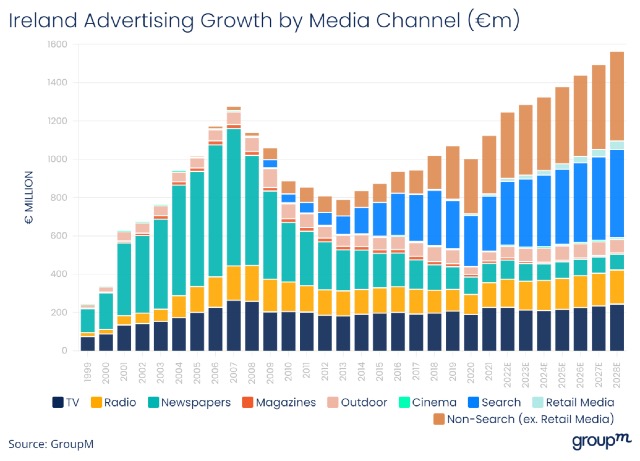

Investment in Irish advertising during 2024 is likely to rise 3.2% to €1.32bn according to the annual forecast from GroupM, the media investment arm of WPP which includes Mindshare, EssenceMediacom and Wavemaker.

This follows a 3.1% increase on advertising spend in 2023 which GroupM estimates closed at around €1.28bn for the year.

The majority of growth in 2024 will once again be attributable to digital advertising which is forecast to grow by 5.1% to €779.3m, giving it an overall 58.4% share of advertising market. Of this, search will account for around €373m, according to GroupM.

Within digital media, it also notes that one of the fastest growing channels is retail media. Having grown by 25% in 2023, GroupM says it is on course to reach €43m by 2028.

“While the retail media space continues to await the transformative arrival of Amazon, there are growth opportunities for more locally focused merchants such as Tesco, Boots and Lidl, who expect to see retail media as a meaningful contributor to profits in the medium term,” the report notes.

GroupM has forecast that TV/AV advertising will decline overall by around 1.3% to €209.9m in 2024, having already declined by around 6.1% in 2023. Of this, traditional/linear TV will account for around €184.7m, a 3% decrease on 2023 while BVOD and connected TV is forecast to grow by 12.8% to around €25.2m, according to GroupM.

“For TV (including linear and digital), we expect an overall decline of 6.3%, as macro economic uncertainty and micro inflationary pressures have knocked advertisers’ confidence in what is arguably their most considered media investment,” the report notes.

“To further exacerbate the issue, linear TV viewing time has continued to decline, according to Nielsen Television Audience Measurement (TAMI) data, and SVOD/AVOD viewing has plateaued as consumers scale back their subscriptions amid the cost-of-living crisis. It’s vital that broadcasters keep pace with these evolving trends by expanding investment, scale and advertiser transparency of their streaming players. Commercially, they currently operate in a sheltered space. But there is an inchoate CTV market developing, and it’s likely only a matter of time before Netflix and other SVOD operators enter the fray,” it adds.

“Smart decisions about how and when to collaborate around measurement, R&D, sports rights and production, locally and internationally, have shown a means of maintaining relevance for advertisers. Over the next five years, we expect linear TV to grow in low single digits as a degree of stability returns to viewing and the underlying trends become more predictable after the volatility of the post pandemic years.

“The outlook for BVOD and streaming services is expected to be far more positive, with the fruits of these future proofing labors leading to growth rates in the low to mid teens.”

Elsewhere, GroupM highlights the strong performance of OOH with the market growing by 15% to €70m in 2023. This is forecast to grow by around 7.5% in 2024 to €74.4m. Of this, digital OOH (DOOH) will continue to drive growth again with a forecast 11.8% increase to €38.7m in 2024.

“2023 saw the continued resurgence of OOH across the Irish market, with full year estimates tracking 17% up year on year; this is on the back of continued investment in new large digital formats and a reestablishment in popularity of large static and transport formats. Alongside this, the growth of DOOH and programmatic continues apace; we expect investment to finally surpass pre pandemic levels next year,” the GroupM report notes.

For the radio sector, GroupM has pencilled in growth of 3.9% to €157m while press print advertising is likely to fall again this year by as much as 4.6% to €87.5m while magazine advertising is forecast to decline by 11.1% to around €8.5m.

Cinema advertising, meanwhile, will continue its post-covid bounceback with GroupM forecasting a 3.2% bump to €7.6m in 2024.

“Cinema has enjoyed a boom year thanks to the Barbenheimer summer,” GroupM notes. “Whether studios can maintain this momentum into next year will depend on their ability to uphold the strength of their release slates despite the lengthy union strikes in 2023,” it adds.