Colum Harmon, marketing director, PML Group with this week’s view from OOH.

It’s All Relevant!

In previous weeks on these pages we have talked to the importance of relevance and context for Out of Home in the Now, Near and Next. Indeed, our network’s ground-breaking ‘Moments of Truth’ research study launched in this country in recent weeks highlighted the effectiveness of relevance in Digital OOH advertising from the point of view of brain response, ad recall and sales. It has therefore been great to see that agenda being advanced this week with some brilliant, smart, contextually relevant OOH activations.

Bank of Ireland’s new mortgage campaign integrates the power of dynamic content to promote the bank’s mortgage offerings across selected DOOH formats. Sharing important and relevant buyer information on specific areas and postcodes, the campaign’s messaging features location shout outs, average house prices, distance to the city/town centre and popular amenities within these areas.

To deliver strong cut-through for the cider and light varieties of Rockshore, Dynamic Digital OOH is providing bespoke content, based on weather triggers. Rockshore Light will be on display throughout, however when temperatures reach 17 degrees and it is dry, the cider creative will automatically activate.

McDonald’s are employing daypart creative to champion breakfast between 6am-11am with creative featuring Big Macs and Fries kicking in post-11am for the rest of the day.

This week we publish some new shopper research along with latest mobility data and news of interest from the leisure and retail sectors.

Mobility

Road to Recovery

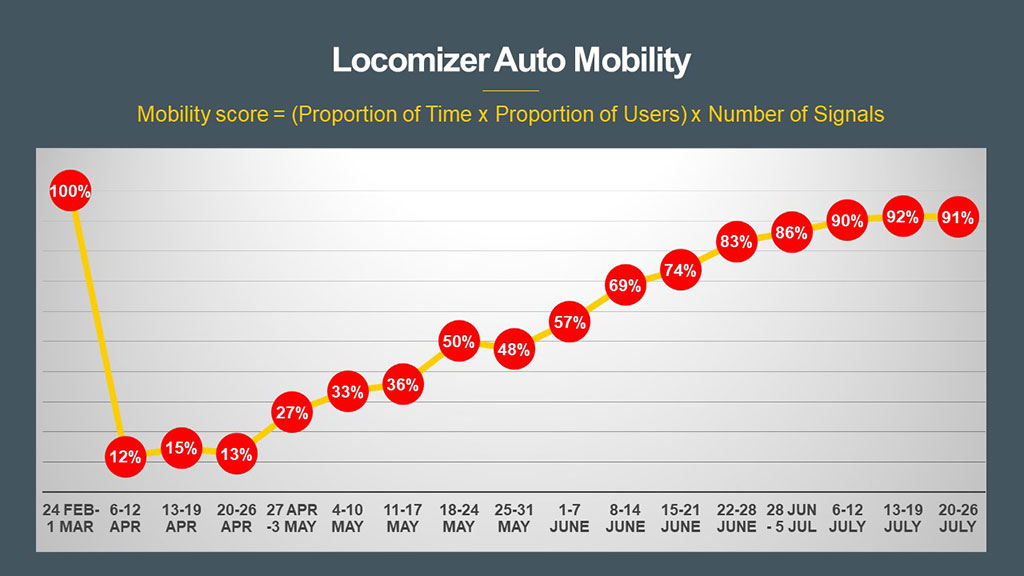

Latest data from Locomizer, based on analysis of mobile phone location data via anonymised app reporting, shows the growth in mobility across Ireland from the end of April has this month stabilised following easing of restriction across June. Mobility levels, which are calculated though a combination of mobile users, time, and signals, are now at 91% of where they were pre-COVID-19.

A similar picture is evident in TII’s latest traffic trend information, derived from a small sample of ten traffic counters located on the national road network, which finds that as of Tuesday 28th July, car traffic volumes stand at 83% of the equivalent day in 2019.

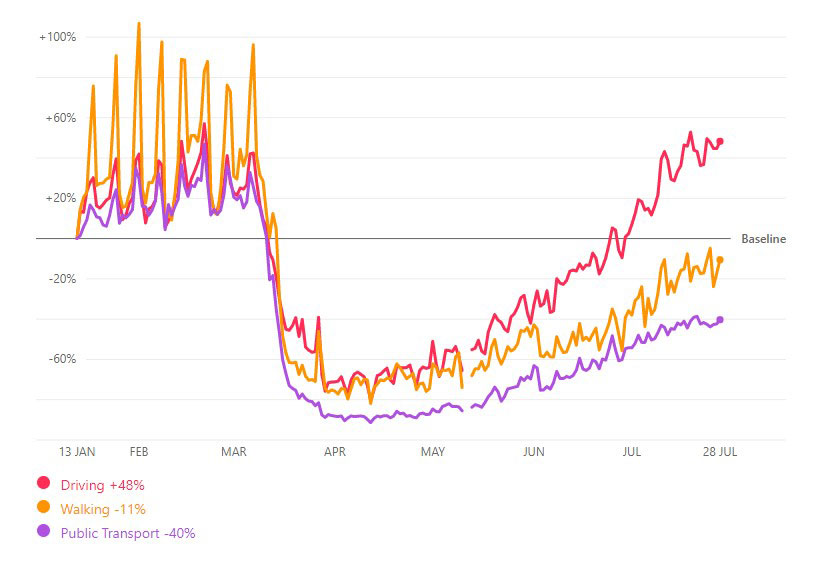

Apple’s routing requests mobility data to Tuesday 28th July shows driving in Ireland is now 48% above January’s baseline and +15% in the past fortnight. Figures indicate public transport is now 60% of pre-COVID levels and a steady recovery has seen it rise by 12% in the past fortnight while pedestrian movement is up 22% for the same period. These figures follow news that Aircoach resumed the Cork and Belfast services to Dublin on Monday. Elsewhere driving in Northern Ireland is now 40% above baseline, while the UK is now +20%.

Life Outdoors

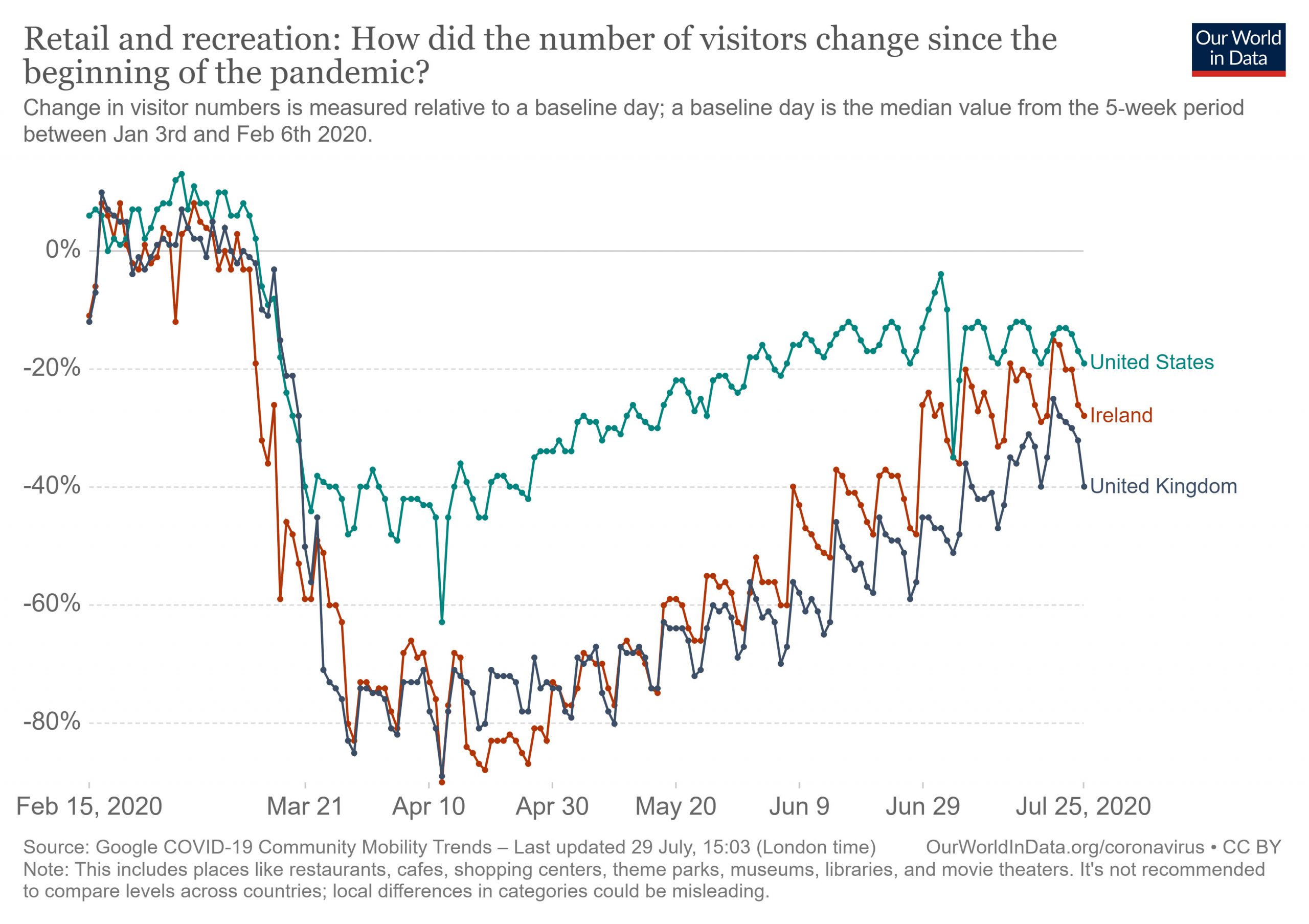

Google’s COVID-19 Community Mobility Reports shows how peoples’ movements have changed throughout the period of the pandemic. The dataset measures visitor numbers to specific categories of location every day and compares this change relative to baseline day before the outbreak. This week we take a look at visitor numbers in Ireland within the retail and recreation environment and compare to the UK and the United States, two countries from which much of our news narrative emanates. This includes places like restaurants, cafes, shopping centres, theme parks, museums, libraries, and cinemas.

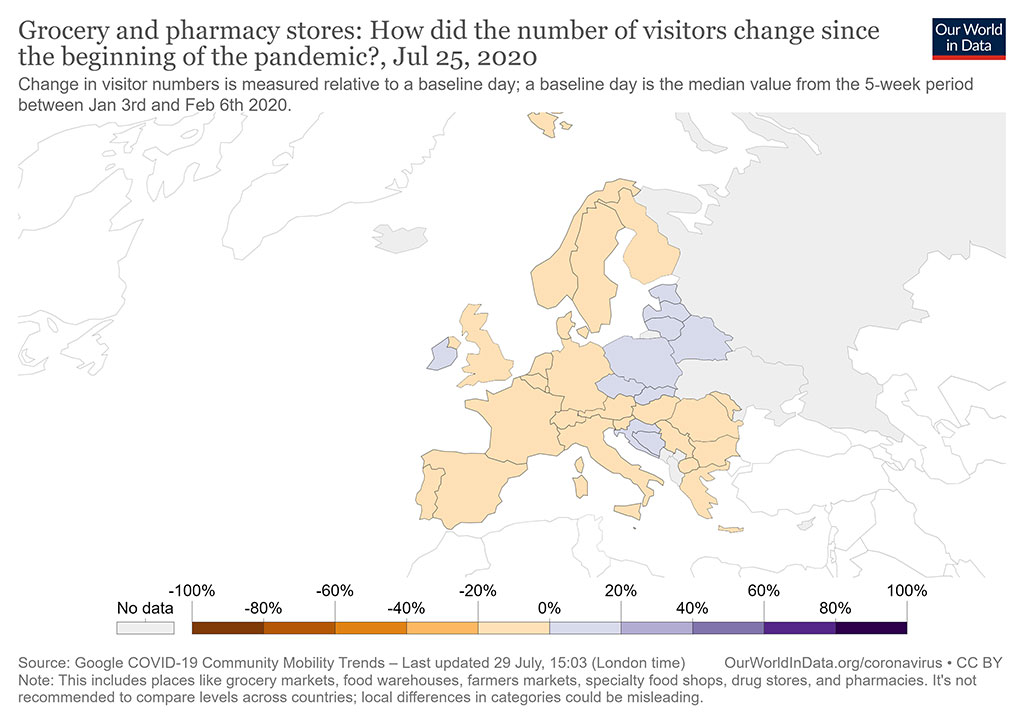

What can be seen is that the decline in numbers at the height of lockdown measures here and in the UK was much more pronounced than that in the US. Recovery in Ireland accelerated in June into July with the phased reopenings. Separate to this shopper volumes in supermarkets and pharmacies remains above baseline here which is ahead of the rest of Western Europe.

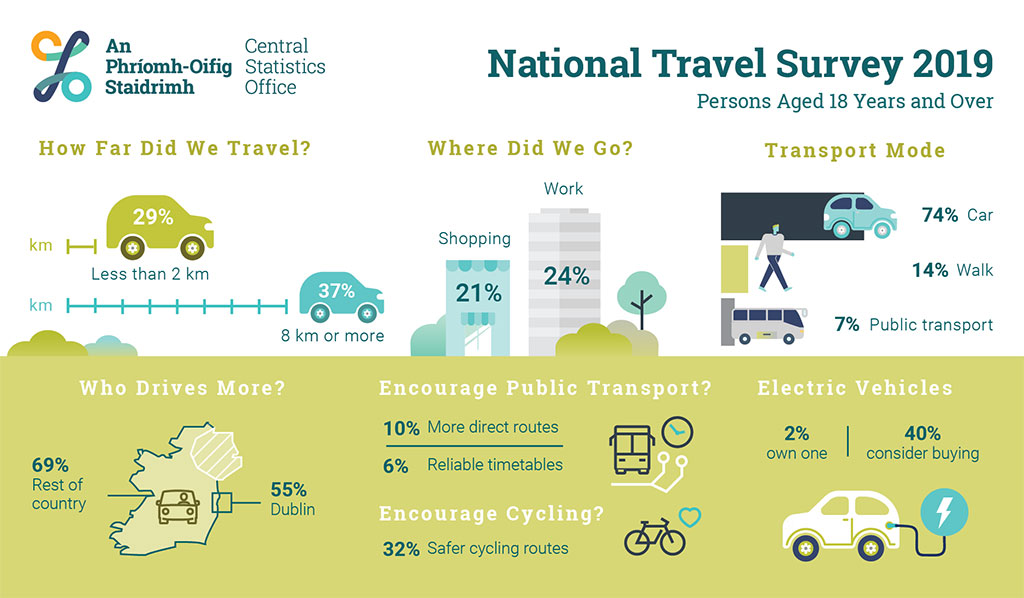

Journeys in Dublin Shorter but take Longer

New figures from the CSO show that journeys by car accounted for 73.7% of all journeys last year. Nearly six in ten (56.9%) travel by car at least 5 times a week, while one in eight (12%) makes a journey by car 1 to 2 times a week, and 14% do so 3 to 4 times a week. Walking accounted for 13.5% of all journeys and one in 20 (4.8%) were by bus. Nearly a quarter of journeys in 2019 were work related, while more than one fifth were for shopping, and a further one fifth of journeys were made accompanying people. The average journey distance in 2019 was 13.7 kilometres and on average, took 23.3 minutes to complete. Average journey distance for persons living in Dublin has continued to get shorter. While average journey distance for Dubliners has decreased to 9.5 kilometres (9.8 kilometres in 2016), average journey duration has remained at 24.8 minutes.

Travel Modes in Dublin

Persons living in Dublin were significantly less likely to drive than those in the rest of the country. In 2019, over half of all journeys by Dubliners (54.9%) were by car as driver compared with nearly seven in every ten (69.2%) journeys taken by those living in the rest of the country. In Dublin, use of the bus as a mode of transport was substantially greater than in the rest of the country – 8.5% compared to 3.3% for all regions outside of Dublin.

Over one in five (21.1%) of journeys made by Dubliners were by walking or cycling, compared to just one in every eight (12.4%) journeys taken by persons living outside of Dublin. Persons residing in Dublin were significantly more likely to walk as a mode of travel – 17.6% of Dubliners compared to just 11.7% in the rest of the country. Similarly, 3.4% of persons living in Dublin cycled to their chosen destination, compared to just 0.7% of journeys for persons living in regions outside of Dublin.

Pedestrianisation of Dublin streets increased business by up to 100%

A survey of 292 businesses by Dublin City Council has found that the trial pedestrianisation of streets around the capital’s centre led to increased takings of between 40% and 100%. The first of four trial weekends took place last weekend. The streets involved are:

- Anne Street South from the junction of Dawson Street

- Duke Street from the junction of Dawson Street

- South William Street from the Brown Thomas carpark exit to Chatham Row

- Drury Street from Fade Street to the Drury Street carpark

- Dame Court from Exchequer Street

Latest footfall figures show levels on Grafton now at 80% of pre-COVID levels on a Sunday. Meanwhile, in Cork……

Cork – the Alfresco Capital of Ireland

This week, Cork City Council unveiled plans for the creation of 14 new ‘people-friendly’ streets around the city.

The ‘Re-imaging Cork City’ initiative will see the pedestrianisation of streets across Cork and €2million invested into the city’s existing cycling infrastructure. The announcement follows a successful trial of pedestrianising Princes Street – one of Cork’s busiest shopping thoroughfares.

The initiative is in response to COVID-19 and aims to create a more people-friendly city and provide additional space for business to operate. Street furniture and outdoor dining facilities for around 1,000 people are also being provided under the plan, which will be sponsored by Cork City Council.

Streets being pedestrianised include Princes Street, Tuckey Street, Pembroke Street, Caroline Street, Little Anne Street, Little Cross Street and Harley Street, while Emmet Place and Paul Street are partially pedestrianised with local access allowed.

In addition to significant pedestrianisation in the city, the programme will invest in the city’s cycling infrastructure. New cycle lanes, repairing existing routes and the construction of 43 bike racks that can accommodate approximately 500 bikes are some of the additional measures announced in the plan.

Under the new initiative, audiences visiting Cork city centre can avail of more alfresco dining and transport options. The trial on Princes Street proved very popular with the area bolstering footfall and dwell time.

With over two thousand OOH panels in Cork the possibilities for targeting Corkonians are endless. Advertisers can surround points of interest or specific locations around shops, restaurants and even tourist spots.

Sentiment/Insight

Studies Point to In-Store Preference for Shoppers

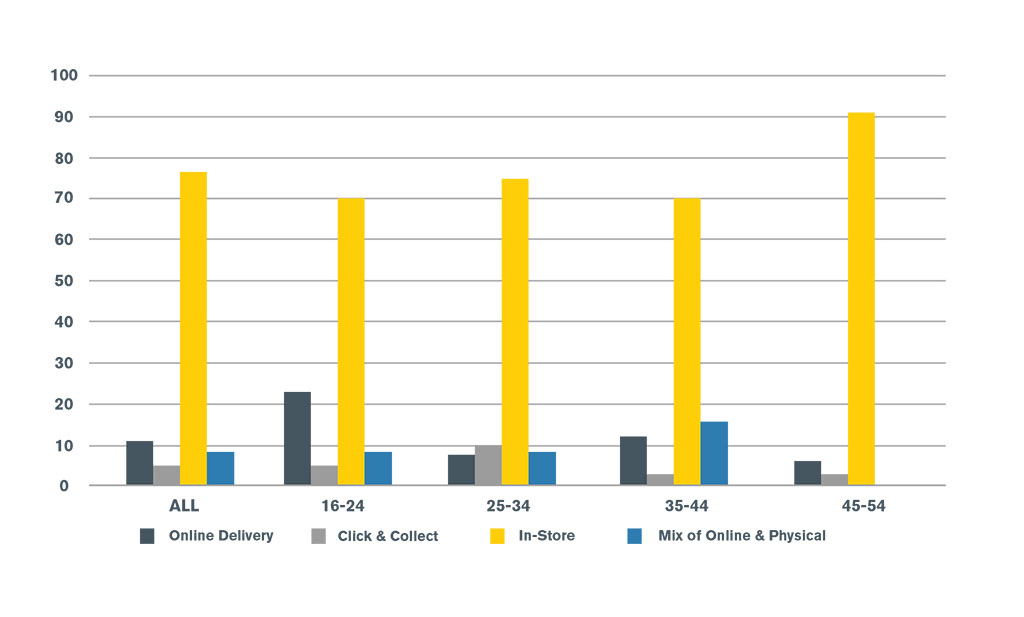

Despite record levels of online grocery shopping in recent months, it appears that Dubliners of all age groups and genders are keen to do the bulk of their grocery shopping in-store. Research we released this week indicates that more than three quarters of Dubliners intend to carry out the majority of their grocery shopping in-store over the next six months.

At a topline level, 76% of all respondents said they intend to shop primarily in-store in the short to medium term, with 11% indicating a preference for delivery and just 5% opting for click and collect. 8% of the representative sample think they will adopt a mix of online and physical shopping in the coming period.

The study highlights a gender difference though, with males more inclined towards online options with 24% intending to use delivery or click and collect, compared to 9% of females. Younger age groups are also more likely to be ordering online with 26% of 16-24s indicating that preference compared to 9% among the oldest group in the sample, 45-54s.

With regard to where respondents live, those in South County Dublin have the biggest preference for online at 22% while North County Dublin residents have the highest preference for in-store, at 78%. Customers of Dunnes Stores and SuperValu have the highest levels of intent for in-store shopping between now and the start of 2021. A desire for such a slice of normality is to be expected following such an abnormal period. Perhaps it’s an indication of older habits re-emerging as we get used to living with COVID-19 and all it entails.

With regard to where respondents live, those in South County Dublin have the biggest preference for online at 22% while North County Dublin residents have the highest preference for in-store, at 78%. Customers of Dunnes Stores and SuperValu have the highest levels of intent for in-store shopping between now and the start of 2021. A desire for such a slice of normality is to be expected following such an abnormal period. Perhaps it’s an indication of older habits re-emerging as we get used to living with COVID-19 and all it entails.

The fieldwork, managed by Ipsos MRBI, surveyed 300 16-54-year-old Dubliners, and took place in the latter part of July.

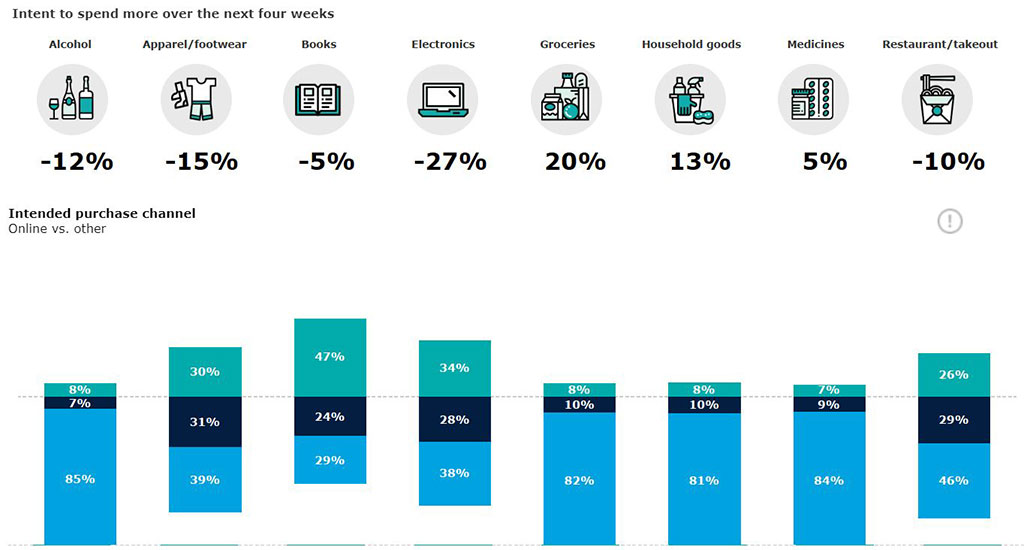

Some product categories are more conducive to an online purchase as evidenced in Deloitte’s latest ‘State of the Consumer Tracker’. The most recent wave of research took place between July 21st and 25th. Below is a graphic from the study, outlining intent to spend over the coming four weeks across various categories and the extent to which the respondents intend to purchase online appearing in green above the dotted line. The light blue box represents in-store purchase intention and this is highest among alcohol, grocery, household goods and medicine categories – all above 80%. These figures refer to Ireland only.

Leisure

The Great (Domestic) Escape

With numerous safety programmes being launched to bolster holidaymakers’ confidence in travelling domestically, it seems the staycation drive is underway as people begin to plan their holidays.

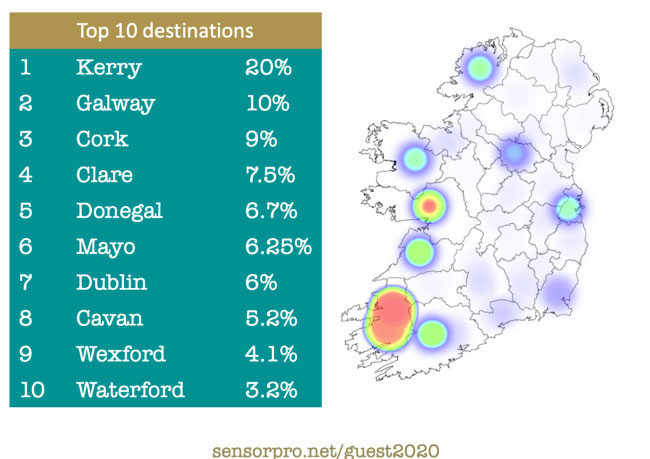

According to data from email marketing and survey platform SensorPro, 80% of Irish holidaymakers plan to travel within Ireland in 2020. However, 44% are still undecided where to travel to.

Of those who have decided, the research details where people are planning to go with Kerry proving the most popular destination (20%) followed by Galway (10%) and Cork (9%).

Luxury hotels/resorts is the accommodation type people are seeking most (41%) with Dubliners more inclined to opt for this type of holiday destination. These are followed by seaside breaks (28%), self-catering (24%), camping (4%) and B&Bs (7%).

In terms of leisure activities while away, holidaymakers seem comfortable in visiting hospitality venues with 75% planning to visit restaurants for their meals. Additionally, 75% stated they plan to visit a bar. With a huge proportion of holidaymakers still undecided on where to go, this presents an opportunity for the travel/hospitality industry to appeal to those still within the decision-making process.

With OOH’s broadcasting ability and regional coverage, the medium can deliver engaging messaging to audiences further afield and promote offerings to influence the destination choice of those still undecided.

Back to the Movies

Plenty of reasons to be optimistic on the Wide Eye Media ‘Escape to the Big Screen’ webinar last week. Cinema is an OOH leisure environment with powerful digital and classic formats serving many sought after demographics.

49% of Wide Eye Media served cinemas have now reopened with the full complement expected to pull back the curtain before late August. According research conducted by company, 87% of 1,200+ respondents are looking forward to returning to the cinema and many already have. One in four say they have/will return to the cinema immediately with a cumulative 61% intending to visit within the first sixty days. Dwell time will increase as more than one third intend to arrive earlier than they would previously have done. One in five (19%) are also planning on visiting more often. Among the releases they will be enjoying this year are Wonder Woman 1984, Tenet and James Bond’s latest outing, No Time To Die. Cinemas currently open are running at around 25% of normal admission levels.

Cadbury, EBS and Pepsi Max were among the brands active on the Cine D network this year, prior to the enforced closure of the nation’s cinemas.

Retail

Retail Sales see Biggest Monthly Increase in June

The latest figures from the Central Statistics Office reveals sales in the retail sector were 3.5 % higher in June than in the same month last year. While total volume of retail sales rebounded by 38.4% in June compared to May.

Excluding the motor trade, the volume of retail sales increased by 22.3% over the previous month and increased by 4.8% when compared with June 2019.

Sales of food are up 19% and electrical goods sales up by 14%. Sales of hardware, paint and glass are also up 30% compared to June of last year.

On the 8th June, all retail sectors were permitted to reopen their doors. Those who benefitted from the June reopening in terms of monthly volumes increase were Furniture & Lighting (+296.8%), Clothing, Footwear & Textiles (+284.2%) and Books, Newspapers and Stationery (+252.0%).

With people reengaging with the physical shopping experience, online retail sales fell by 6.8% from a share of 13.2% in May.

After several months of closure, it’s encouraging to see retail sales bounced back so quickly in June. This shift back to the physical shopping experience is positive from an OOH standpoint as it has a unique role to play in influencing shoppers in the retail environment. Retailers that have been closed for several months can capitalise and benefit from building back brand presence in the relevant setting.

Ireland Returns to Normality but Lockdown Habits Stick

Kantar’s monthly grocery market analysis published this week revealed that take-home grocery sales in Ireland increased by 23.2% during the 12 weeks to 12th July. It reported shoppers are beginning to return to more normal spending patterns with a small decrease recorded in the latest four weeks as it slowed to 17.8%.

However, some of the habits observed over lockdown may be here to stay. The uptick in ‘treat’ spending is still evident with sales of savoury snacks and confectionery up 45% and 35% respectively.

As reported in previous Now,Near,Next editions, Irish sourced products are still in high demand and Irish brands such as Keeling’s and Kelkin have enjoyed a sales boost.

Looking to market share, SuperValu topped the charts for the fourth month in a row and saw sales rise by 30.9%. Tesco’s larger store infrastructure allowed it to capitalise on bigger trolley shops, growing by 20.7 per cent to claim a 21.1 per cent share.

Dunnes Stores recorded the highest spend per buyer with an extra €12.24 being spent per trip on average. While Lidl had a record-breaking month as it recorded its highest ever market share of 12.7%.

And finally….

The World Out of Home Organisation (WOO) has launched the biggest ever global Digital OOH campaign and it’s currently running here in Ireland along with countries in Europe, North and South America, Africa, Asia and the Far East including China and Australasia. The campaign is called Our Second Chance.

WOO President Tom Goddard says “Our Second Chance reflects the new post COVID world, in a non-partisan way and highlights the opportunity it gives citizens across the world, to consider their priorities and aspirations.

“New Commercial Arts has produced a stunning campaign which will run in multiple languages, that shows the Out of Home industry at its best and most striking: a reminder to advertisers and agencies that, as the world re-opens for business, Out of Home remains the only true global broadcast medium.”

The campaign is supported by Out of Home media owners across the world and National Trade Associations – with an estimated value of $25m of prime inventory. Alongside the massive DOOH campaign will be a major social initiative with the hashtag #OurSecondChance deploying Twitter polls to explore consumer attitudes to the choices and opportunities presented in a world changed by COVID-19.