As the country looks forward to the next phase of lockdown restrictions being lifted, James Byrne, marketing manager PML Group, with this week’s view from Out of Home.

We are now more than halfway through phase one of the government plan for the reopening of society and the economy and phase two will kick off in a little more than a week’s time on June 8th. Evidence of increased mobility of audience has built during phase one and we report on the latest figures for this week below. This increased mobility is also reflected in increased numbers being back in the workplace and this week saw the release of some revealing information regarding the workplace, which we also feature. We look at how technology will create opportunity for OOH advertisers and how home tourism will have a major impact on the OOH audience this summer.

Mobility

Locomizer

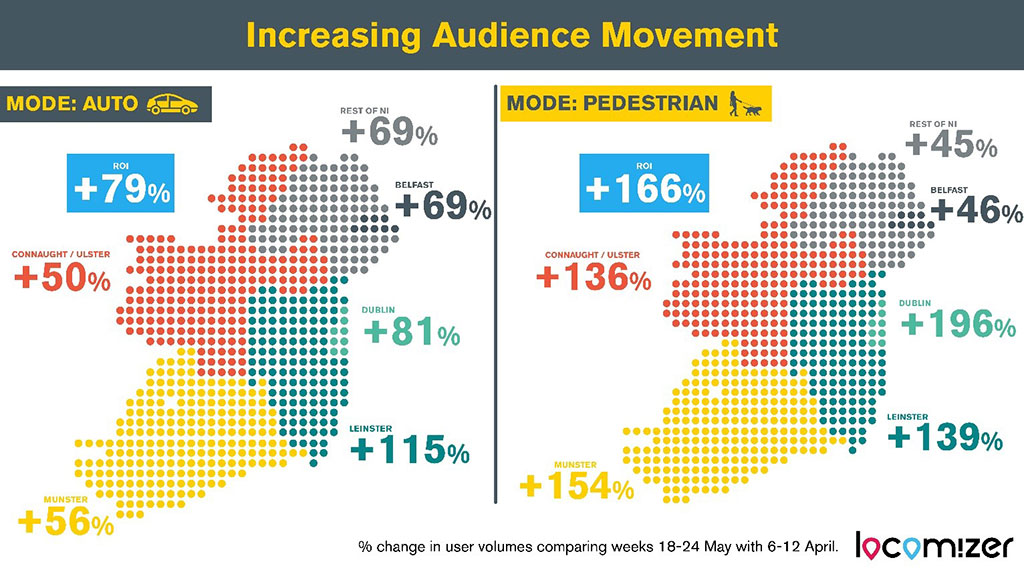

Latest data from Locomizer, based on analysis of mobile phone location data via anonymised app reporting, shows the growth in mobility across the Island of Ireland over the course of the pandemic, and as restrictions ease. By comparing user figures based on individuals generating at least one signal per small area district across two weeks; 6-12 April and 18-24 May, uplift in both auto (all forms) and pedestrian modes of movement is witnessed.

Over the five weeks auto mobility is up 79% in ROI and 69% in NI while pedestrian movement is up 166% in ROI and 46% in NI. Looking regionally, Leinster has seen the biggest rise in auto mobility at +115% while growth in pedestrian movement growth is at its highest in Dublin City at +196%. Data from multiple sources has indicated the initial drop off in mobility was lower in NI which accounts for the smaller increases over the period.

TII

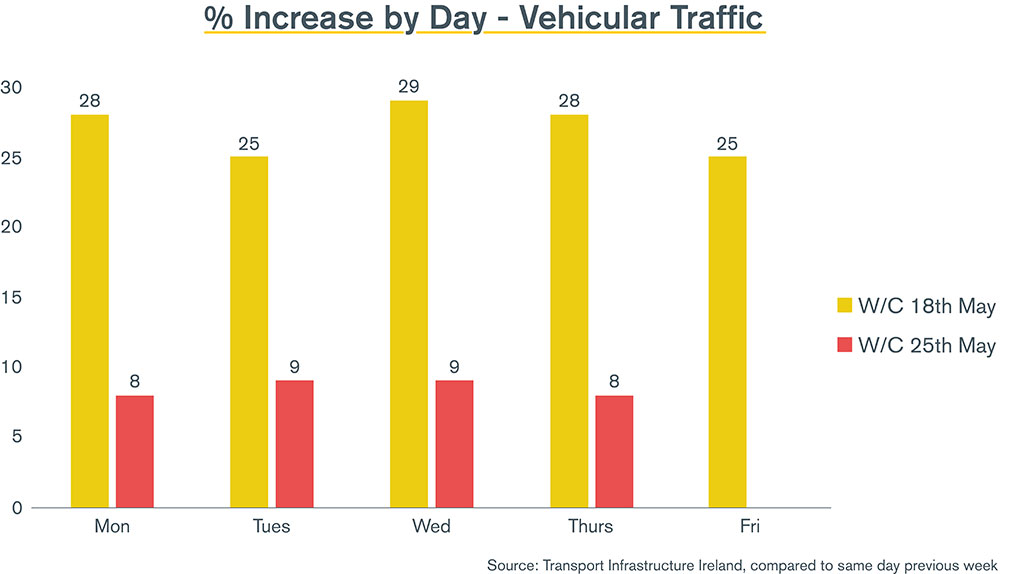

Daily traffic data from Transport Infrastructure Ireland this week indicates a continued increase in road users. Following daily increases of between 25%-30% in the first week of phase 1 (w/c 18th), this week saw further increases of between 8%-9%. This means that traffic levels nationally are now at around 50% of that for the same week last year.

Apple Mobility Trends

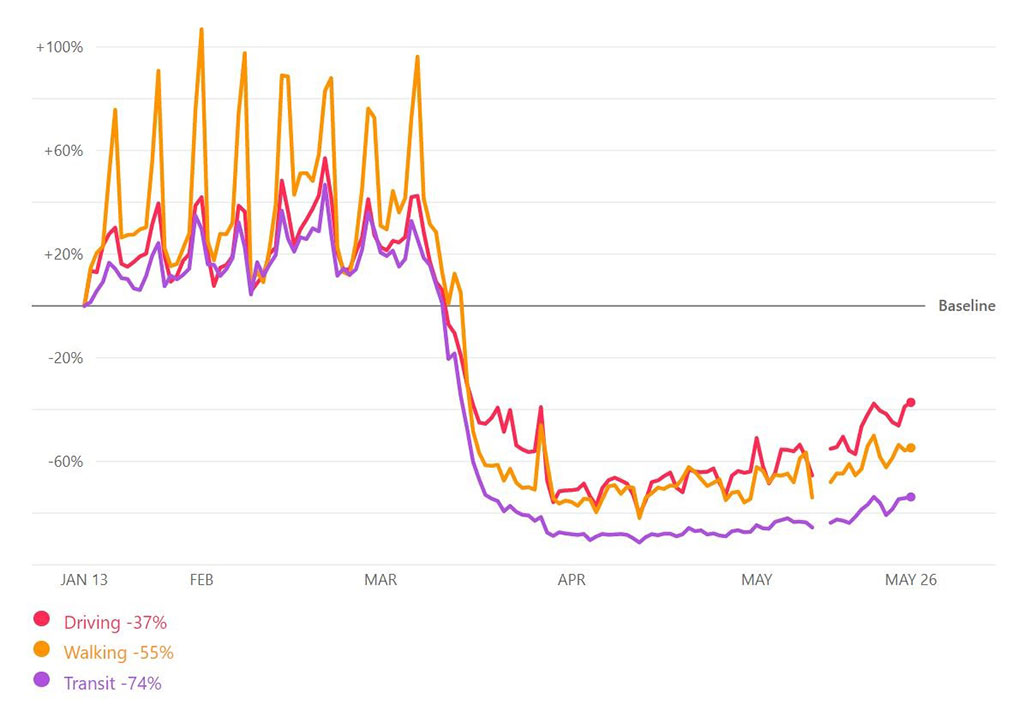

Apple’s routing requests reveal daily trends in mobility in terms of driving, walking and public transport. The latest data, up to May 26th, shows that driving mobility is up 8% this week compared to last and 96% up on the low point of April 14th. Transit is up 13% this week and has more than doubled since April 14th. Interestingly, walking is down 2% on the week, perhaps indicating a movement back to other transport forms as restrictions have been eased. As a whole, mobility is up 6% this week and 93% on the lowest point.

Apple mobility data also shows that average weekly driving activity in Northern Ireland at the beginning of April dropped to 42% of previous baseline levels. Since then there has been a steady rise in driving activity over the past 8 weeks, increasing to 73% of the baseline value (Apple data as of 24th May 2020). For the week ending 24th May the average driving activity increased by 21% compared to the prior week.

Footfall activity around Grocery locations remain strong at 85% of the baseline, an increase of 18% in activity over the past 8 weeks (Google data as of 21st May). The latest data also reports footfall activity around Parks at 108% of baseline, with a 50% increase in activity over the past 8 weeks. As restrictions continue to ease, we anticipate the mobility levels will increase accordingly.

Amárach Public Opinion Tracker

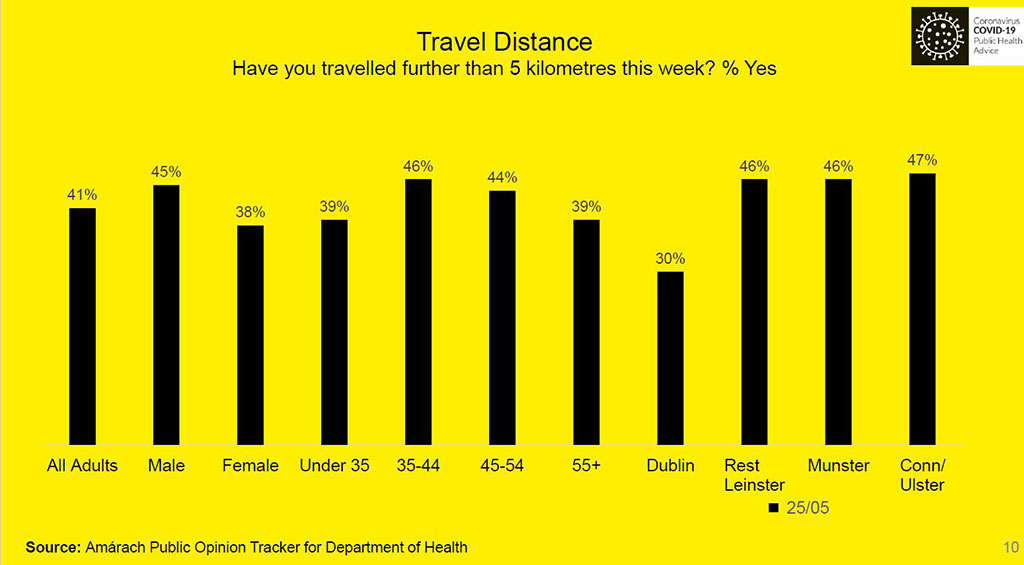

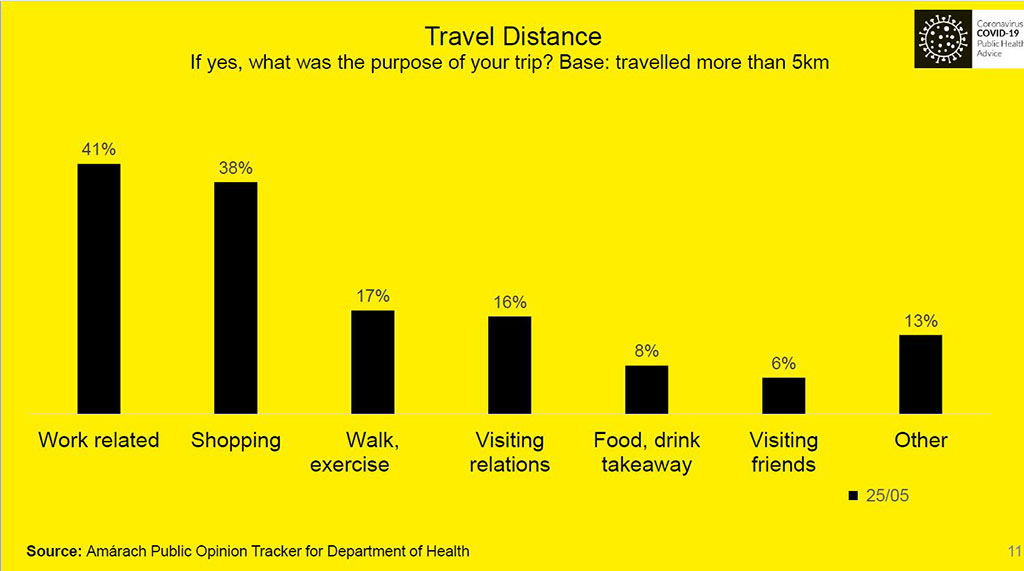

45% of males and 38% of females have travelled further than 5KM in a single journey in the past week, according to new figures from Amárach. The 35-44 age group is the one to have travelled more than 5KM the most in that period. The research also shows that Dubliners are stuck more rigidly to their 5KM radius with 30% travelling beyond that distance, compared to 46% in Munster.

For the vast majority (79%), the reason for their 5KM+ journey was for work or shopping, but 17% admitted to breaking the 5KM limit for exercising in phase one of the government roadmap.

Insight/Sentiment

Return to Work

Google’s latest Covid-19 Community Mobility Report (May 16th) indicates a significant move back to the workplace across the country. The report states that attendance at workplaces is now 40% down on pre-lockdown figures. This is a 12% increase on the April figures, which had been at 52%. This return to workplaces is more pronounced in more sparsely populated regional areas with counties such as Offaly and Tipperary registering workplace attendance now only 30% down on pre-Covid levels.

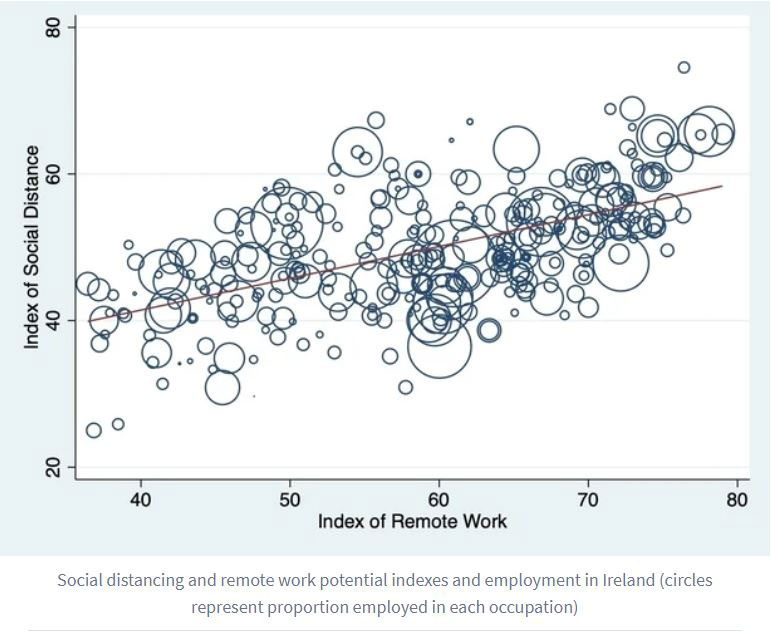

On the topic of workplaces in the Covid era, Irish researchers have released a paper this week – Covid-19, Occupational Social Distancing (SD) and Remote Working Potential in Ireland. It looks at how SD will impact the world of work and what sectors will be most affected. The authors, Dr. Frank Crowley and Dr. Justin Doran from Cork University Business School in UCC, generated two indices which will influence the effect of SD on a business. They generated two indices which capture the potential impact of Covid-19 through identifying firstly, the occupations which may be most able to implement social distancing procedures and secondly the occupations which have the greatest potential scope for remote working.

The social distancing index takes account of the prevalence of face to face communication, customer interaction and physical proximity for a given worker in a specific occupation. Workers who face high levels of face to face communication, customer interaction, and are in close proximity to others whilst working, score poorly for social distancing potential.

The remote working index accounts for jobs requiring daily work outdoors, whether the tasks entailed require the operation of vehicles, mechanised devices or equipment, and the degree to which electronic means of communication versus face-to-face communication is used. Those whose jobs require working outdoors or operating vehicles, or who work in close proximity to others score poorly for remote working potential.

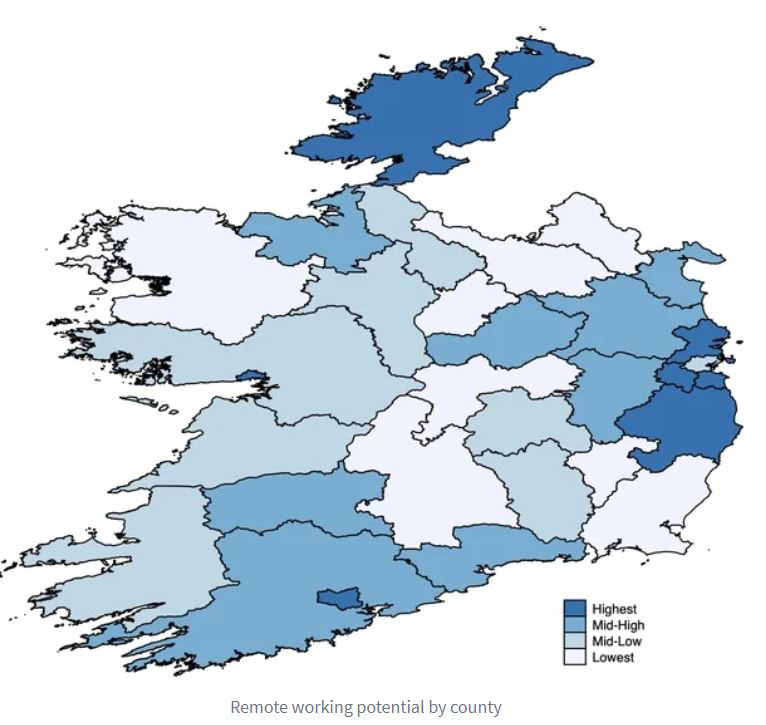

The economic crisis in Ireland is likely to play out differently across places due to, firstly, existing occupational and industrial geographical clustering across Ireland, and secondly the associated social distancing and remote working potential required across occupations and sectors. In other words, the location of different types of jobs and sectors is going to matter.

They found that the potential for social distancing and remote work favours occupations located in the Greater Dublin region and provincial city regions. Donegal is an exception bucking this pattern. Some places are going to be better equipped than others to deal with this crisis. At a town level, more affluent, better educated and better broadband provisioned towns have more workers with a greater potential for social distancing and remote working. Paradoxically, urban areas with greater density levels and higher populations have also greater social distancing and remote working potential.

The full paper can be found here.

The Next….how ‘Covid tech’ will influence OOH

Online shopping gurus. Netflix ninjas. E-commerce experts. Zoom zealots.

There is no doubt that technology’s influence in our lives has gone up a few notches in the last few months. As we move through the various phases set out by the government for the reopening of the economy and society, innovative technological solutions to the logistical issues of our changed environment may well have implications for OOH communications.

We are already seeing some evidence of this emerging as business across the world adapt for what’s coming next.

Digital Hand Sanitisers

Hand sanitizers are one of the first touch points that the public will encounter as they enter an outlet. New digital advertising screens with built-in sanitizer dispensers are coming on stream.

Queuing Systems

As socially distanced queuing becomes a normal part of our day to day lives, companies have been looking at innovative ways to improve the customer experience. Cue intelligent digital signage and virtual queuing software.

Intelligent digital signage can be used to count customers entering and leaving retail outlets, thus delivering a real time stop/go system. Arnotts and BT announced this week that such a system will be in place for their customers when they reopen next month.

Asda, Britain’s third biggest retailer is beginning trials of a virtual queuing system. Customers will be able to get a virtual ticket by scanning an OOH poster and return to the safety of their car whilst waiting to be called via their mobile phone.

Lidl Ireland has announced that it is planning to introduce a new COVID-19 queue management system designed to control the number of customers entering and exiting the store at any one time, in order to maintain social distancing during busy periods. The innovative software controls an automated traffic light and monitor that signals to shoppers when they can proceed through the entrance based on individual customer limits that are in line with social distancing guidelines, the retailer said.

Self Service Interactive Screens and Mid-Air Haptic Technology

In order to minimise human contact, there has been a rise in self-service interactive kiosks and screens, similar to the interactive order screens often found in McDonalds restaurants. In an effort to eliminate the “touch” element, mid-air haptic technology is accelerating. Mid-air haptic technology allows you to interact with interactive digital screens using hand gestures rather than physical touch.

The pace of innovation has been impressive. Out of Home has shown itself to be nothing if not flexible and adaptive in the past decade. In a media sense, what we are experiencing is a shift in audience behaviour. Change brings opportunity. Out of Home is opportunity.

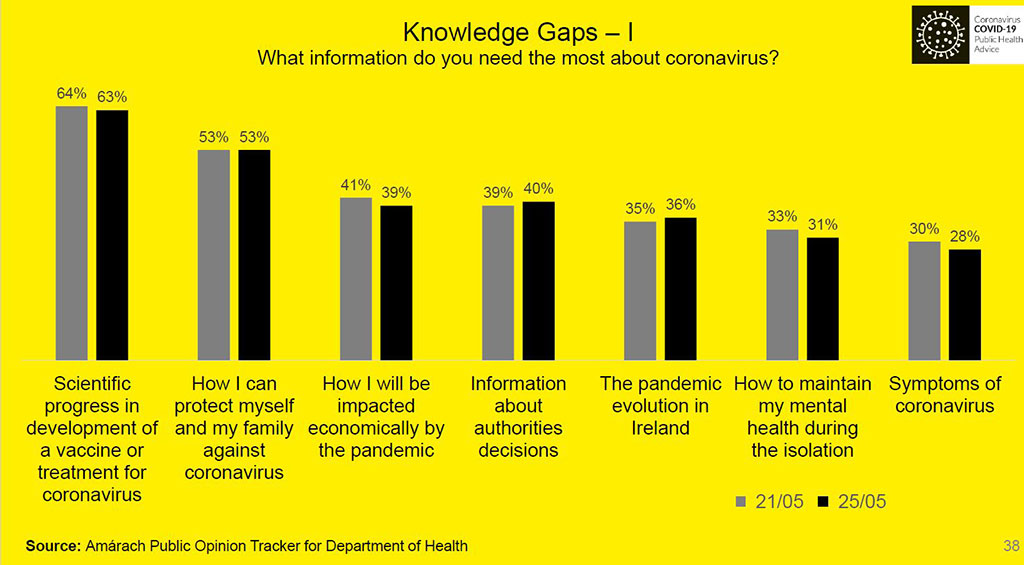

Knowledge Gaps still exist re Covid

In research by PML group in April we found that 77% of respondents agreed that OOH was a very effective channel for communicating public information messaging. The research from Amarach this week shows substantial knowledge gaps among the public regarding Covid – including how to protect against Coronavirus and information about decision by the authorities.

The pace of innovation has been impressive. Out of Home has shown itself to be nothing if not flexible and adaptive in the past decade. In a media sense, what we are experiencing is a shift in audience behaviour. Change brings opportunity. Out of Home is opportunity.

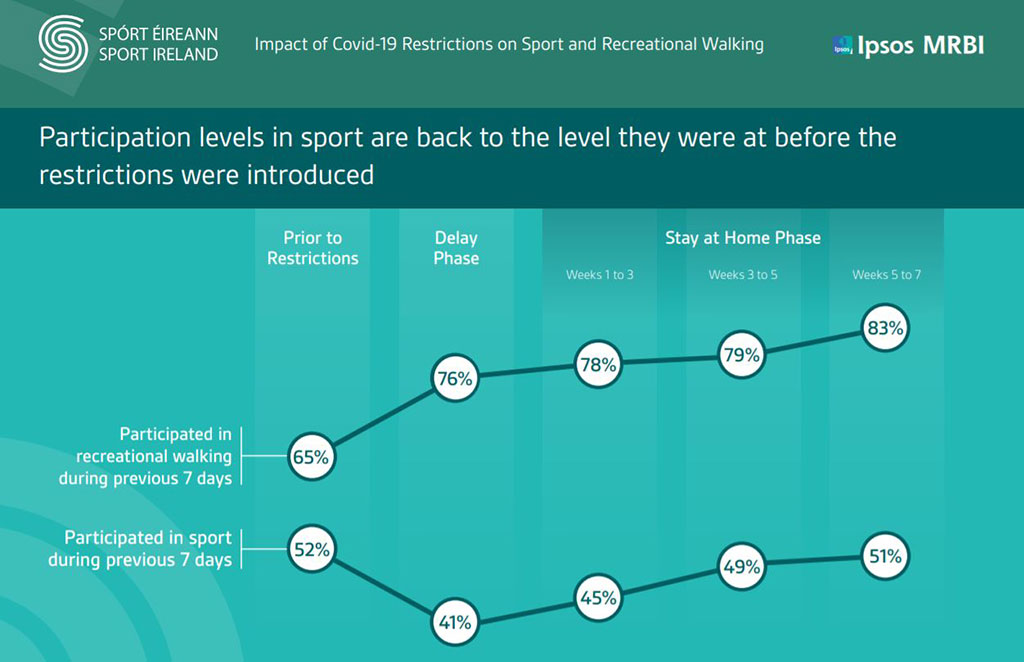

Participation in Sport

Unprecedented Number of People Cycling

Cycling Ireland this week reported on research that found an unprecedented number of adults are cycling every week. The latest figures show an estimated 510,000 people within the Republic of Ireland are enjoying cycling as a form of exercise, participating at least once per week. This marks an increase of approximately 260,000 people compared to the same time last year.

Cycling Ireland CEO Matt McKerrow welcomed the figures; “I think everyone in the cycling community has anecdotally noticed more people cycling in and around their towns and suburbs recently, but it is great to see the research with numbers quantifying the levels of increased participation.

The gradual easing of restrictions will allow new and returning cyclists to enjoy greater freedom on their bikes, benefiting from both a physical and mental health perspective.

Staying in (car) is the new going out

Research we conducted in April highlighted outdoor events such as festivals and concerts as one of the main things people were looking forward to doing again when restrictions eased. This week we saw how such events may look with social distancing a reality for the medium term at least. Gavin James was announced as headline act for a series of Drive-In live shows in July and August at venues in Limerick, Cork, Waterford and Kilkenny. Up to four ‘carevellers’ per vehicle will be permitted.

This is a trend we expect to see gain much traction and extend to other gatherings such as cinema, theatre and church services.

Such events will literally drive traffic to venues from all around the country and OOH is perfectly suited to engaging this new audience – both at the venues and en route.

Interest in Domestic Holidays Grows

With uncertainty lingering over travelling abroad, many holidays and foreign getaways have been cancelled or placed on hold for the time being.

As a result, staycations are set to soar in popularity this year. New research from Core Optimisation published on marketing.ie this week shows a piqued interest in domestic getaways. Online searches related to Irish hotels increased in May, indicating an increased interest in travelling domestically. The luxury travel market may emerge as the quickest to recover with the search term ‘luxury travel’ experiencing an upward curve since mid-March.

Research carried out by iReach insights also indicates a renewed interest in staycations with 20% of its respondents hoping for a staycation later in the year. A further 23% have given up on the thought of overseas travel and are now planning a staycation.

The lack of foreign travel in 2020 will inevitably lead to an increased domestic audience for OOH advertising, especially across the summer months.

OOH can be an important medium for reaching staycationers. With a significant portfolio of regional touchpoints, advertiser can reach staycationers at a time where they may be more difficult to reach through other modes of advertising.

Retail

FMCG Sales Surge Ahead

Off- trade alcohol sales surged by 59% in the week ending 10 May, compared to the same period last year, research conducted by Nielsen shows. Alcohol sales have reached a record €6million a day during lockdown, equating to €342.5 million spend in the past 8 weeks.

Typical pub drinks such as stout and gin rocketed by 155% and 38% respectively. The research also suggested shoppers are frequenting their corner shop for alcohol rather than including it as part of their weekly shop.

The same research concluded that overall FMCG sales reached €333million in the week ending 10 May, 12.5% higher compared to the same week last year.

More positive signs in the retail sector are emerging with retailers announcing plans for a return to business. Cineworld revealed plans to reopen all its cinemas in July.

McDonald’s is back to full drive-thru capacity next week, with the QSR announcing that all its drive-thru restaurants in Ireland will reopen by Thursday June 4. Its 95 restaurants contribute close to €200m to the Irish economy, according to the company.

Retailers are also beginning to look at more long-term social distancing strategies with Tesco, Lidl and Aldi announcing new queuing systems for entering stores, evidence that the queues we experience outside retailers will continue well into the future.

The buoyancy of the retail market is indicative of our reliance on retailers currently. With a wide range of OOH opportunities in the retail sector, advertisers can engage with guaranteed audiences at supermarket and convenience store entrances and retail screens in shopping centres where dwell time is particularly high.