James Byrne, marketing manager, PML Group with this week’s view from OOH.

Future-Facing OOH continues to Evolve

This week saw the evolution of Out of Home’s infrastructure continue with the installation of two new Digipoles on two of Dublin’s busiest roads. The new JCDecaux large format digital screens have replaced existing Metropole units on Amiens Street, Dublin 1 and Swords Road in Drumcondra. This welcome development is just the latest evidence of the industry’s investment in the Next and adds to the critical mass of roadside digital formats now operating in Ireland. The future success for brands using OOH will be based around the complementary strengths of classic and digital formats, fuelled by powerful creative, insightful data and contextual relevance.

From an audience point of view this week, further evidence of high levels of footfall in Ireland’s shopping malls, a continuing trend upward trend in terms of mobility and increasing confidence among the public for socialising.

Mobility

Road to Recovery

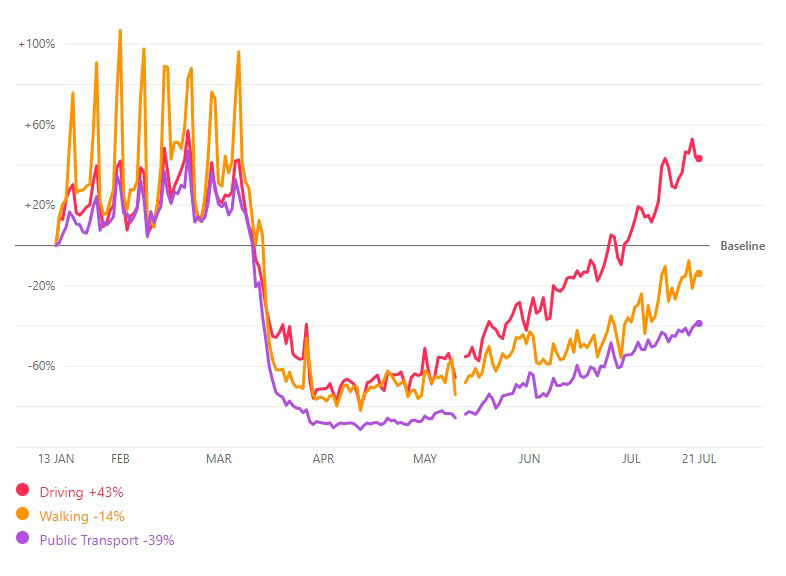

Apple’s routing requests mobility data to Tuesday 21st July shows driving in Ireland is now 43% above January’s baseline and +28% in the past fortnight. Figures indicate public transport is now 61% of pre-Covid levels and steady recovery has seen it rise by 24% in the past fortnight. Driving in Northern Ireland is now 35% above baseline, while the UK is now +16%.

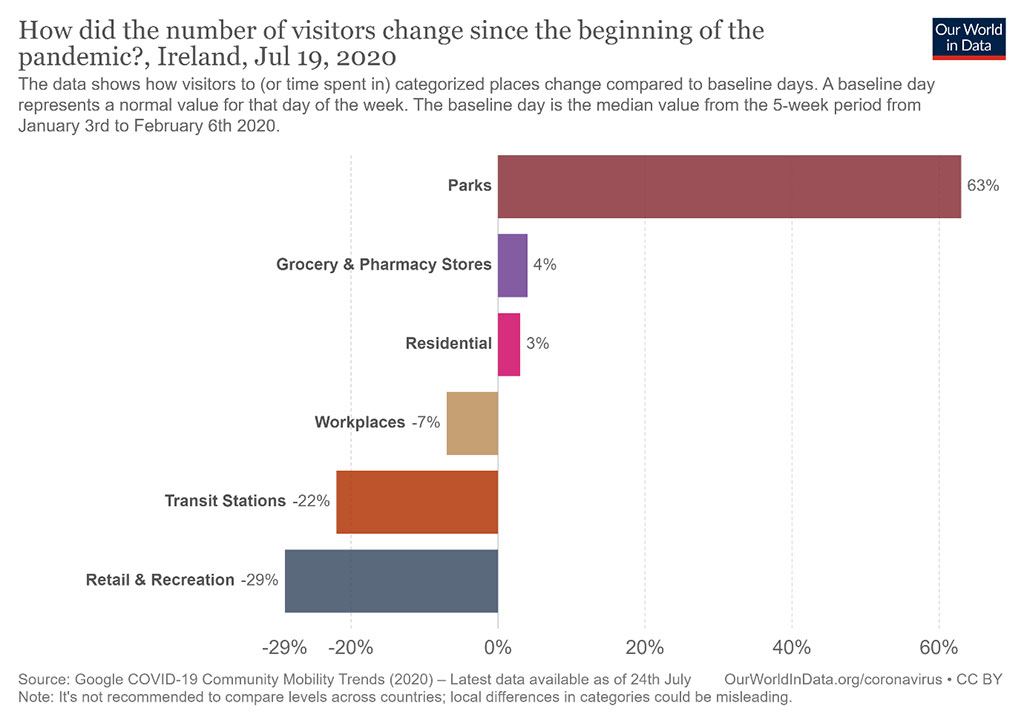

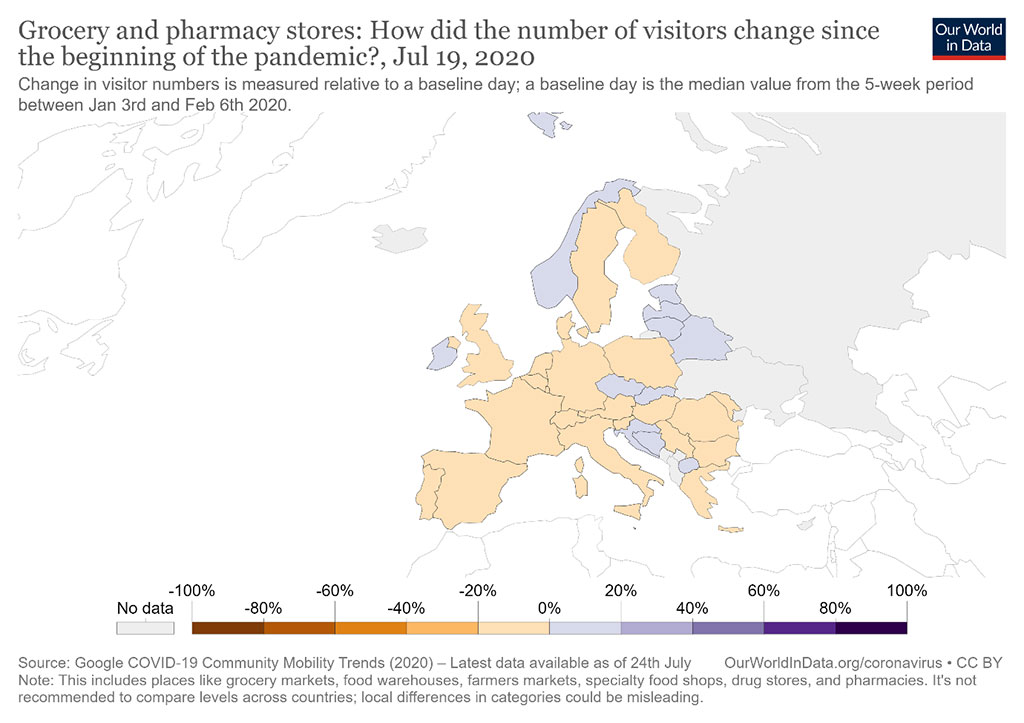

Latest Google Mobility Report

Google’s COVID-19 Community Mobility Reports shows how peoples’ movements have changed throughout the period of the pandemic. The dataset measures visitor numbers to specific categories of location (e.g. grocery stores; parks; train stations) every day and compares this change relative to baseline day before the outbreak.

Trials Begin to Pedestrianise Dublin city centre streets

The Irish Independent today report that the pedestrianisation of streets off Grafton Street in Dublin is being trialled from this weekend. The trials will take place on Saturdays and Sundays, from 11am to 7pm, with the first starting tomorrow, running for four weeks.

Sections of South Anne Street, South William Street, Duke Street, Drury Street and Dame Court are included as part of a broader strategy for traffic control.

Publishing pilot details earlier this month, Dublin City Council said the step was designed to provide space for safe movement of people and to help businesses to overcome the Covid-19-inflicted downturn.

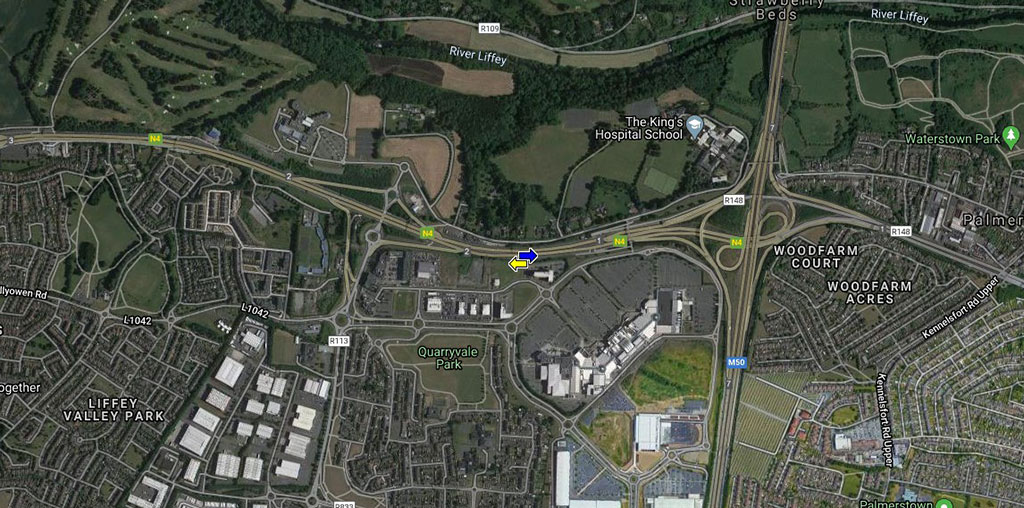

Go West

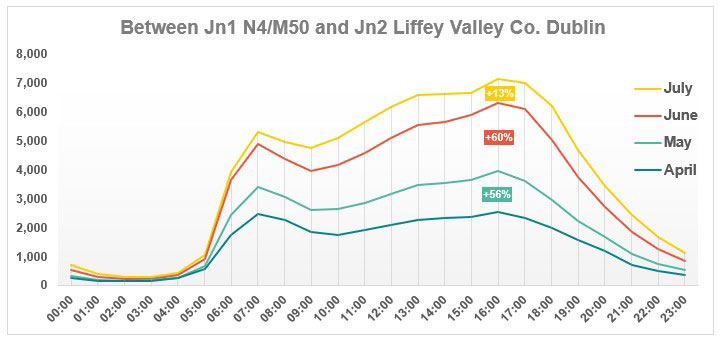

Transport Infrastructure Ireland (TII) presents traffic data collected from counters located on the national road network. This week we focus on trends at a key arterial intersection between the M50 and westbound N4 near Liffey Valley Shopping Centre.

Average daily traffic on this road this month so far (July 1-22) is up 18% on June, +87% on May and +173% on April. AM peak volume is at 11am whereas in the months previous it was at 7am. PM peak volume remains at 4pm and the monthly increases are represented in the chart.

Phase 3 of the reopening of society and business commenced Monday 29th June. By Thursday July 16th, overall traffic volumes were 178% above the average volumes on the network during the full COVID restrictions. This equates to an approximate 11% increase in daily traffic since the implementation of Phase 3 of the reopening. It should be noted that traffic volumes this week are still down 10-20% on the equivalent weekdays in 2019, i.e. they are at 80-90% of 2019 traffic levels.

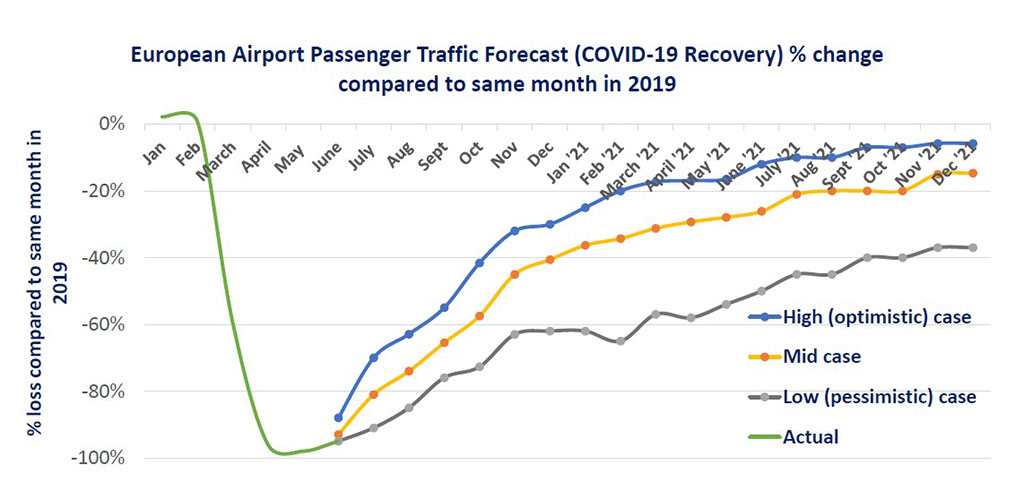

European Air Travel doubles in June

A recent report published by Airports Council International (ACI), forecasts monthly passenger traffic could rise to -41% by December 2020 versus the same month the previous year, based on a ‘mid-case’ scenario. The easing of travel restrictions from the 15th June has hugely bolstered European bookings, with passenger numbers at EU27/Schengen airports doubling from 2.7 million passengers between 1-14 June to 5.6 million between 15-28 June.

Retail

Recovery in Mall footfall gathers pace

Figures supplied by JCDecaux this week show volume of footfall within some of Ireland’s major shopping centres is not far off that of the same period in 2019. Among the twenty-one malls in which JCDecaux’s iVision network is active are Stephen’s Green, Jervis Centre, McDonagh Junction, Eyre Square and Charlestown. Average footfall levels across all twenty-one malls last week was 77% that of 2019. Active brands on the network currently include Laya, Heinz, eFlow, McDonald’s and the National Lottery.

This figure of 77% reflects similar percentages we reported in Now Near Next last week across some other key mall destinations such as Blanchardstown Centre and Swords Pavilions. These data sets represent reassurance for brands that audiences in these shared public spaces are back and being accommodated in a safe way.

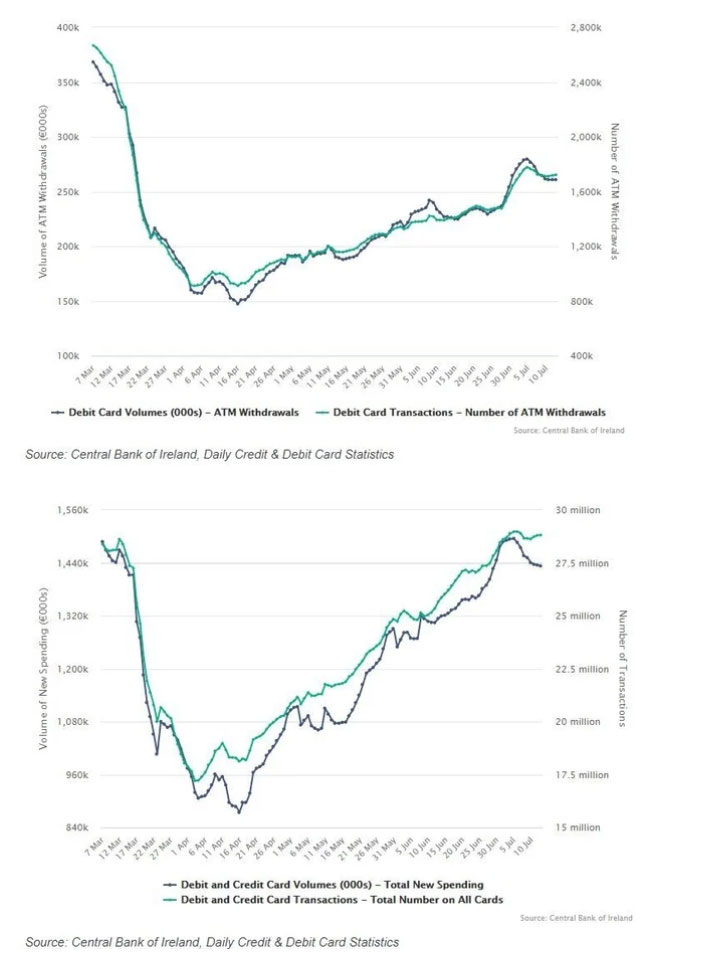

Spending Back to Pre-COVID-19 Levels

According to the latest data from the Central Bank, spending on debit and credit card has return to pre-COVID-19 levels.

In the first week of March, 28 million card transactions worth €1.488 billion was recorded. At its lowest, in the week ending 16th April transactions fell by 41%.

Things picked up again as the restrictions eased and by July 13th debit and credit card transactions recovered to €1.433 billion across 29 million transactions.

The figures show cards are replacing cash with the number of ATM withdrawals and volumes of cash withdrawn significantly down.

It is encouraging to see the return to normal spending limits as people focused on returning to normal when the restrictions began to lift.

BWG Foods Study Highlights Shopping Priorities

Food wholesaler and retailer, BWG Foods, recently released the results of its retailer survey to assess future outlook and key challenges.

Retailers are optimistic about their long-term performance with approximately 73% of respondents feeling positive or very positive about the future outlook of their businesses. 67% reported they are positive about the outlook for the wider grocery sector.

Looking at how its retailers adapted to the crisis, 44% of independent retailers introduced Home Delivery services in response to Covid-19 while a third (33%) began providing Call & Collect services. 70% of BWG food retailers are planning to retain these services in the future.

From a retailer perspective, the most important shopping priorities for consumers going forward will be price and value (42%). Retailers believe hygiene standards will be the second most important priority for consumers replacing product quality and availability.

BWG owns and operates a number of leading retail brands with over 1,000 SPAR, EUROSPAR, MACE, Londis and XL stores serving local communities in partnership with independent retailers.

The COVID-19 outbreak significantly changed how consumers approach grocery shopping with customers priorities changing and adapting to the climate we find ourselves in. It is interesting to see the retailers view on what the key drivers are for consumers currently. OOH is well placed for retailers to communicate to customers on theses priorities such as broadcasting deals and promotions along with reassuring consumers on continued safety measures.

In recent weeks, we have witnessed this focus on customers priorities in retailer messaging. A number of retailers have focused on deals and promotions in their OOH communications with SuperValu promoting its summer value price cuts and Centra’s Welcome Back campaign promoting weekly deals. Others have built awareness around their delivery services with Lidl’s delivery partner buymie advertising its 1-hour service on Bus Shelters and Digishelters across the city.

Leisure

The Family Day Out

A female orientated study conducted by MyInsightsOnTime show females intentions around days out post COVID-19. The online survey was carried out on mykidstime.com in June.

The survey found 69% of the panel plan to take days out this summer with their kids while 48% of the female respondents’ plan to have a family day out together every week as Ireland opens.

In terms of preferred activities, family walks/tips to the beach, outdoor adventure parks and tourist sites are the preferred activities for a day out.

Reassurance is imperative when planning days out with 40% planning days out and don’t mind going to indoor venues as long as social distancing is maintained. While 29% plan to go on family days out but will only visit attractions with outdoor spaces.

With Ireland’s reopening, people are embracing the outdoors after being confined to local areas and their homes for so long. As reported in previous Now, Near, Next editions outdoor activities and outdoor socialising will be big trends for the rest of the summer with people feeling the most comfortable in this space.

OOH is invaluable to reach audiences enjoying outdoor/public spaces and can connect with them at different environments and at different points in their journeys. The increase in outdoor activities means exposure to OOH will intensify and provides a great window of opportunity for brands to make a major impact.

With an engaged in-market audience, tourist sites and venues can also capitalise on OOH’s reach and coverage to advertise its attractions.

Sentiment/Insight

Confidence Rises for Social Activities

We have reached mid-July and Phase 3 in the Government’s plan to reopen the country, but how safe do the general public feel returning to non-essential businesses? B&A has launched its second report in the Reopening Ireland series which looks at the activities Irish adults are most looking forward to, and when they feel it will be safe to return to them. The news is positive for many businesses this month, as they have seen growth in the numbers believing it will be safe enough to return to restaurants, cafés and pubs within the next two weeks.

As evidenced in the last wave, younger adults are more likely to feel safe returning to a wide range of non-essential businesses, whereas older adults remain cautious.

Global Delay in Big Purchases

GlobalWebIndex latest wave of data shows that, globally, people are delaying big purchases currently. The research found 80% of people globally are delaying big purchases, most commonly amongst Gen Z, Millennials, and higher income groups.

With uncertainty lingering around travel, vacations/trips are the most common purchase people are delaying with 50% stating they are delaying such purchases. Correlating with this, 30% are delaying the purchase of flights. Home furnishings and smart devices were items less likely to see a stall in purchasing.

When asked about their resumption of big purchases, 24% stated they would purchase these when the outbreak is over in their country while 23% stated they would wait until the outbreak has decrease in the country- something that we are seeing across the world as many countries re-emerge from lockdown and lift restrictions.

While vacations and trips are being stalled to a later date, they are the big purchase items people will prioritise. Vacation plans for the next year are dominated by domestic vacations (48%) and local staycations (32%).

Another aspect of the research looked at approval for brands running “normal” advertising campaigns. 55% of the global respondents approve of brands running normal brand activity. The highest approval rate was found among Gen Z at 60%.

Only 13% disapprove of brands running “normal” advertising (which are not related to COVID-19).

Looking at different aspect of brand activities, approval levels were high for running promotions for customer with 85% approving globally. While globally 80% would approve of offering flexible payment terms.

Big increase in reserved office space for Q3

With the government’s advice to continue to work from home (where possible) still in place, it many who needed to return to the workplace have done so.

Figures recently released by the CSO shows that in the week ending 28th June, responding enterprises had an average of 58% of its staff working at their normal place of work. Of the responding enterprises, more than nine in ten (92.1%) were trading in the week ending 28th June.

As many of us worked from home over lockdown, opinions and articles circulated around the death of the office and business hubs. However, property consultant Bannon are optimistic about the Dublin office market moving into Q3. The impact of COVID-19 translated to a take up of 75,000 sq. ft in Q2. However, a significantly busier Q3 is on the cards with over 700,000 sq. ft of space reserved, a substantial take up in the office market.

With more people returning to work and business-focused locations seeing footfall incrementally rising, OOH has the ability to react to this re-emerging trend, both from a media planning and creative point of view.

And finally….

Interesting OOH campaign in the UK targeting the business community in transport hubs as they return to the workplace. OOH is a highly effective platform for online brands to communicate with real world audiences, both for consumer messaging and B2B.