James Byrne, marketing manager, PML Group, with this week’s view from OOH.

Outdoor Life

As we approach the final week of April, this month brought an injection of positivity and optimism to the nation’s psyche as the gradual lifting of restrictions began. On Monday, the next phase begins.

Among the changes, outdoor activities are again top of the agenda as the road out of lockdown takes shape. This will see the reopening of outdoor visitor attractions (such as Dublin Zoo and heritage sites), outdoor sports facilities including golf and tennis and non-contact training.

With these gradual easings, weekend and family outings will only grow in popularity and scope as people begin to partake in even more outdoor pursuits and re-engage in their preferred leisure activities.

Dublin Zoo reopened its online booking service yesterday to high demand, only further highlighting the anticipation there is to return to such activities.

There is also an increasingly optimistic narrative that the reopening will continue as planned in early May which will see the full reopening of the construction sector and the phased reopening of non-essential retail and personal services.

Mobility

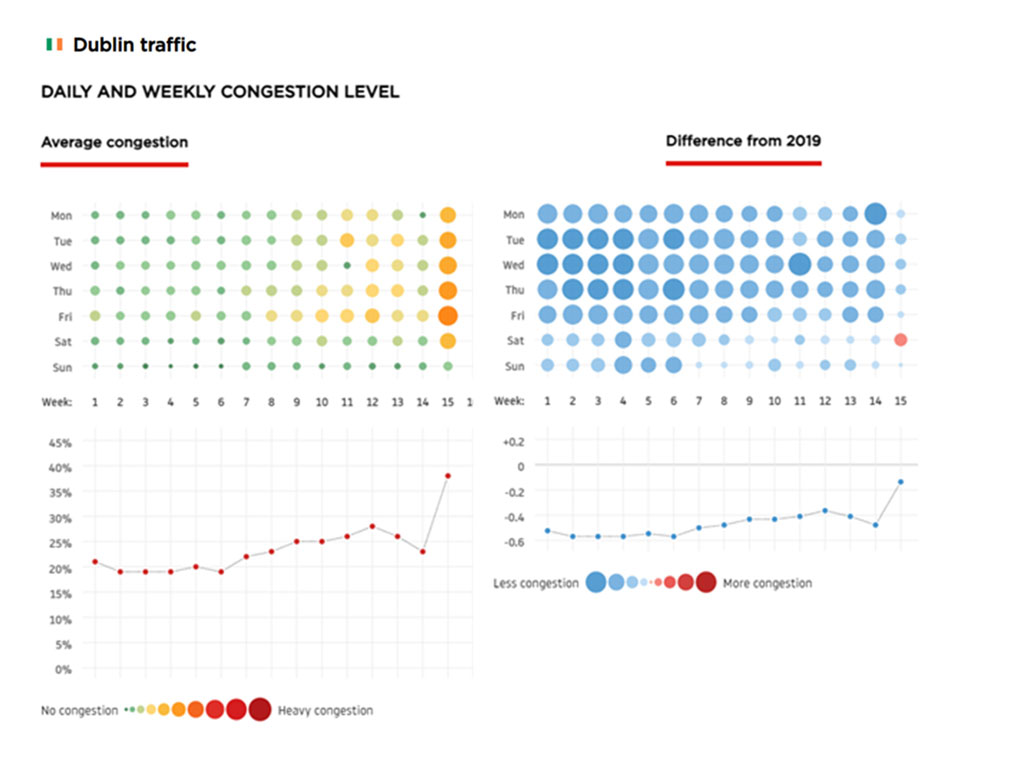

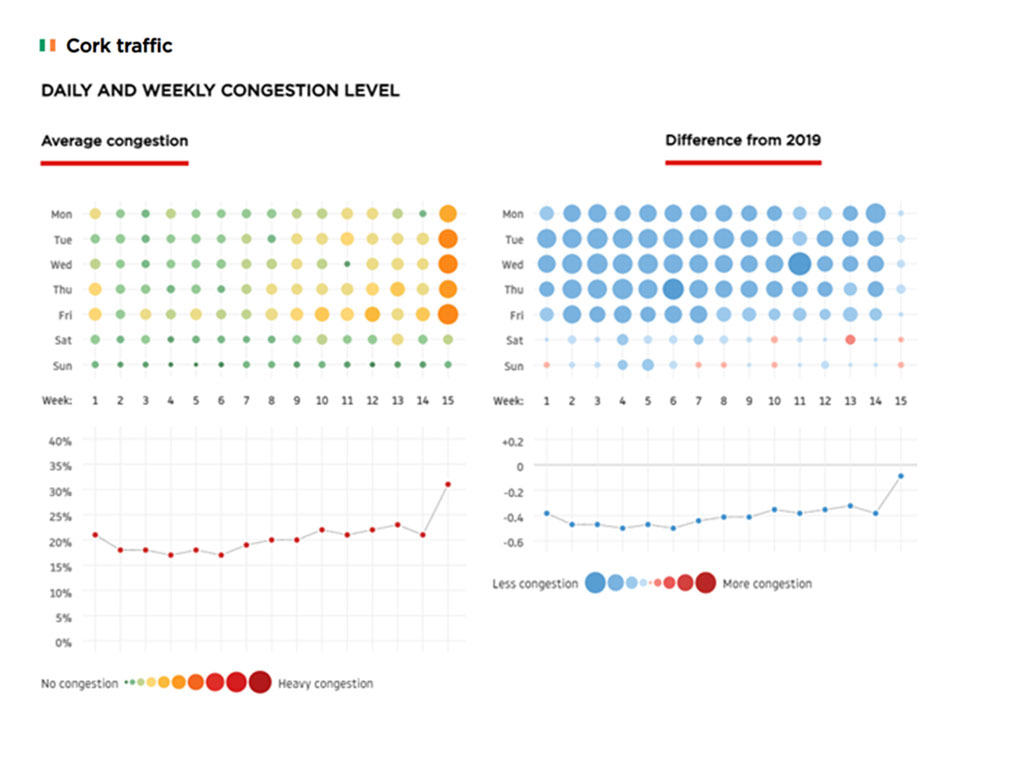

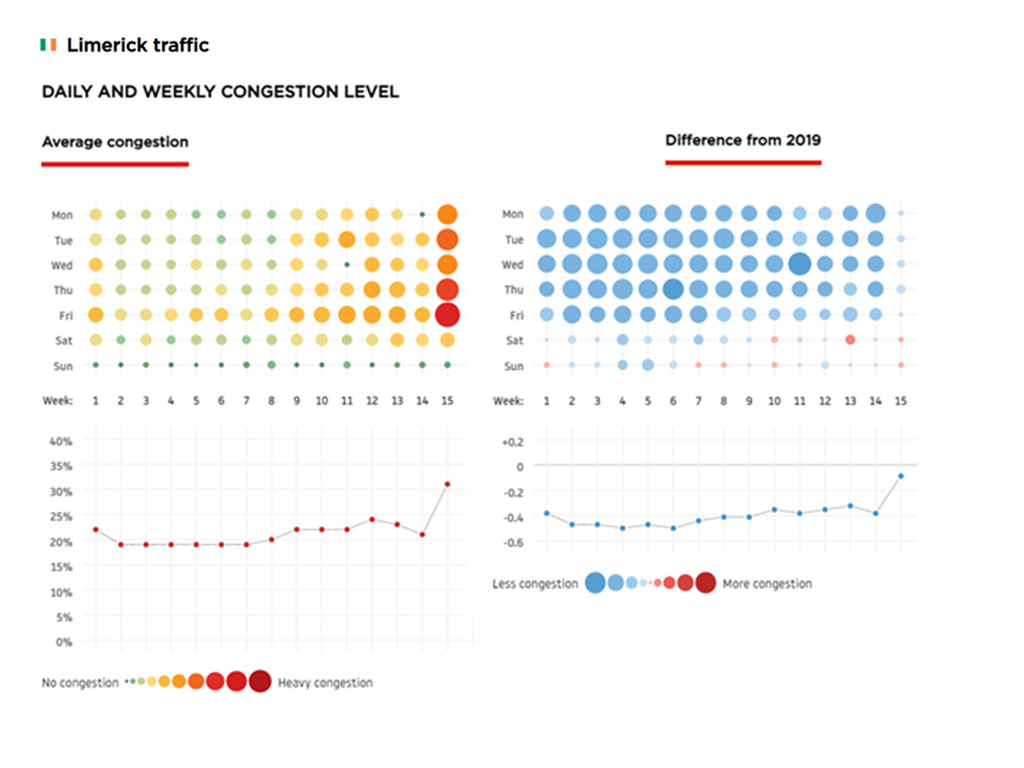

Last week was the most congested in the three main cities this year according to latest figures from TomTom’s Traffic Index, with Friday 16th being the busiest year to date, in Dublin, Cork and Limerick.

Dublin: Last week’s average congestion level was 38%, up from 23% week previous. Busiest day of the whole year so far was Friday 16th April, at 45%. The weekly congestion level was just 14% lower than 2019 standard with Saturday especially busy. It was up 32%. As a comparison Dublin’s congestion level in week 15 last year, during the April lockdown, was just 15%.

Cork: Last week’s average congestion level was 31%, up from 21% week previous. Busiest day of the year was also Friday at 38%. Weekly congestion level was just 9% lower than 2019 standard with Saturday +5% and Sunday +7%.

Cork: Last week’s average congestion level was 31%, up from 21% week previous. Busiest day of the year was also Friday at 38%. Weekly congestion level was just 9% lower than 2019 standard with Saturday +5% and Sunday +7%.

Limerick: Last week’s average congestion level was 31% up from 21% week previous. Busiest day of the year was, again, Friday at 38%. Weekly congestion level is now 3% above 2019 standard with Monday +10% and Friday +9%. As a comparison the congestion level in week 15 last year during the April lockdown was just 15%.

Limerick: Last week’s average congestion level was 31% up from 21% week previous. Busiest day of the year was, again, Friday at 38%. Weekly congestion level is now 3% above 2019 standard with Monday +10% and Friday +9%. As a comparison the congestion level in week 15 last year during the April lockdown was just 15%.

Apple’s routing requests mobility data for Tuesday 20th April reports traffic at 73% of January 2020’s pre COVID-19 baseline. It reached parity on Saturday 17th April for the first time this year, with the clement weather together with the relaxation of travel restrictions no doubt contributing. Google’s COVID-19 Community Mobility Report supports this with park and beach visits 50% above baseline.

Apple’s routing requests mobility data for Tuesday 20th April reports traffic at 73% of January 2020’s pre COVID-19 baseline. It reached parity on Saturday 17th April for the first time this year, with the clement weather together with the relaxation of travel restrictions no doubt contributing. Google’s COVID-19 Community Mobility Report supports this with park and beach visits 50% above baseline.

The TII is reporting that traffic volumes are now back at or very close to levels experienced before the introduction of Level 3 restrictions in October of last year.

Wednesday totals from the sample of ten traffic counters located on the national road network for the morning period from 7am until 10am give the following comparisons:

- Same day 2019: -19%

- Same day 2020: +154%

- Same day last week: +1%

- Same day pre-Level 3: -2%

Insight

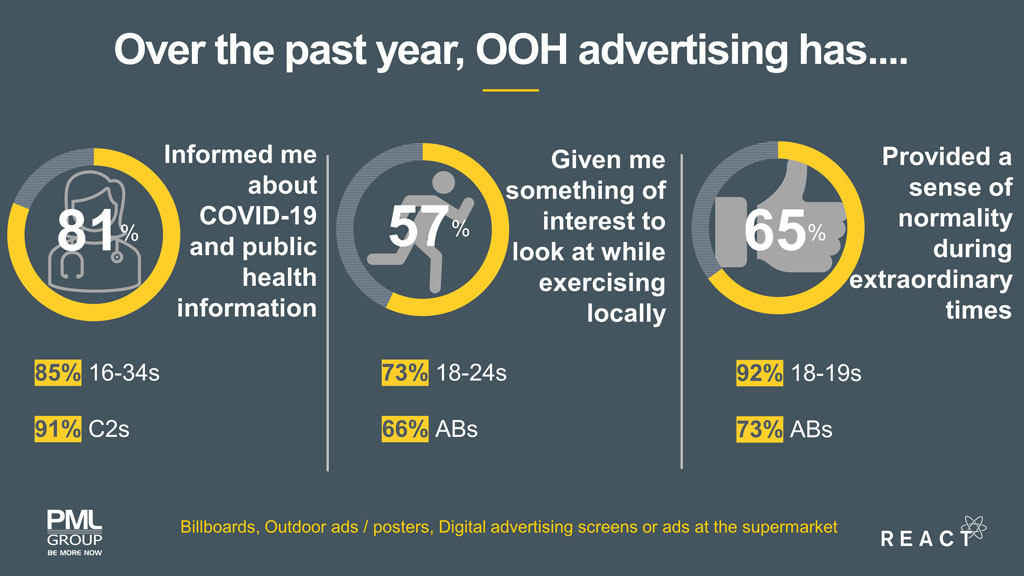

This week we conclude our latest wave of the React study with a look at OOH in relation to public health communications, exercising locally and the yearning desire for normality.

Public Health Communications

Over four fifths of adults say that they’ve been informed about public health matters in the past year via OOH with 16-34s indexing particularly high at 85%. Our recent Going Local research found that 64% view posters and screen as an important public noticeboard. The HSE’s COVID-19 public advisory campaign at the outset of the pandemic was the most recalled campaign of 2020.

Throughout the pandemic, OOH has been an effective mechanism to communicate with audiences – whether transmitting public health and safety advice, messages of togetherness and support, or serving advertising to audiences in key environments and at a local level.

Exercising Locally

57% of respondents take an interest in OOH while exercising locally with attention particularly high among the young and upmarket.

The Dentsu Pulse report on health & wellness in 2021 found that 71% of people have intentions to work on their physical health, either increasing their exercise or making an attempt to lose weight. Recent research conducted by Amárach on behalf of consultancy and training company, Stride, reveals over half (53%) of us are going on a daily walk. And this leisure routine is set to continue with 85% of the respondents saying they will continue walking as an exercise activity after the pandemic. With more people out and about exercising, exposure to OOH and the frequency in which it is seen intensifies especially in local areas. Also of note is the positive mindset people are in when out walking which contributes to positive sentiment and receptiveness to advertising they pass by.

Desire for Normality

Advertising can tap into a desire for a sense of normality in such an abnormal period. 65% of people agree that OOH has provided a sense of normality, interesting the same percentage who our Going Local research found are more likely to notice advertising in their local areas. Half of consumers feel more connected with brands that advertise in their local area while 72% pay more attention to what is happening in their locality, rising to 84% among 45-54 year olds. People are tuned in and attentive to their surroundings now, perhaps more so than any point in recent years.

OOH brings messages into shared public spaces, making the context of where you are matter. These real-world moments can build meaningful connections in light of the past year’s restrictions.

Home & Away

Fáilte Ireland’s consumer planning and insights division has released its latest consumer update of Irish people’s holiday travel intentions. Fieldwork for this wave took place between March 5th – 28th.

It reports that the desire for overseas travel is mitigated by low levels of confidence in actually being able to do so. Despite government messaging, many consumers still believe they will be able to travel overseas at some point – 33% intend to do so in the next 6 months, with the bulk of that being in July – September 2021. Only 37% of these consumers are actually confident that they will be able to go.

- Consumers are claiming that they are substituting their international trip with a local break. 52% of consumers will replace a long break overseas with a domestic trip and 48% will replace a short trip overseas with a domestic one.

- Should consumers be able to travel overseas a minority would discard all of their domestic trips but 32% will replace some of their domestic trips with overseas ones.

- On average, consumers intend taking two domestic trips this year which is on par with previous years.

Trip Intentions

As national restrictions begin to lift, consideration of domestic short breaks has gone up 4pp to 85%. This has filtered down into intent measures, in particular those for more immediate travel, i.e., with 3-month intention increasing. At the time of fieldwork, 3 months would include June which is the target month for the Government in terms of the large majority of adults being vaccinated.

A similar dynamic is apparent for long breaks abroad, with little change in 12-month intent masking some growth in travel intention for the next six months. 33% of consumers still intend to take a long break abroad, despite Government messaging about international travel.

The shifts in intention are being driven by consumers who had previously not intended to travel in 2021 now saying that they will travel.

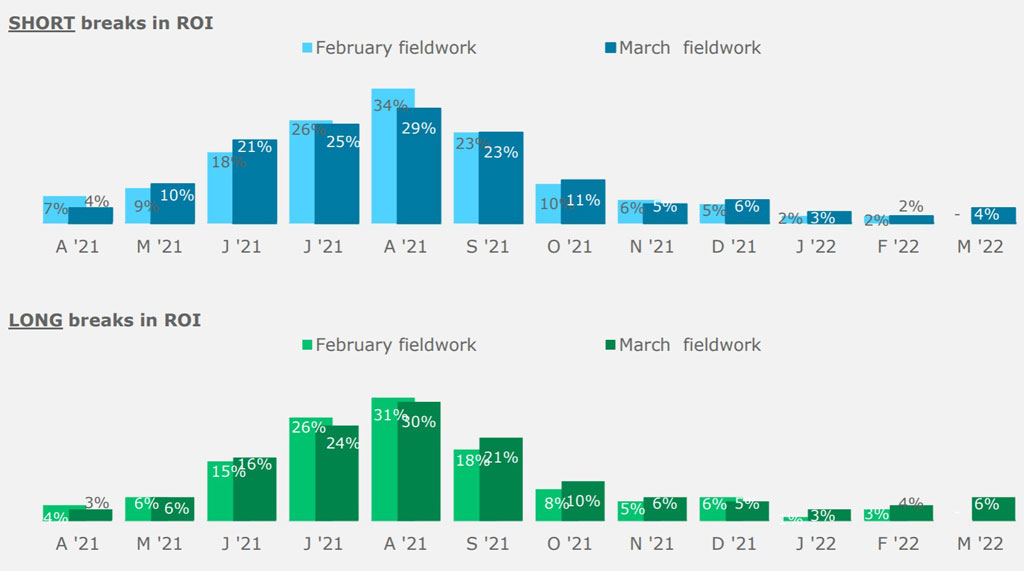

Planning – Month of Intended Trip

The established seasonal patterns of trip timings remain consistent, with the continued exception of longer breaks extending into September. However, the willingness of unconstrained adults to travel outside the traditional peak months represents an opportunity, especially if international travel opportunities are uncertain. Consumers aim to take an average of two short breaks and 1.7 long breaks in the next year.

Retail

Consumer Spending Increasing

Credit and debit card spending increased by 14% in March compared to the previous month according to data from AIB.

In-store spend saw a significant increase and jumped 20% month on month. The busiest day for in-store spend was Saturday 13th March, the weekend before St Patrick’s Day as people stocked up ahead of the festivities.

Consumers took advantage of the good spring weather in March. With more businesses reopening takeaway services, spend in off-licences and pubs was up 30%. While restaurant spend increased by 19%. The home improvement trend is still prevalent with spend in hardware stores and garden centres up 38%.

Clothing and groceries spend was up 24% and 14% respectively.

Looking to the age profile, spend by those over the age of 65 was up 20%. The figures show the next highest spend increase was between those age 45-54 and 55-64 both at 16%.

Geographically, Waterford saw the biggest increase in spend, up by 17% on February followed by Kildare, Wicklow and Laois at 16%.

Rachel Naughton, Head of SME Banking at AIB said “It’s encouraging to see spend in some of the key consumer sectors up in March, following good weather, St Patrick’s Day and the rollout of the vaccine. Over the coming months as the vaccine rollout continues and we start to get more information on the easing of restrictions we expect consumers to start spending more of the money some have been saving during lockdown. It’s also important that as restrictions are lifted the sectors most impacted by this pandemic are supported in every way possible to ensure they can trade after this challenging period.”

And Finally…

In the week where we globally celebrated Earth Day, our attention turns to how brands and advertisers have an important role to play with regards to long-term sustainability and the health of the environment.

Many brands and companies have now seen the benefit of leading on environmental change with a plethora of sustainability commitments, pledges and initiative announced and innovations in packaging and product design to reduce their commercial carbon footprint. In recent years, climate change and sustainability have been a priority globally but no more so than last year as the world paused and reflected.

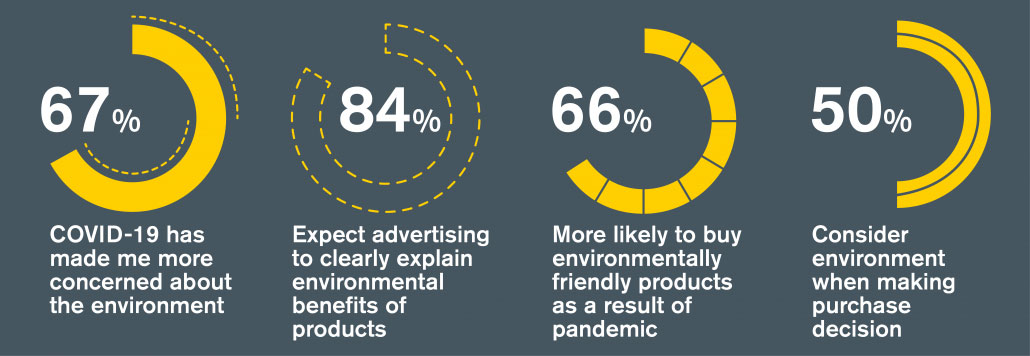

Our ‘Green Means GO-OH’ study, conducted late last year, found that the COVID-19 pandemic has altered our collective behaviour in relation to the environment and speaks to how consumers are placing more weight on sustainability.

As we strive to live more eco-friendly and sustainable lives, marketers have a responsibility to clearly highlight the efforts companies are doing to increase sustainability. Advertisers can become advocates and leaders in driving sustainability efforts while improving consumers perceptions of a brand at the same time.

As an industry, Outdoor is striving to become more environmentally sustainable. And as part of a joint commitment with Nestlé Ireland to improve sustainability in Out of Home advertising, we were thrilled to deliver Ireland’s first OOH campaign made entirely of recycled paper.

The campaign advertising the launch of KitKat Zebra, has used green printing techniques on 100% recycled paper. Unlike current processes, this new recycled paper collects used paper which has the ink removed and is pulped prior to reaching the papermaking stage.

This is an important step forward in delivering greener solutions to advertisers but to also do our part in reducing the industry’s environmental impact, one campaign at a time.