Colum Harmon, marketing director, PML Group with this week’s view from Out of Home.

Much cause for optimism in the world of Out of Home this week. A step-change in audience behaviour will happen next week with the beginning of the phased return of schools and we look at the positive implications for brands and OOH below. It’s the first phase of what is sure to be a sharp increase in activity oudoors as weather improves, mobility increases, vaccines are rolled out and the light at the end of the tunnel becomes a sunburst of collective euphoria. Data from various mobility sources, below, highlights a growing trend in this direction already.

This week we also reveal findings from our ‘Focus on Zero’ research study into the growing market for ‘NoLo’ beverages and share trended information on key effectiveness metrics from our Poster Impact research programme.

Back to School

It’s March 1st next week, and in the topsy-turvy world of 2021, that of course can mean only one thing…….SCHOOL’S BACK!

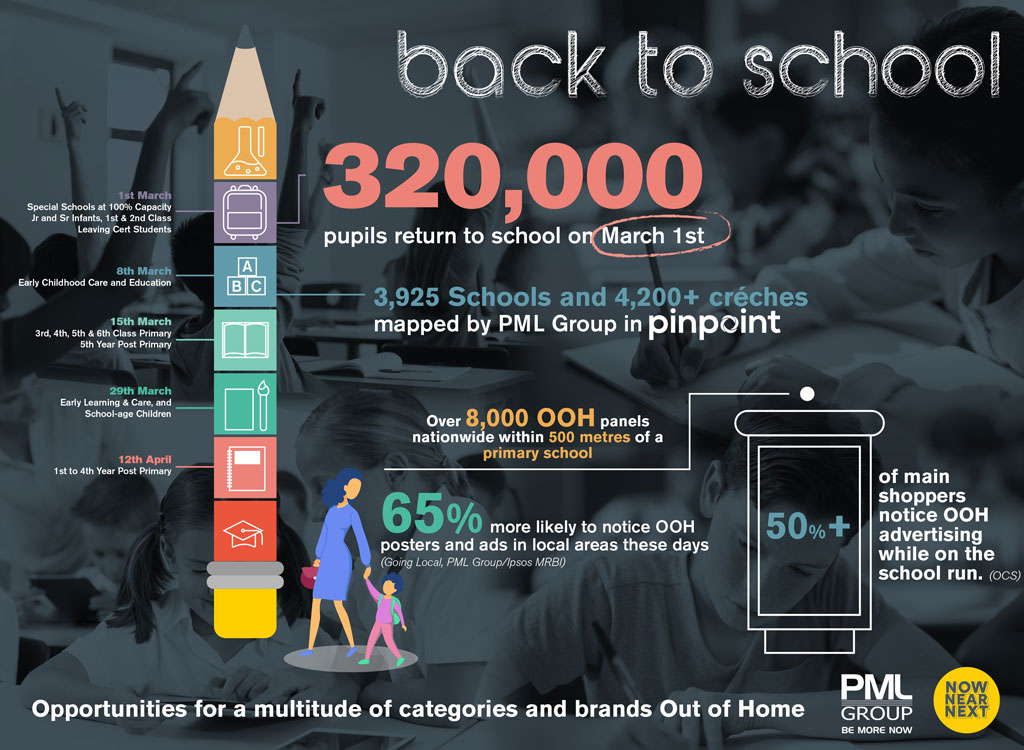

After a very extended Christmas break, 320,000 children return to the classroom on Monday, beginning the phased reintroduction of in-person learning for our young population. This return to school period will be a key time for so many brands and an opportunity for advertisers to harness OOH’s ability to engage families and key decision makers as they recommence the morning and afternoon school run in their local communities. Our OCS travel and consumer survey indicates that over half of main shoppers notice OOH advertising while on the school run.

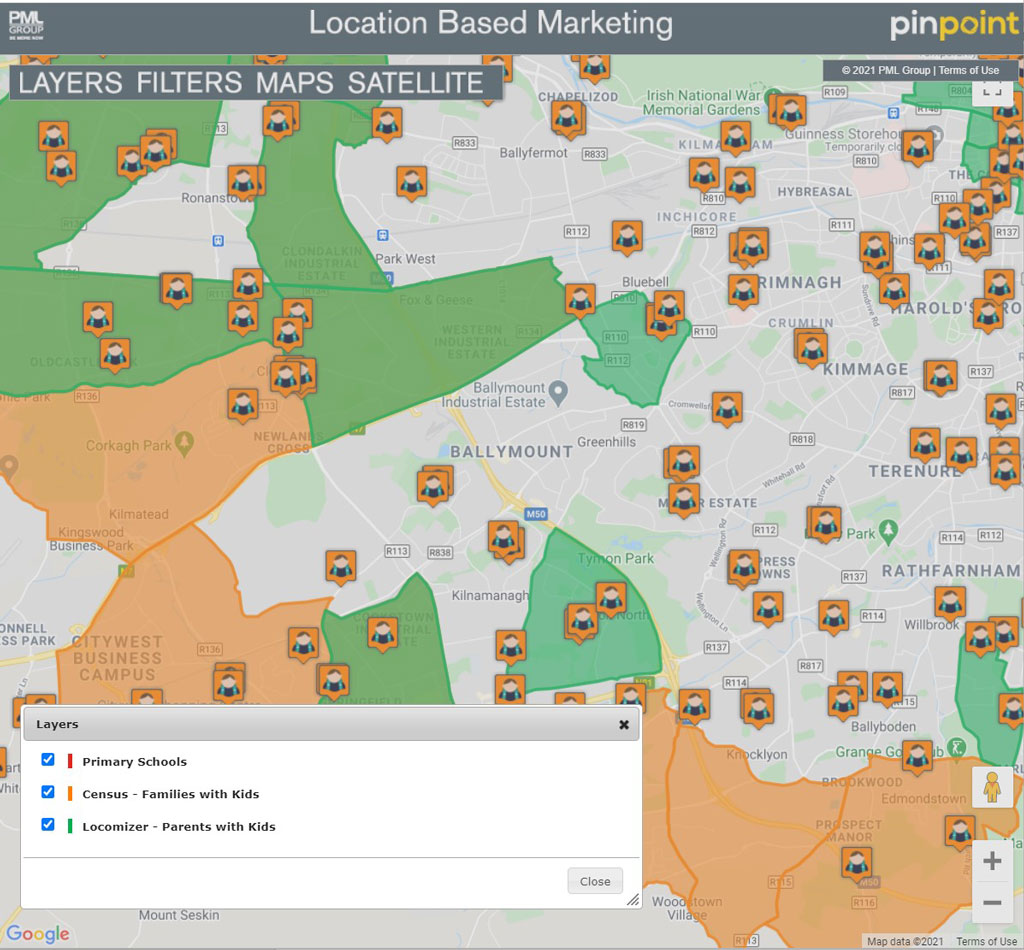

At PML Group, we are perfectly placed to create large scale but targeted campaigns with almost 4,000 schools and in excess of 4,200 creches mapped and overlaid with OOH panels on our Pinpoint platform. More than 8,000 OOH panels fall within 500m of a primary school. Also, Locomizer lets us harness the power of mobile by creating category affinity groups based on analysis of mobile phone location data via anonymised app reporting. By looking at travel patterns of those who spend time in and around category POIs we can build and target key audiences including parents with kids.

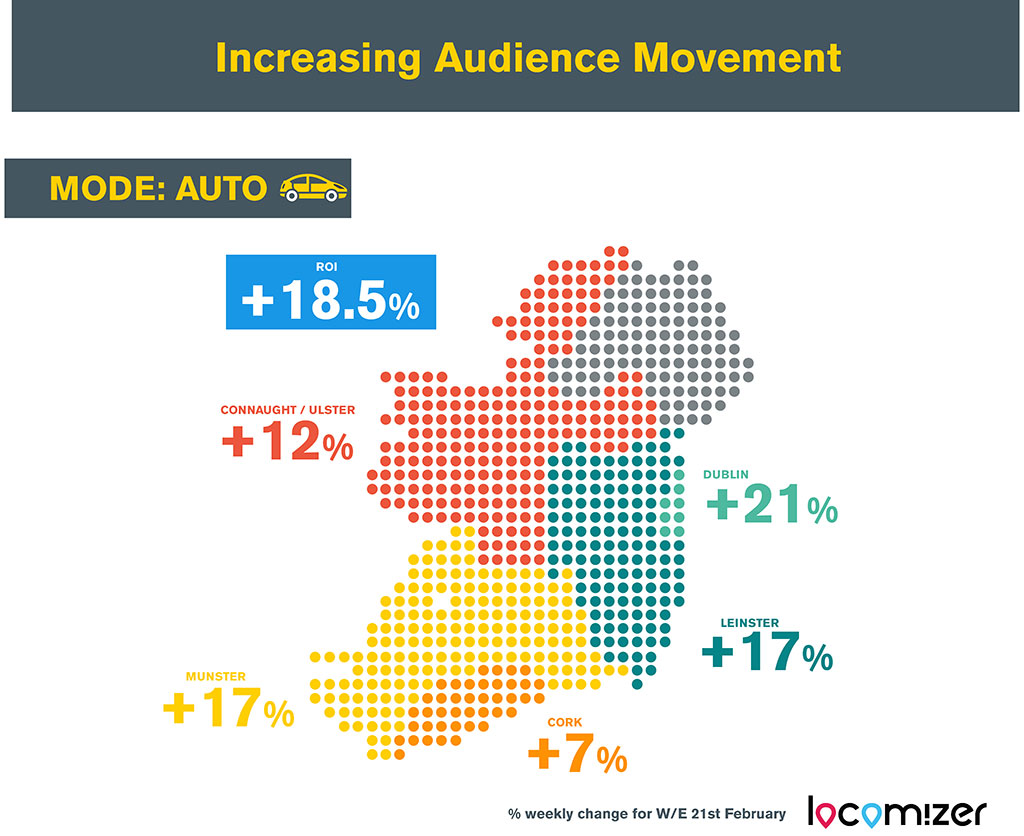

Weekly Locomizer Auto Mobility up 18.5%

Locomizer mobility data is based on analysis of mobile phone location data via anonymised app reporting. Latest figures (w/e 21st February) show that the auto mobility level in ROI, which is calculated though a combination of mobile users, time, and signals, rose 18.5% week on week.

Generally, mobility trends in main urban centres have outperformed those in rural areas, with Dublin above average at +21% having recovered to 75% of the pre-pandemic baseline.

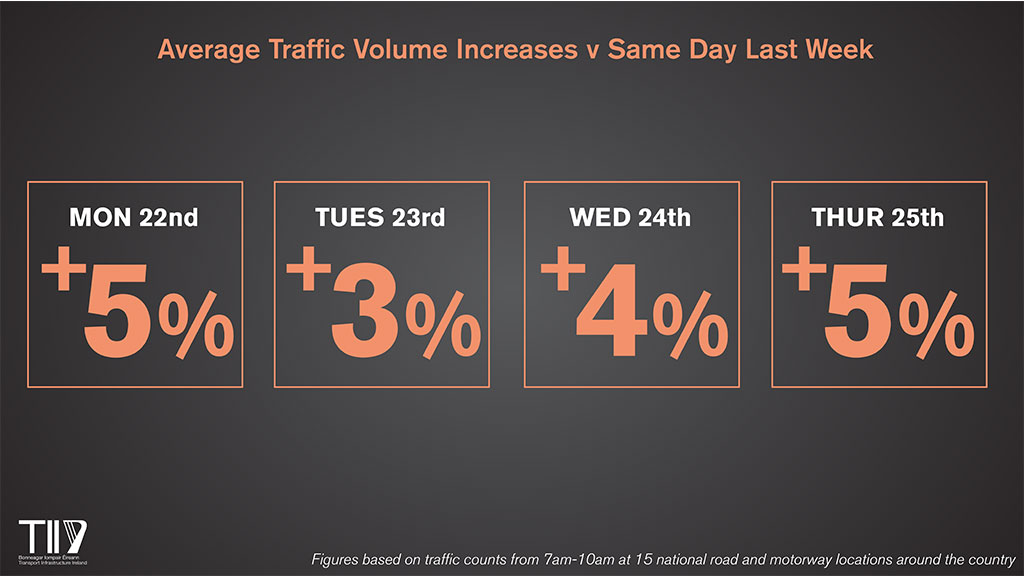

4% weekly rise in TII Traffic Volumes

TII’s latest traffic trend information, covering the morning period from 7am until 10am and generated from a sample of ten traffic counters located on the national road network, reports a ‘substantial’ 4% weekly increase overall in volumes for Monday-Thursday cumulative.

Examining traffic volumes on the radial routes into Dublin, comparisons with Thursday 18th February are as follows: +4% on the N7 at Citywest, +5% on the M1 at M50 to Airport, +6% on the M11 at Bray and +4% on the M4 at Celbridge-Maynooth.

The M50 (N3 Navan Road to N4 Galway Road) shows a +8% increase compared to a week earlier. In the case of the regional cities the changes in car traffic volumes the 7-day comparisons are as follows: N6 Bóthar na dTreabh Galway +8%, N40 Cork +11%, M9 Waterford +13%, and M7 Limerick +8%.

In the case of the regional cities the 7-day changes in car traffic volumes on Thursday morning are as follows: N6 Bóthar na dTreabh Galway +4%, N40 Cork +7%, M9 Waterford +10%, and M7 Limerick +4%.

92% of people left their home in the last week of January

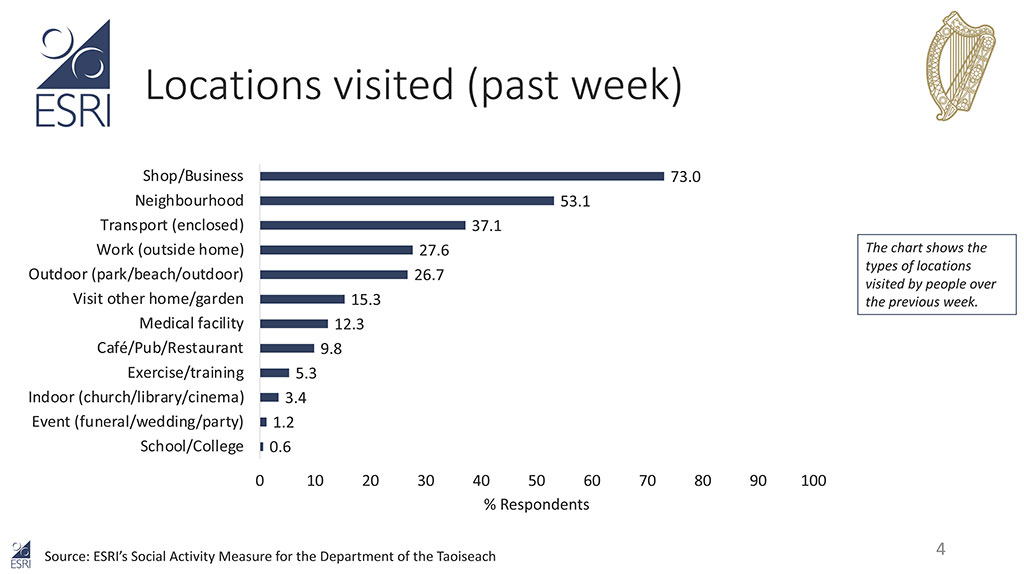

The Social Activity Measure (SAM) is a behavioural study that records the public response to the risk of Covid-19 infection over time. Designed by the ESRI’s Behavioural Research Unit (BRU), SAM is an anonymous, interactive, online study that surveys people about their recent activity.

This first wave of the study reports results from a nationally representative sample of 1,000 people aged 18 and over who participated in the study on the week beginning January 25th, 2021.

Most people (92%) had left their home over the previous week. A majority (73%) shopped for food and most had walked in their local neighbourhood (53%).

The large majority of participants (81%) believed they were following recommendations to prevent the spread of Covid-19 better than others. People who met three or more people from outside their household were in the highest 25% with respect to social activity, yet they believed they were meeting fewer people than average. Similarly, more than 90% of people believed their behaviour was more careful than average. The figure was only slightly lower for those who had had a close contact the previous day.

At a time in January when case numbers and hospitalisations due to COVID were particularly high, the public were out and about doing things in their localities. As that perceived risk decreases one would assume an upward trend in such activity also.

Spring into Action

With the fine spring weather we have experienced of late, people are out and about locally, making the most of it and enjoying some much-needed leisure time.

This week, DLRCC published footfall counters for its Coastal Mobility Route, the segregated cycle lane which follows the coast road from Dun Laoghaire north to Blackrock and south to Sandycove. On Sunday 21st February, the council observed 4,735 cyclists (at Seapoint) and a further 5,638 pedestrians enjoying a stroll along the east pier.

Bleeper Bike is also reaping the benefits of the good spring weather as it experienced its busiest day of 2021 so far on Sunday 21st February, with a 42% increase in bike usage compared to its second busiest day. It was also Bleeper’s busiest February day on record.

As we move into a new season, the weather and brighter evenings will have a positive effect on OOH’s exposure and viewability. With more people out enjoying local recreation areas, parks, their neighbourhoods and villages, OOH is well placed to connect with audiences at a local level.

Two Thirds of the Nation Staying Local

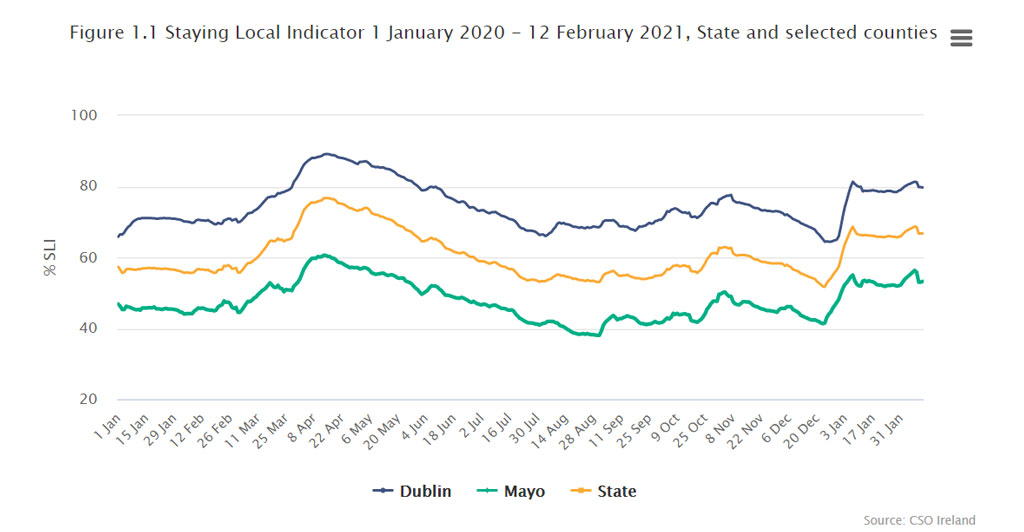

The third Staying Local Indicator report from the CSO shows the vast majority of the country are continuing to stay local.

The SLI offers insight into the population’s travel patterns and provides daily estimated percentages of the population that have stayed within 10km of home, averaged over the preceding seven days.

During the week ending 12th February, an estimated 66.7% of the population stayed local (within 10km of home). The CSO outlines the propensity of the population to stay within 10km of home tends to differ by county as movement is impacted by a whole range of circumstances and conditions such as levels of urbanisation.

With easier access to amenities and services, Dublin continues to be the county with the highest percentage of the population staying local at 79.7%. Mayo (53.2%) and Roscommon (51.7%) had the lowest percentage of people staying local for the week, however this was attributed to low levels of urbanisation.

Comparing week on week changes in mobility, all counties witnessed a slight decrease in SLI figures (-1.4%), suggesting a modest relaxation in mobility behaviour.

While the report provides a snapshot into the nation’s mobility, the figures do not take into account important variables that contribute to people’s movements such as essential workers commuting or travel for essential purposes such as attending appointments or those who need to travel further for food shopping etc.

81% find OOH Ads Easy to Understand

Throughout 2020, our Poster Impact research programme continued to assess the effectiveness of almost one thousand OOH campaigns. Apart from recall and design ratings, the research, conducted by Ipsos MRBI, also investigated metrics including call to action, ease of understanding and relevance. Last year, more than 6,000 Dublin respondents took part in the post-campaign effectiveness study.

Out of Home ads need to be easily digestible, relatable and understandable for a busy, mobile audience. Our findings from 2020 show that, on average, 81% of respondents found the researched OOH campaigns either very easy or fairly easy to understand. This figure peaked at 83% among 35-44s. There was a slight difference in genders – Females 84% v Males 79%. The campaign that respondents found easiest to understand across the entire year was for Lidl, from cycle 14. Supermarkets was also the category most easily understood, followed by QSR (Quick Service Restaurants) and FMCG.

Ads on T-Sides stood out as the easiest to understand on average. Could it be that the unique shape of this format lends itself to a more refined creative process?

On average across all campaigns researched, 69% of 25-34-year olds said they probably or possibly would act directly on that ad in terms of likelihood to buy or avail of the product or service advertised. The category of ads most likely to illicit a ‘call to action’ were Public Information ads, driven mainly by the HSE’s COVID-19 communications around masking. Next best categories in this regard were Supermarkets and QSR. However, it was Cadbury’s Dairy Milk campaign from August that scored best for call to action in 2020. Males were slightly more likely to act on the researched campaigns – averaging 66% versus 64% among females.

The HSE’s OOH work was considered the most ‘relevant to me’ campaign of 2020, with 90% feeling the campaign was relevant to some extent, with 66% agreeing strongly. The three best performing categories in terms of relevance were Supermarkets, Public Information and QSR.

Zero a Hero

IWSR, a leading source of data on the global beverage alcohol market describes the current growth of ‘NoLo’ (zero and low alcohol) drinks as a ‘moderation trend that’s sweeping across key global markets’.

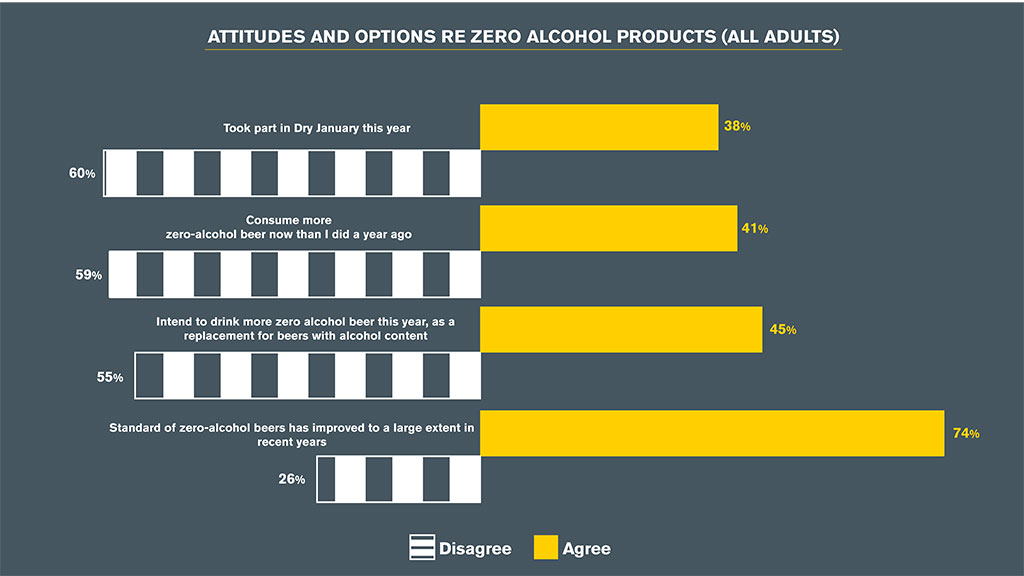

Across the next two weeks in Now Near Next we will be publishing details of recent research we have conducted in association with Ipsos MRBI called ‘Focus on Zero’. The online survey of 300 respondents investigated opinions and perceptions associated with zero-alcohol beers including taste, consumption, relationship to ‘parent’ alcohol brands and the role of advertising in consumers’ decision making in the sector.

The survey found that 38% of Dublin alcohol drinkers aged 18-54 took part in so called ‘Dry January’ this year. This figure was actually highest among 18-24s, at 48%. The 45+ age group were lowest in terms of participation in the well-established month of abstinence.

Querying current consumption levels found that 41% consume more zero-alcohol beer than they did a year ago. There was a large disparity here between males/females here at 54% v 29%.

The research indicates high levels of positive sentiment towards this product category with three in four respondents believing the quality of zero-alcohol beers has improved greatly in recent years. This rises to a massive 92% among 35-44s.

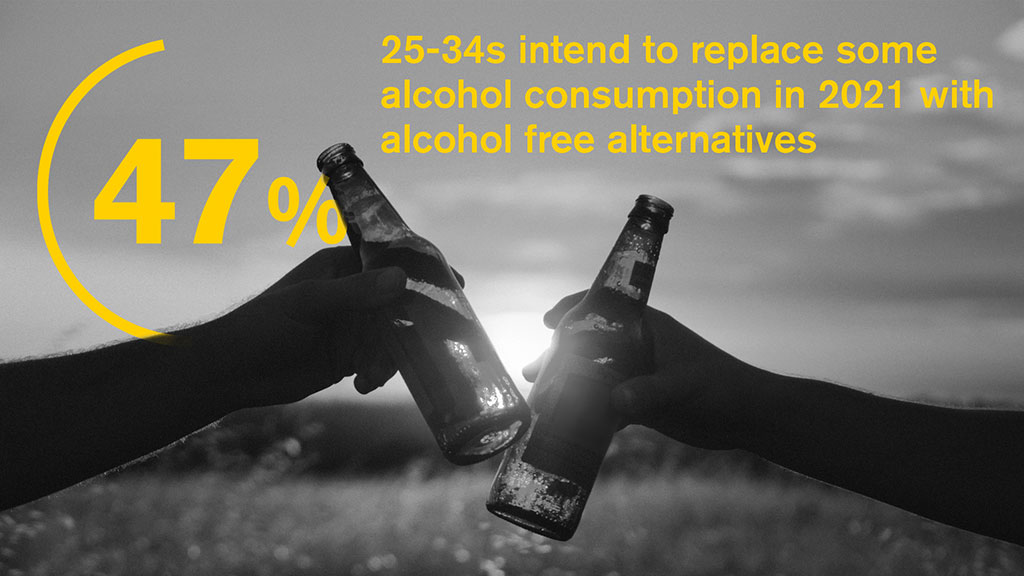

This no doubt feeds into the statistic that 45% of respondents intend to drink more zero-alcohol beer in 2021 than they did in 2020, as a replacement for alcoholic drinks. There’s no major gender or age differences regarding this intention with a peak of 53% among males 25-34.

Next week we’ll be covering the role of advertising and the importance of ‘parent’ brands when it comes to making zero-alcohol choices, among other relevant findings.

And, finally…

If you are eager for more OOH news and info, PML Group has just published its monthly Engage bulletin. The February issue features campaign stories including Guinness, Heinz, Pringles and belVita along with a great guest article from Antoinette O’Callaghan of Exterion Media. Click here to see it.