The Irish marketing and media sector is undergoing its biggest changes in living memory, according to a new research report co-authored by digital experts John Dunne and Aileen O’Toole.

The fall-out from Covid-19, the race to digital, disruption in the ad agency landscape, more empowered consumers — these are some of the big challenges faced by the Irish marketing profession, according to the report which is called The Paradox Report

The Paradox Report includes data, insights and advice for Irish marketers on navigating a market in flux as well as primary research, data that has never been previously published as well as expert commentary from a number of academics, practitioners and thought leaders including Professor Mary Lambkin, Peter McPartlin, Colin Gordon, Olivier Gauthier, Colin Lewis, Steven Roberts and Robert Webster.

“Our big message is the strategies and models of the past are not a fit for the future. Instead, marketers need to embrace change and to plan, execute and measure holistically – and with a greater deal of flexibility and accountability than in the past,” says John Dunne.

Among the main findings in the Paradox Report are:

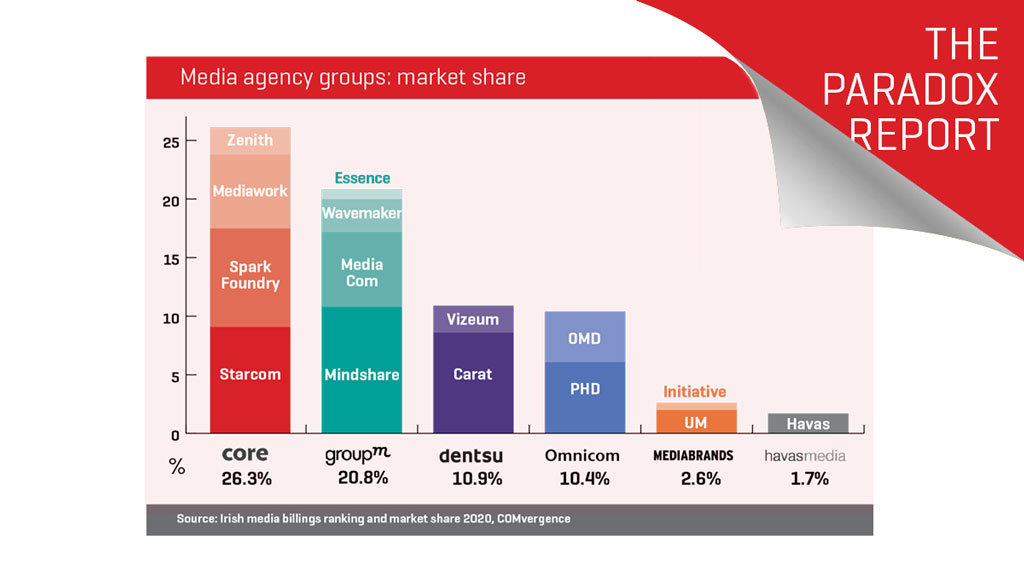

- Core is the market leader among agency groups operating in Ireland with a 26% market share, according to new research on Irish advertising agencies

- Lidl, Diageo and Fáilte Ireland were the top three large advertising accounts to be the subject of pitch processes in 2020

- Advertising pricing models are switching from traditional ‘time and materials’ or ‘output

- Google and Facebook will be the main beneficiaries of the phasing out of third-party cookies in 2023, according to research undertaken among Ireland’s largest media buyers. The two Big Tech companies will account for as much as 42% of the estimated €941 million that will be spent on advertising in Ireland.

- Indigenous publishers have most to lose from the phasing out of third-party cookies and this will heighten the commercial challenges they face

- Traditional media have lost considerable share of the Irish advertising market over a ten year period as a consequence of the growth of digital advertising. Press has been most affected, with its share of the overall Irish advertising market declining from 32% in 2011 to an estimated 8% this year

The Paradox Report is being distributed on a restricted basis and to obtain a copy email insights@ignitemediaconsulting.ie