As the country gets ready for the gradual lifting in lockdown restrictions, James Byrne, marketing manager of PML Group kicks off the first in a series of articles on how brands and advertisers should be preparing their OOH campaigns.

Last week saw the welcome publication of the government roadmap for a phased reopening of the country. The five-phase approach now gives us a clear indicator of important milestones in the weeks and months ahead and it has positive implications for advertisers and OOH media.

The confirmation provided by last week’s announcement means OOH media owners are now in a position to reinstate the posting of many classic OOH formats from cycle 11 (May 18th) onwards. Great news for brands, offering them more scope to deliver relevant OOH advertising in the context of a widening of the 2km exercise limit to 5km and more far-reaching changes from May 18th. The phased return of outdoor workers will take place from then as well as the reopening of some retail such as DIY and electrical outlets. Outdoor public amenities, tourism sites and outdoor sports activities such as golf and tennis will also be accessible again, all of course at safe social distance.

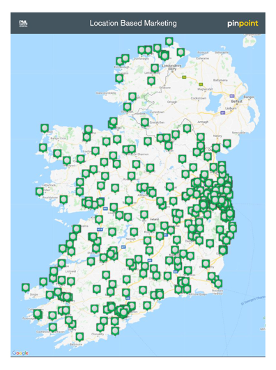

Our Pinpoint mapping system has of course plotted all these points of interest, overlaid with audience movement data and OOH panels, meaning brands can optimally reach an ever-expanding OOH audience in the present, the near future and when planning in longer term. As golf courses are in the news this week it’s worth pointing out that the 300+ golf courses on the Pinpoint platform have almost 8,000 OOH panels within a 5km proximity.

AUDIENCE MOBILITY

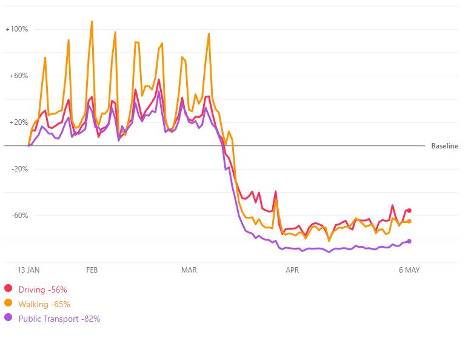

The latest data from Apple reveals changes in the travel behaviour of people who use its Maps app. The Mobility Trends Report produces three daily percentage figures, showing how many fewer people are driving, walking and using public transport compared with on 13 January, before the coronavirus lockdowns came into effect. A breakout for Ireland is available by county.

Here is the change in routing requests in Ireland since 13 January 2020. Mobility Index has increased by an average of 38% across the three transportation types in the past week.

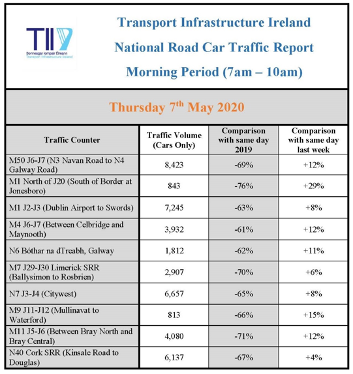

The latest release from TII provides a daily snapshot of car traffic during the peak morning travel hours from 7:00AM to 10:00AM across identified locations on the national road/motorway network. These numbers will fluctuate based on a variety of issues (weather, day of week), but they will give an indication as to potential trends in travel patterns.

It reports that in the initial three weeks following the introduction of the March 27th restrictions, traffic volumes were very consistent. Overall traffic volumes were typically down approximately 65-70% across the national road network. From Tuesday 21st April, an upward trend in car traffic volumes became apparent with yesterday’s combined data indicating a single week increase of 9.4%.

CONSUMER INSIGHTS

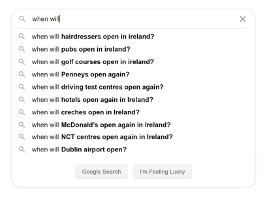

Out of home pursuits feature prominently in Google searches.

People in Ireland appear to be growing increasingly interested in retail, leisure and entertainment activities with questions about the reopening of such businesses amongst the most searched for things on Google so far this month.

It seems that Irish people are ready to get their hair done, hit the shops, and book a holiday. Topping the list was the question as to when hairdressers will reopen in Ireland. Under the plan, hairdressers are not due to reopen until phase four – on 20 July. The second most searched questions were when pubs will reopen, followed by when golf courses will reopen. In terms of sport, golf and tennis will be permitted in phase one while close-contact sports such as rugby will have to wait until phase five (10 August).

SHOPPING

Supermarket Sweep

As consumers adjusted to life under lockdown, the retail sector has witnessed a dramatic shift in shopping patterns and household spending.

The latest 12-week period review from Kantar shows Irish consumers spent a whopping €3BN on groceries in the period up to April 19th, an increase of 17%.

As people spend significantly more time at home, baskets continue to get fuller with shoppers adding an extra 4 items to their basket per shop and have increased their monthly bill by €118 on average.

Clear Channel’s analysis of Tesco’s sales figures for the 9 week period up to Easter Sunday shows non perishables such as canned goods and pasta are still in huge demand with triple digital growth. Customers aiming to combat the effect of hand sanitiser and the increase in handwashing has led to a 160% growth in handcare’s value in the latest 4 weeks, enough hand cream to fill 30 standard bathtubs. With hairdressers closed for a lengthy period, consumers are looking to DIY solutions contributing to 107% unit increase in home hair treatments.

With non-essential retail businesses closed, we are seeing consumers replicating experiences at home with sales of alcohol, coffee and cooking sauces/aids all seeing an increase in demand. According to data firm Nielsen, alcohol sales at Irish off-licences and supermarkets increased by 44% to €49.3 million over the Easter period.

At present, retail is an important OOH environment and will remain so in the near and next as dwell times and opportunity to engage shoppers increases with social distancing measures.

SENTIMENT

GlobalWebIndex have published a multinational study into 17 global markets, including Ireland, examining the scale to which the coronavirus pandemic is impacting the consumer landscape.

Their research shows almost no consumer concern about brands advertising at this time. 94% of Irish consumers either approve of, or are impartial to, carrying on as normal. Just 4% somewhat disapprove and 2% strongly disapprove.

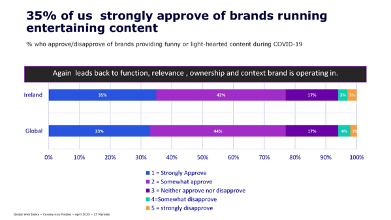

It’s fair to say the general approach from brands to coronavirus until now has been one of caution, but we’re past that stage now. Alongside their exposure to coronavirus content, consumers are also looking to be entertained, with 77% in Ireland approving of brands providing funny/light-hearted content at this time.

James Byrne is marketing manager at PML Group.