same (86%) for Millennials, 84% for Gen X and 88% for Baby Boomers.

Water Cooler Moments

78% of office workers in Ireland say they want to work in dedicated office spaces at least some of the time. This is among the findings of a new study – carried out by real estate investor and operator Fine Grain Property by Amárach Research that suggests sense of community and opportunities to collaborate, interact and socialise are seen as key benefits of the office.

The research found that workers have missed so-called ‘water cooler moments’ – serendipitous occasions in which staff interact socially at work – while working from home. Ninety per cent of employees say the social aspect of the office is the best thing about returning to the workplace. Getting out of the house (78%), having a dedicated workspace (66%) and collaboration time (62%) also scored highly.

WATCH – February OOH Market

OOH advertising is the ideal medium to leverage the excitement of real-world events and as pandemic restrictions have eased the return of people has amplified these opportunities for brands to engage consumers in and around events and special occasions. Valentine’s Day, the return of Six Nations rugby and the Dublin International Film Festival were examples in February, and our WATCH market intelligence service monitored many campaigns leveraging these events for an OOH audience.

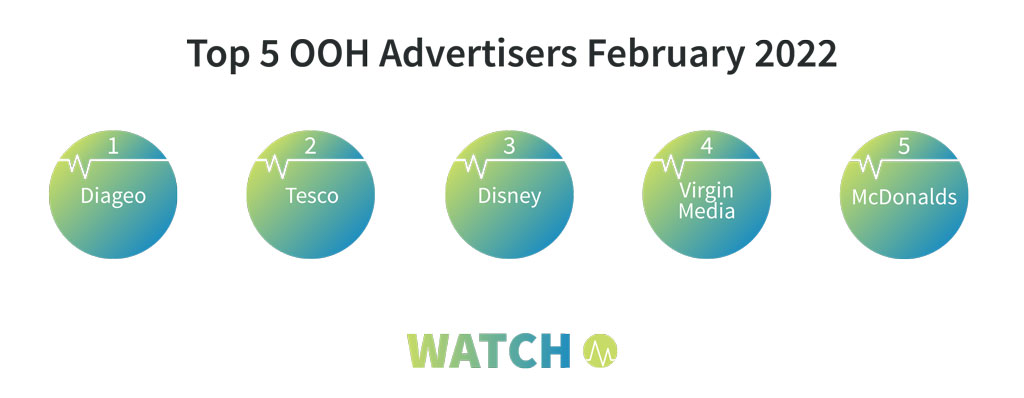

Guinness were among the brands supporting the Irish rugby team as the new Six Nations season kicked off and the campaign helped Diageo to top spending advertiser for the month on OOH. They were followed closely by Tesco, with Disney, Virgin Media and McDonalds making up the top five. Virgin Media are, of course, title sponsor of the aforementioned film festival.

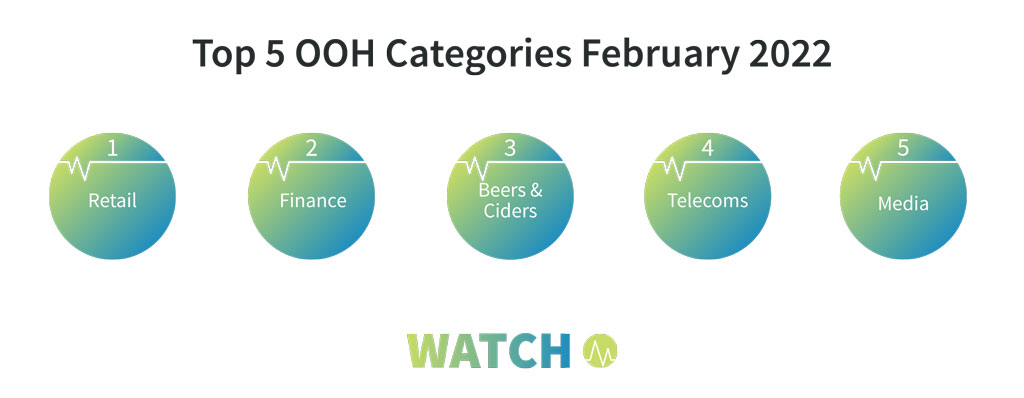

Retail was the most active category in February, with SuperValu joining Tesco among the biggest campaigns in cycles 3-4.

It’s a time of year when holiday planning is top of mind and our recent iQ research showed high levels of intention regarding breaks in Ireland in 2022. Tourism NI were very active in February, encouraging trips to Northern Ireland from the south.

The top five advertisers and categories for February are below. These are based on WATCH marketing intelligence from PML Group. Based on campaign monitoring display at rate card.

For full information on categories or brands, please contact the PML Group team.