James Byrne, marketing manager PML Group with this week’s Out Look on Out of Home.

Uncovering market potential for annual seasonal events

Seasonal events provide a unique opportunity for retailers, FMCG brands and media providers to build brand awareness, engage with consumers and increase sales and revenue.

Our new Seasonal Shopping study conducted by Ipsos measures the market potential for seasonal events such as Christmas, Mother’s and Father’s Day, Black Friday, Cyber Monday, summer holidays, Easter, and Back-to-School.

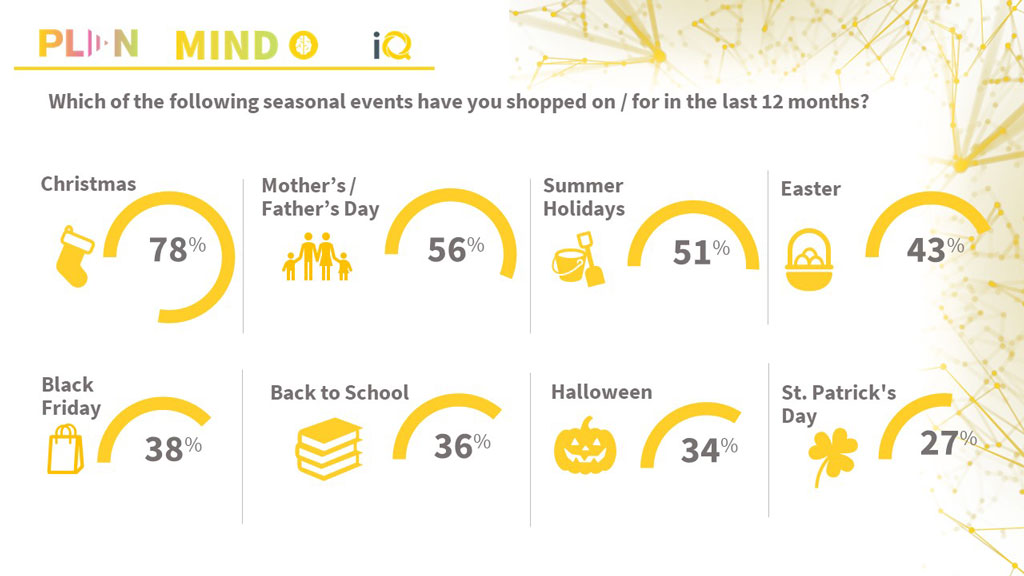

Traditional holidays dominate the shopping season by a wide margin, with nearly four in five (78%) consumers indicating they shopped for Christmas in the last 12 months rising to 90% among 45–54 year-olds.

Mother’s Day or Father’s Day (56%; grouped together) are the second most popular seasonal shopping events. These celebrations of family have become big opportunities for FMCG brands, high street brands and digital retailers alike. The highest responding age group is 35-44s at 68%.

The busy summer holiday season is another big occasion for retailers coming in a close third, with over half (51%) of the sample and 60% of females reporting occasion spend. It is followed by Easter (43%) and Black Friday/Cyber Monday (38%), with the Back-to-School season (36%), Halloween (34%), and St. Patrick’s Day (27%) rounding off our list of seasonal marketing opportunities.

A recent research study we conducted in partnership with Ipsos investigated consumer intentions regarding the return of school and colleges. The findings suggests that the most popular period for buying supplies for the new school/college year will be the two-week period prior to reopening. 57% of respondents who will be buying such items will do so in those last few weeks before the restart.

Not unexpectedly back to school and Halloween are priority times for parents at 62% and 49% respectively while 58% of 25-34s reporting spending across Black Friday/Cyber Monday.

Black Friday is the perfect example of how brands can leverage Out of Home as an event-based marketing channel. Outdoor is a location medium but its agility means its content can be hyper-relevant to time and to events happening across the physical and virtual landscape. Digital OOH and Dynamic Digital OOH are ideal platforms for brands to inform, remind and drive direct response on the day in question.

This year the FIFA World Cup will be a football fan’s paradise. For the first time in the event’s history, it is being held during the northern hemisphere’s winter months to avoid the blistering heat of summer in the Middle East. Over 28 days of play, 32 national football teams compete in 64 matches, culminating in a final game that hundreds of millions of people will watch. Taking place in Qatar the tournament will run from 21st November until 18th December, with the pool stages lasting until 2nd December and the knockout stages beginning on 3rd December.

With matches being played across the day many fans will be out and about during gametime as they live, work and play. Our OCS study finds that 78% of people who are passionate about sport are interested in digital screen advertising relevant to a live sporting event placing OOH centrally in terms of activations by sponsors and associated brands.

New Family Research Finds that Planned Spend for Christmas 2022 is on the Rise in Ireland

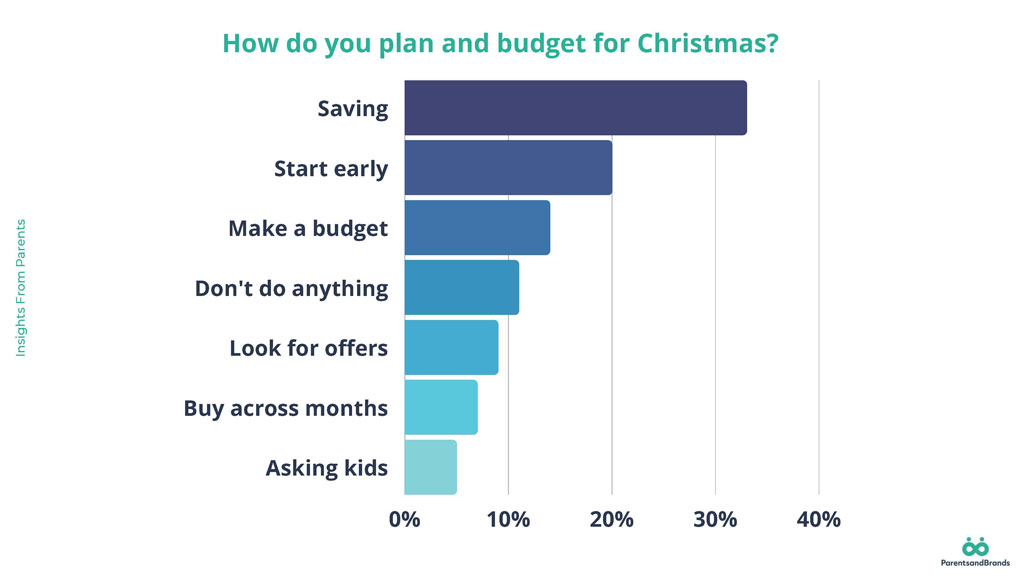

New research shows that despite rising household costs, the planned average budget for families for Christmas 2022 is increasing, with parents saving throughout the year to “make sure Christmas is magical for the children.”

The survey found that only 5% of parents use their child’s Santa letter to help them plan, with 1 in 5 parents buying early to help spread the cost. Of the parents surveyed, many are planning ahead to ensure they get everything they need before it’s sold out and to avoid paying too much at the end of the year.

Insights from this research indicate that:

- Only 6% of parents are now keeping to a budget of up to €250, dropping from 16% in 2021.

- 16% of parents said they plan to stick to a budget of €250-€500 compared to 35% last year.

- Higher Christmas budgets have gone up significantly, with 74% saying they will spend from €500 euro-€1k plus, compared to 45% of parents in 2021.

Typically, it was found that toys are bought between Sept – Nov, but 45% of parents are now saying they buy these before the end of October, with most noting that they compare online and in-store to keep track of good offers.

For Irish retailers planning for Christmas 2022, communicating their ranges early is going to be helpful, bearing in mind that parents are researching potentially from summer onwards and that they commence buying after school starts. While parents surveyed acknowledged that Christmas might seem very far away, they noted that they wanted to be as prepared as possible.

Commenting on the survey findings, Jill Holtz, co-founder of ParentsandBrands, said:

“In some good news for retailers, this year’s insights show that parents are increasing their planned Christmas budgets. Last year’s ‘shopping earlier’ trend appears to be staying, with parents telling us that it helps to spread the cost and they also like to shop around for value and offers. We believe that with some careful planning there’s a huge opportunity for Irish businesses and brands to cater to this key shopping demographic, while also ensuring Santa’s elves have all the help they can get!

“Take hiding presents, for example, this is always a hassle for ‘Santa’s elves,’ but perhaps retailers could consider offering “buy now deliver later” options to help parents out, so they know that the “hot toy” has been bought but don’t need to worry about hiding it for weeks.”

Survey results can be seen in full on the ParentsandBrands website, here