Aaron Poole, marketing executive, PML Group with this week’s Out \ Look on Out of Home

As the new academic year approaches, the hustle and bustle of back-to-school shopping once again takes centre stage. The back-to-school period represents a prime time for brands to leverage OOH’s ability to engage with families and key decision-makers preparing for the new term. Our latest research, in partnership with Ipsos, dives into consumer intentions for this key retail period, offering fresh insights and trends compared to last year.

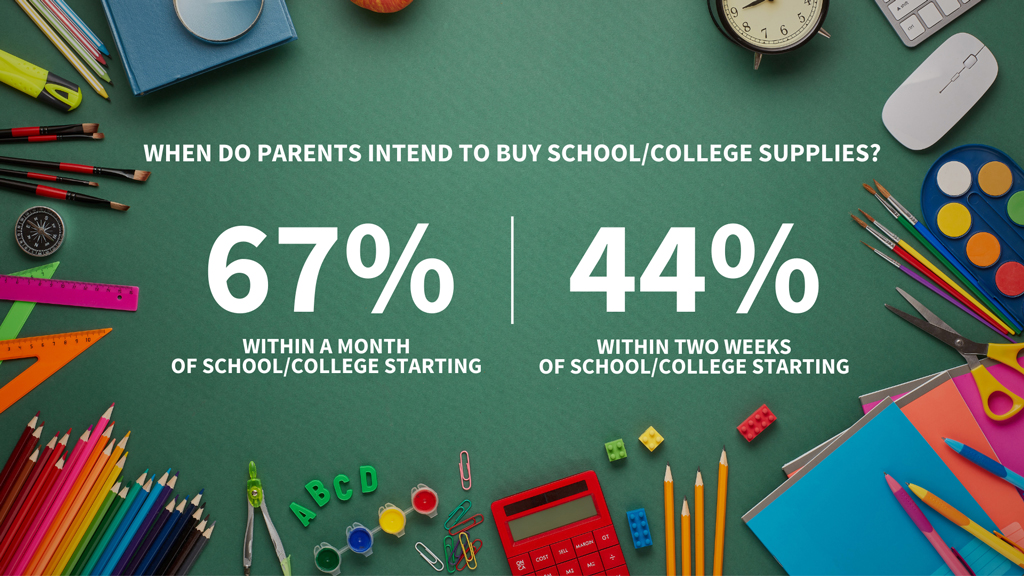

Our research reveals that the shopping surge is strongest in the two-week period leading up to the school reopening, with 44% of parents planning to purchase their supplies within this window. This trend is also prominent among full-time students (74%), who demonstrate a notable propensity for last-minute shopping.

Conversely, the more forward-thinking parents intend to secure their school and college supplies earlier: 67% intend to have their supplies in-hand within a month of term starting.

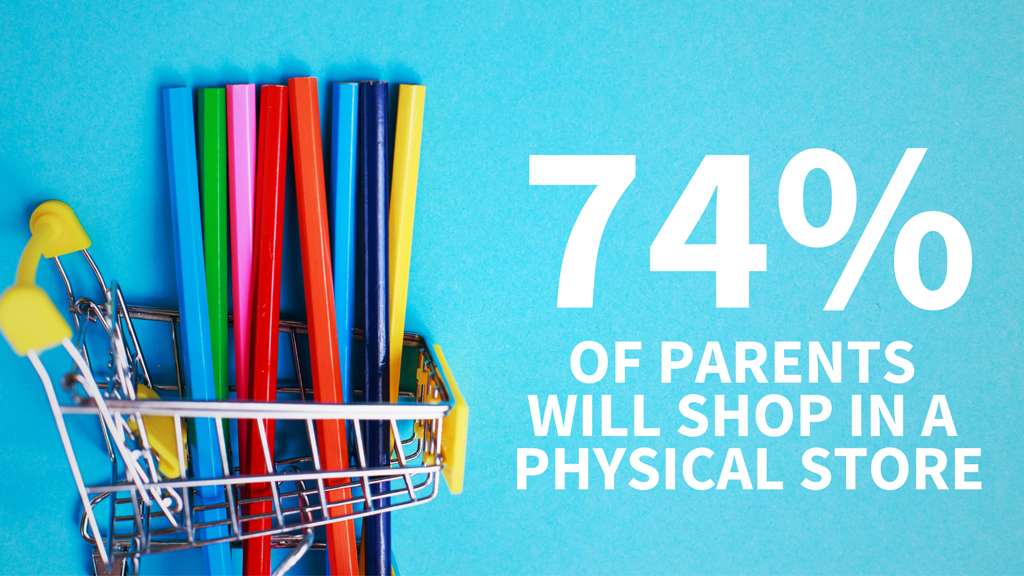

When we dig deeper into the shopping preferences, a significant trend surfaces: the majority of consumers still prefer in-store purchases over online shopping. Almost 74% of parent’s intent on buying back to school materials prefer to buy their supplies in physical stores. As noted in our recent Mall Scene research 63% of consumers spend a duration of 2+ hours during their typical shopping centre/mall visit, offering an excellent opportunity for OOH advertisers to capture the attention of these shoppers.

Specifically, supermarkets are a popular choice for parents. 35% plan to make their purchases there at the likes of SuperValu and Dunnes Stores, though the appeal of shopping centres and high street locations is not far behind at 23%. Department stores like Arnott’s attract a respectable 17% of consumers shopping for schoolbags and uniforms.

The preference for physical retail locations amplifies the reach and impact of OOH advertising, capitalising on high footfall areas and consumer shopping habits. However, the rise of digital can’t be ignored. With 22% of parents preferring online shopping, the interplay between online and offline becomes crucial. While this group will be making their purchases digitally, their path to purchase is often influenced by outdoor advertising, demonstrating OOH’s pivotal role in a connected, multi-channel retail world.

More adults spend over €500 during back-to-school time compared to any other key retail date. Those in the highest OOH media quintile (TGI) are more likely to spend over the back-to-school period. OOH, as an engaging and versatile medium, is ideally positioned to influence the important purchase decisions of families, students, and key decision-makers.

In addition to these insights, PML Group have a rich understanding of where schools are located via our MAPS platform, pinning nearly 4,000 schools and over 4,000 creches. The platform identifies more than 8,000 OOH advertising panels located within 500 metres of a primary school, giving advertisers a robust framework for highly localised campaigns.

By seizing the moment, brands can leverage OOH advertising’s ability to create awareness and drive purchases during this significant retail period.

OOH Planning Tip:

Communicate directly with back to school shoppers through retail OOH formats and build mental availability through the wider path to purchase.

Bus Journeys Surge Above Pre-Pandemic Levels in June

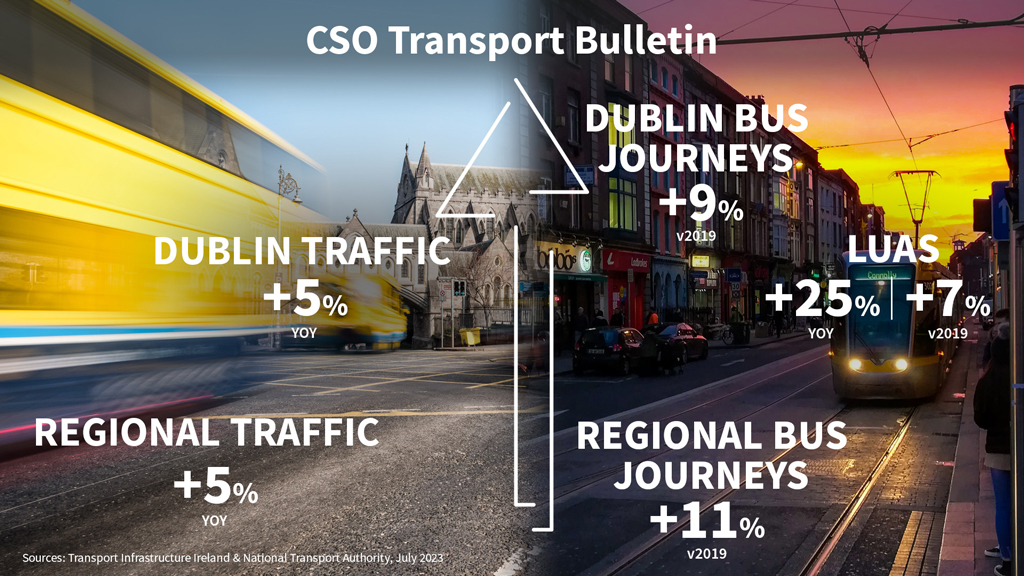

Dublin’s bustling streets saw an impressive surge in bus journeys this June, with figures rising to 9% higher than those of the same period in pre-pandemic 2019, according to data from the Central Statistics Office (CSO). Similarly, areas outside Dublin witnessed an even greater 11% increase in bus journeys compared to June 2019 levels.

On the rail and tram front, Luas journeys showed notable growth. While 2019 comparable data for rail travel was unavailable, the number of Luas journeys recorded in the week that began on 26 June soared by 7% compared to 2019 figures, and by a significant 25% compared to the same period in 2022.

Airport passenger data compiled by the CSO reveals that passenger numbers at Dublin Airport in June were equivalent to those recorded in the same month of 2019. However, they reflected a 14% uptick from the levels seen in June 2022. The number of passengers handled by Dublin Airport in June was exceeded 3.2 million, while the 2019 figure of approximately 3.2 million. Overall, Dublin Airport saw over 15.6 million passengers in the first half of 2023, slightly higher than the number of passengers during the first half of 2019.

In the regional airports, Cork Airport saw a 13% increase in passenger numbers compared to June 2022, with passenger numbers remaining consistent with those of June 2019. Shannon Airport, meanwhile, witnessed a notable 32% year-on-year increase in passenger numbers in June 2023, a figure which also represented a 10% increase compared to June 2019 levels.

The four airports – Dublin, Cork, Shannon, and Knock – collectively handled close to 3.8 million passengers in June 2023, marking a small increase from the nearly 3.74 million passengers in June 2019.

OOH Planning Tip:

Roadside and transport formats are the perfect method to engage public transport commuters.

From Clicks Back to Bricks

With the pandemic well in the rear-view mirror the Irish tradition of ‘going to town’ is alive and well, according to Penney’s recent ‘Pulse of the Nation’ study. 6 in 10 people indicated their preference to shop in-store, driven by factors such as store returns, sustainability, and local investment.

The study conducted in collaboration with Amárach Research, shows that Irish consumers want to spend time and money in their community, with 79% of people preferring to shop locally in their town when they can, while 86% believe that busy town centres are vital for the health of the local economy.

CSO data supports this shift from online shopping, indicating a return to pre-2020 patterns of consumer behaviour. While online purchases of clothing, footwear, and textiles skyrocketed to 66% of all sales in April 2020, these had declined to just 8% of total sales by February of the current year.

The results emphasise the importance of physical retail, with reasons for preferring in-store shopping including the opportunity to try on items (72%), the ease of returns (54%), avoiding delivery waits (47%), and the social experience of shopping with family or friends (32%).

Head of Penneys Ireland and Northern Ireland, Damien O’Neill, highlighted the critical role retail plays in supporting thriving communities, drawing footfall, and promoting employment. He cited the “Penneys ‘Halo Effect'” with examples of increased footfall at the new Tallaght store and Golden Island Shopping Centre in Athlone, demonstrating the positive impacts of retail on local communities.

OOH Planning Tip:

72% of 16-34 year olds agree that they notice OOH ads in shopping malls regularly (PML Group iQ)